Fabulous Info About Accrued Wages On Balance Sheet Profit And Loss Statement Irs

Under the accrual method of.

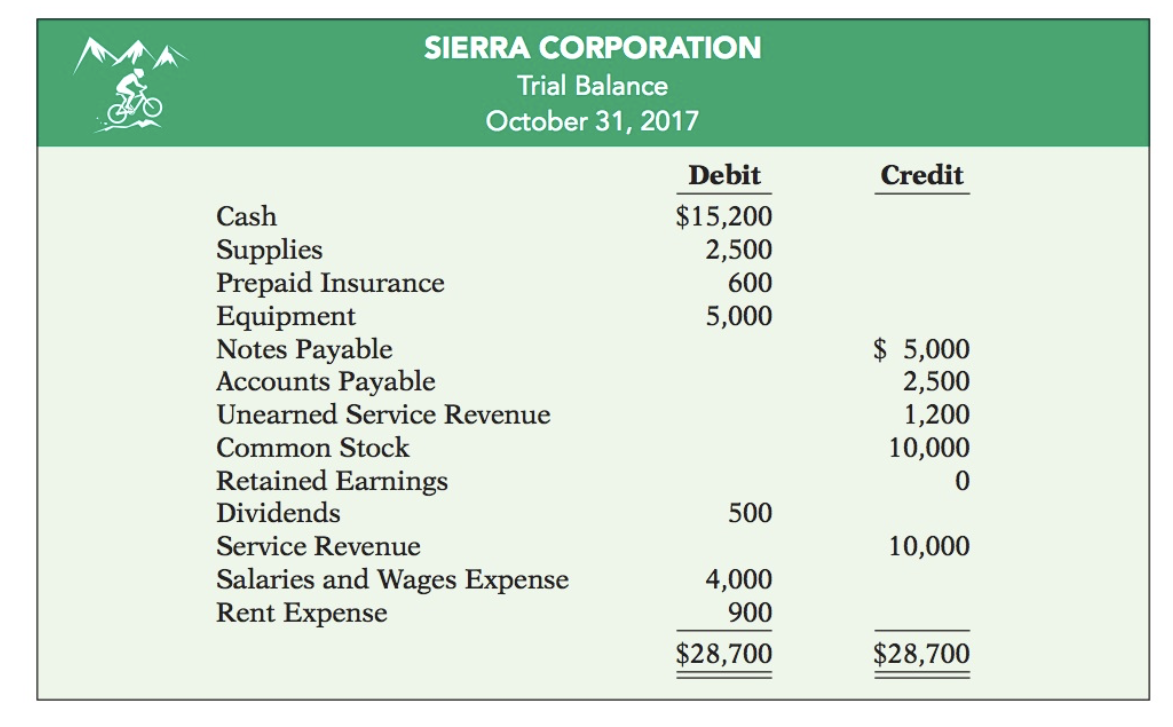

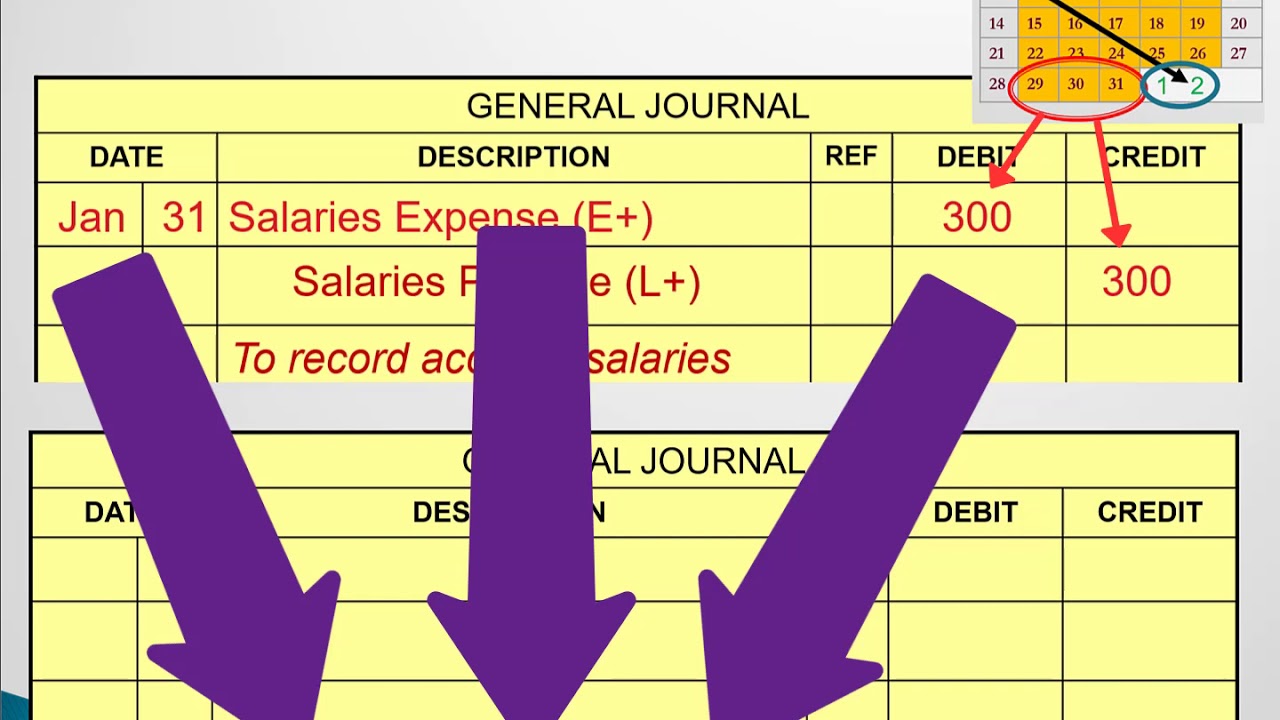

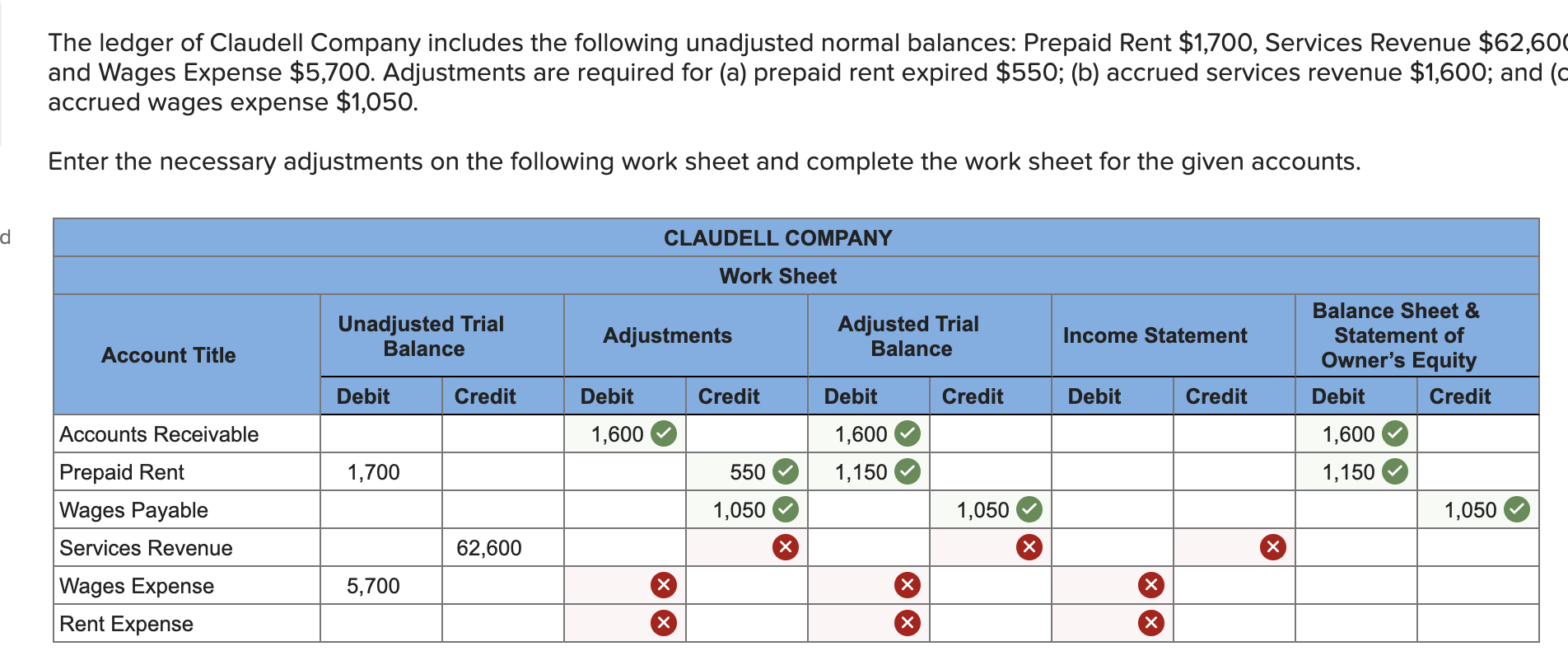

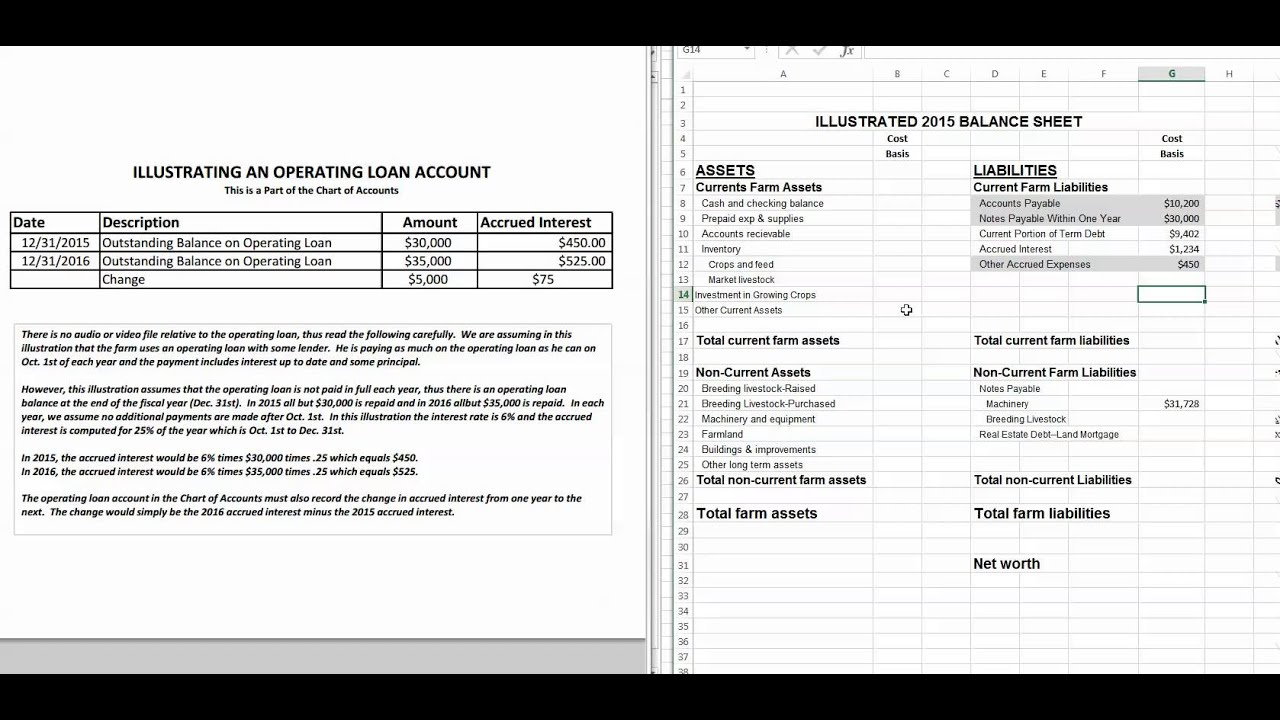

Accrued wages on balance sheet. Accrued wages is always considered a current liability, and so is included within the current liabilities section of the employer’s. The adjusting entry for an accrued expense updates the wages expense and wages payable balances so they are accurate at the end of the month. Accrued wages are money a company owes to employees for work done but not yet paid.

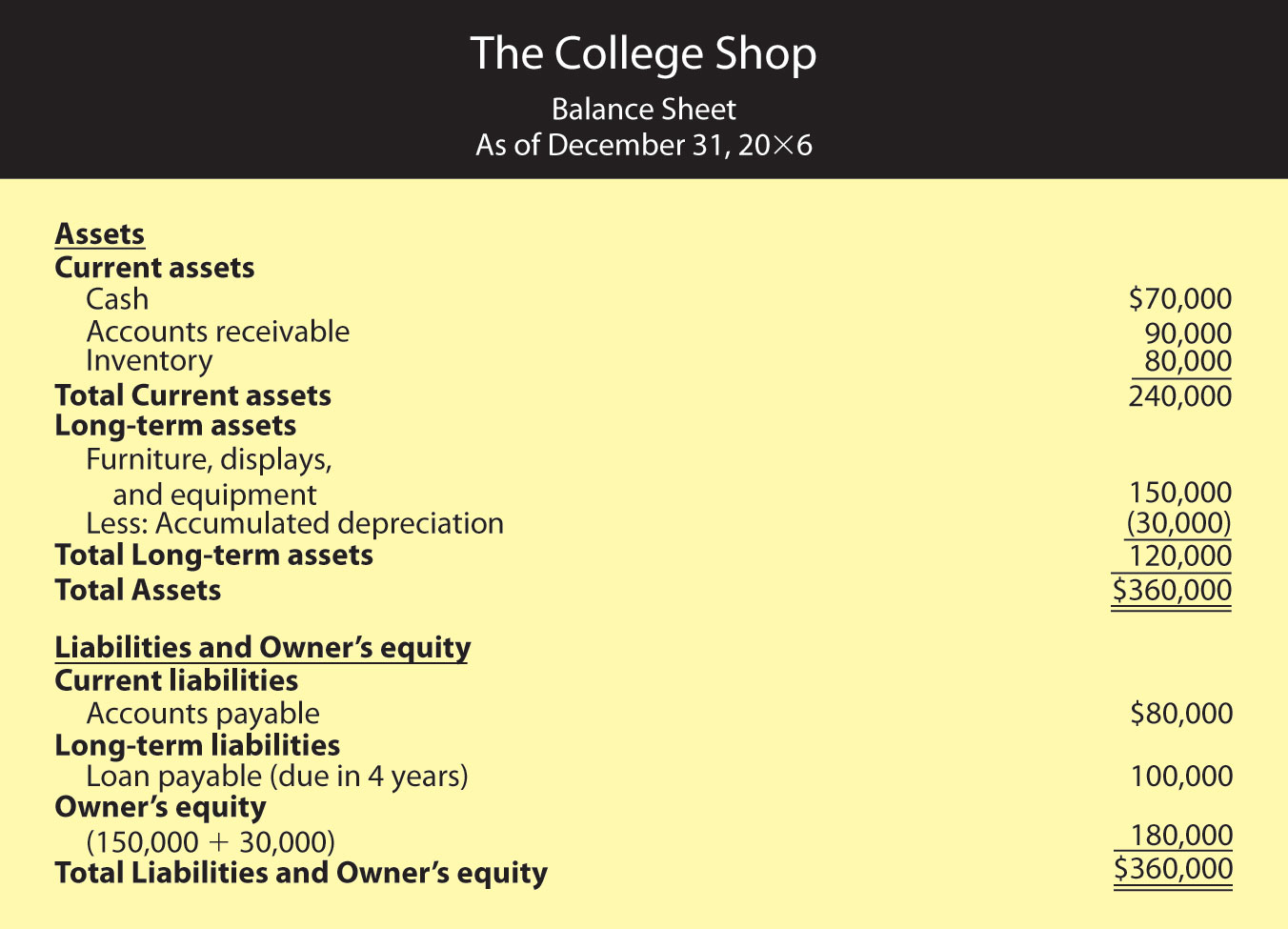

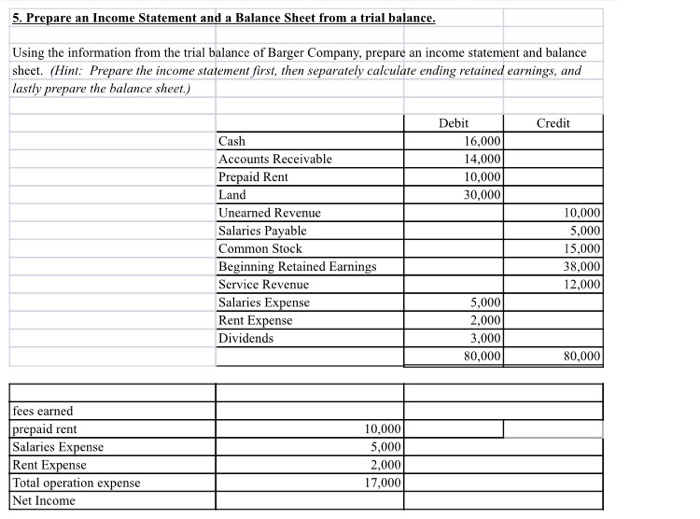

If the amount is payable within one year, then this line item is classified. Most students learn that labor and wages are a cost item on the profit and loss statement (p&l). They appear as a liability on the balance sheet.

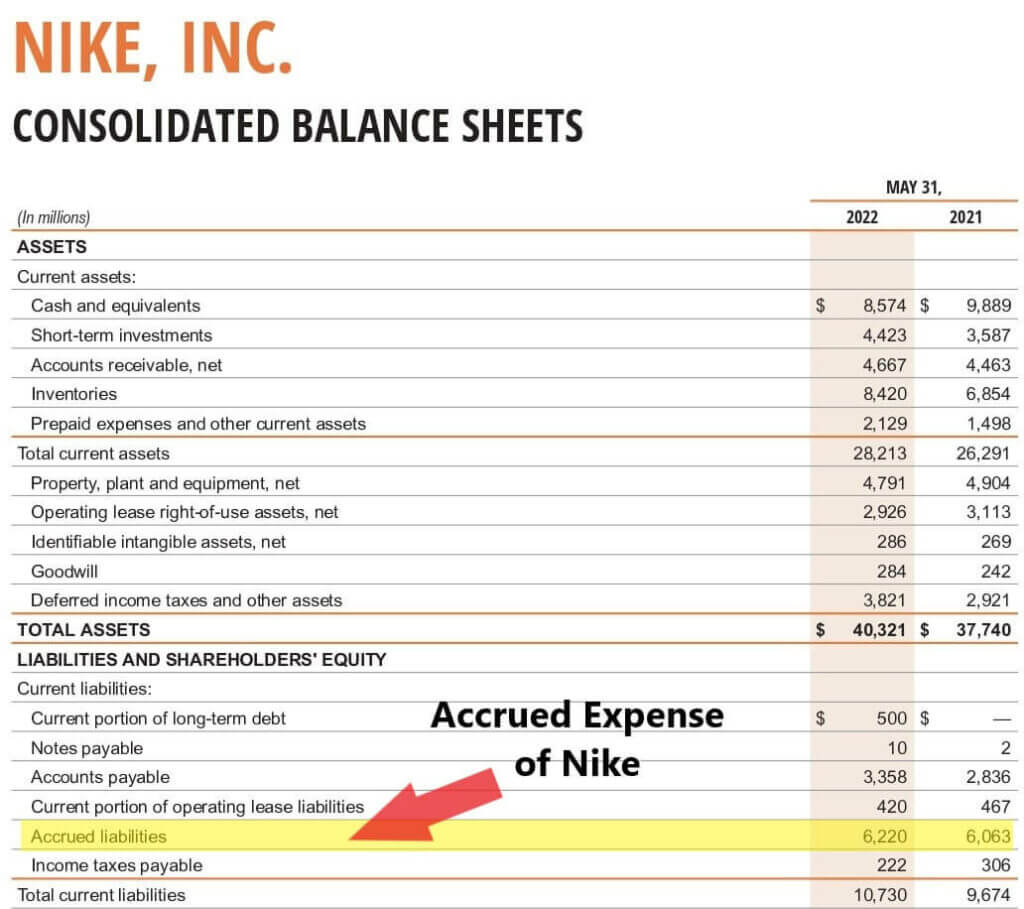

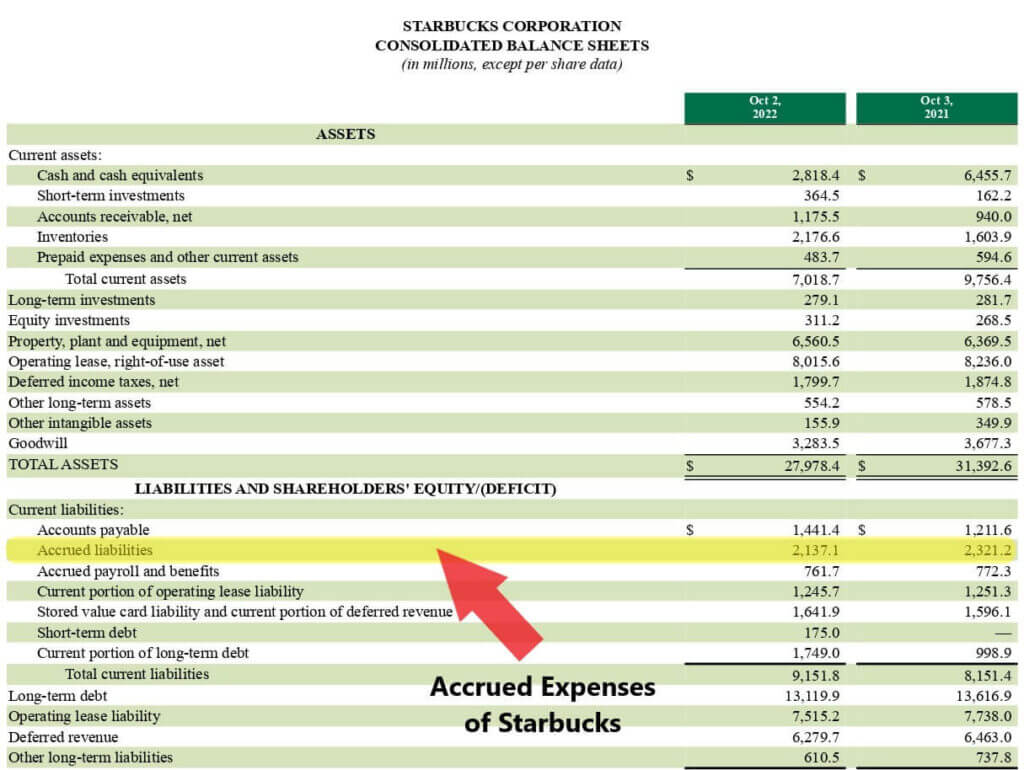

Accrued wages are categorized under the accrued expensesline item, which is a current liability on the balance sheet. Presentation of accrued wages. The accrued salaries are debited in the salaries account of the income statement and subsequently credited as current liabilities in the balance sheet of the company.

For example, an accrued expense for unpaid wages. Accrued wages payable is a liability account on the balance sheet that reflects the amount of wages that a company owes to its employees for work performed. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid.

This is because an accrued salary expense affects both the expense. However, labor expenses appear on the balance sheet as well, and in three. The adjusting entry will debit repairs expense for $6,000, and credit accrued expenses payable for $6,000.

The accrued wages account is a liability account, and so appears in the balance sheet. The accounting term “accrued wages” describes the unpaid compensation not yet paid by a company to employees for the services they have already provided. Examples of other expenses that usually need an accrual adjusting.

Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received. Definition of wages payable wages payable refers to the wages that a company's employees have earned, but have not yet been paid. The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet.

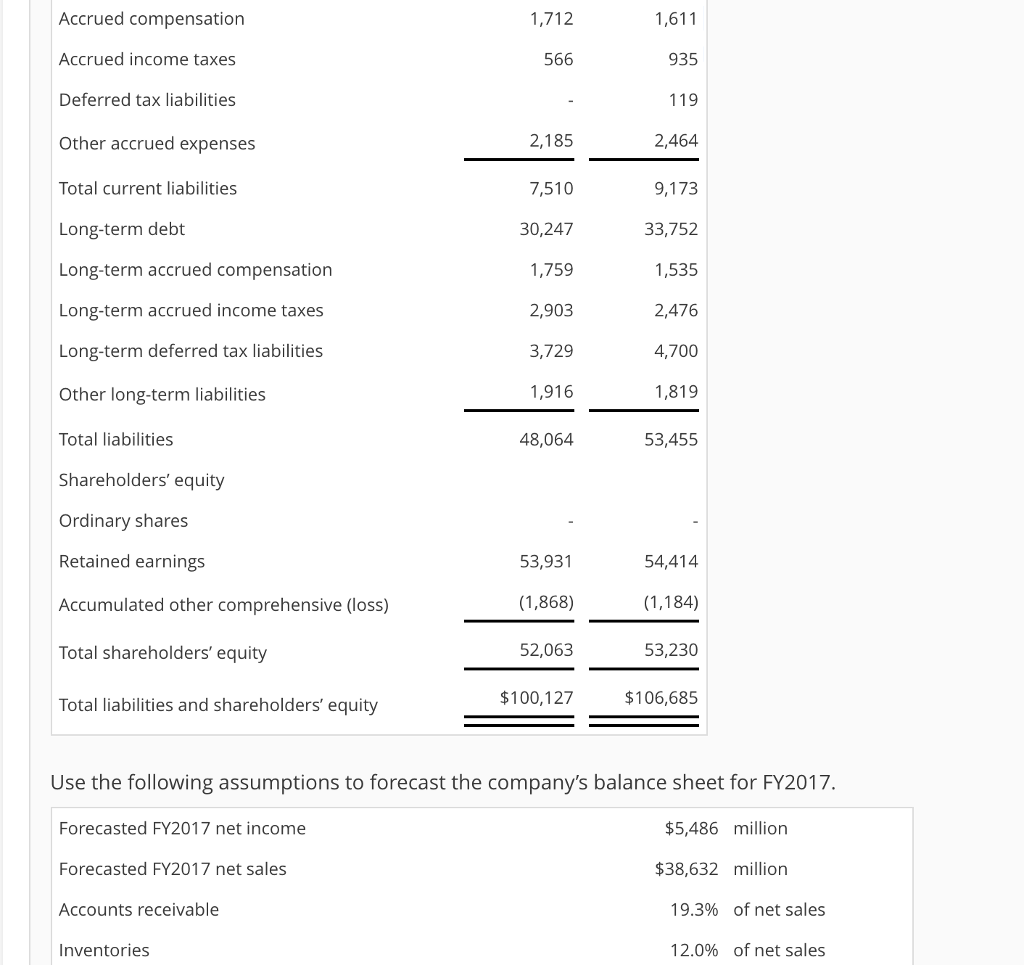

Accrued wages are recorded to determine the entire expense incurred during a reporting period instead of the amount paid. In accounting, accrued wages are the wages that the employees have earned but have not received the payment yet. Since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities.

Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet.