Painstaking Lessons Of Tips About Reviewed Financial Statements Balance Sheet Template For Consulting Company How To Do A Income Statement

Consider using accounting software or financial statements provided by the company.

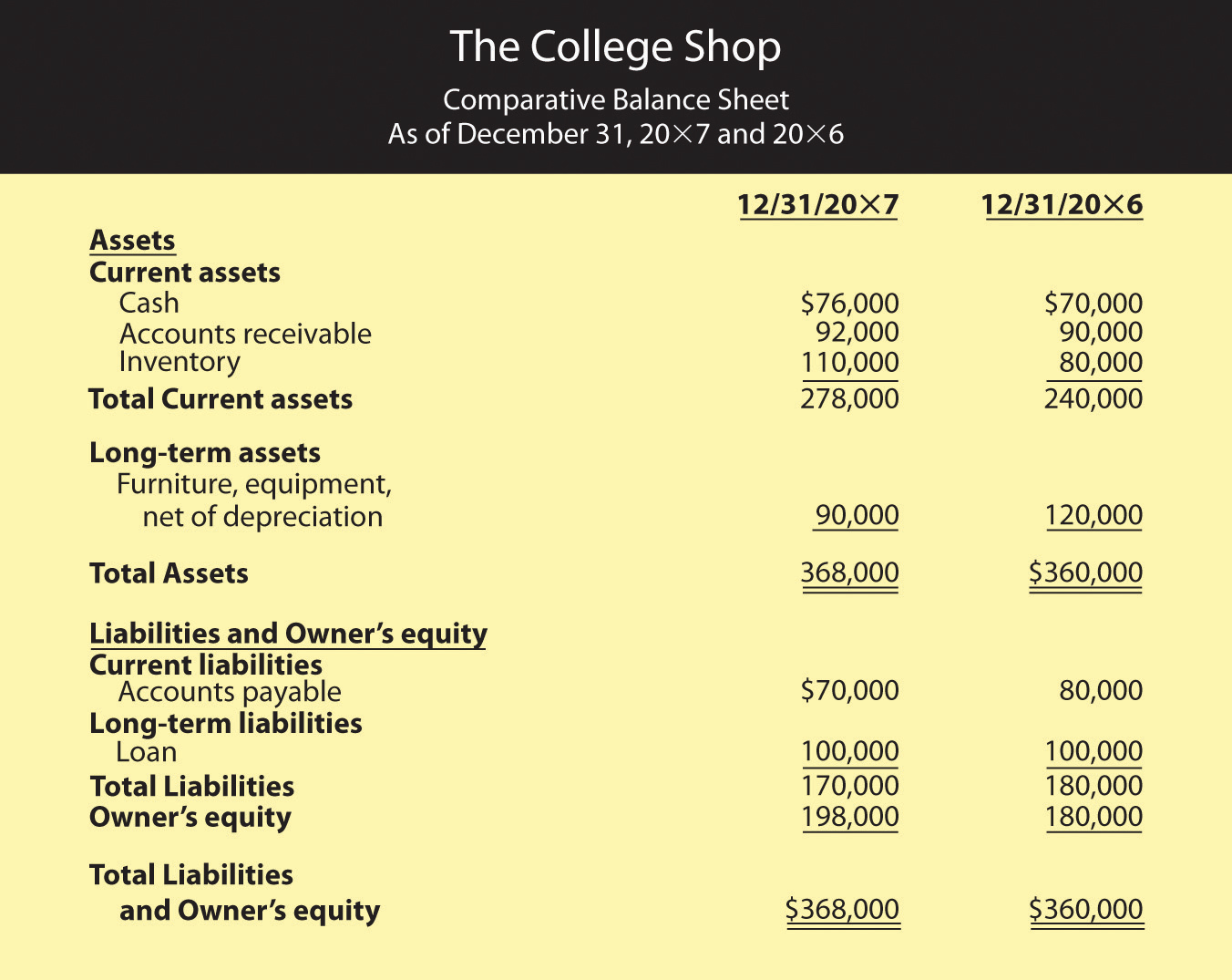

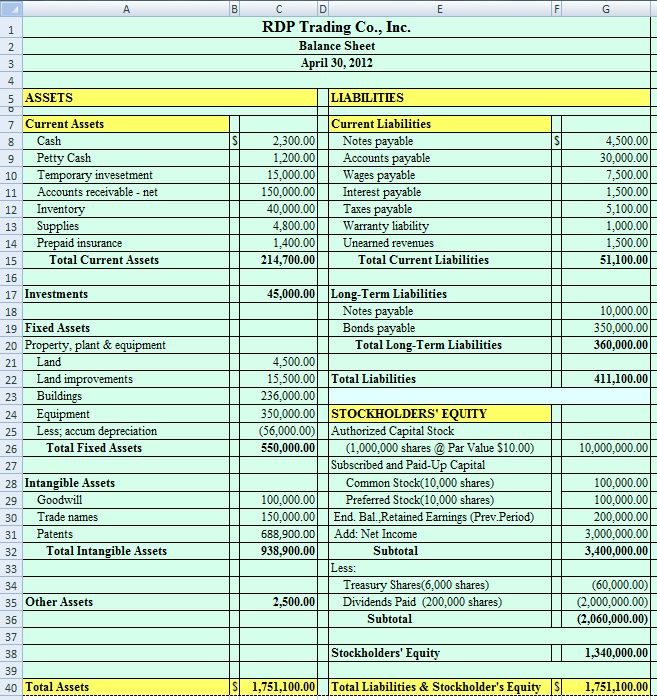

Reviewed financial statements balance sheet template for consulting company. Subtract current liabilities from current assets to determine your working capital level. See why thousands of small business owners trust bench with their books. For the year ended 31 may 2021 report to members 1 independent auditor’s report to the members of deloitte llp 7 income statement 11 statement of comprehensive income 12 balance sheet 13 statement of changes in equity 14 cash flow statement 15 notes to the financial statements 16 appendix to the financial statements 67.

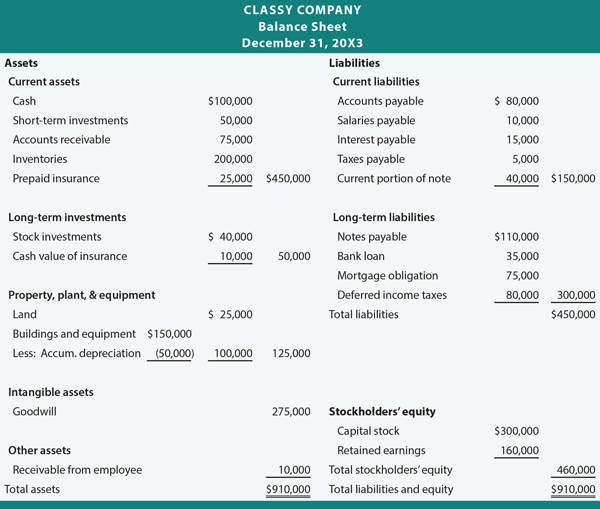

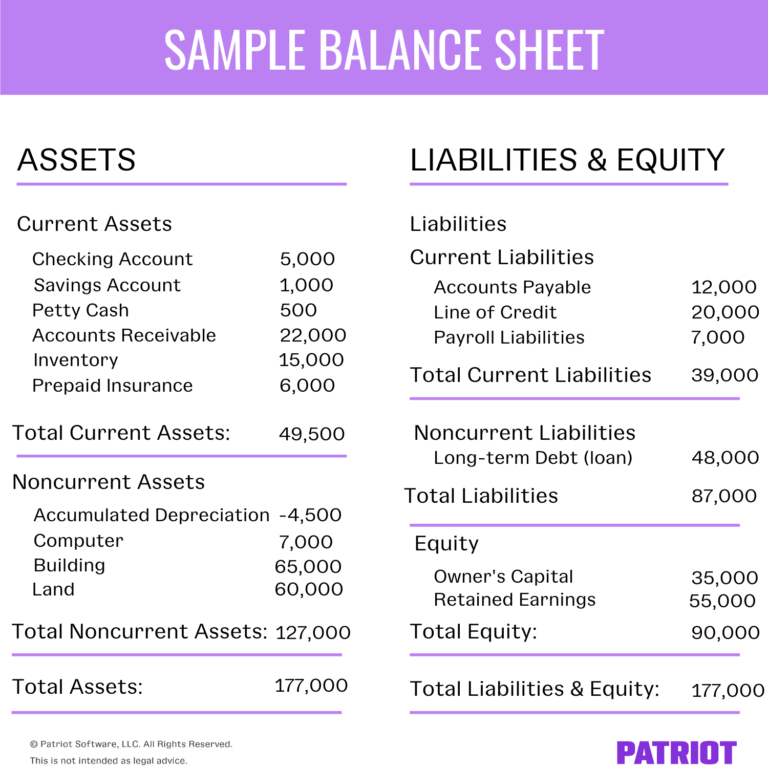

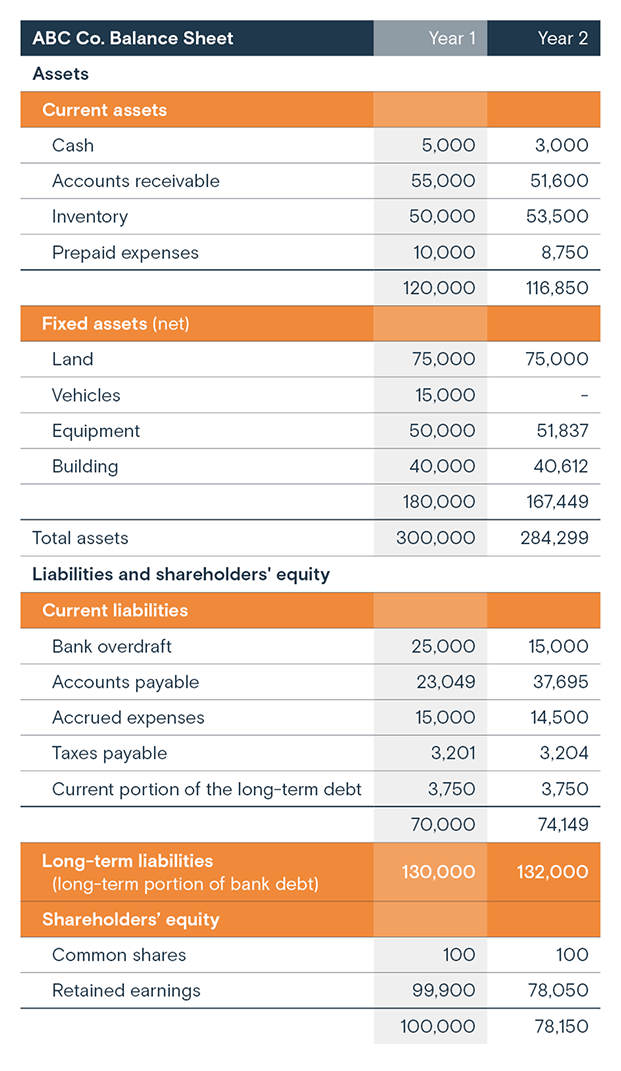

The balance sheet format displays the company’s total assets and the sources of these assets. Basic equation of a balance sheet: Types of financial statements.

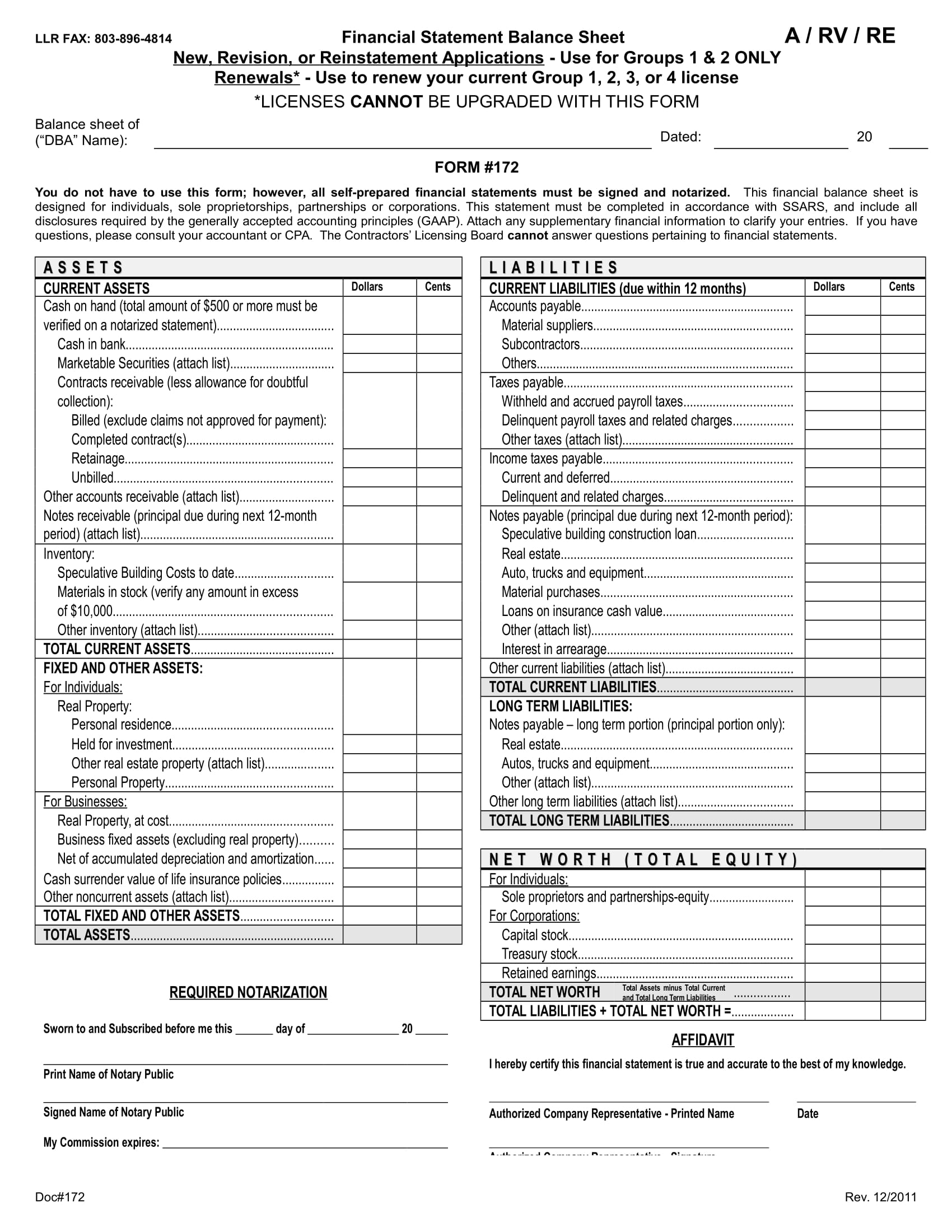

We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. See review exhibit d,illustrative review reports, for examples of review reports.29 each page of the financial statements reviewed by the accountant should include a reference, such as see independent accountant's review I (we) have reviewed the accompanying financial statements of xyz company, which comprise the balance sheets as of december 31, 20x2 and 20x1, and the related statements of income, changes in stockholders’ equity, and cash flows for the years then ended, and the related notes to the financial statements.

Cash is only part of working capital. In order to fully grasp the financial position of any company, you need to be able to review and analyze the following reports. Included on this page, you’ll find the essential financial statement templates, including income statement templates, cash flow statement templates, and balance sheet templates.

Create financial statements first, where possible, electronically link. Plus, we cover the key elements of the financial section of a business plan. In other words, the balance sheet format.

This includes income statements, balance sheets, and cash flow statements for the relevant time period. Effectively break down the financial efforts of your company with the help of this simple balance sheet consulting report template. A company’s balance sheet is one of three financial statements used to give a detailed picture of the health of a business.

It tells you the value of all the assets your business owns (including cash), and how they financed: If the date of effectiveness is more than 134 days past the audited balance sheet date, additional unaudited and reviewed interim financial statements are required to be included in the registration statement filing. Download a simple balance sheet template

Three ways to quickly determine the health of your business: 1 use the balance sheet to review the financial condition of a business, as of a given period, by looking at how it manages its asset, liabilities, and equity. Unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements such as balance sheets, income statements, or statements of cash flow, right?but now you’ve got some money to invest, you’re looking at a few companies and trying to figure out.

Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. How to read a balance sheet. Ifrs for smes illustrative financial statements for close corporations (included from page 84 to138 of the saica close corporations guide) may 2015.

Have reviewed the accompanying financial statements of xyz company, which comprise the balance sheets as of december 31, 20x2 and 20x1, and the related statements of income, changes in stockholders' equity, and cash flows for the years. Identify reliable sources of data and gather the necessary information. This blog post tells you how to create and review financial statements efficiently and effectively.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)