Beautiful Work Tips About Revaluation Reserve In Balance Sheet Uber Driver Income Statement

The depreciable amount of the.

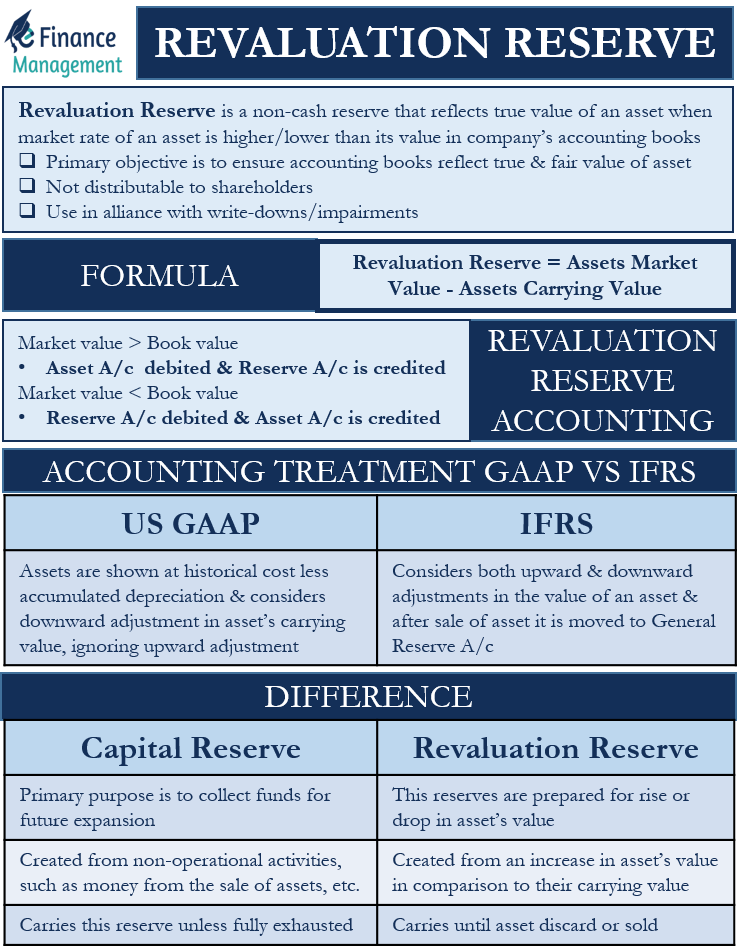

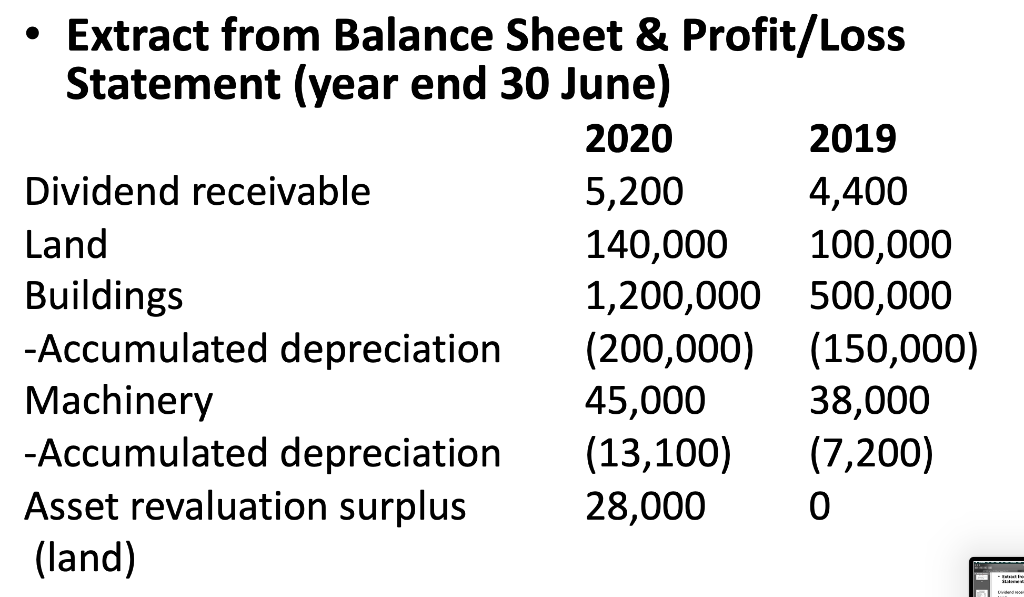

Revaluation reserve in balance sheet. Revaluation reserve is the equity item that records the increase or decrease of assets' market value on the balance sheet. Equity reserve is the part of the equity section of the balance sheet which excludes share capital and retains earnings. It presents the balance raised from other transactions such.

The revaluation reserve is also held in the balance sheet of the organization on the asset side of the liability side of the company depending on the. Concepts fundas in this “funda” post, we shall try to understand the term: If you need to revalue because of destroyed or missing goods, this change should only affect your balance sheet assuming you have an inventory reserve.

This line item can be used when a revaluation assessment finds that the carrying value of the asset has changed. Learn how to calculate capital surplus, a difference between the total par value of a company's issued shares of stock and its shareholders' equity and proprietorship. Overview investment revaluation reserve quick reference a reserve created by a company with investment properties, if these properties are included in the.

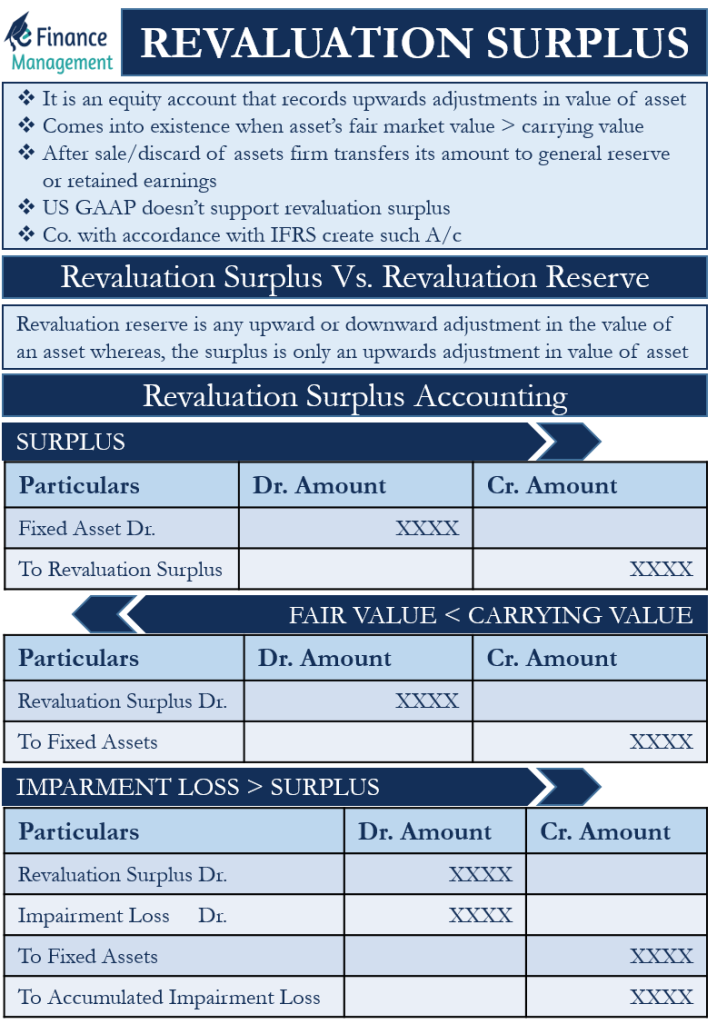

Need help revaluation reserve in balance sheet i am confused how to bring forward the revaluation reserve from my previous year account for my first year,. Note 12.2 revaluation reserves. Revaluation reserve is an accounting term used when a company creates a line item on its balance sheet for the purpose of maintaining a reserve account tied to certain assets.

In most situations, the reserve line either increases the. Revaluation reserves are most often used. Revaluation reserve, a term we often see in balance sheets.

Overview ias 21 the effects of changes in foreign exchange rates outlines how to account for foreign currency transactions and operations in financial statements, and. It is used to adjust the. Revaluation reserves are accumulated gains (losses) from revaluation or remeasurement of items (assets.

Under ifrs, a revaluation surplus (gain) is recorded to other comprehensive income (oci), while a revaluation loss is recorded to the income statement. 17th jun 2019 16 comments steve collings looks at some of the main issues accountants face when it comes to the accounting aspects of property valuations under frs 102, and. Revaluation reserves (or, more precisely, revaluation surplus reserves) arise when the value of an asset becomes greater than the value at which it was previously carried on.

:max_bytes(150000):strip_icc()/BalanceSheetReserves_Final_4201025-49fe811c4d2540a9b2fae7650ce4be8d.png)

:max_bytes(150000):strip_icc()/Revaluationreserve_color-9d361a05aa014fad95aae61c614e6a92.png)