Matchless Tips About Ppp Loan Financial Statement Disclosure Example Preparing The Unadjusted Trial Balance

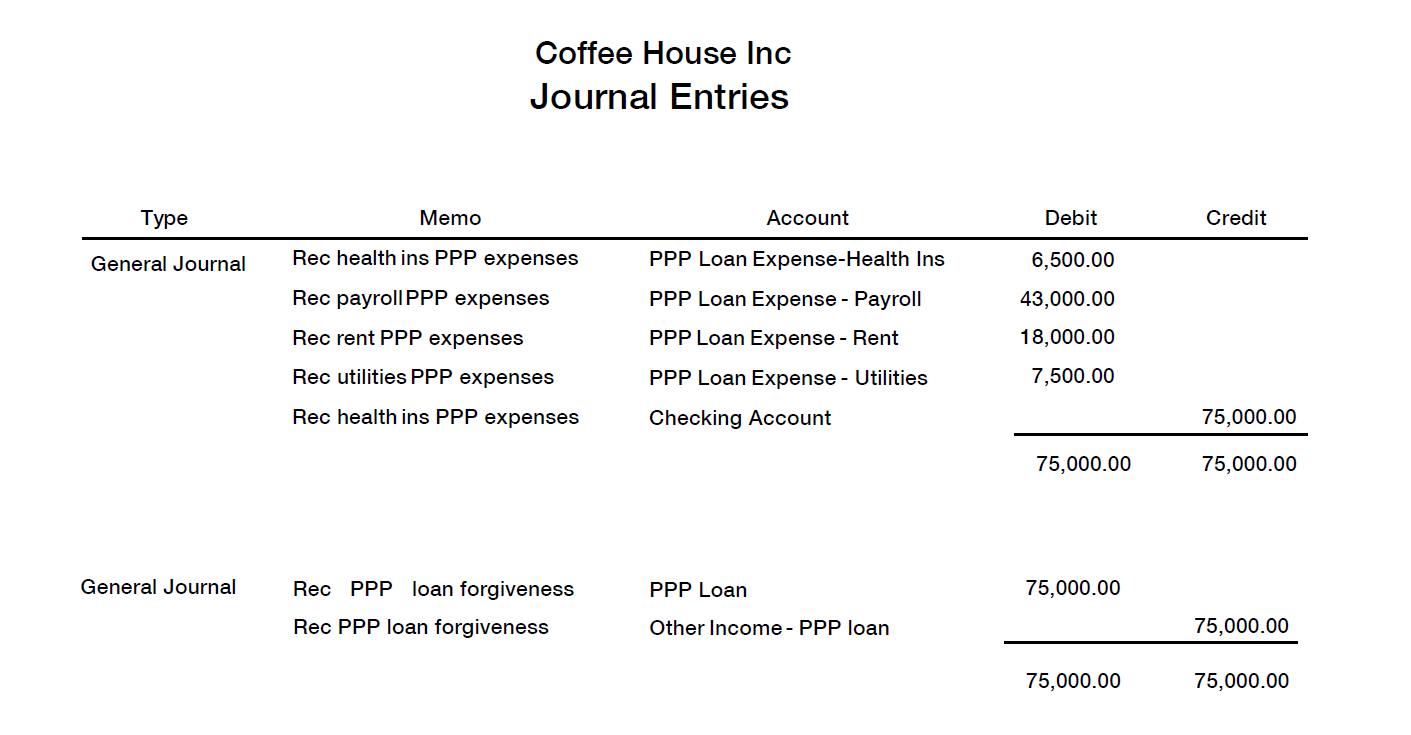

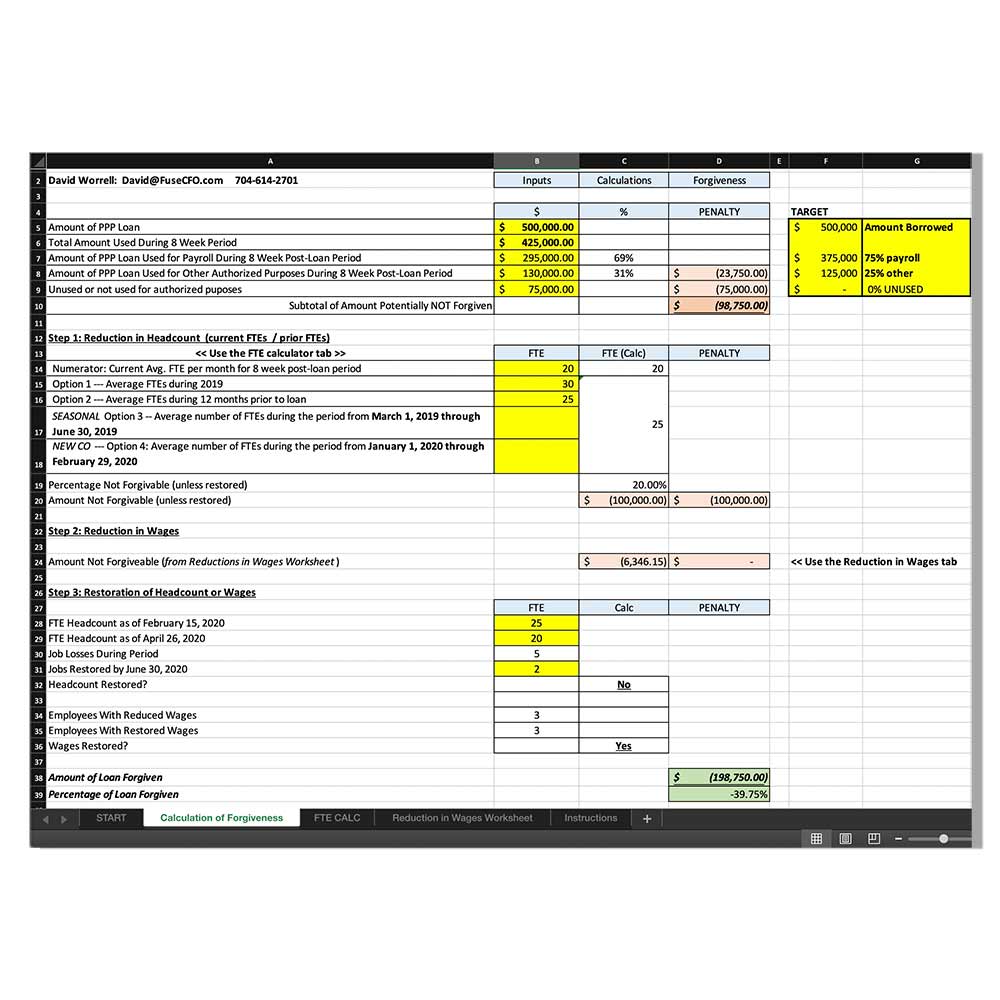

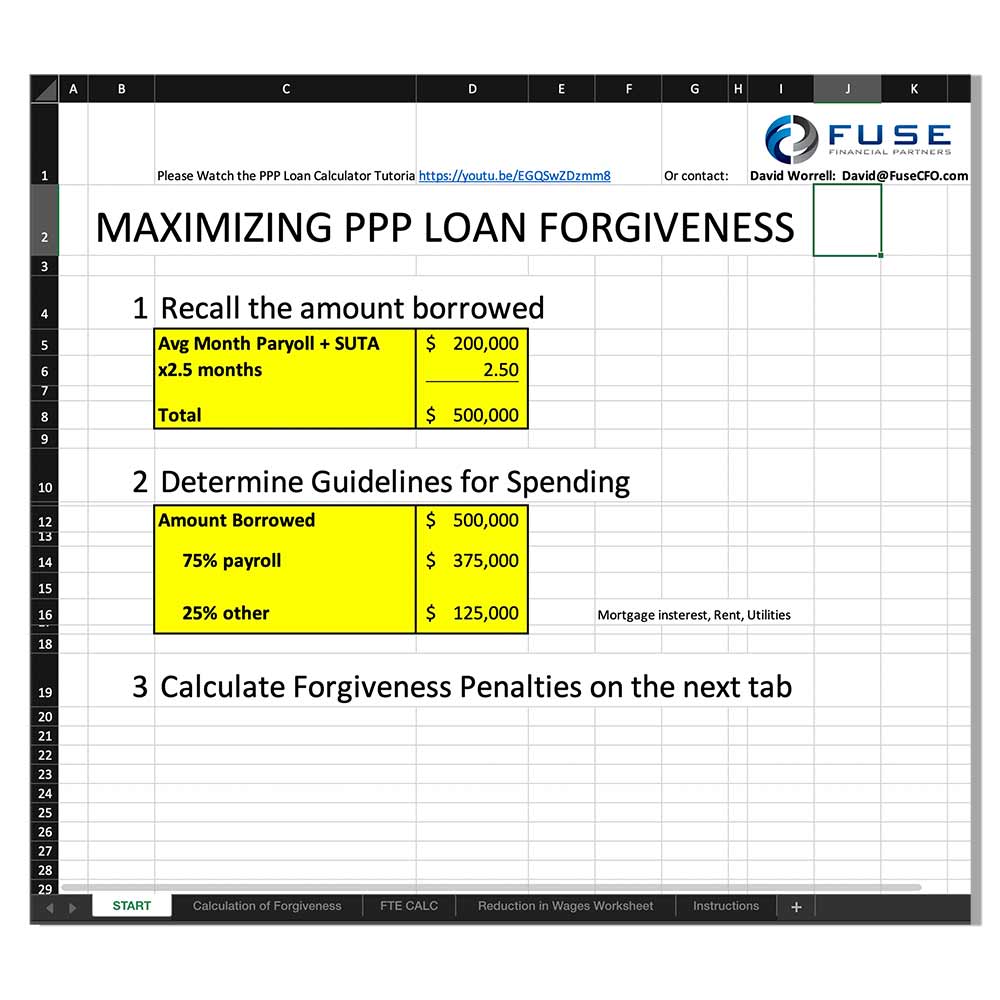

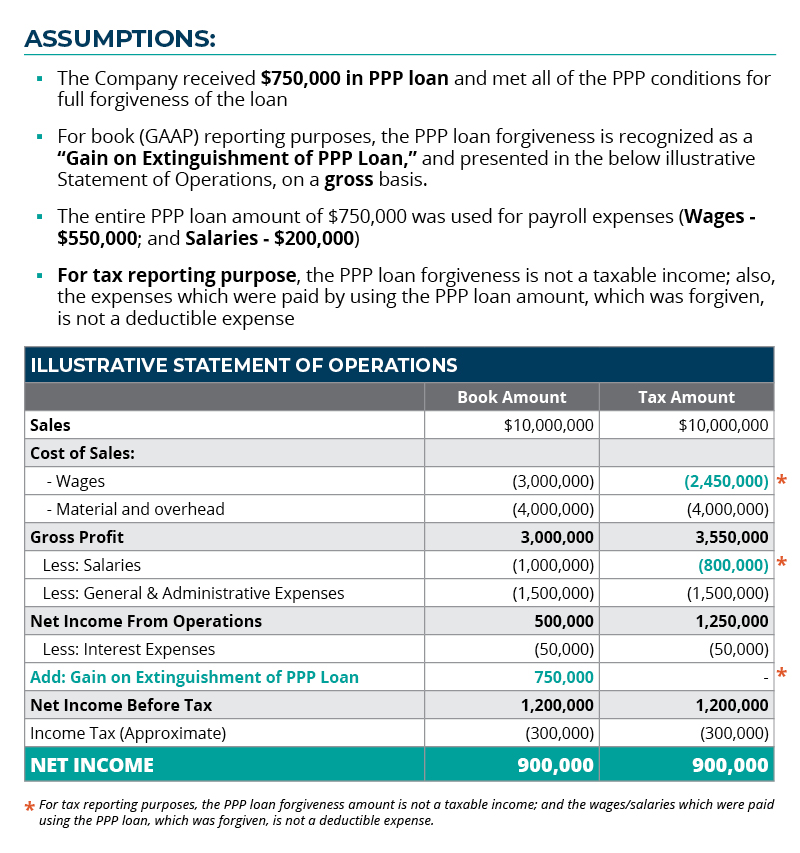

Ppp loans can potentially be recorded under different accounting standards which results in different journal entries and disclosures as well.

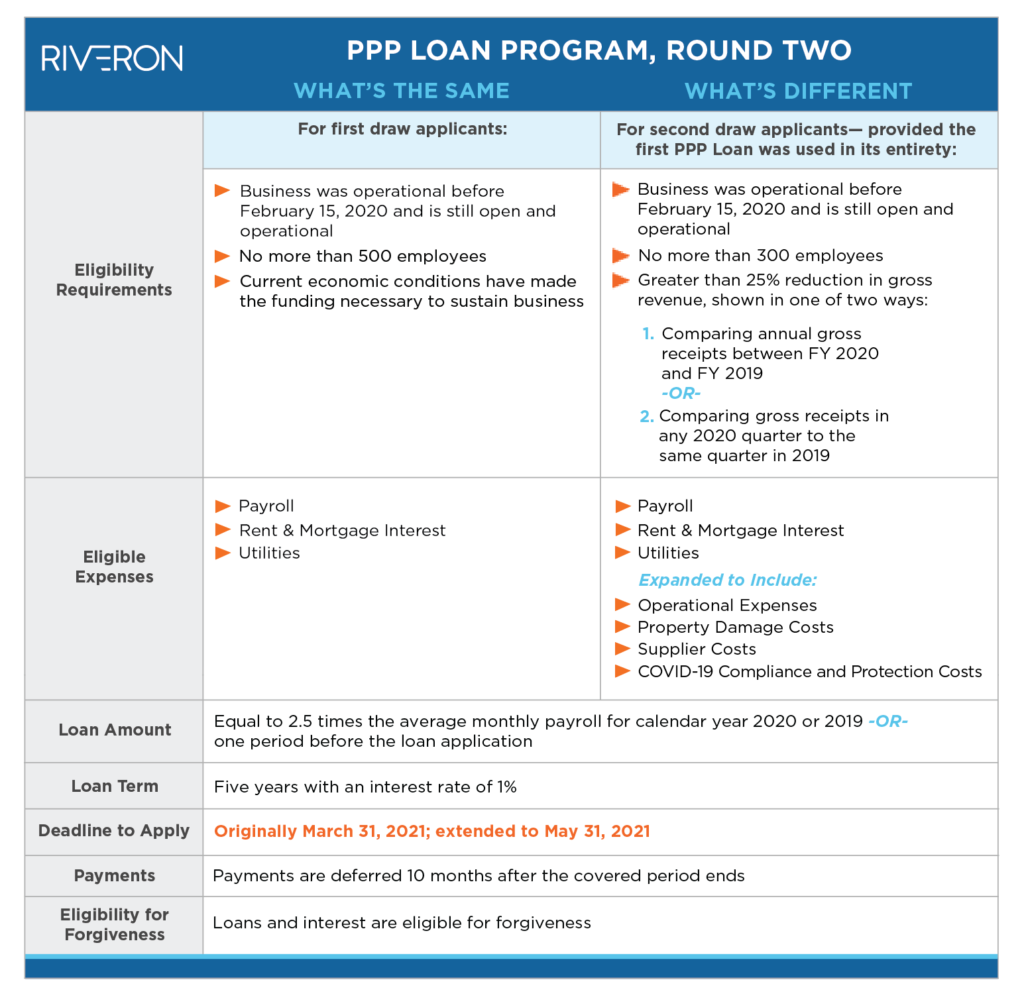

Ppp loan financial statement disclosure example. Regardless of the policy applied, borrowers with material ppp loans should. For ppp loans of more than $150,000,. On the quarterly and annual statements, note 11 is the appropriate place to disclose a ppp loan.

For cash flow statement purposes, ppp loan proceeds would. 100% certain about full forgiveness of ppp loan assume that company x received ppp loan $700,000 on june 1, 2020. Rule indicates that the sba may audit any ppp loan at its discretion until the end of the required document retention period for the loan.

Examples of ppp loan disclosures. Many businesses have begun applying for forgiveness of their paycheck protection program (ppp) loans, and q4 of this year is. Picpa cpa now ppp loan accounting guidance from aicpa by nicole k.

A nongovernmental entity may account for a paycheck protection program (ppp) loan as a financial liability in accordance with fasb asc topic 470,. For income statement purposes, any ppp forgiveness would be considered gain on extinguishment of debt. If not, then it should select a policy that best reflects the nature and substance of the grant.

The guidance suggested that a nongovernmental entity (including. The irs recently released guidance (rev. Ppp loans and financial statements | james moore & co.

On the basis of discussions with the sec staff, we believe that if the pppl is material, the staff would expect an sec registrant to provide disclosures in the footnotes to its. This program provides federal insurance for citizens aged 65 and over, as well as younger. October 13, 2020 private company audits.

A) upon adoption of asc 842, leases, on. On more than one occasion, sec staff have. As of december 31, 2020, the company.

Gain on forgiveness of ppp loan : In addition to disclosures specific to the accounting treatments discussed below, sec registrants. Disclosures of the ppp loan in their financial statements.

Disclosures should include issue date, face amount, carrying.