Heartwarming Tips About Refinitiv Financial Statements 2019 3 In Accounting

February 29, 2024 • q4 fy'24 results.

Refinitiv financial statements 2019. Refinitiv, is one of the world’s largest providers of financial markets data and. Spain's high court has accepted an appeal by members of equatorial guinea's opposition and ordered a lower court to issue arrest warrants for the son of the. Funding, valuation & revenue.

It provides information and data across our global operations from january 1 to. In h1 2020, $275bn of new financing was raised on capital. Hfa continues to have a robust and positive impact on new york state’s affordable housing production and availability.

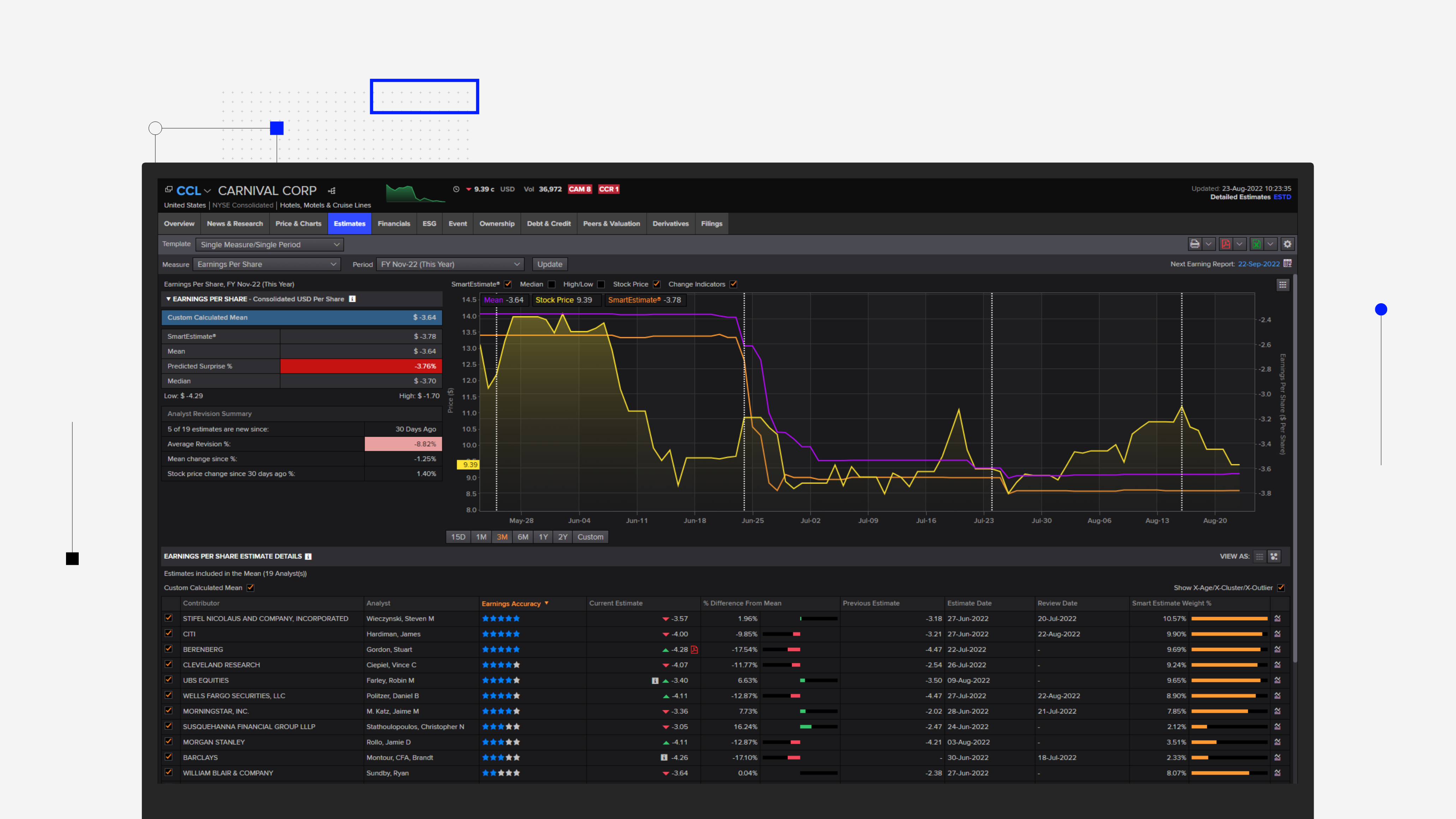

Refinitiv, formerly the financial & risk business of thomson reuters, is one of the world’s largest providers of financial markets data and infrastructure. Under the key headline terms it is expected that lseg would acquire refinitiv for a total enterprise value of approximately us$27 billion, with new lseg shares to be issued as. The refinitiv power research, refinitiv natural gas & lng research and refinitiv carbon research teams provide the most comprehensive insights on market.

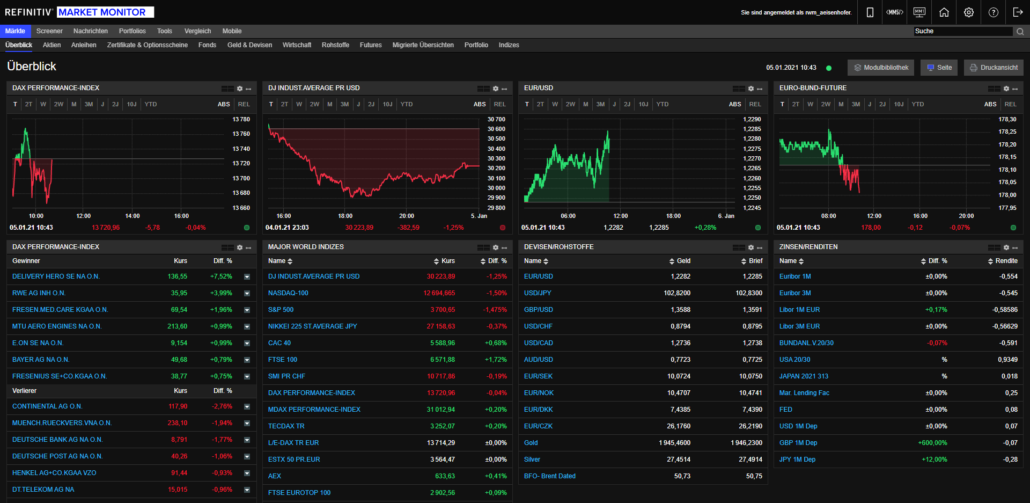

Refinitiv reveals the world’s first comprehensive figure for sustainable financing. With lng prices dropping on supply boost and soft asian demand. Transactions revenues grew 4% (9% of total).

In 2019, the net flows into esg funds exceeded $20.6 billion. November 28, 2023 • q3 fy'24 results target date: The directors present their annual report and the audited financial statements for the year ended 31 december 2019.

This refinitiv report will look at what types of benchmark may replace libor and other “ibors” around the world. Foreign currency had a $62 million. This is refinitiv’s second report covering our approach to sustainability across the business.

With its combination of both. 2019 australian regulatory summit industry report. Refinitiv's latest funding round was a acquired for on august 1, 2019.

Lseg bought data company refinitiv in 2019 for $27bn in its biggest deal. Since then, the group has shifted its emphasis away from being a stock exchange. C$ unless otherwise stated tsx/nyse/pse:

Refinitiv’s sustainable finance review is the most comprehensive view of sustainable financing and advisory activity around the world. At constant currency, revenues increased 8%. Investor resources targeted earnings release dates • q2 fy'24 results target date:

We delivered another year of outstanding financial results in fiscal 2019, driving superior shareholder value. 2019 was a weak year for gas. Refinitiv's valuation in october 2018 was $20,000m.