Best Of The Best Info About Profit And Loss Statement For Sole Trader Interest Paid On Debentures In Cash Flow

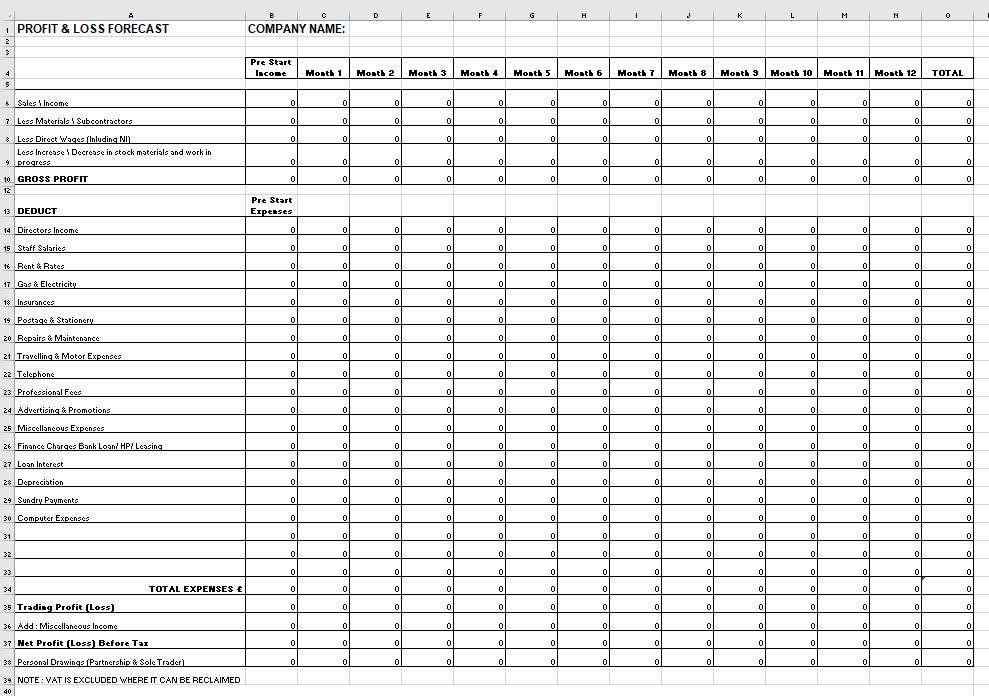

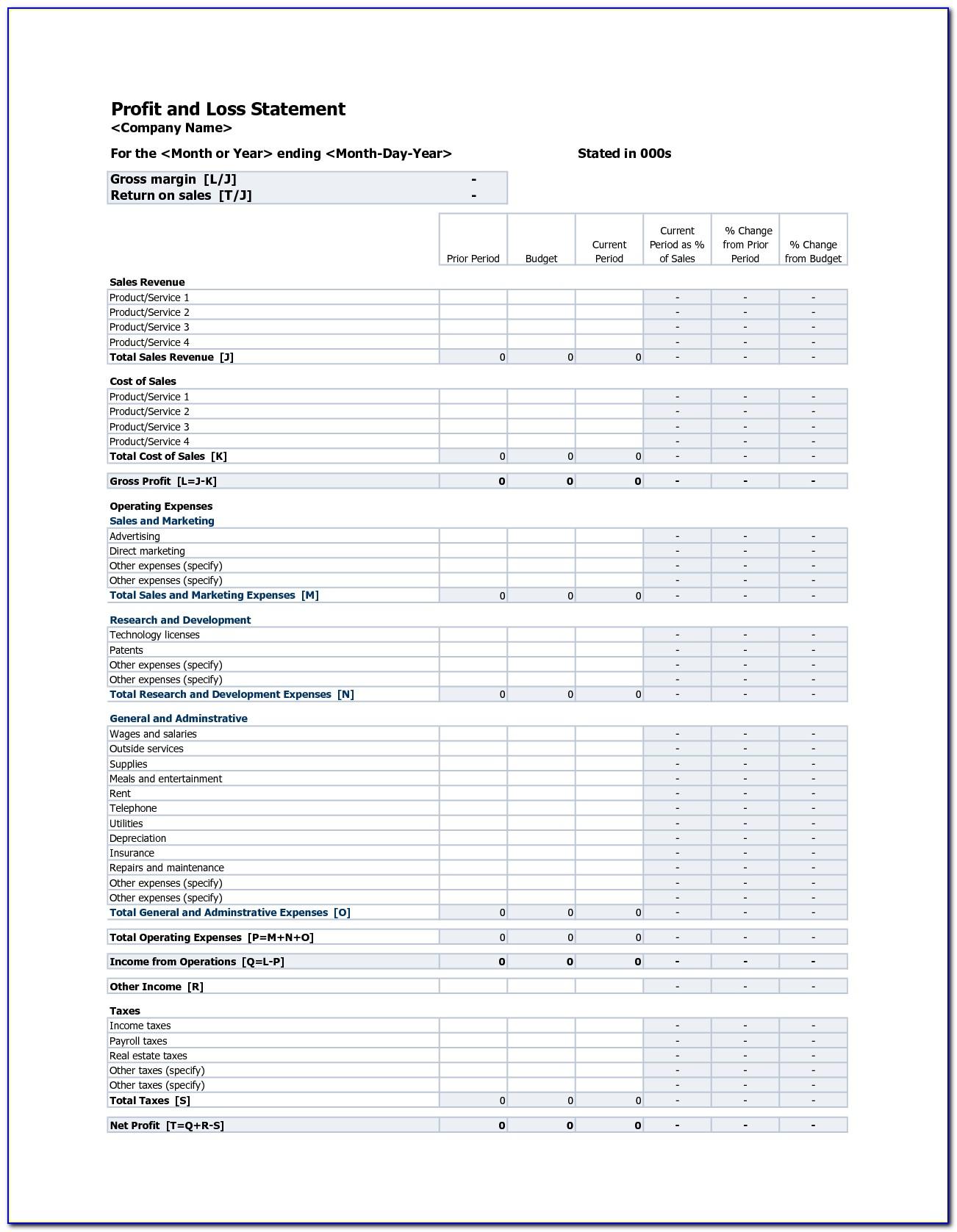

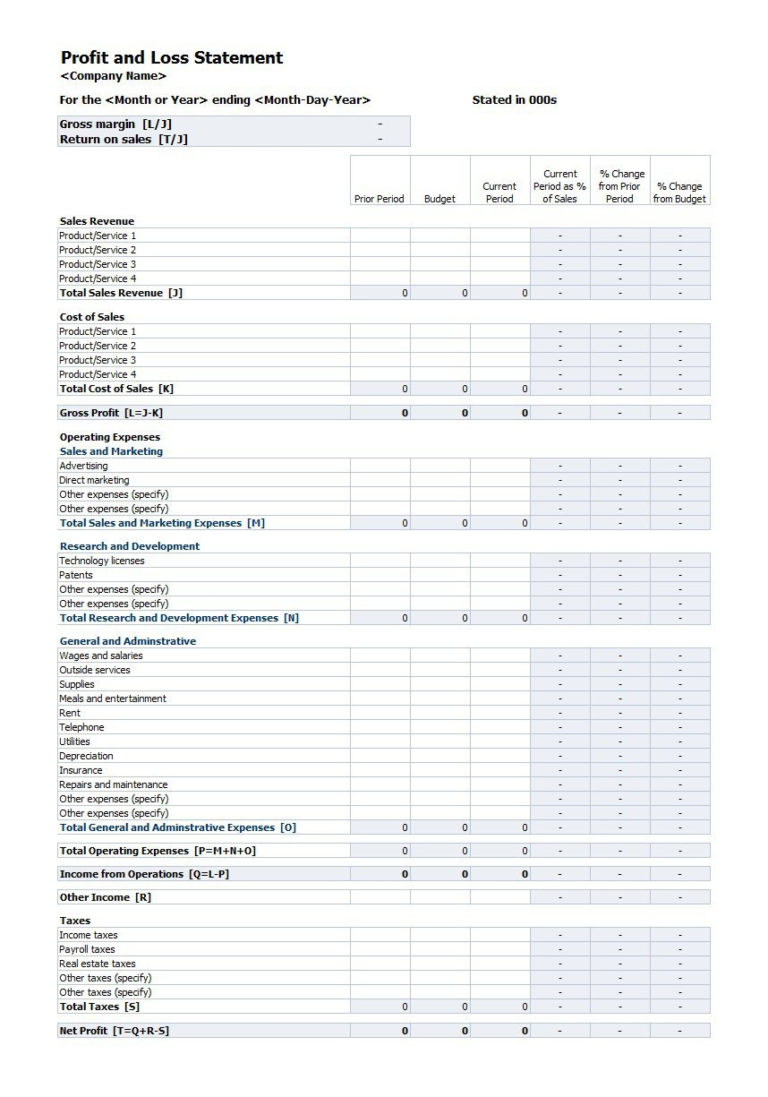

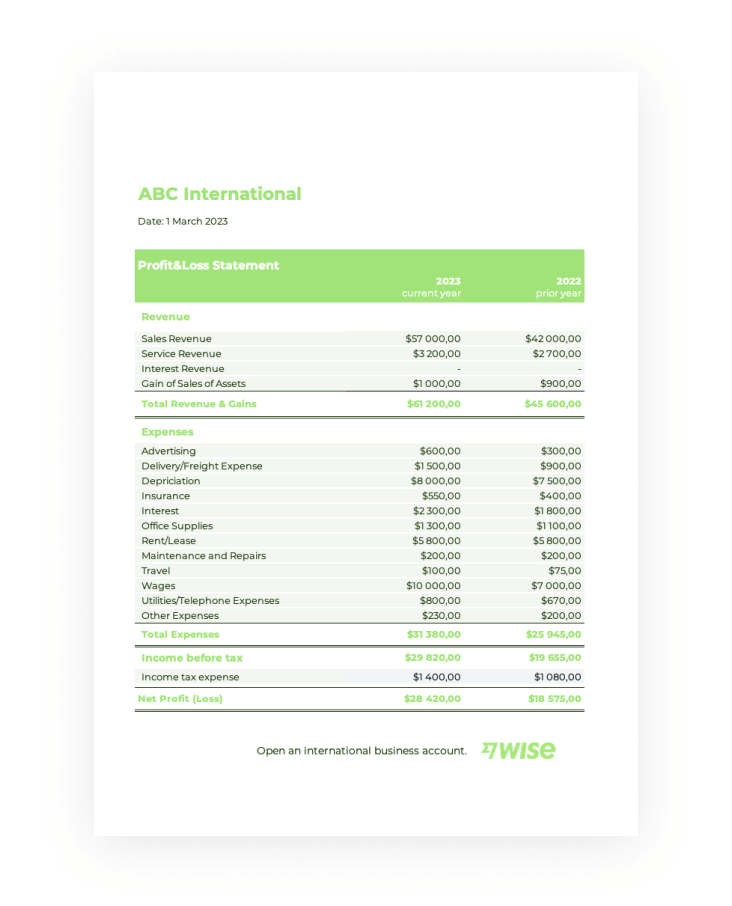

Download a free profit and loss template.

Profit and loss statement for sole trader. How to prepare a profit and loss (p&l) statement. If your business assets have changed, you need to give us an updated.

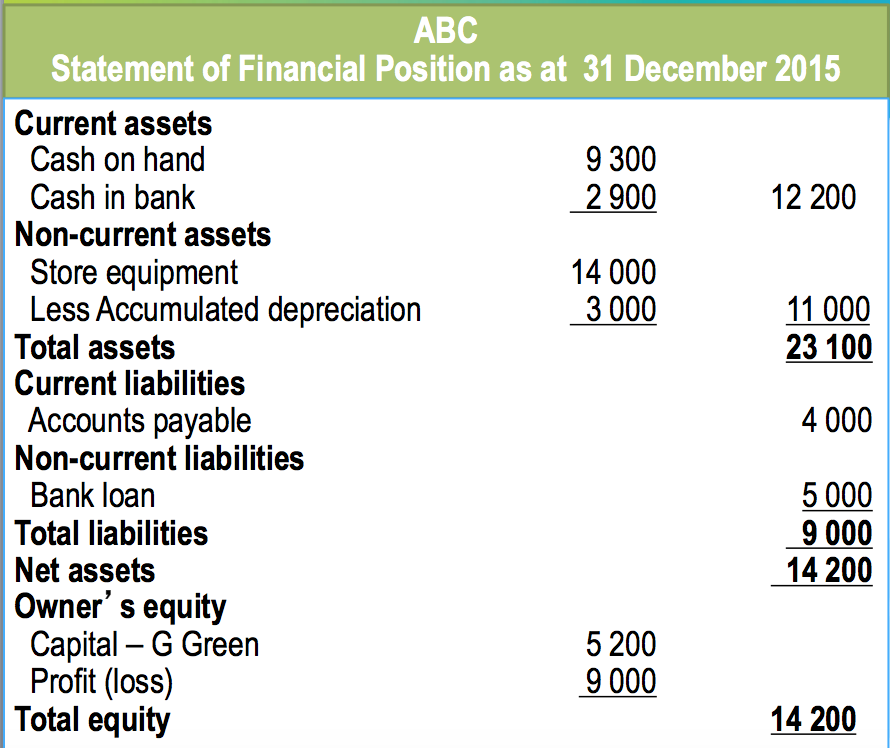

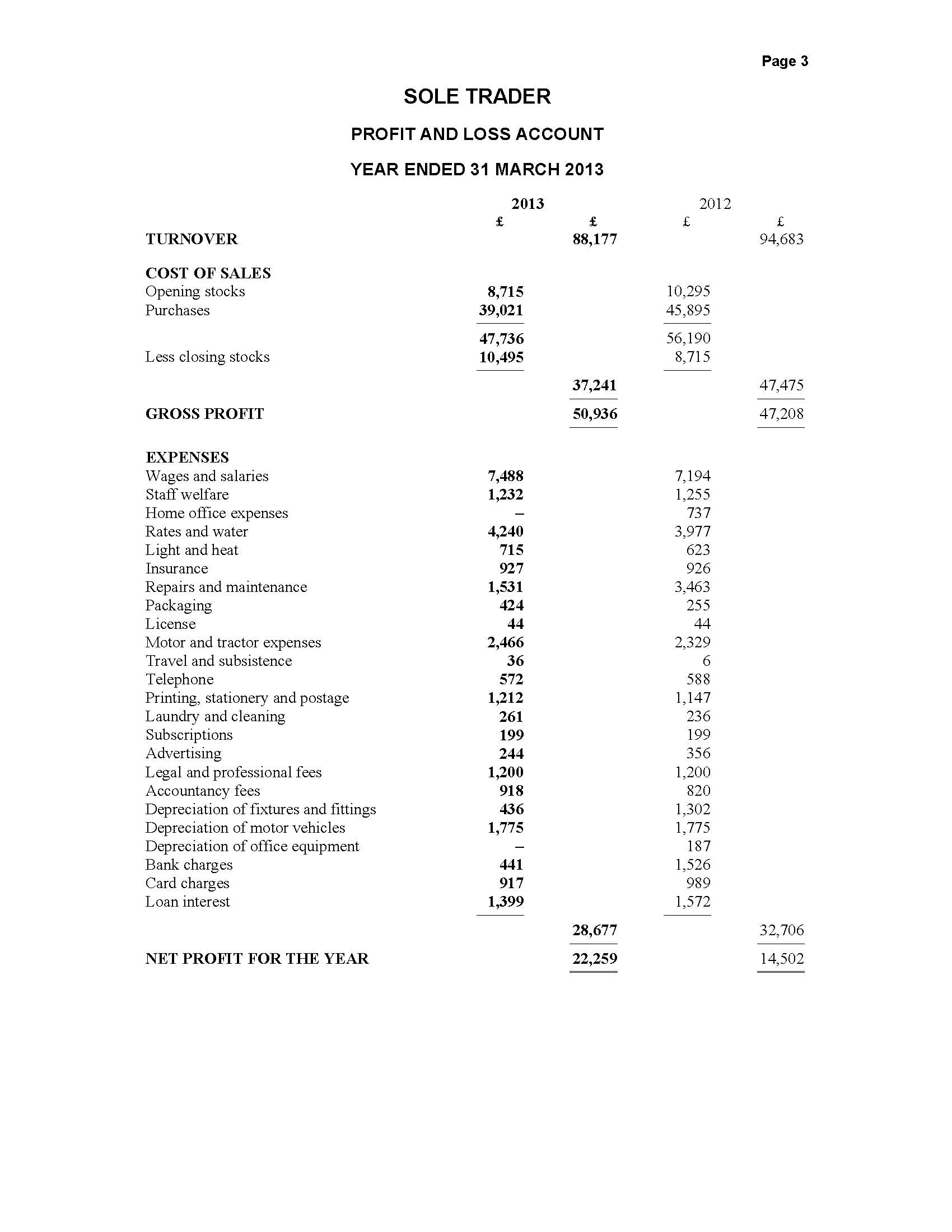

A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit. A profit and loss account is a financial statement that shows the financial performance. The profit and loss statement (p&l) is one of the most important financial documents that any small business owner or sole trader should maintain regularly.

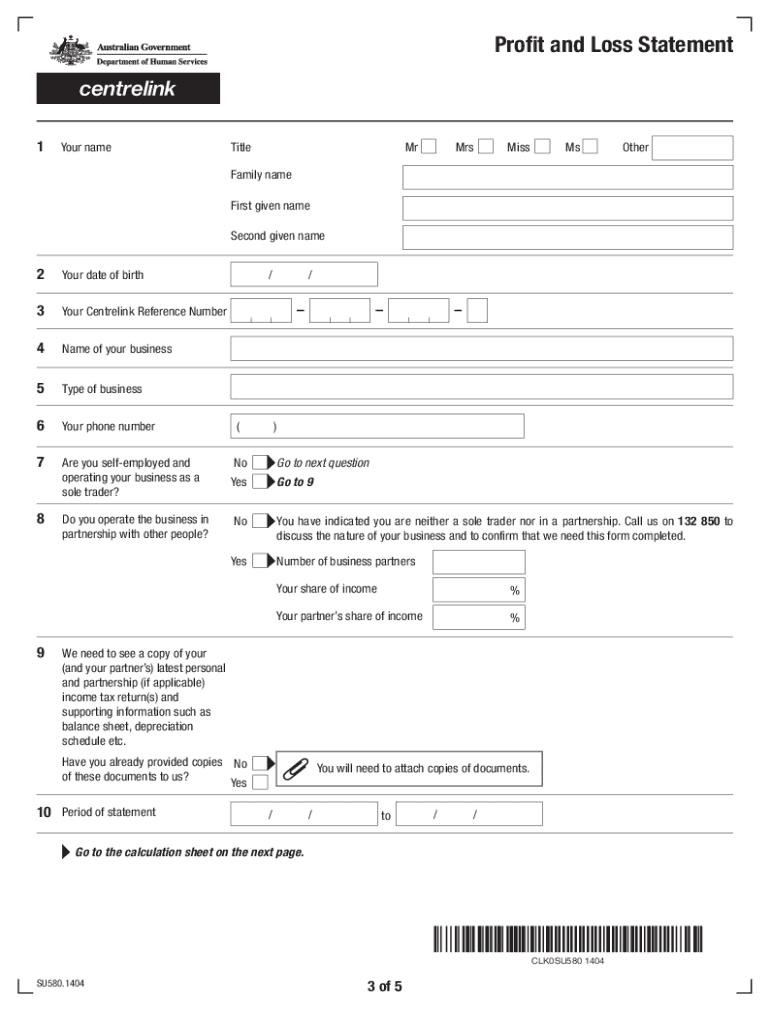

Use this form if you are a sole trader, subcontractor or a partner in a partnership that has started new employment or a new business. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period,. Trading, profit and loss account @a.eaccountingtutorials6593 #accounting.

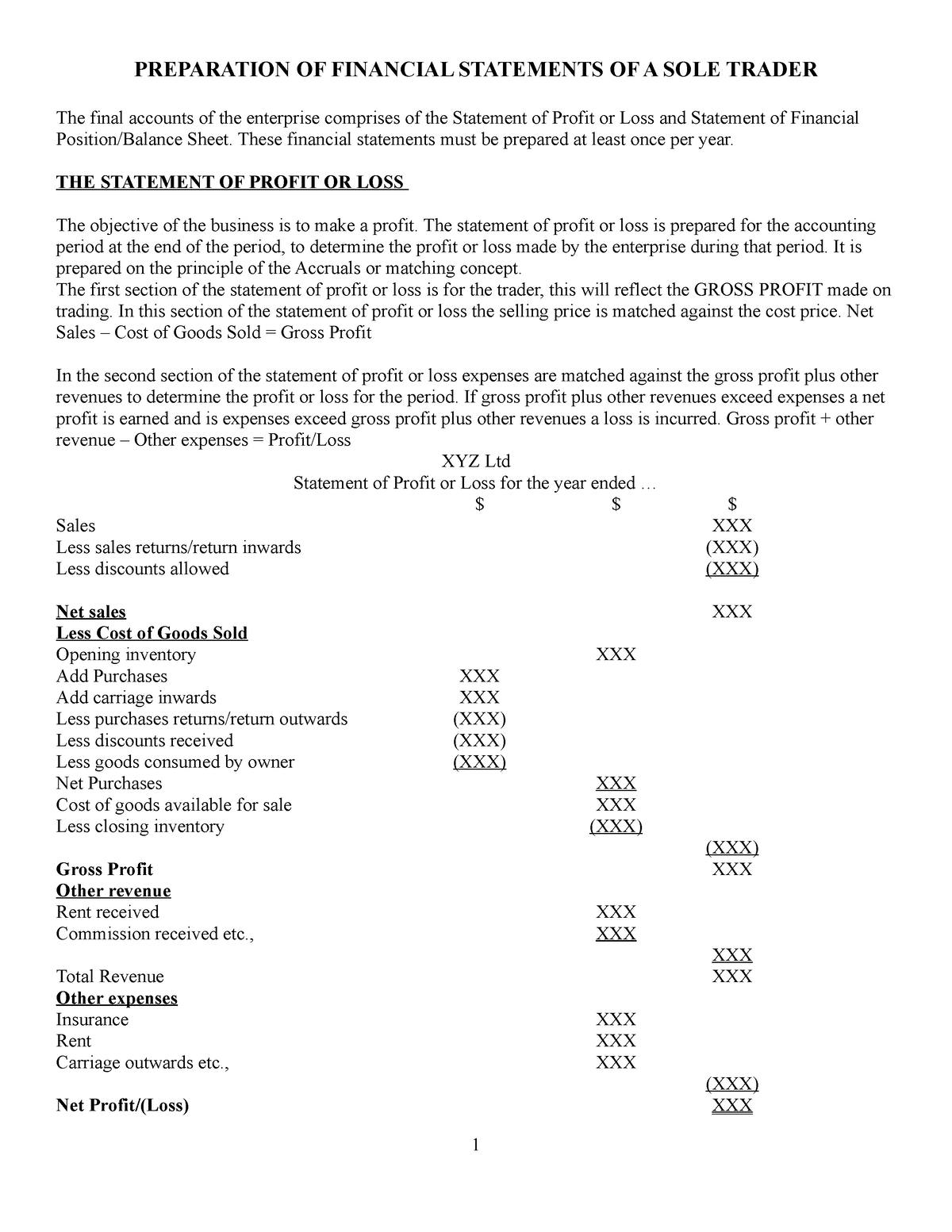

What is a profit and loss (p&l) statement? Zimsec o level principles of accounts notes: Use this form if you are a sole trader (including a subcontractor) or a partner in a partnership who has:

Canteen / dairy shop / supermarket operators. It shows how much money has been earned (revenue) and how much money has been spent. From the following trial balance of s madondo, extracted after one.

Trading and profit and loss account example. A profit and loss template to help you identify how much profit your business has made over the last 12 months. The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce.

6 the profit and loss account of a sole trader 6.1 introduction the financial performance or profitability of a business is one aspect that is of key interest to its owners and other. When a recipient commences working as a sole trader or in a partnership, they must provide an interim profit and loss statement for the first 3 months of their. In this article what is a profit and loss statement?

No specific format of profit & loss account is given for the sole traders and partnership firms. Small business owners can use profit and loss statements to measure business performance on a monthly, quarterly, or annual basis. For limited companies, and sole traders earning over £50,000 a year, a profit and loss statement is required for hmrc.

You’ll sometimes see profit and loss statements called an income. Final account of a sole trader ( income statement part 1). A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and.

If your business income has changed you need to give us an updated profit and loss statement form. They can prepare the p&l account in any form.