Simple Tips About Accrued Revenues Would Normally Appear On The Balance Sheet As Condensed Consolidated Sheets

![[Solved] Common categories of a classified balance sheet include](https://khatabook-assets.s3.amazonaws.com/media/post/2022-05-30_122705.4100930000.webp)

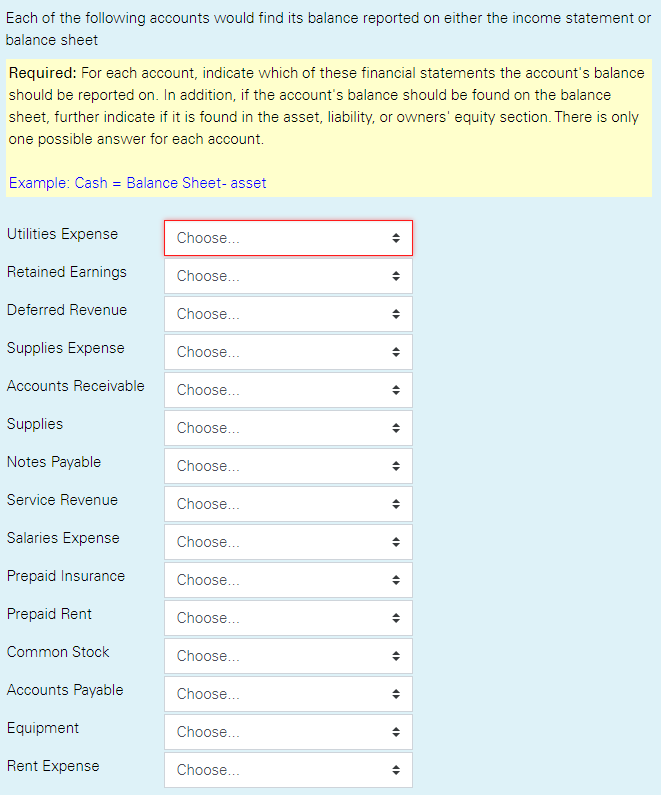

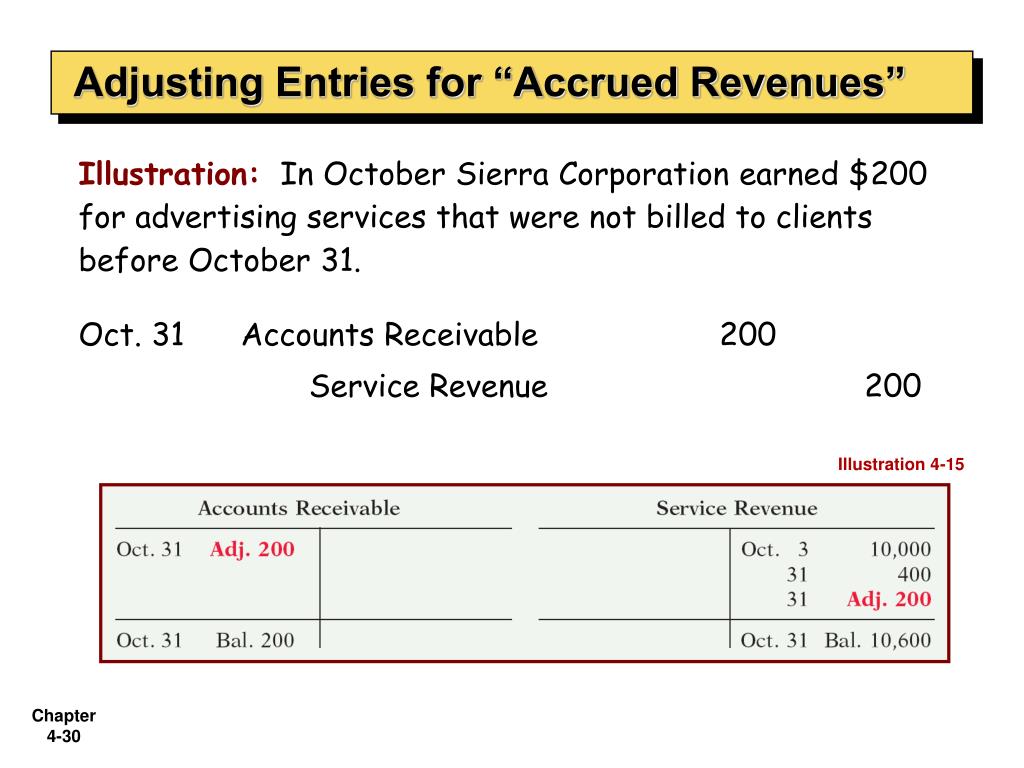

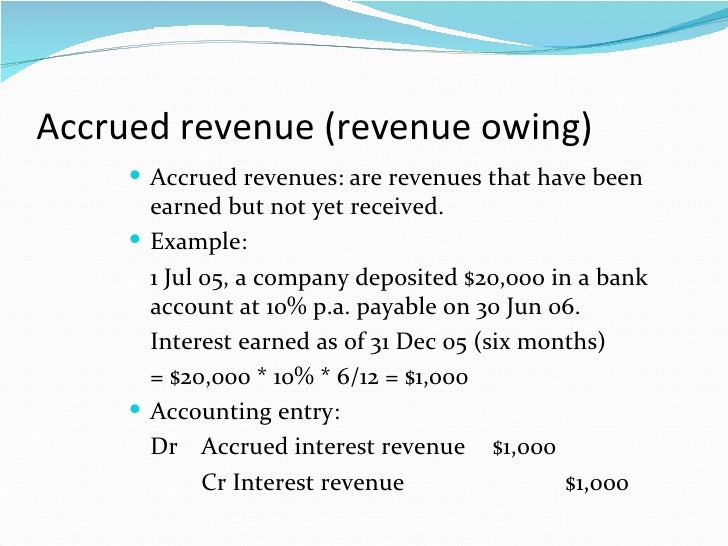

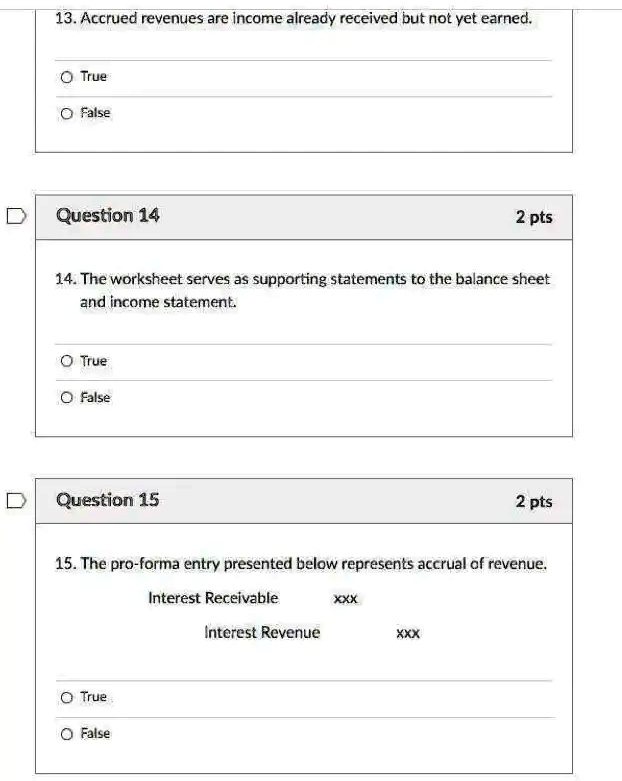

Definition of accrued revenues accrued revenues include service revenues, interest income, sales of goods, etc.

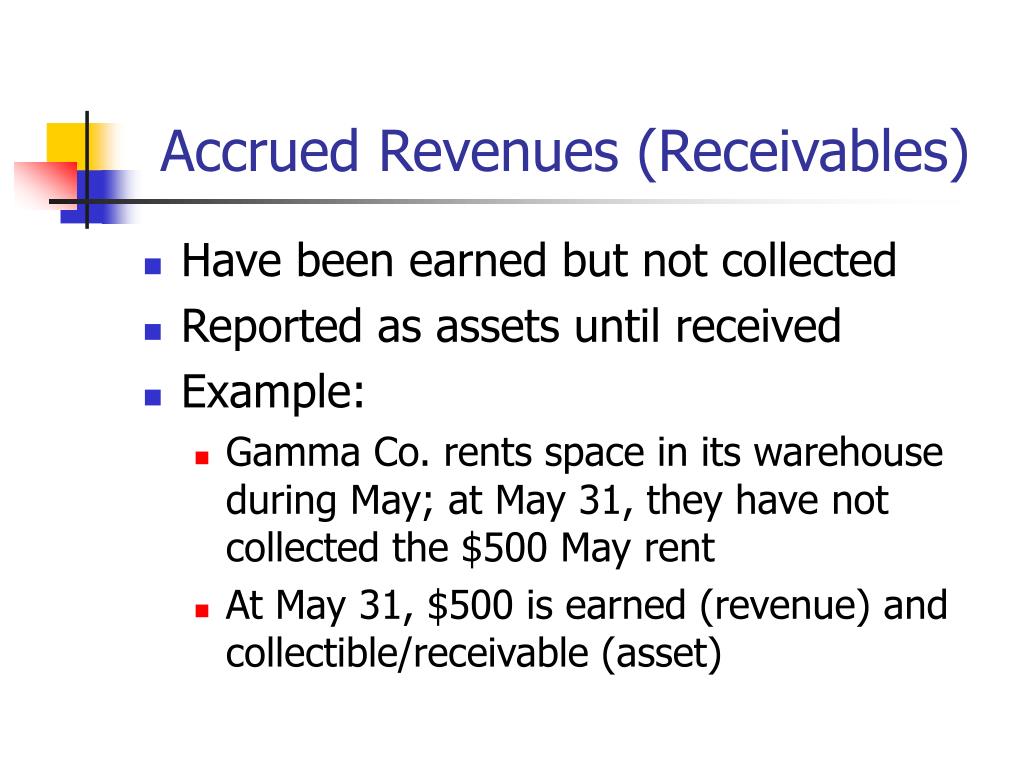

Accrued revenues would normally appear on the balance sheet as. They may appear under cogs (cost of goods sold) or operating expenses, such as sg&a. For instance, let’s assume a company pays $100,000 in salaries for the whole year. If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account.

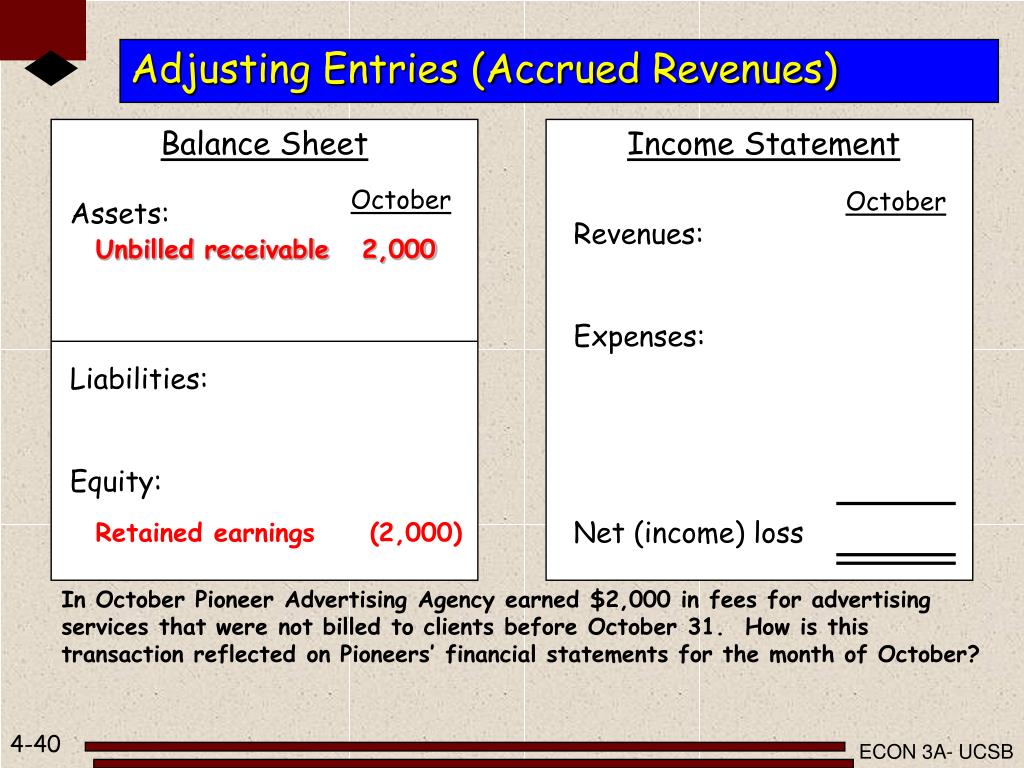

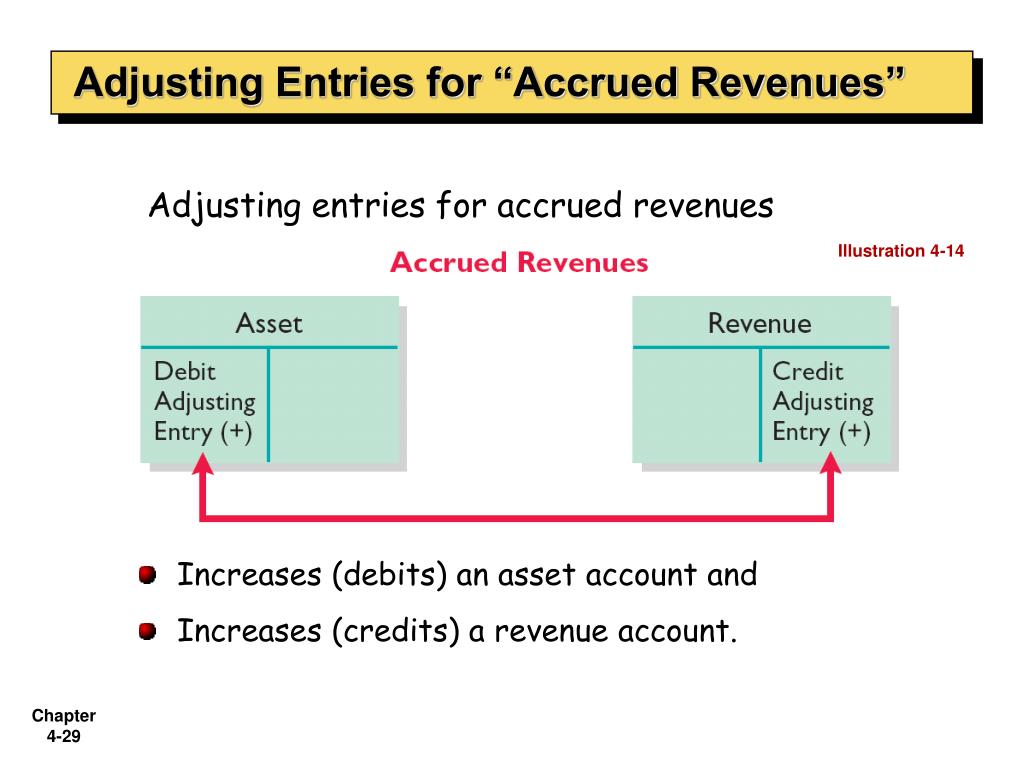

The accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. As discussed in step 2, accrued revenues are recorded using the accounts receivable account, which is an asset account. Before the adjusting process, you have earned accrued revenue, but not.

Accrued revenues would appear on the balance sheet as a. Both accrued revenue and accounts receivable are considered assets on the balance sheet, but accounts receivable is listed separately from accrued revenue. Accrued revenues are recorded as receivables on the balance sheet to reflect the amount of money that customers owe the business for the goods or services they purchased.

It could be described as accrued receivables or accrued income. Therefore, accrued revenues would appear on the balance sheet as assets. Since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities.

The accrual of an expense will usually involve an accrual adjusting entry that increases a company's expenses and increases its current liabilities. Since it comes with the customer’s future obligation to pay, an accrued revenue account on the balance sheet will appear when the related revenue is first booked on the income statement. What are some examples of accrued expenses?

Accrued revenue is recognized as earned revenue in the receivables balance sheet, despite the business not receiving payment yet. In this case, a company may provide services or deliver goods, but does so on credit. Each transaction will appear on the income statement as earned revenue and on the balance sheet as a current asset.

Each transaction will appear on the income statement as earned revenue and on the balance sheet as a current asset. Accrued revenue is shown as adjusting journal entries under the current assets category in the balance sheet and as an earned revenue in the income statement of the company. Which have been earned by a business, but the transactions are not yet fully processed and therefore are not recorded in the company's general ledger accounts.

Adjustment for accrued revenues lets you cover items on your balance sheet that otherwise wouldn’t appear until your pay come through. The accounting equation remains in balance. When the payment is cleared, it is recorded as an adjusting entry to the asset account for accrued revenue.

Accrued revenue is recognized in a business’s income statement under the heading “unearned revenue,” while accounts receivable is recognized under the heading. When it comes to making an accrued revenue journal entry, there's one thing that you need to keep in mind at all times; The unbilled revenue account should appear in the current assets portion of the balance sheet.

Accruals recorded as current liabilities. If it is the end of the a. As the payments are received, the accrued revenue account is reduced by the amount of cash received, with no further impact on the income statement.