Peerless Tips About Trial Balance Worksheet Steps Cash Flow Not Balancing

The eight steps of the accounting cycle are as follows:

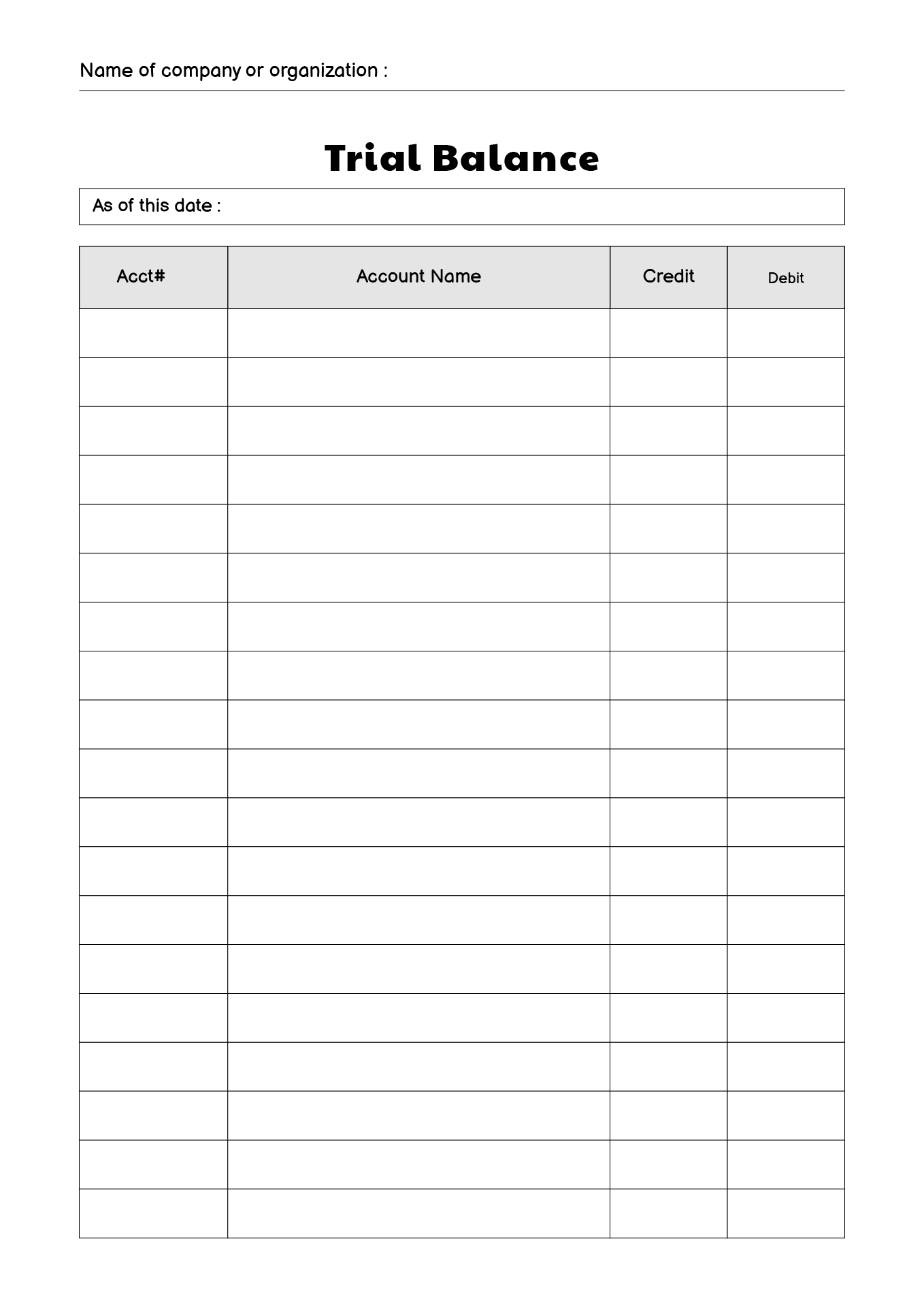

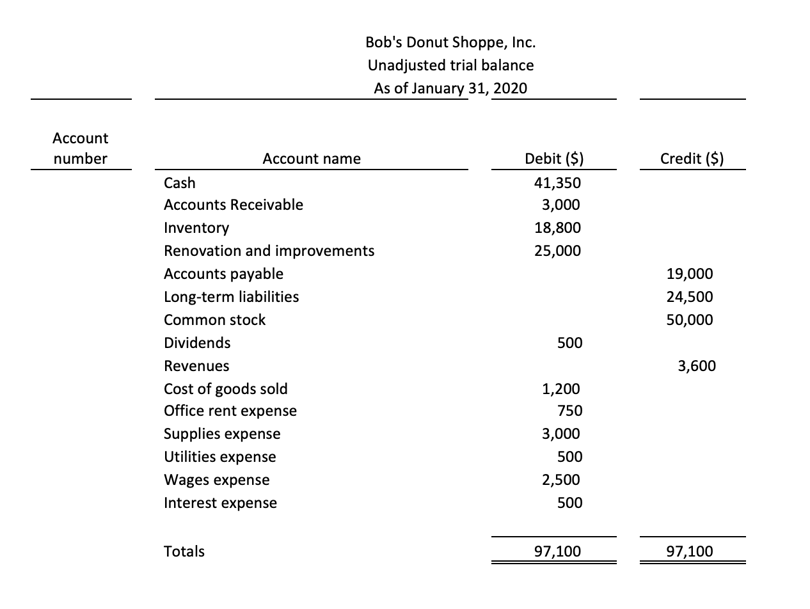

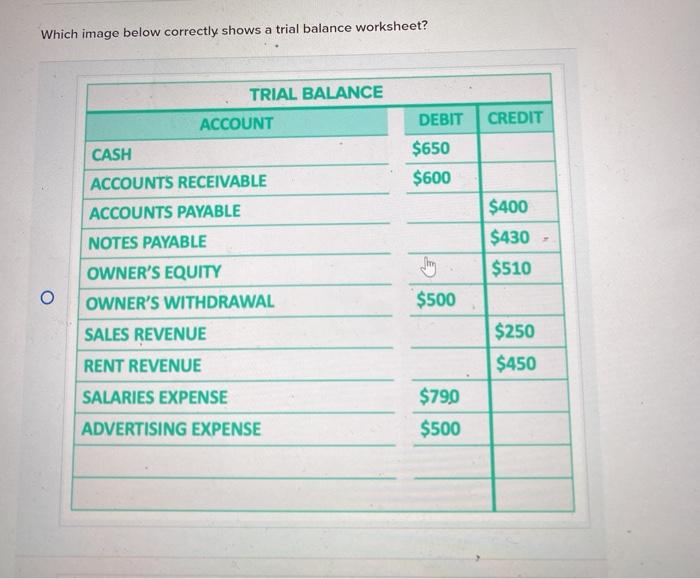

Trial balance worksheet steps. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. The trial balance information for printing plus is shown previously. Total up the credit amounts and debit amounts for each ledger account separately.

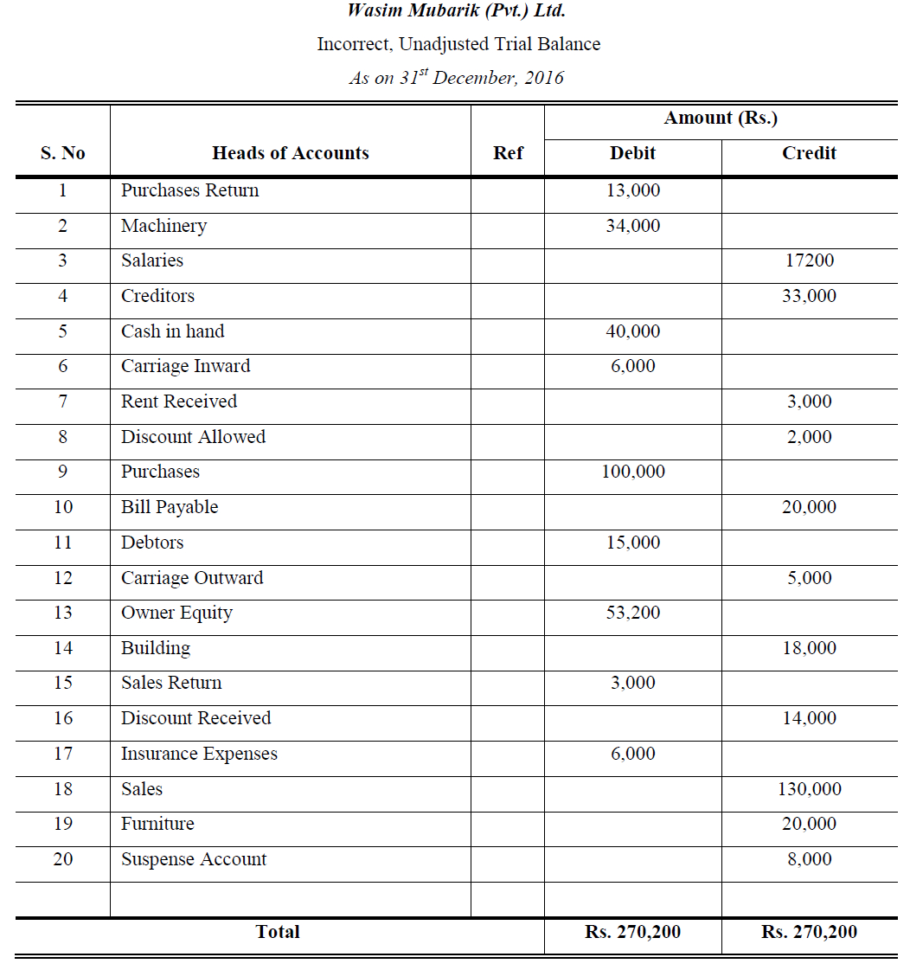

It is used primarily to establish the debits and credit balances entered from. Statement of cash flows 1h 57m. Trial balance is a worksheet in bookkeeping that contains ledger balance compiled in sections of debit and credit.

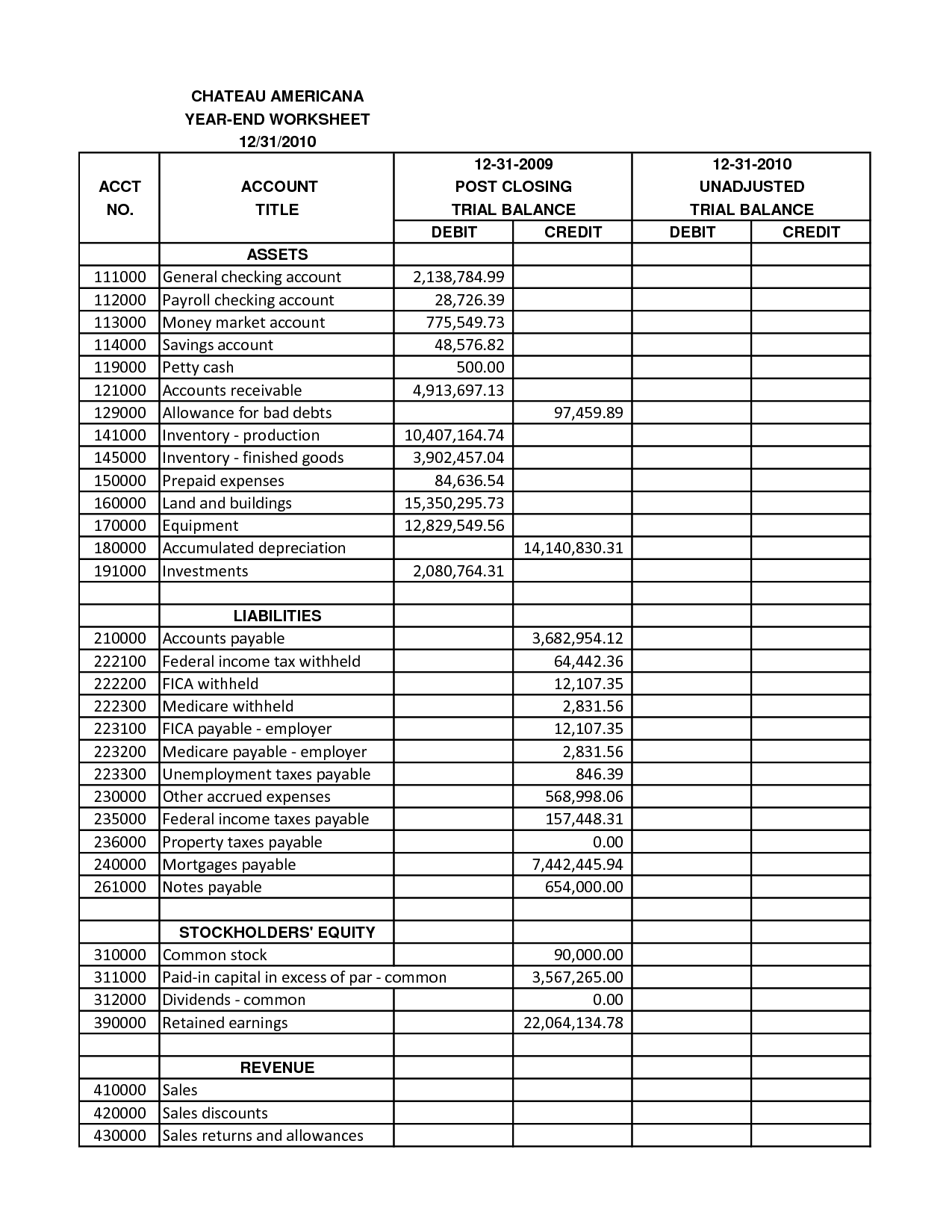

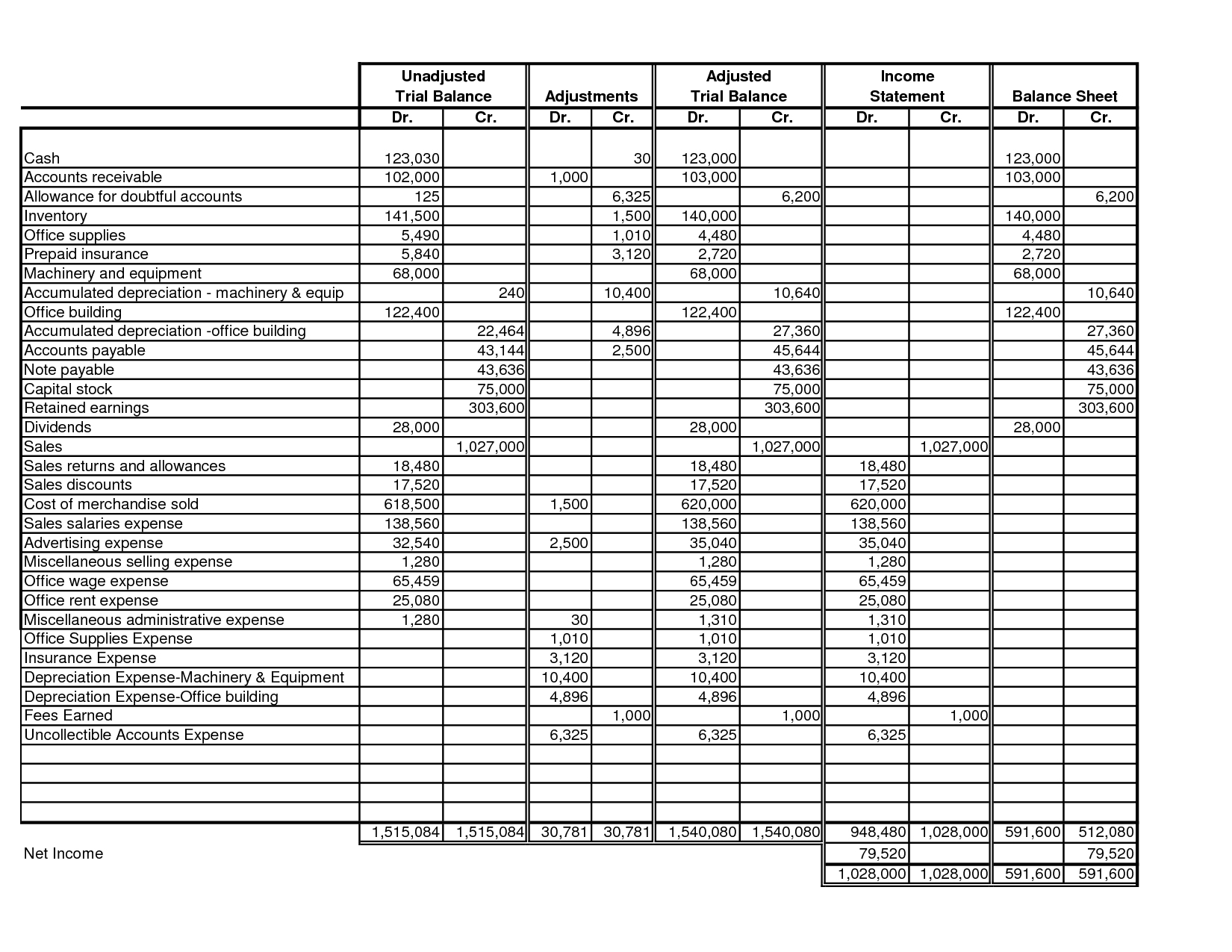

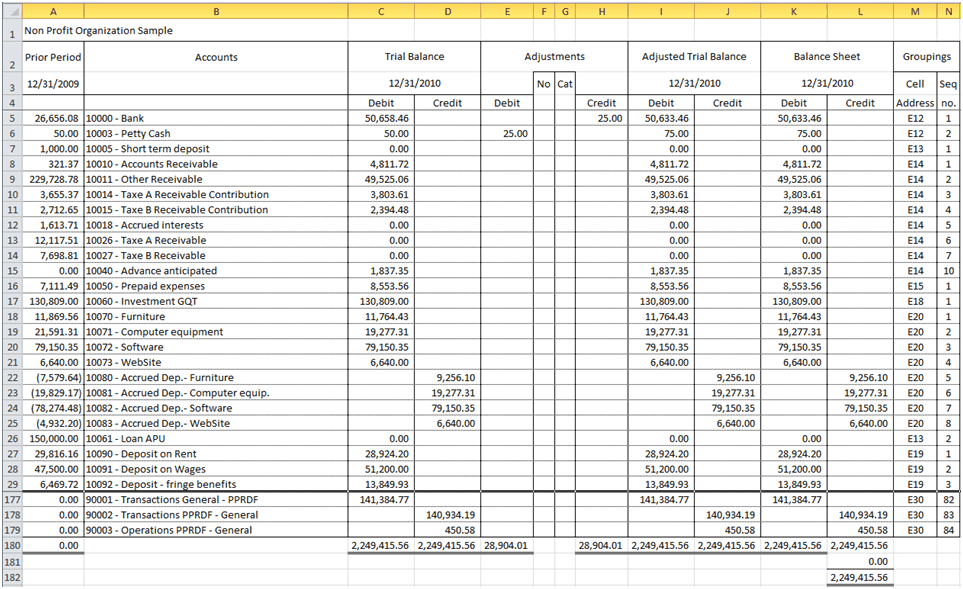

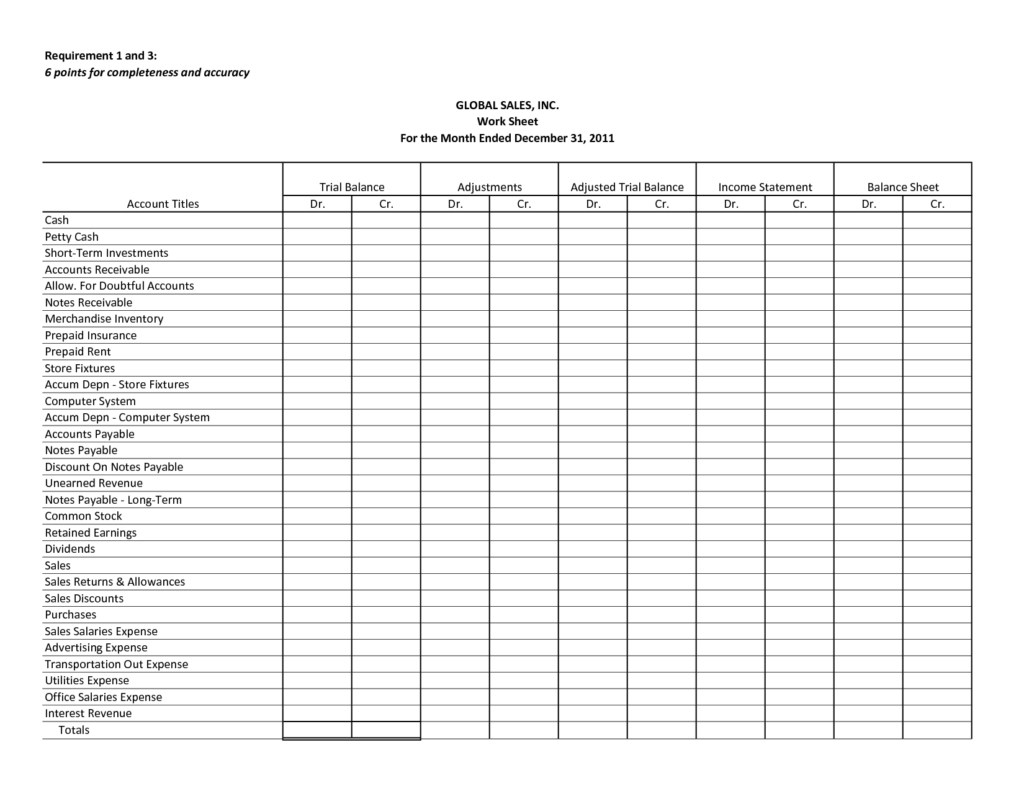

Post balances in trial balance columns, post adjusting entries in adjustment columns, enter balances in adjusting trial balance columns, complete income statement columns, determine net loss or net income, and complete balance sheet columns. The four basic steps to developing a trial balance are: A trial balance is an accounting report that denotes the balances of a company's ledgers.

Updated 29 august 2023. A trial balance contains accounts that are the main accounting items, such as assets, liabilities, revenues, expenses, equity, gains, and losses. This worksheet is used for creating the balance sheet.

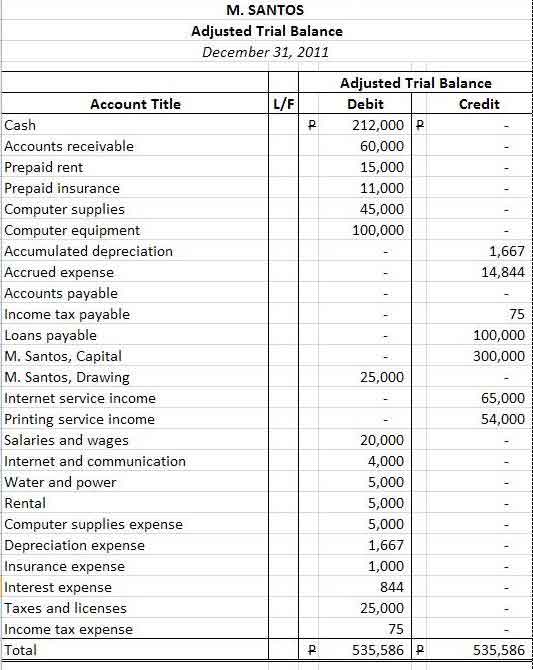

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. Learn what an adjusted trial balance is and explore a detailed adjusted trial balance example. Customize the spreadsheet to suit your needs, adding or deleting accounts.

(with 2 steps) we need to first understand what ledger and trial balance are. Trial balance is a useful accounting tool for the accounting process of listing ledger accounts along with their respective credit or debit accounts. Both of these things have significant use in accounting and have use in excel.

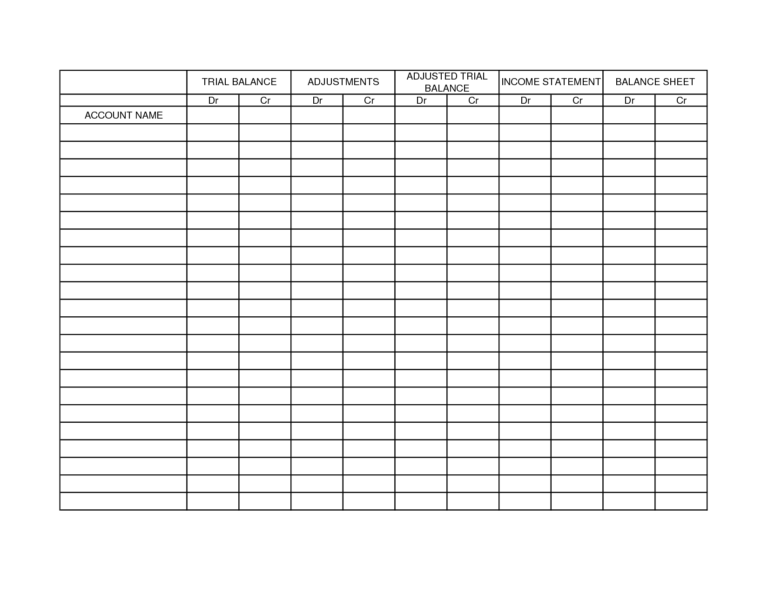

Prepare a worksheet with three columns. In preparing a worksheet, the following steps must be followed: Let us learn more about the methods and procedures of preparation of trial balance.

This is done to determine that debits equal credits in the recording process the trial balance is the first step toward recording and interesting your financial results. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. For account names, debit quantity and credit quantities.

We will add the remaining column titles later. The next step is to record information in the adjusted trial balance columns. A trial balance is a financial report that lists a company's general ledger accounts closing balances at a certain period.

Fill in all the account titles and record their balances in the appropriate debit or credit columns. One column is for account titles, another is for debits, and the other is for credits. How to prepare the trial balance.