Marvelous Tips About Prepare Trial Balance Example Khan Academy Sheet

For example, taking 1200 instead of 2100.

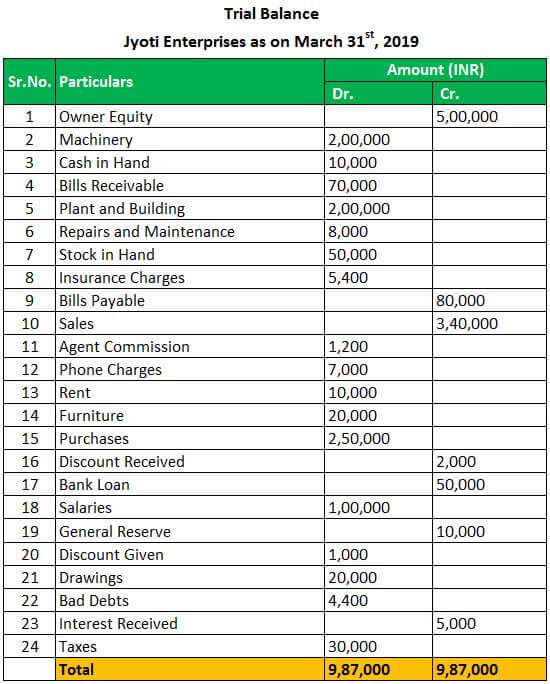

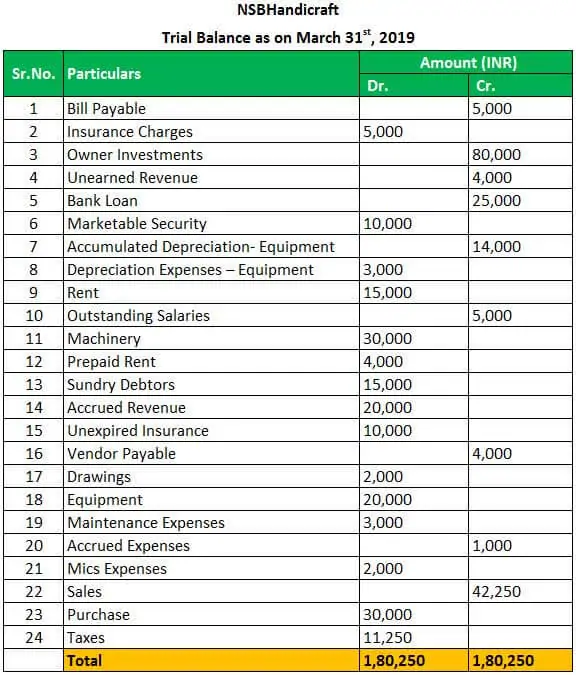

Prepare trial balance example. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account. In a trial balance, each general ledger account is listed with the account number, account name description, debit amount in the debit column, and credit amount in the credit column. From the available balances as on date 31.03.2019, which as follows:

Examples of trial balance format example #1. 2.3 prepare an income statement, statement of. The trial balance is prepared with the objective to eliminate all kinds of accounting errors.

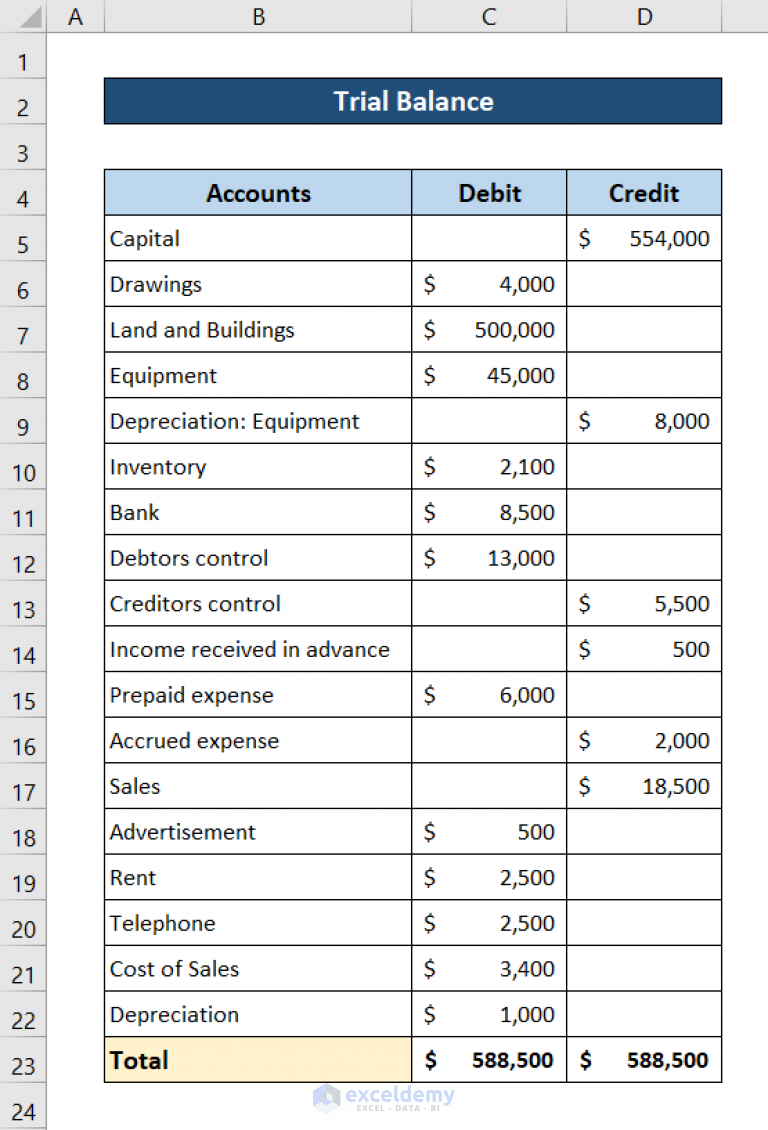

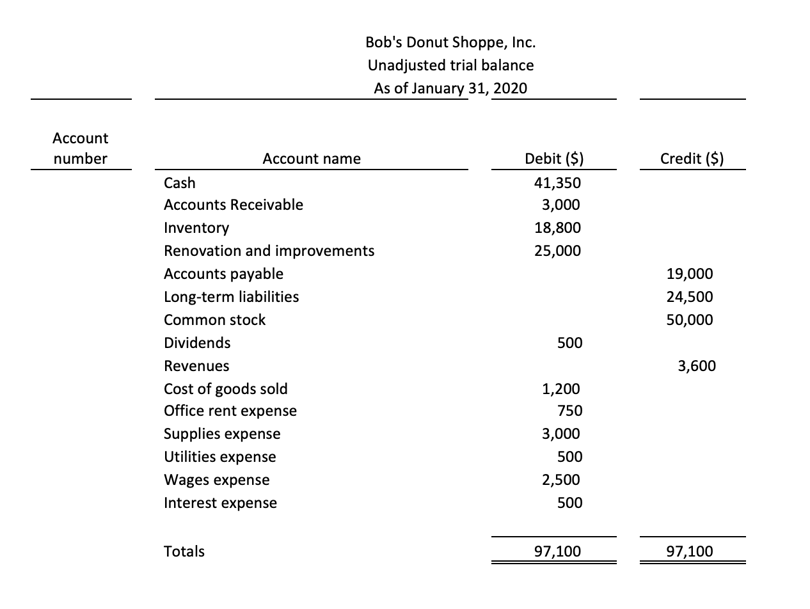

Prepare the trial balance of abc inc. The accounts are listed on the left with the. Review this example of an adjusted trial balance:

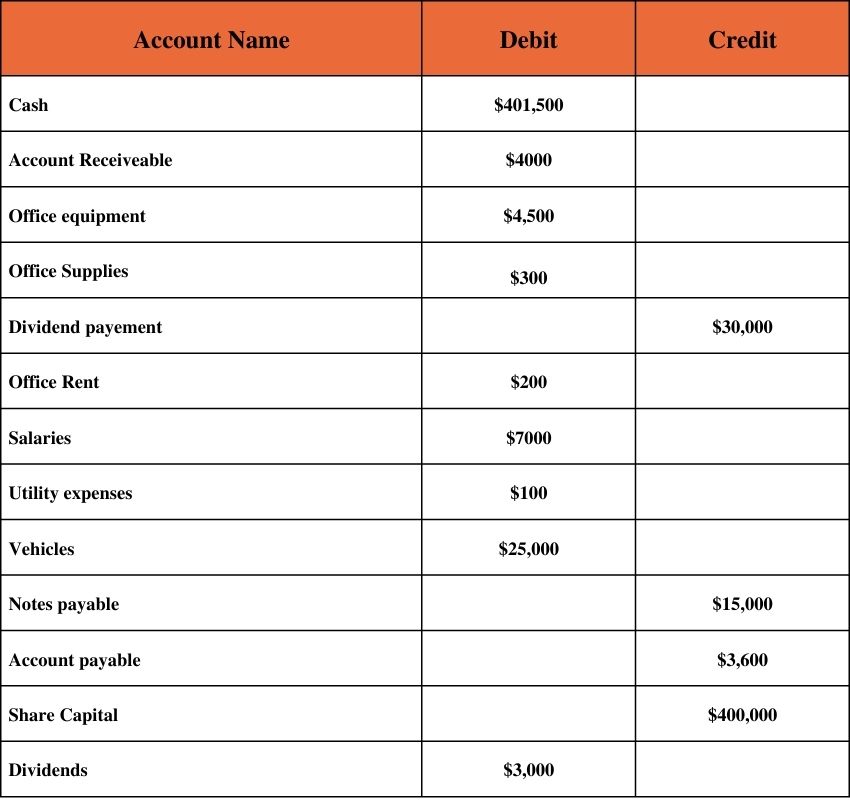

2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; Here are the steps involved in preparing the trial balance. This trial balance example includes an image and a description of a trial balance.

2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses; For example, if you determine that the final debit balance is $24,000 then the final credit balance in the trial balance must also be $24,000. In addition to error detection, the trial balance is prepared to make the necessary adjusting entries to the general ledger.

If the two balances are not equal, there is a mistake in at least one of the columns. Here is an example that will help you understand how trial balance is prepared and how to understand the accuracy of the result. Here is what a trial balance might look like for company x.

Below is a list of all of our balances from our ledgers. Ledger account should be balanced, that means the entries of both debit and credit should be equal. How to prepare a trial balance first of all, we take all the balances from our ledgers and enter them into our trial balance table.

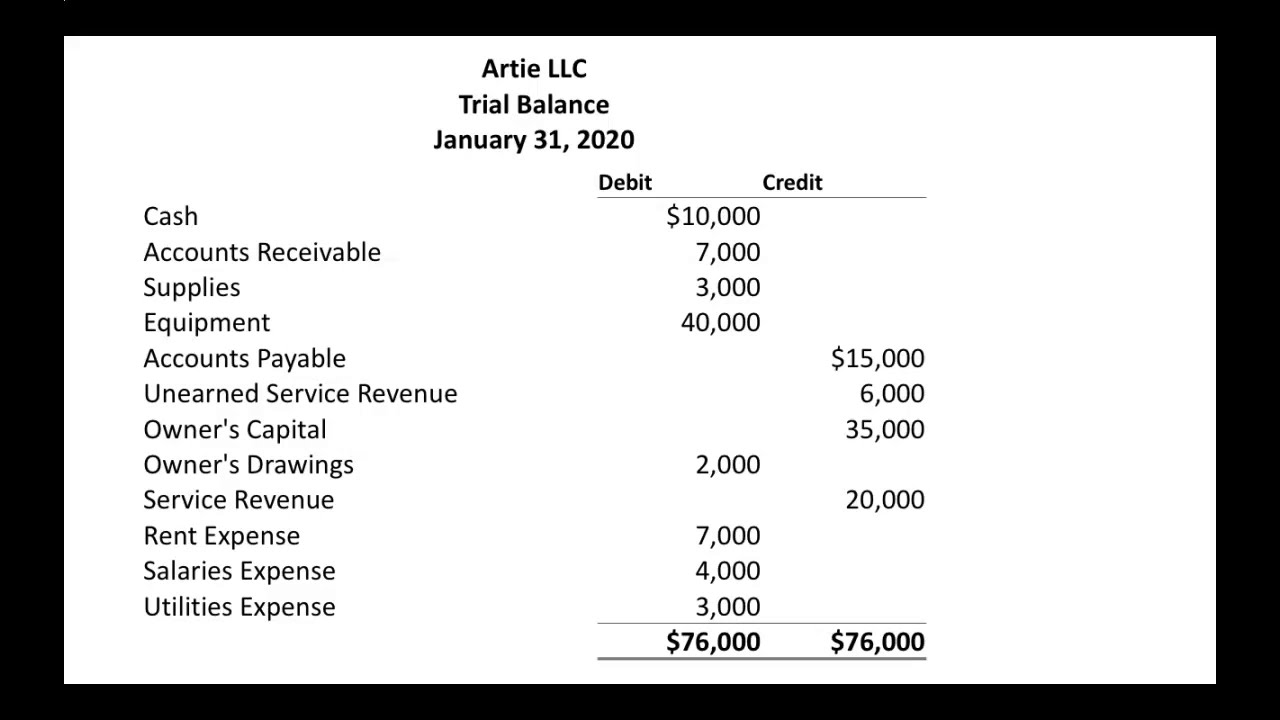

The main thing to focus on is that the total balance of the credit and debit sides of the trial balance would always match if all the postings were made correctly. Recorded the following balances after preparing and closing the general ledger accounts: As of 31st march 2023, ar handicrafts pvt.

A trial balance is a statement that shows the total debit and total credit balances of accounts. For example, if a purchase is entered as $19 instead of $91 in a debit column and is likewise entered as $91 in the corresponding credit column, the trial balance will still show that the columns are equal but there will still be an error in the company's bookkeeping system. Example trial balance:

This is done to determine that debits equal credits in the recording process the trial balance is the first step toward recording and interesting your financial results. Because you used the first of the three columns listing the accounts, you now. For preparing a trial balance, it is required to close all the ledger accounts, cash book and bank book first.