Impressive Info About Profit And Loss Statement For Service Business Periodic Income

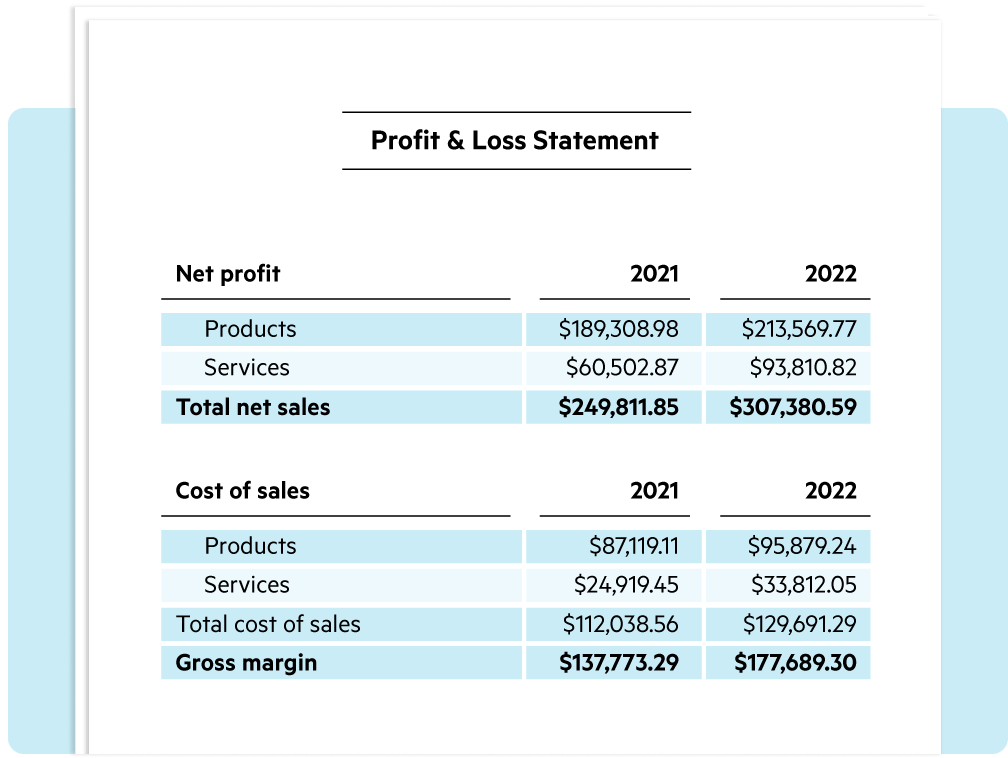

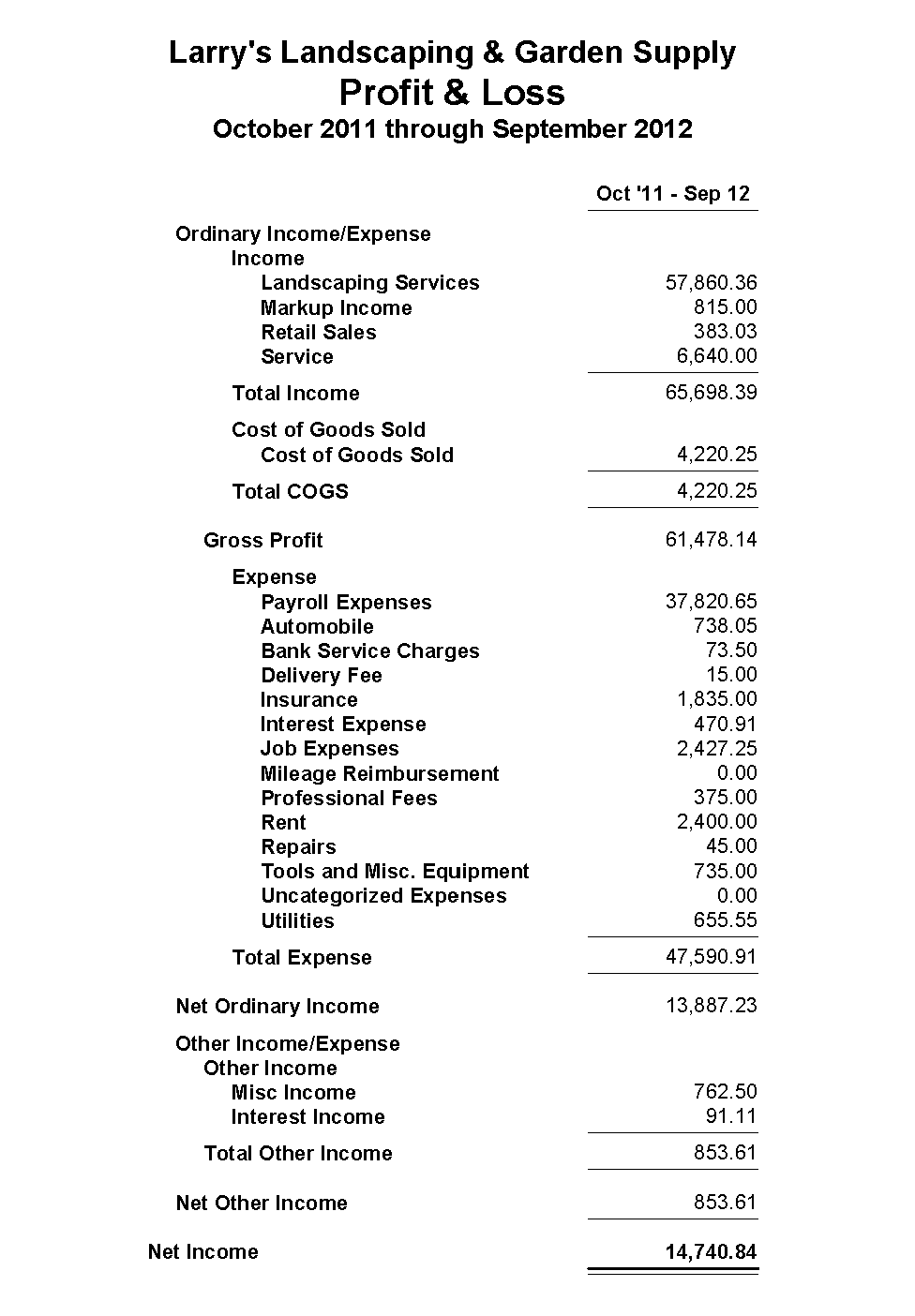

Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

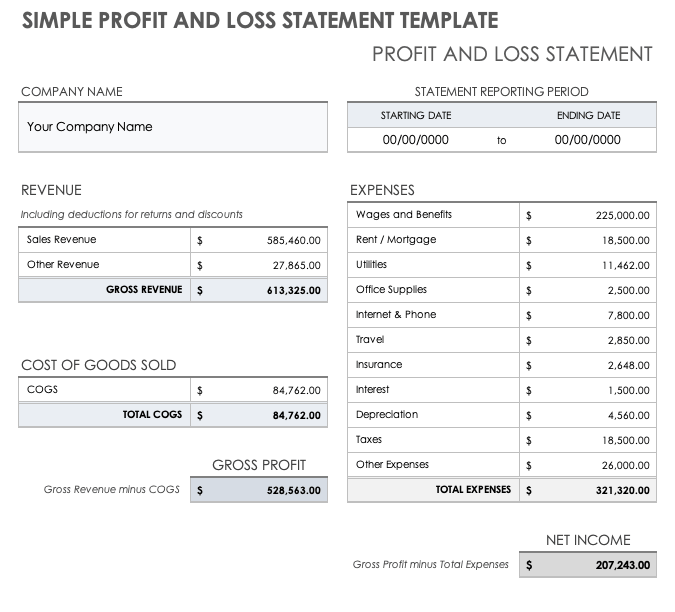

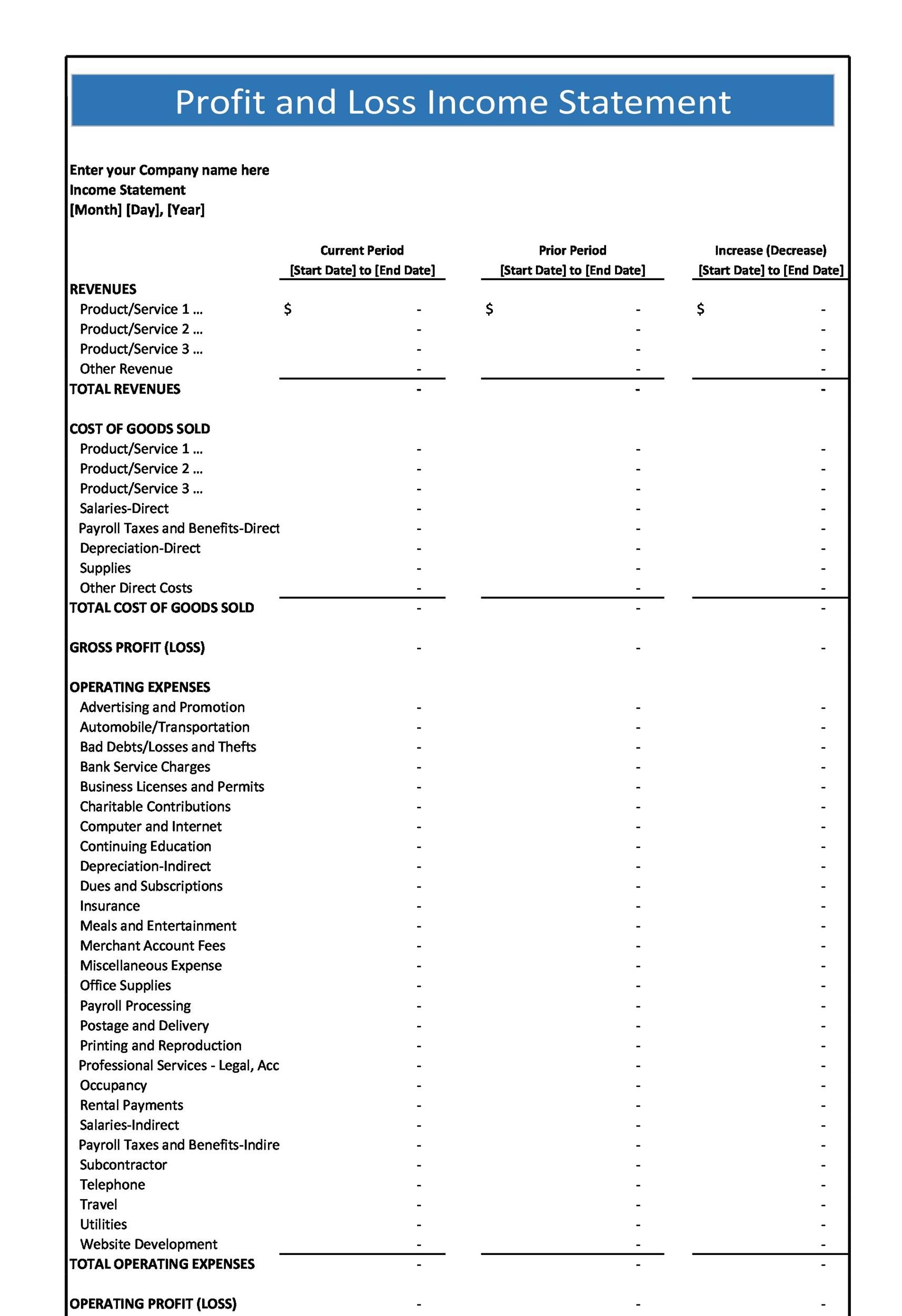

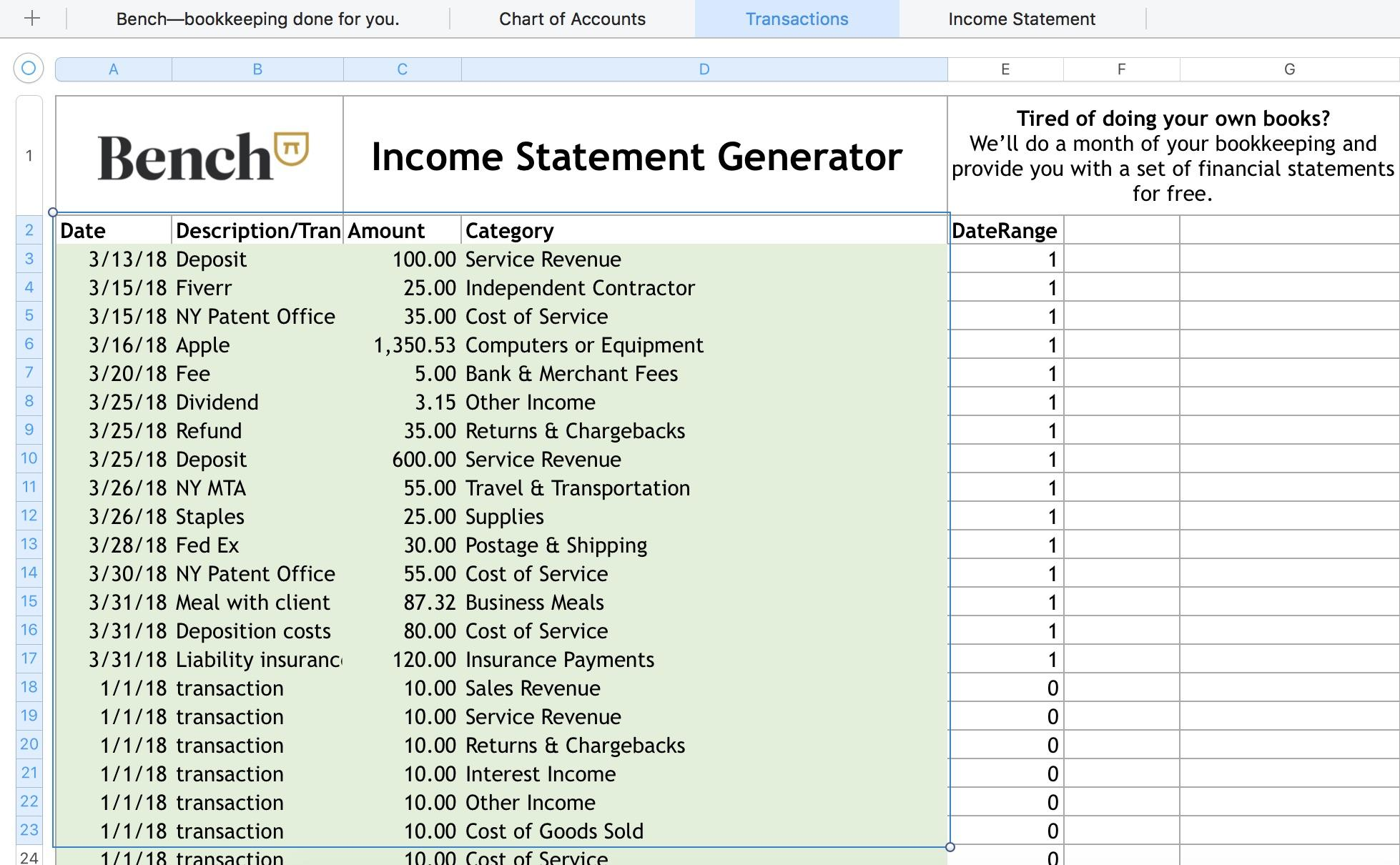

Profit and loss statement for service business. Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

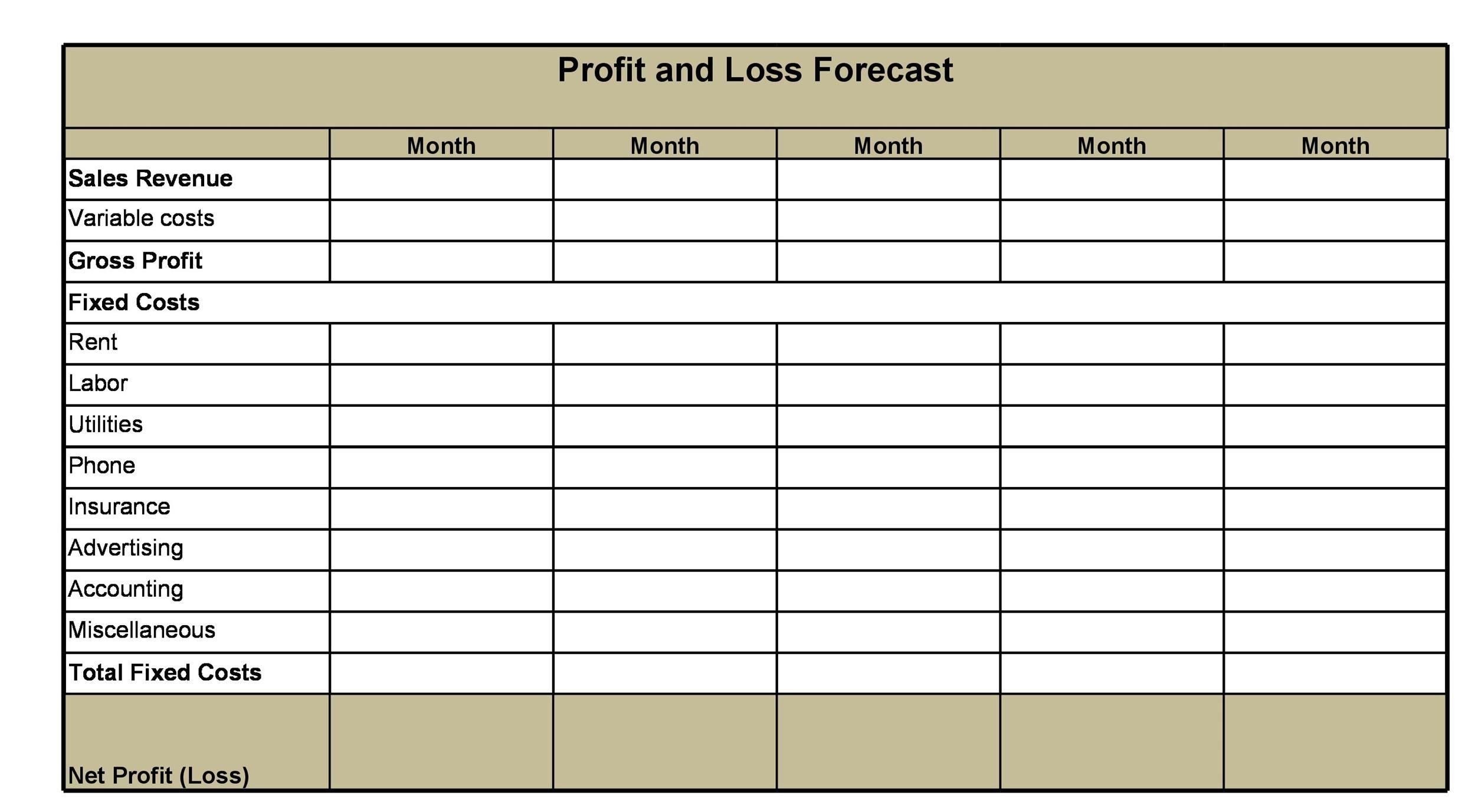

Annual profit and loss template sample; The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. A profit and loss statement (p&l) is a vital financial document for businesses, providing a snapshot of a company’s financial performance over a specific period, such as monthly, quarterly, or annually.

It’s usually assessed quarterly and at the end of a business’s accounting year. A sample profit and loss statement demonstrates a company’s ability to make money, drive sales, and control costs. It’s always important to keep this simple formula in mind and to.

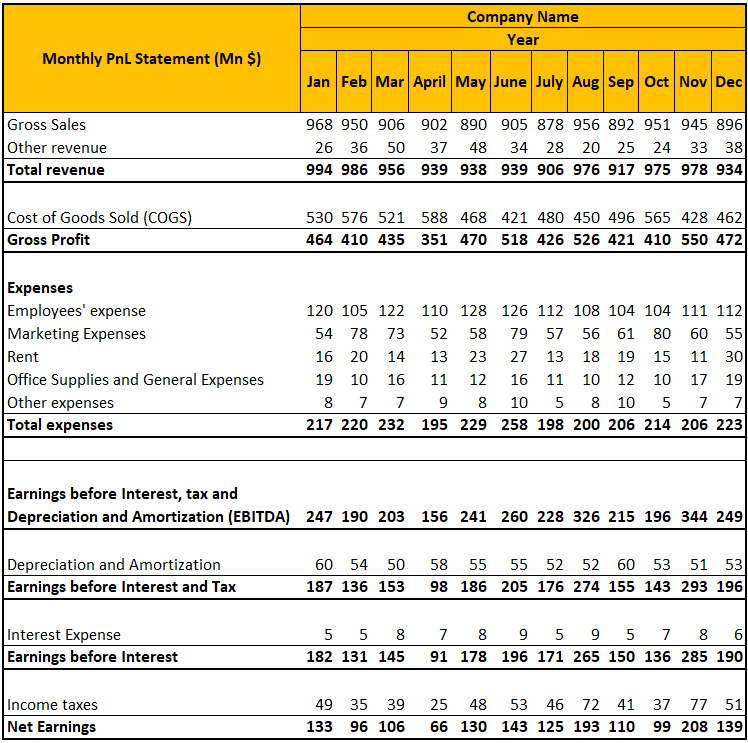

Monthly profit and loss template; It tells you how much profit you're making, or how much you’re losing. Small bakery p&l statement, product/service company p&l statement, and;

Since service based companies do not sell a product, the income statement will not contain cost of goods sold. And (5) the statement of financial position. A profit and loss statement is just one of several financial reports that businesses use to track their progress and performance.

Income statements for service companies. Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or. You can obtain current account balances from.

It shows your revenue, minus expenses and losses. The bottom line on a p&l will be net income, also known as profit or loss. You’ll sometimes see profit and loss statements called an income statement, statement of operations, or statement of earnings.

Jacob dayan there are five types of financial statements that are integral to the smooth operation of a business of any size. General profit and loss templates for small business. Familiarizing yourself with these fundamental practices is a crucial step to getting your small business on the path to profitability.

Then, it subtracts the costs of making those goods or providing those services, like. Net income is the profit that remains after all expenses and costs, such as taxes. Qbi is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, s corporations, sole proprietorships, and certain trusts.

(1) the profit and loss statement; Other terms for a p&l statement include: This template can be used by service, retail, and b2b organizations.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Quarterly-Profit-Loss-Statement-Template-TemplateLab-790x1102.jpg)