Peerless Info About Cash Flow Ledger Debt Equity Ratio Calculation From Balance Sheet

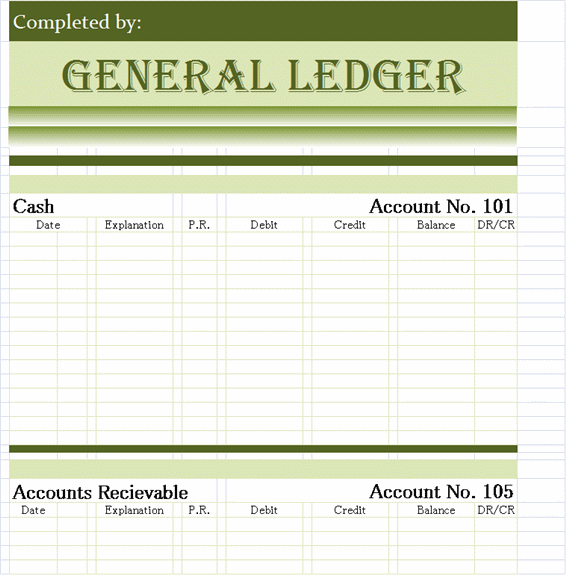

Each sheet for each head or account.

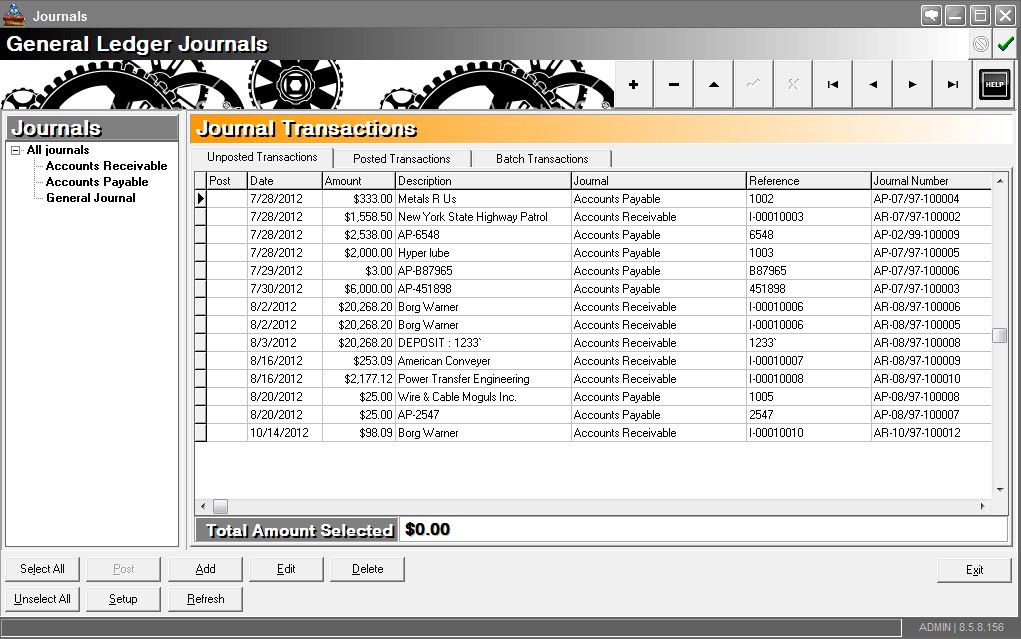

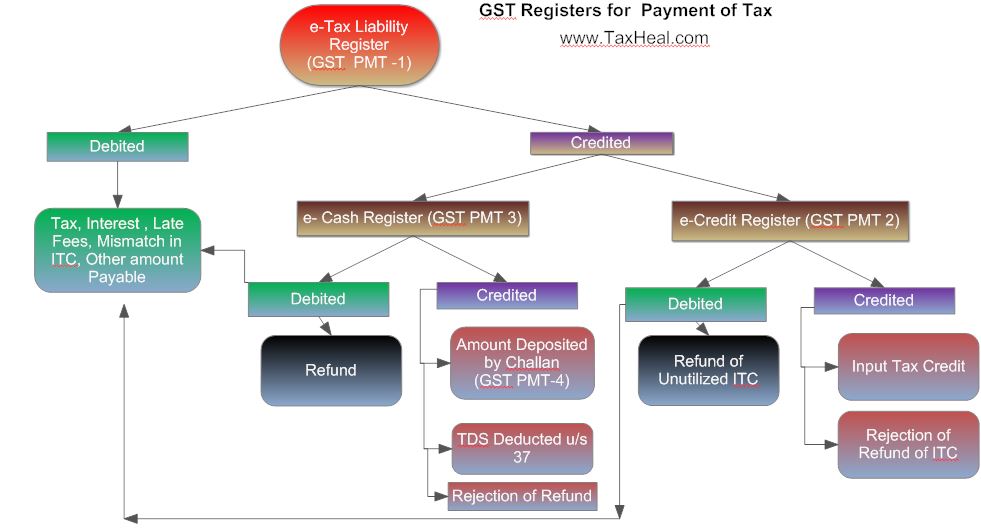

Cash flow ledger. Account reconciliation standard chart of accounts problems in chart of account design cash flow statement income statement subsidiary ledger general ledger reconciliation and analysis definition define a general ledger as the financial record of every transaction of a company. Ledger balance, on the other hand, is only updated at the end of the day. Free cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric for a simple reason:

With the help of ledgers, users can gain a better idea of what is going on inside their company so they may make more informed. This is the amount that appears in the cash line item in a firm's balance sheet. Here are the steps to maintain ledger in excel:

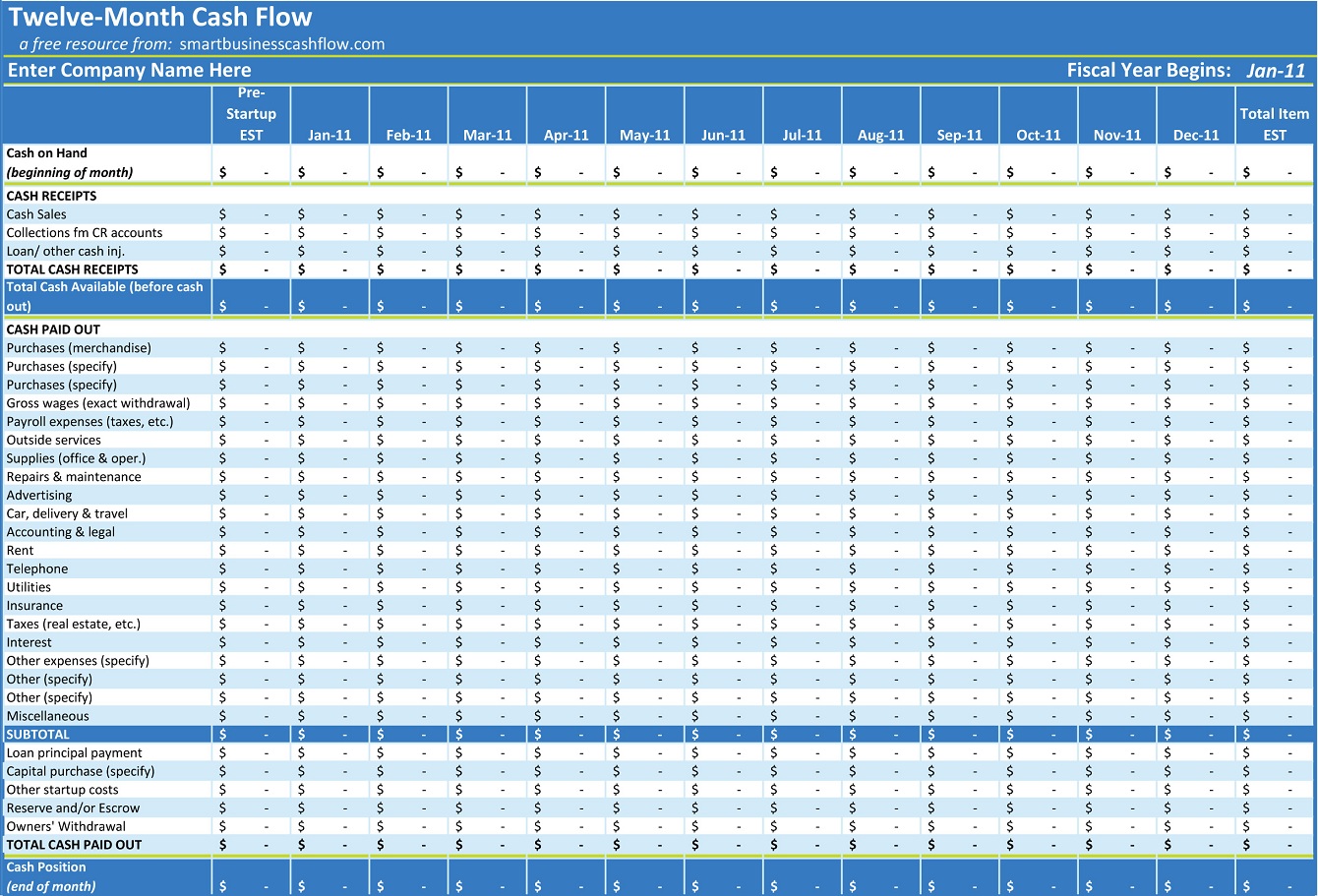

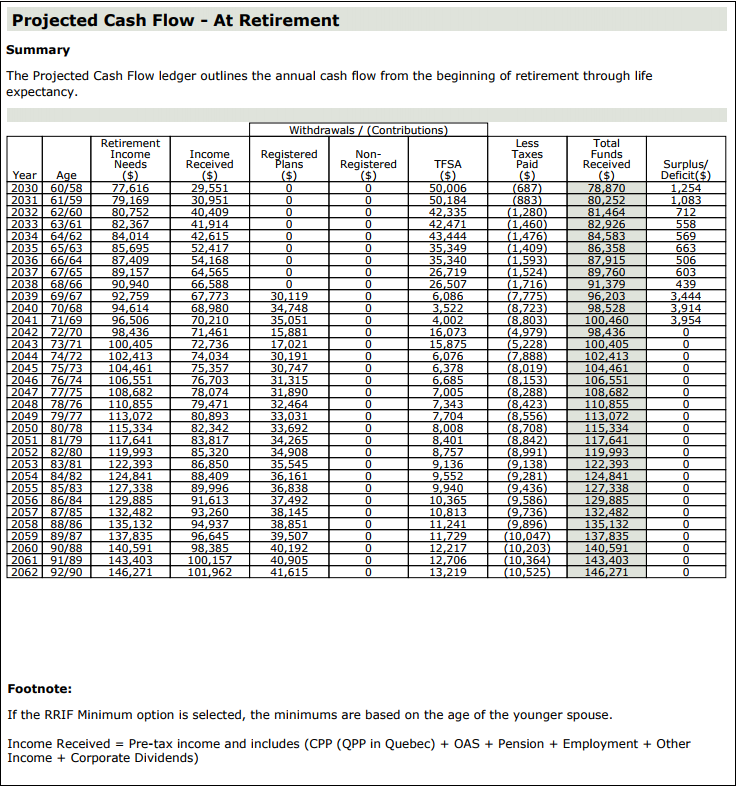

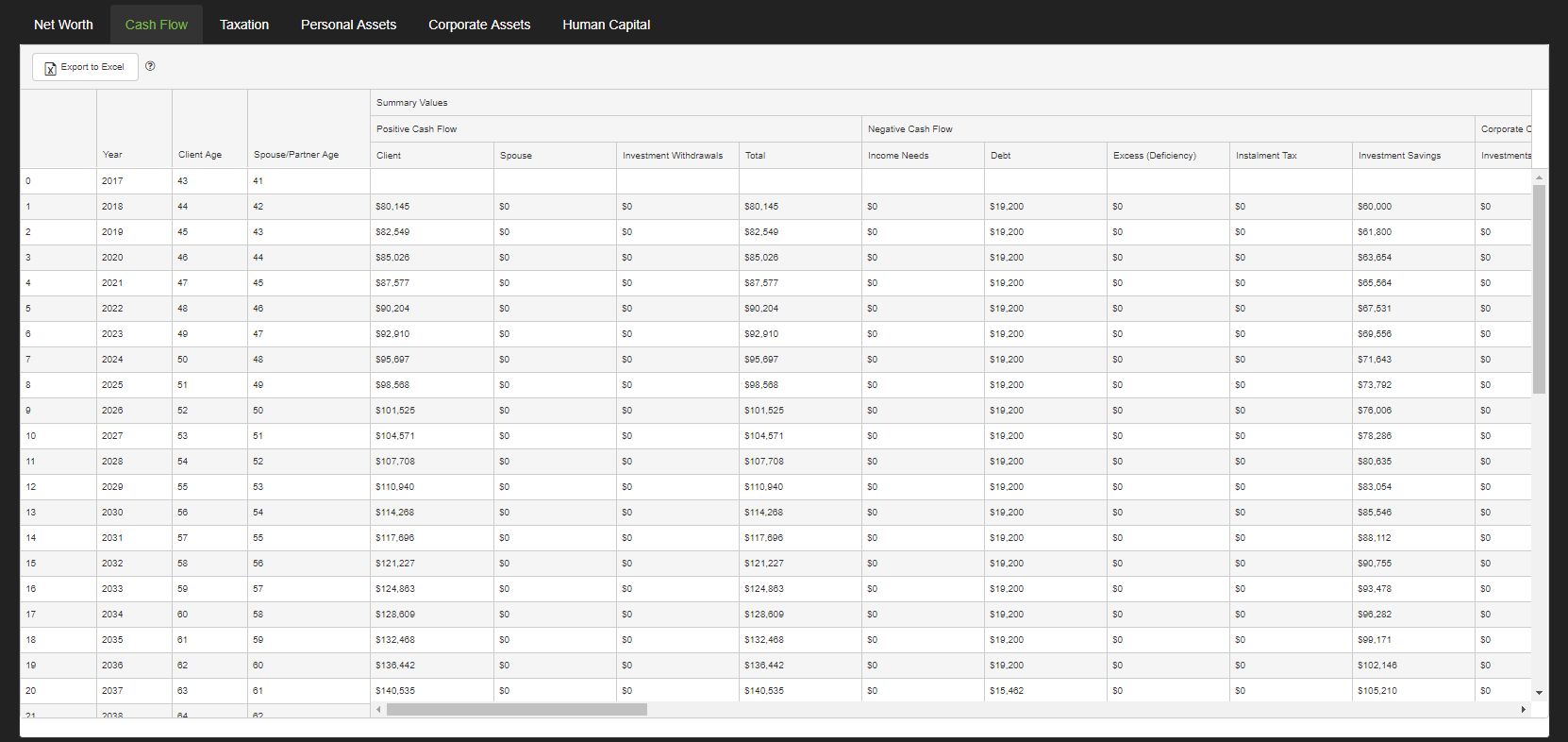

If you're using the accrual method of. The assisted setup wizard is the fastest way to setup the cash flow forecast. Below, we’ll take a closer look at what a general ledger is and how to build one.

In the daybook sheet, create the following columns: This value can be found on the income statement of the same accounting period. General ledgers, also referred to as accounting ledgers, are the physical or digital record of a company’s finances.

An account’s available balance may fluctuate throughout the day, depending on your activities. Cash flow ledger puts all the information about your cash right at your fingertips. Commonly, it is referred to as the.

Your cash flow information is contained in ledger accounts such as cash account, bank account, accounts payable, accounts receivable and owner’s equity account. It is looking into the future vs looking at historical transactions. The cfs measures how well a company.

In accounting, a general ledger (gl) is a record of all past transactions of a company, organized by accounts. Cash transactions from your southware excellence series™ business system flow automatically into cash flow ledger. 29% of business owners and managers check their cash flow position daily.

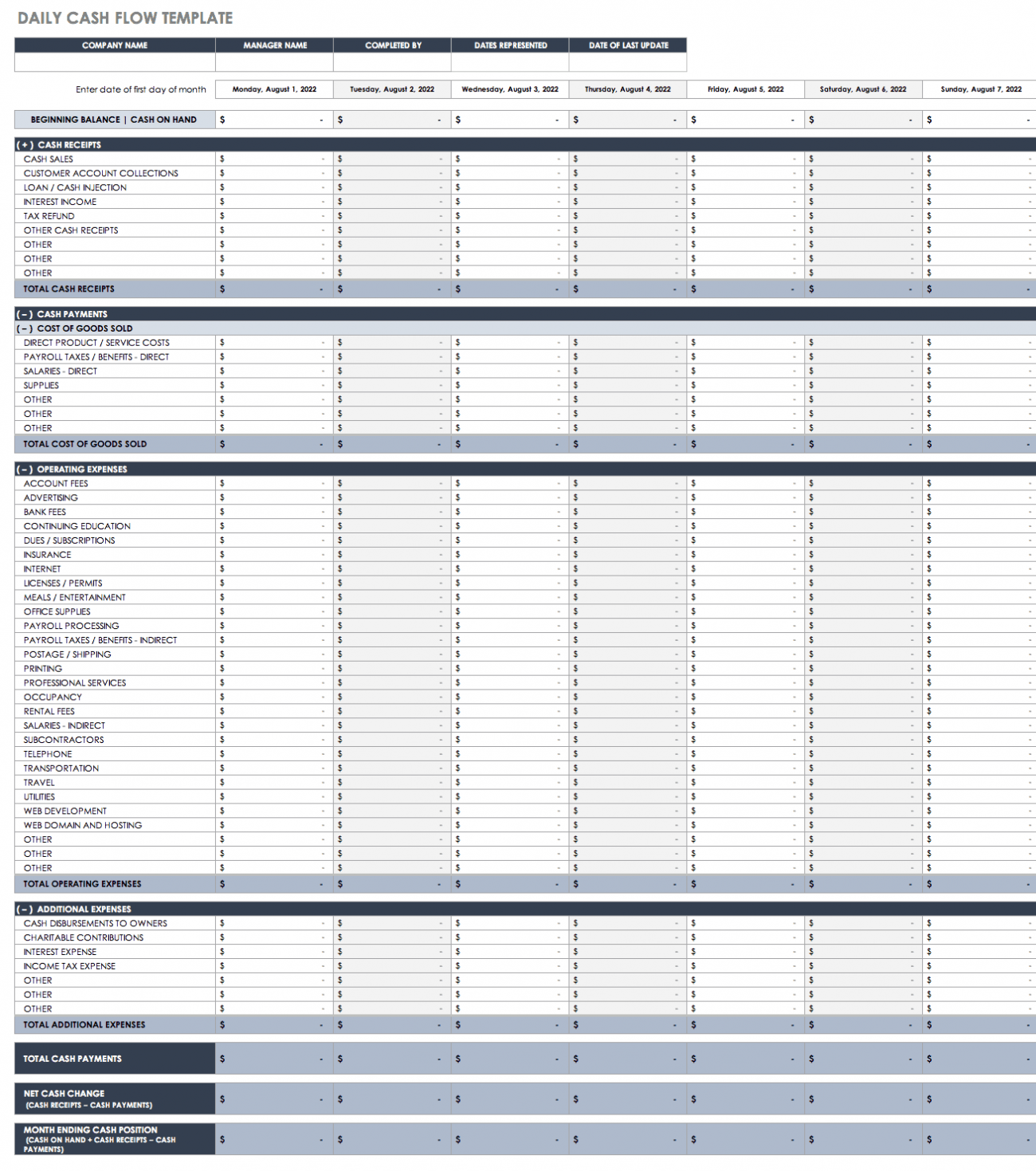

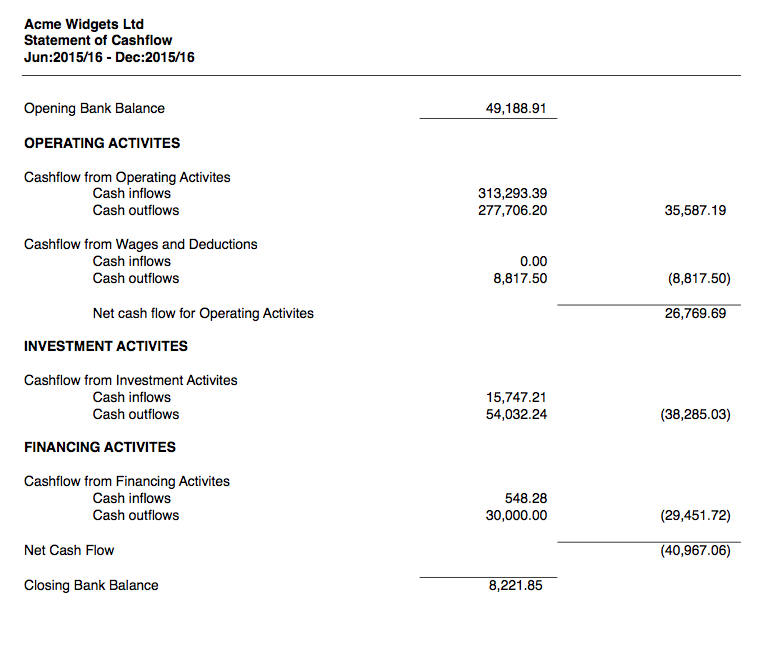

A cash ledger represents one type of subsidiary ledger. Balance sheet, cash flow statement, and income statement), which enable you to evaluate the profitability, liquidity, and overall financial health of your business. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

The writer is the managing partner of daams, a social enterprise for development of smes and. Create multiple sheets in the workbook: Cash flow from operations, cash flow from investing, and cash flow from financing are summed to calculate the net change in cash.

November 09, 2023 what is ledger cash? The real estate evaluator is a quick and easy tool for analyzing any potential real estate investment without actually having to go to the property. Sr no, date debit amount, credit amount as shown in the picture.