Ideal Tips About Amortization In Balance Sheet Nly

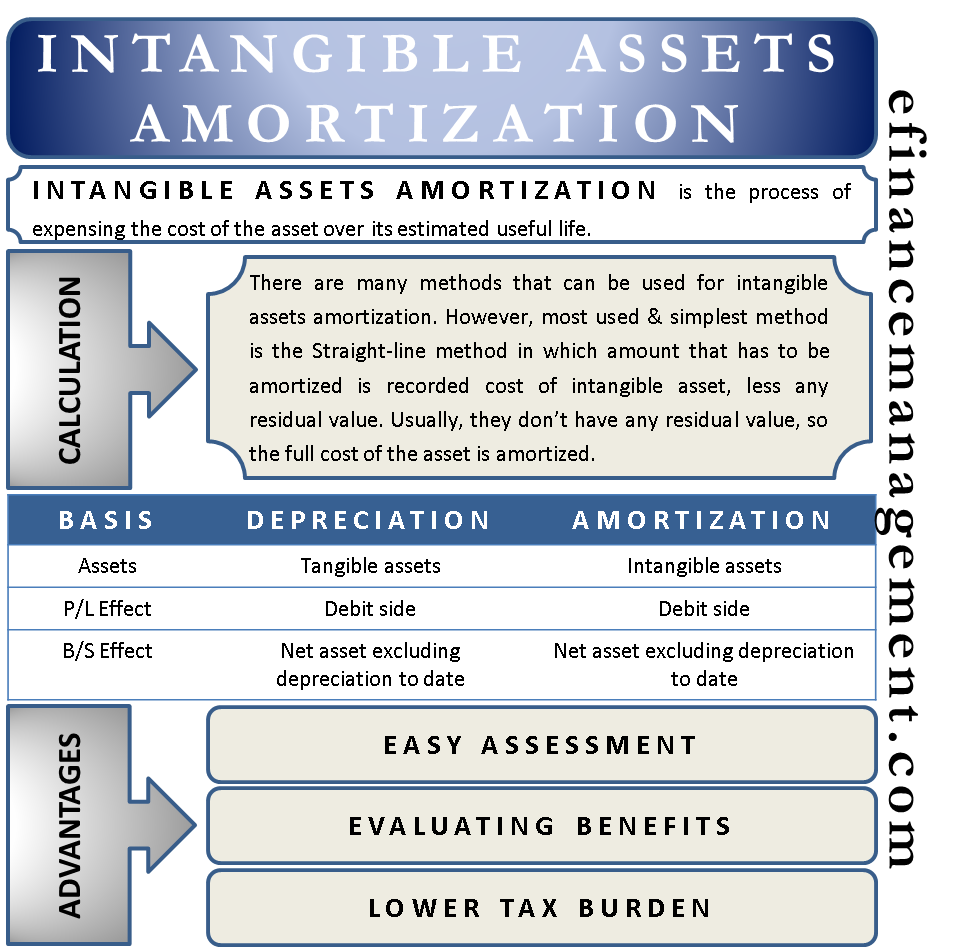

Amortization expenses are shown in both the balance sheet and profit and loss account.

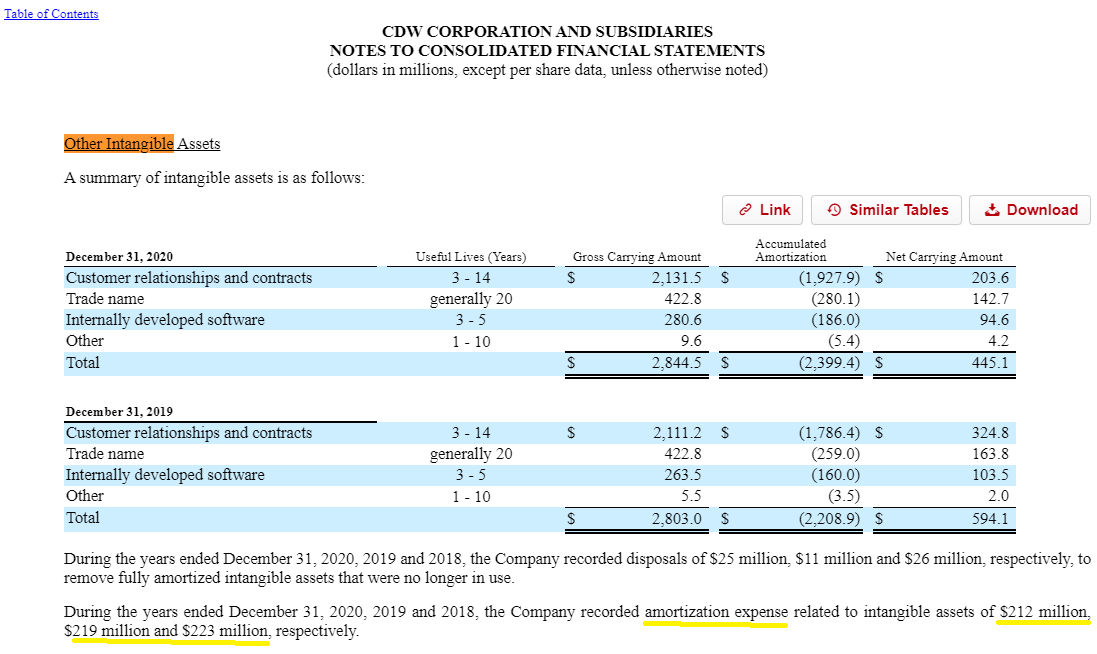

Amortization in balance sheet. The balance sheet follows the basic accounting equation: The accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet. A business records the cost of an intangible asset in the assets section of its balance sheet only.

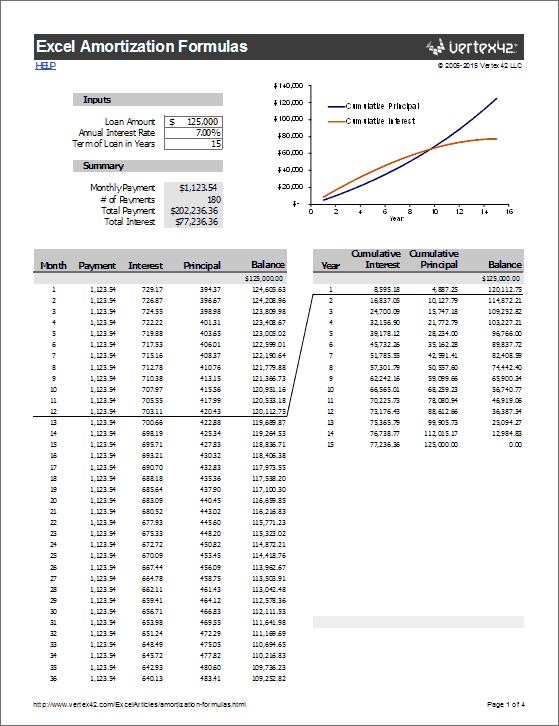

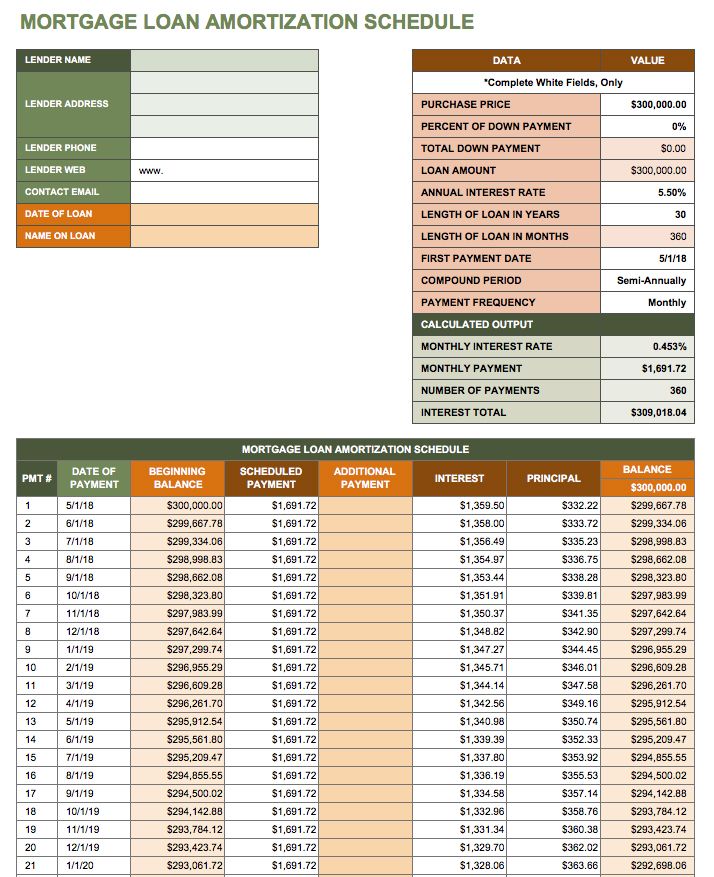

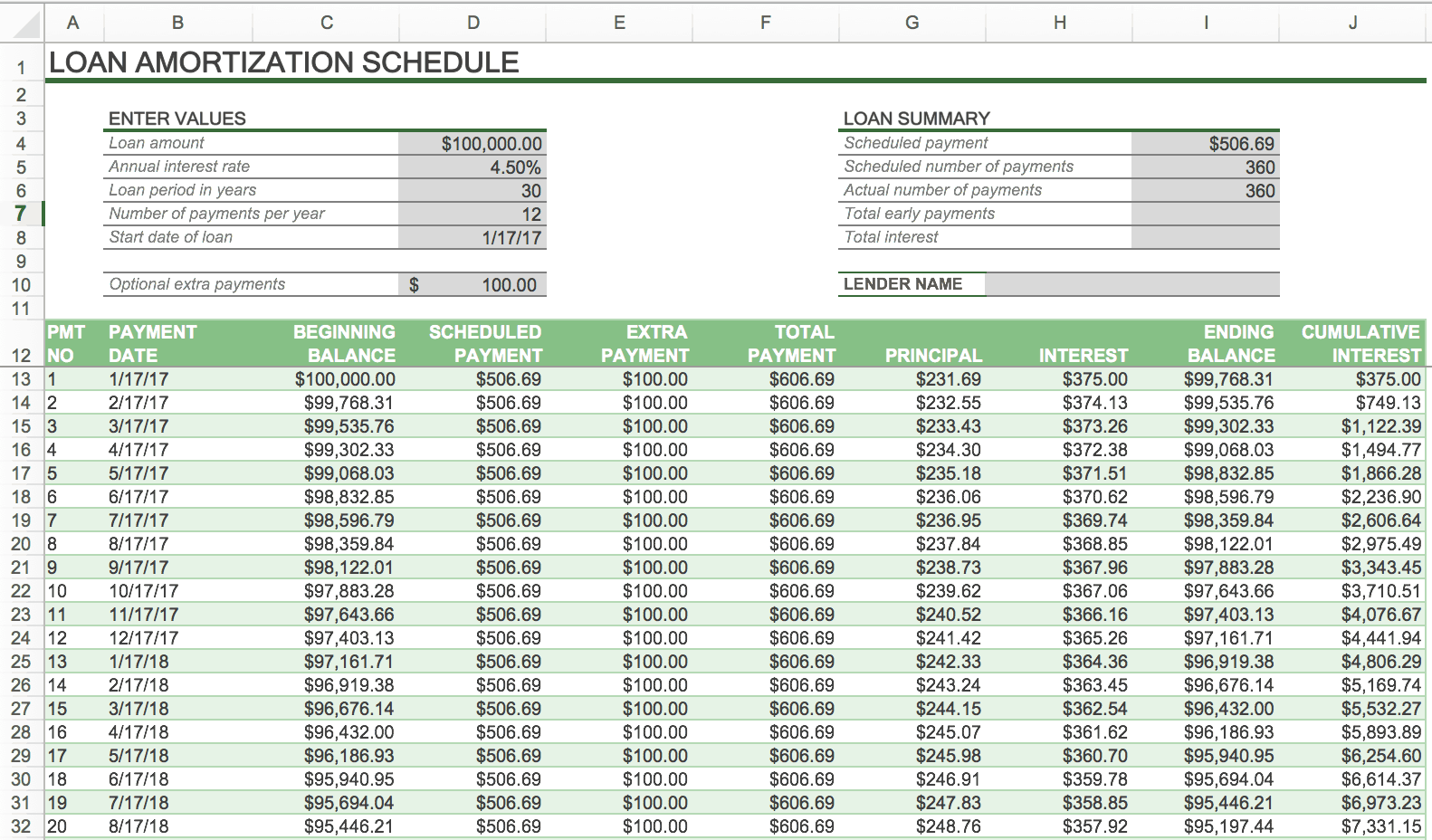

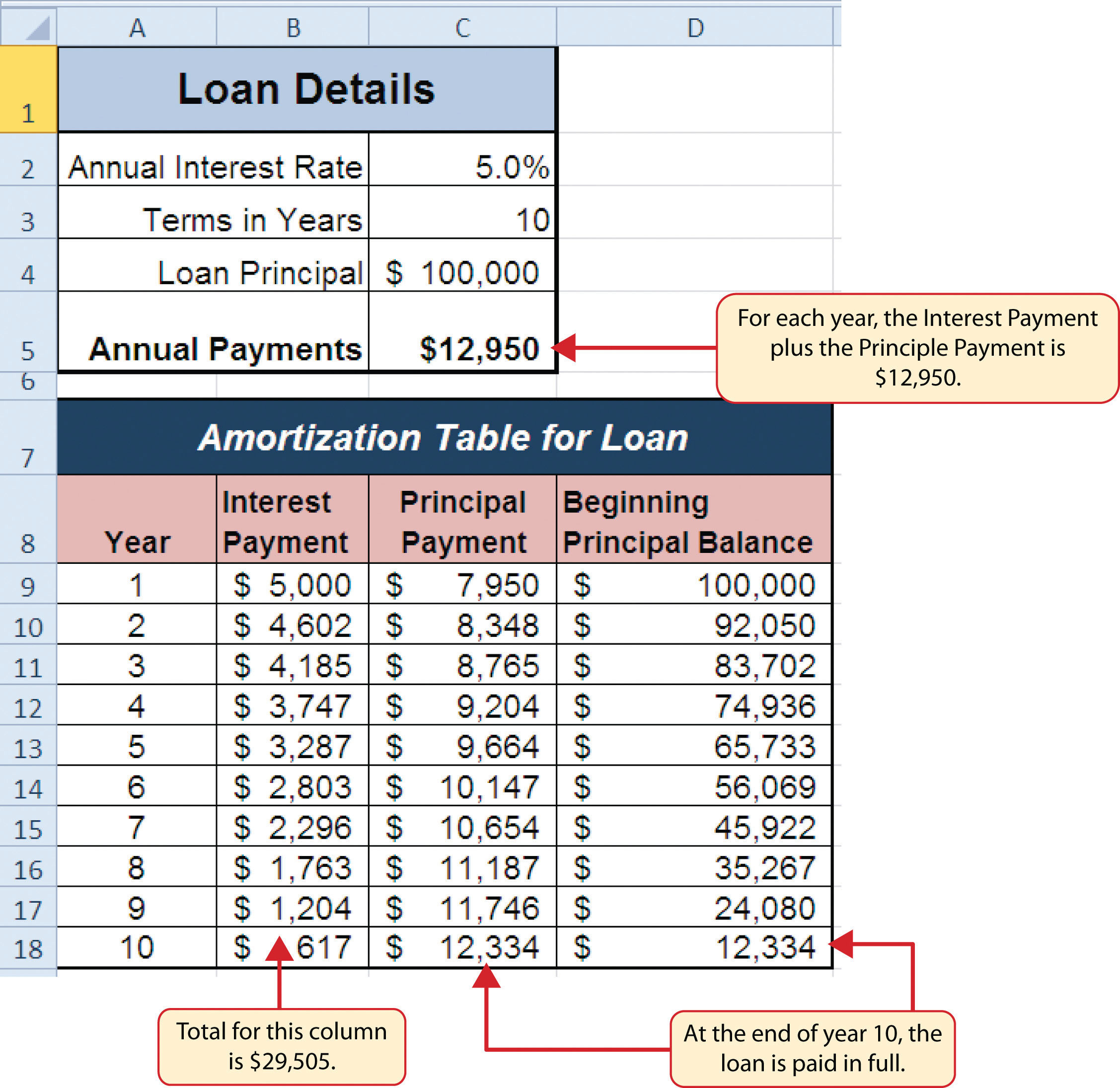

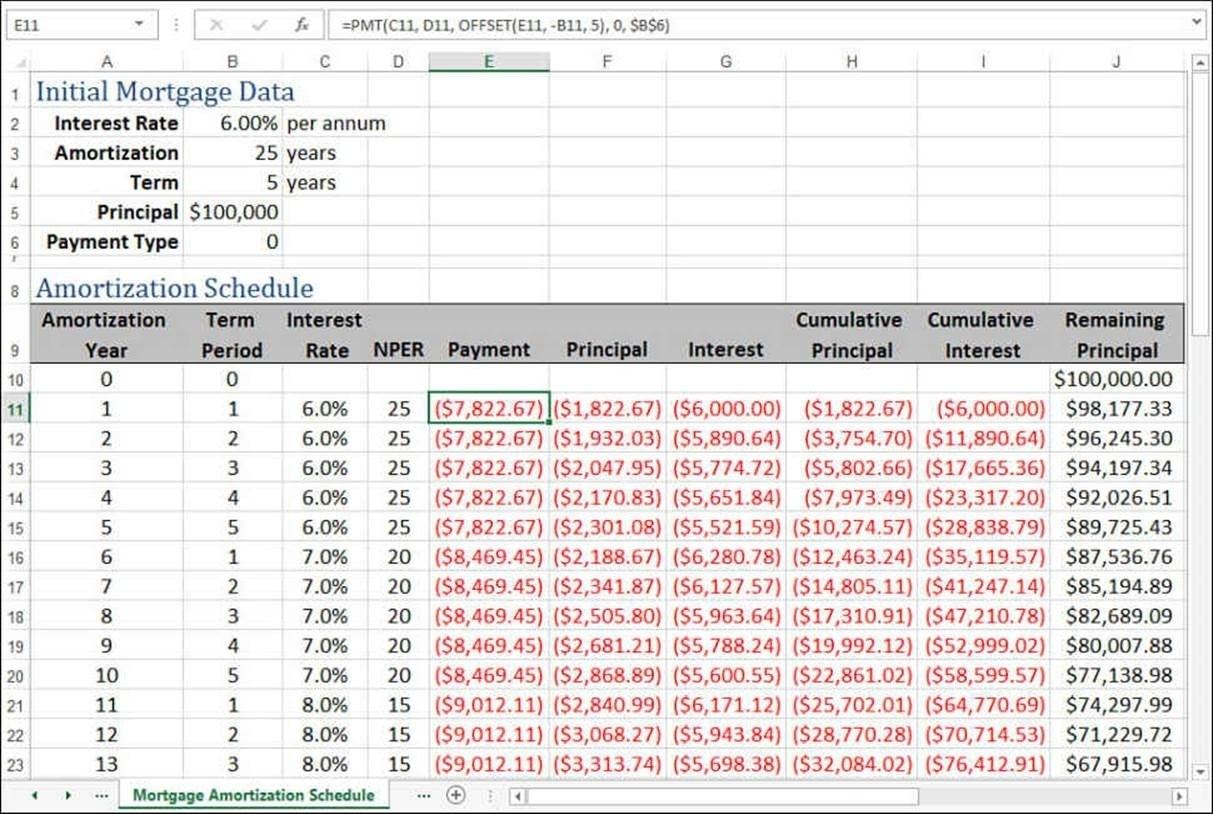

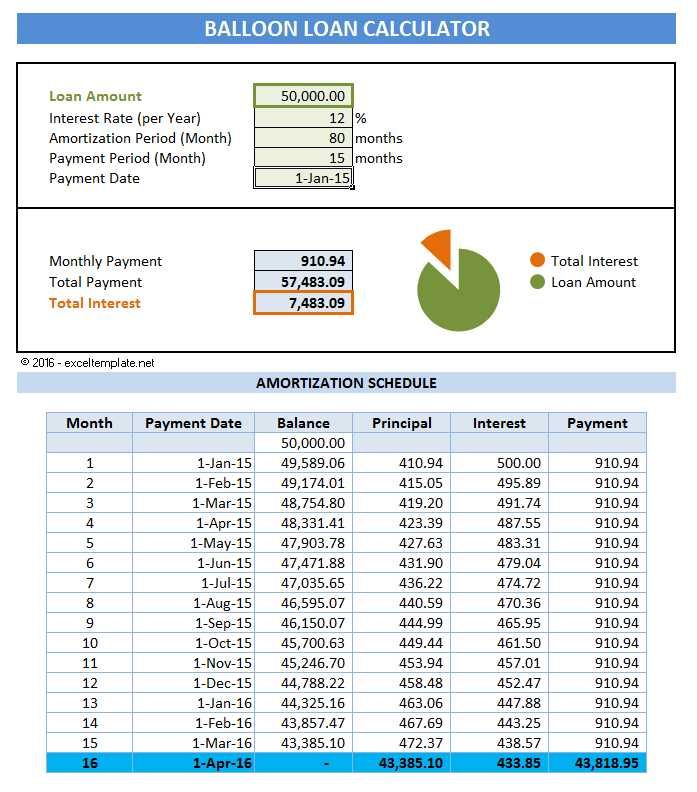

Accumulated amortization is an amortization expense aggregated value recorded for an intangible asset based on the cost, lifetime, and usefulness allocated to the investment in. An amortization schedule (sometimes called an amortization table) is a. The loan is initially measured on a present value basis.

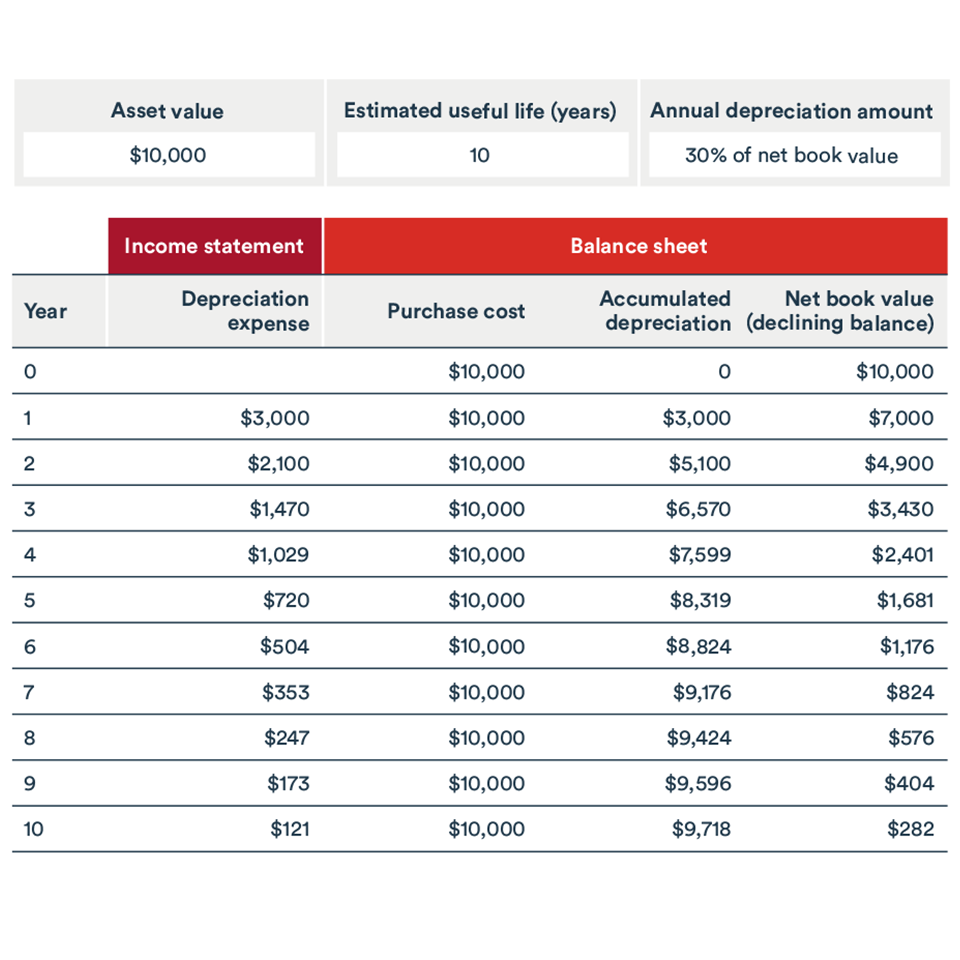

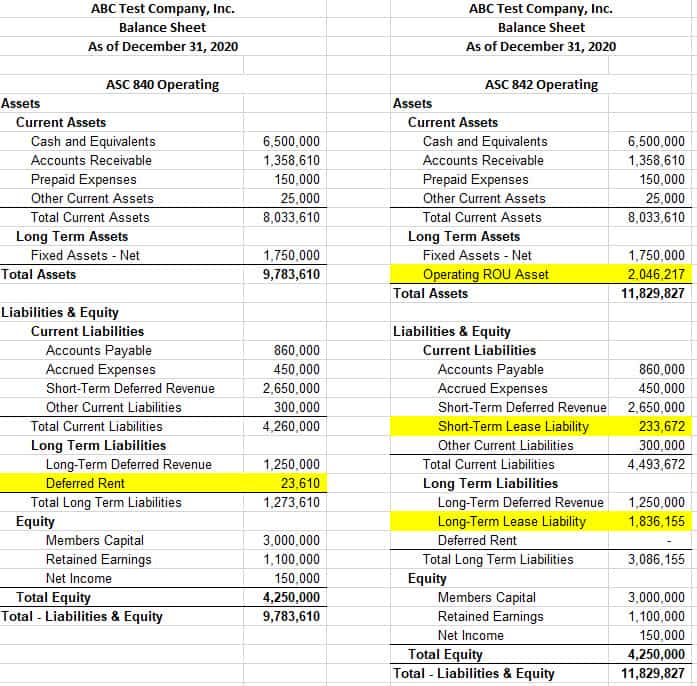

This equation ensures that the balance sheet always balances,. Depreciation represents the cost of capital assets on the balance sheet being used over time, and amortization is the similar cost of using intangible assets like. In general, amortization expense should be recorded as a debit to the amortization expense account and a credit to the accumulated amortization account.

Amortization focuses on the intangible assets of a company. Amortization refers to capitalizing the value of an intangible asset over time. Amortization is used to indicate the gradual consumption of an intangible asset over time.

With no goodwill left on the balance sheet there was no amortization to depress reported profit in subsequent years. How does amortization affect a balance sheet? However, they apply to different types of assets.

Amortization is recorded in the financial statements of an entity as a reduction in the carrying value of the intangible asset in the balance sheet and as an expense in the. The basics of depreciation in the income statement and balance sheet. An amortization schedule is used to determine how much of each payment is applied to interest and principal each period.

Specifically, amortization occurs when the depreciation of an intangible asset is split up over time, and depreciation occurs when a fixed asset loses value over. Assets = liabilities + equity. Amortization occurs when the value of an asset, usually an intangible asset, like research and development (r&d) or a trademark, is reduced over a specific.

It's similar to depreciation, but that term is meant more for tangible assets. The difference between these two accounts shows the.

:max_bytes(150000):strip_icc()/Amazon3-88916bd66a244178b1f977a1d758dda0.JPG)