Unique Info About Balance Sheet Accrual Basis What Is A Business

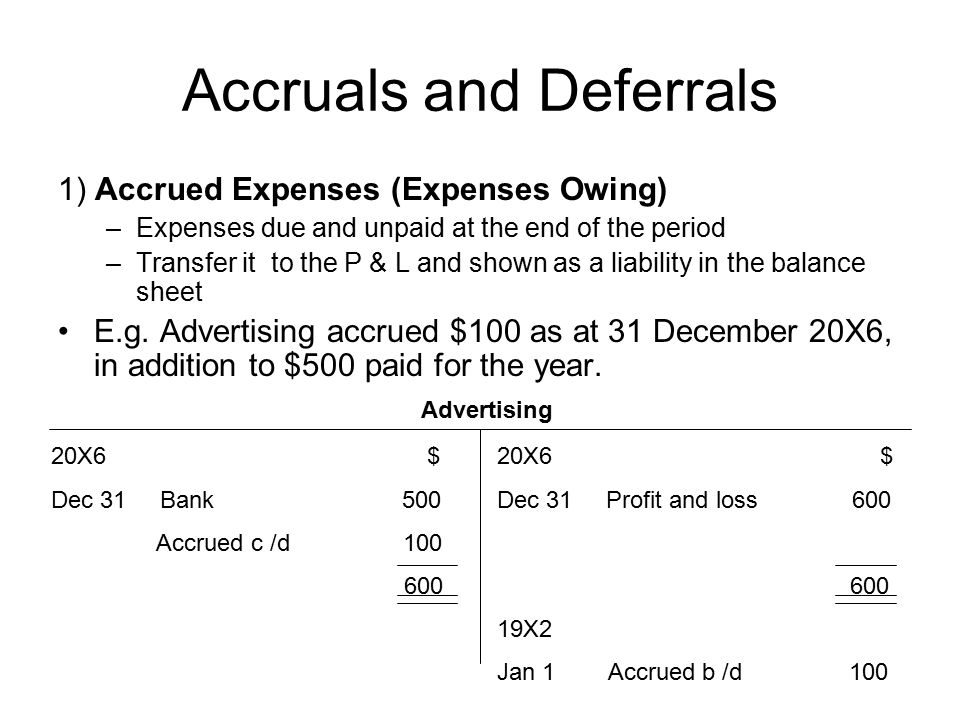

The matching principle and the revenue recognition principle.

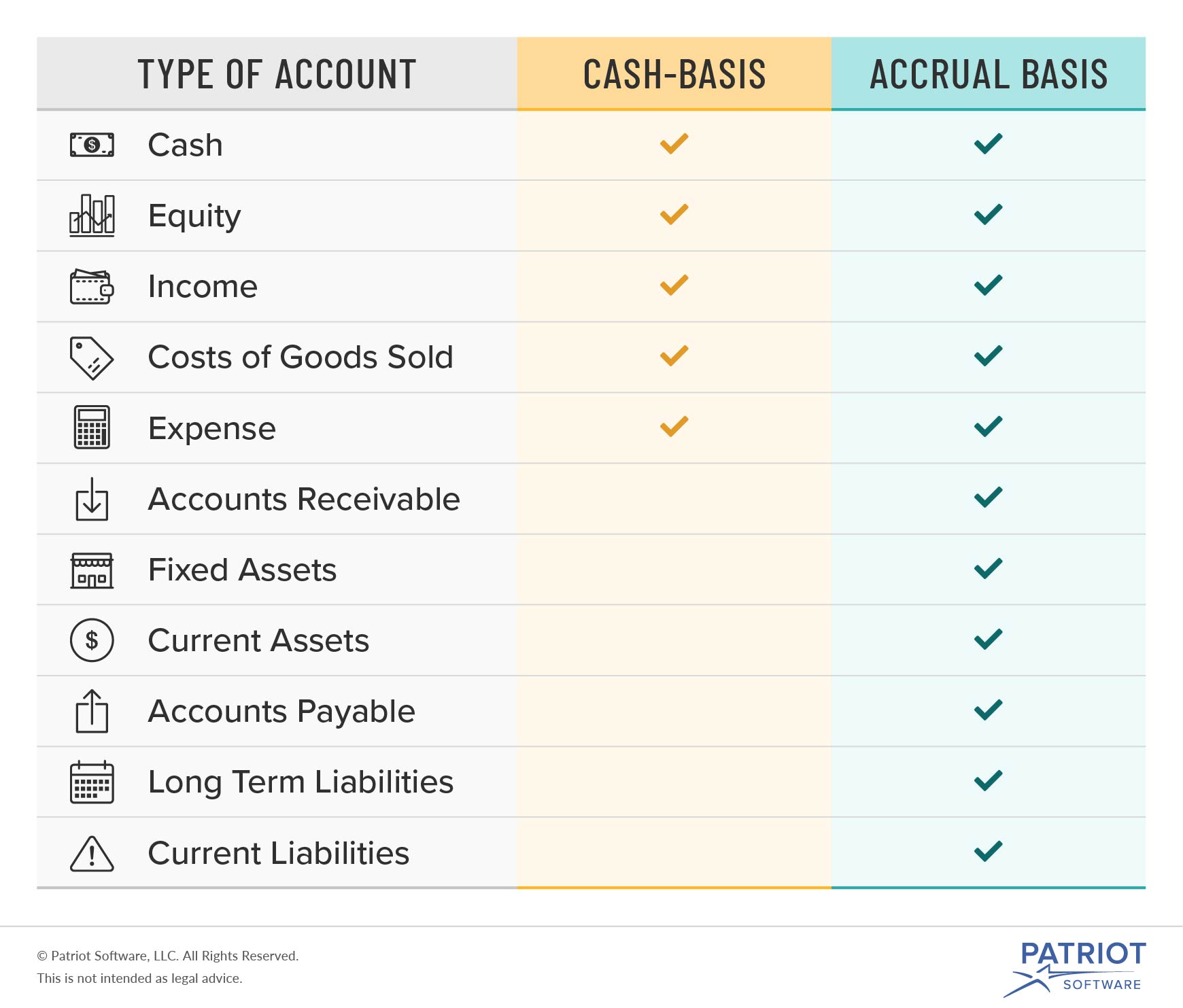

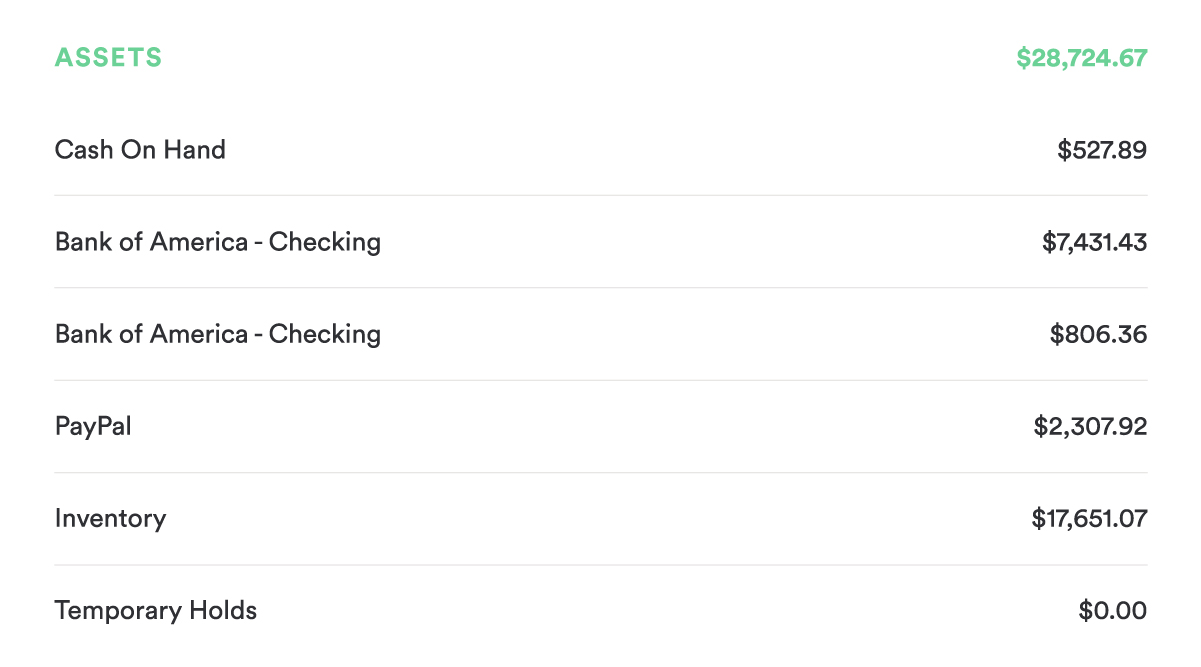

Balance sheet accrual basis. What is the accrual basis of accounting? Accountants make all entries in an accrual basis accounting system in double, or as reversing entries. The balance sheet for accrual accounting includes more details and additional accounts.

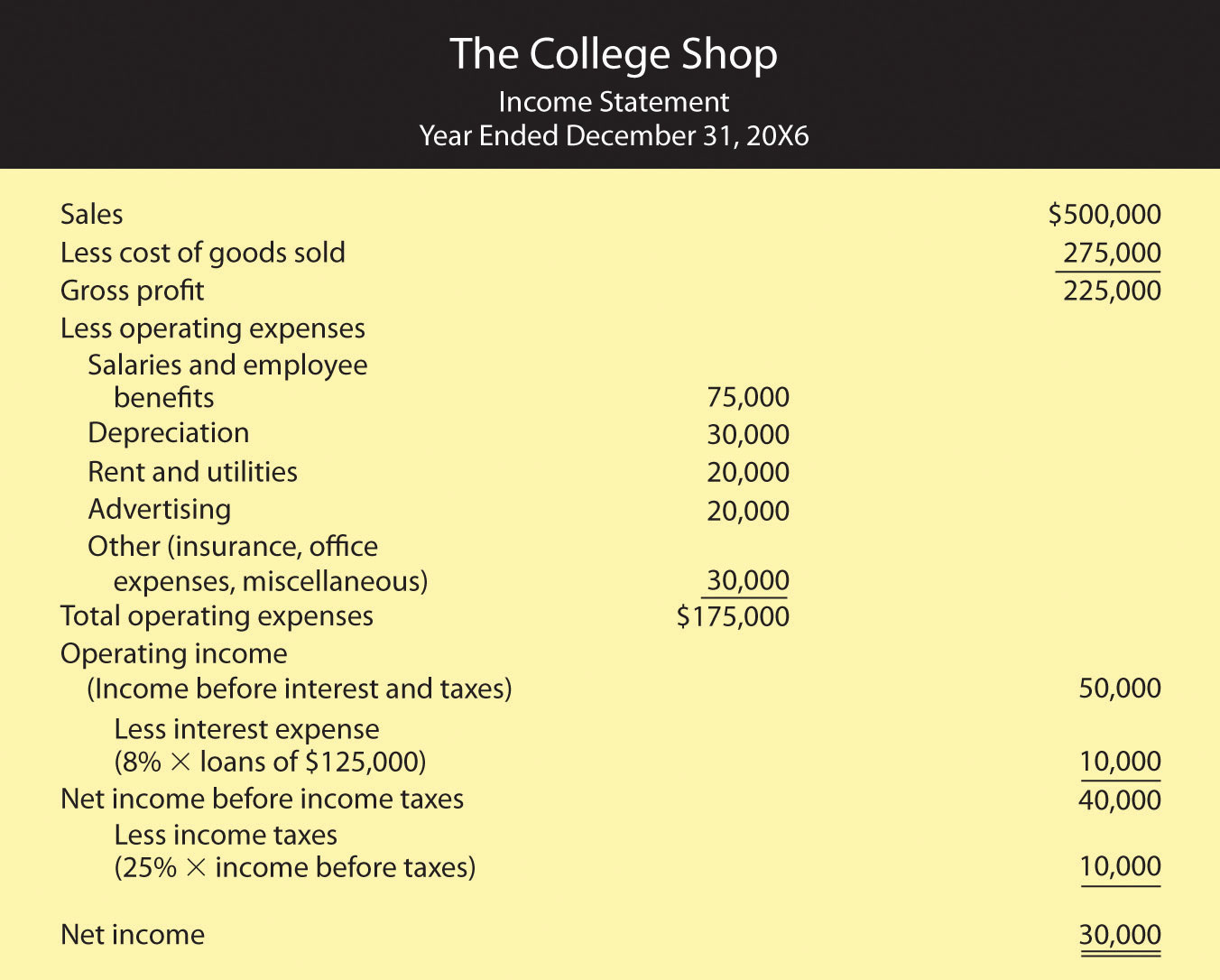

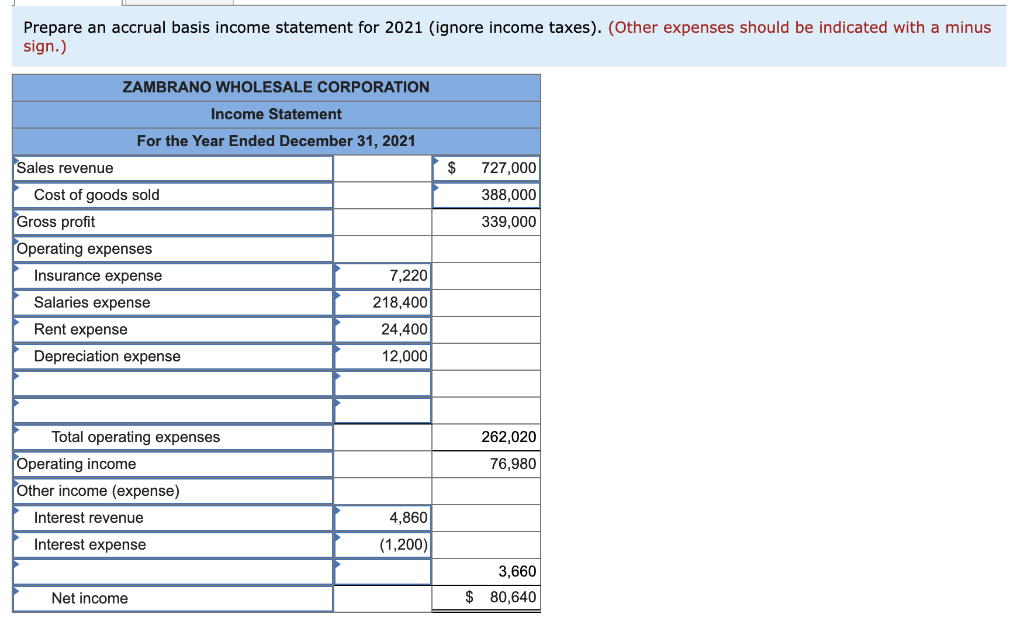

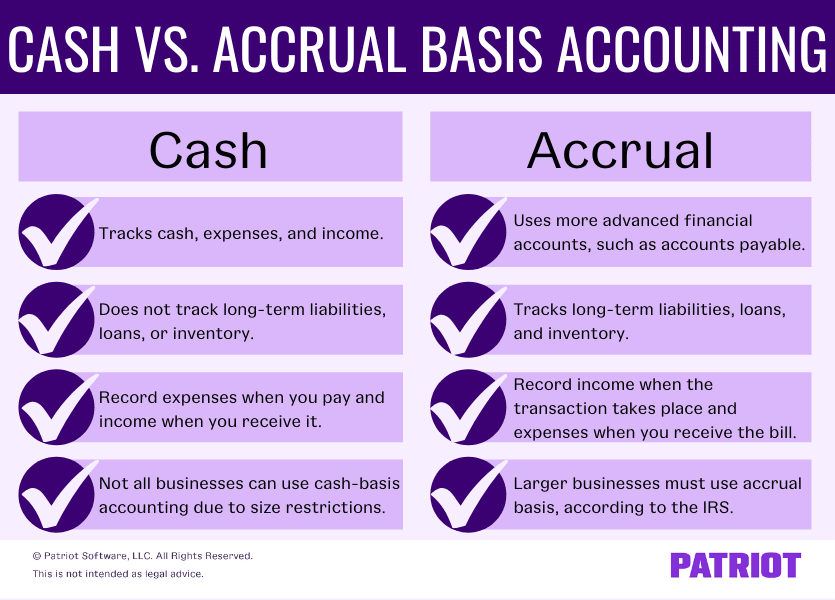

Under these principles, revenue is recognized when it is earned, and expenses are reflected in the period that best matches the revenue they help create. Example of reporting expenses under the accrual basis of accounting Cash basis accounting is a viable alternative for some small businesses.

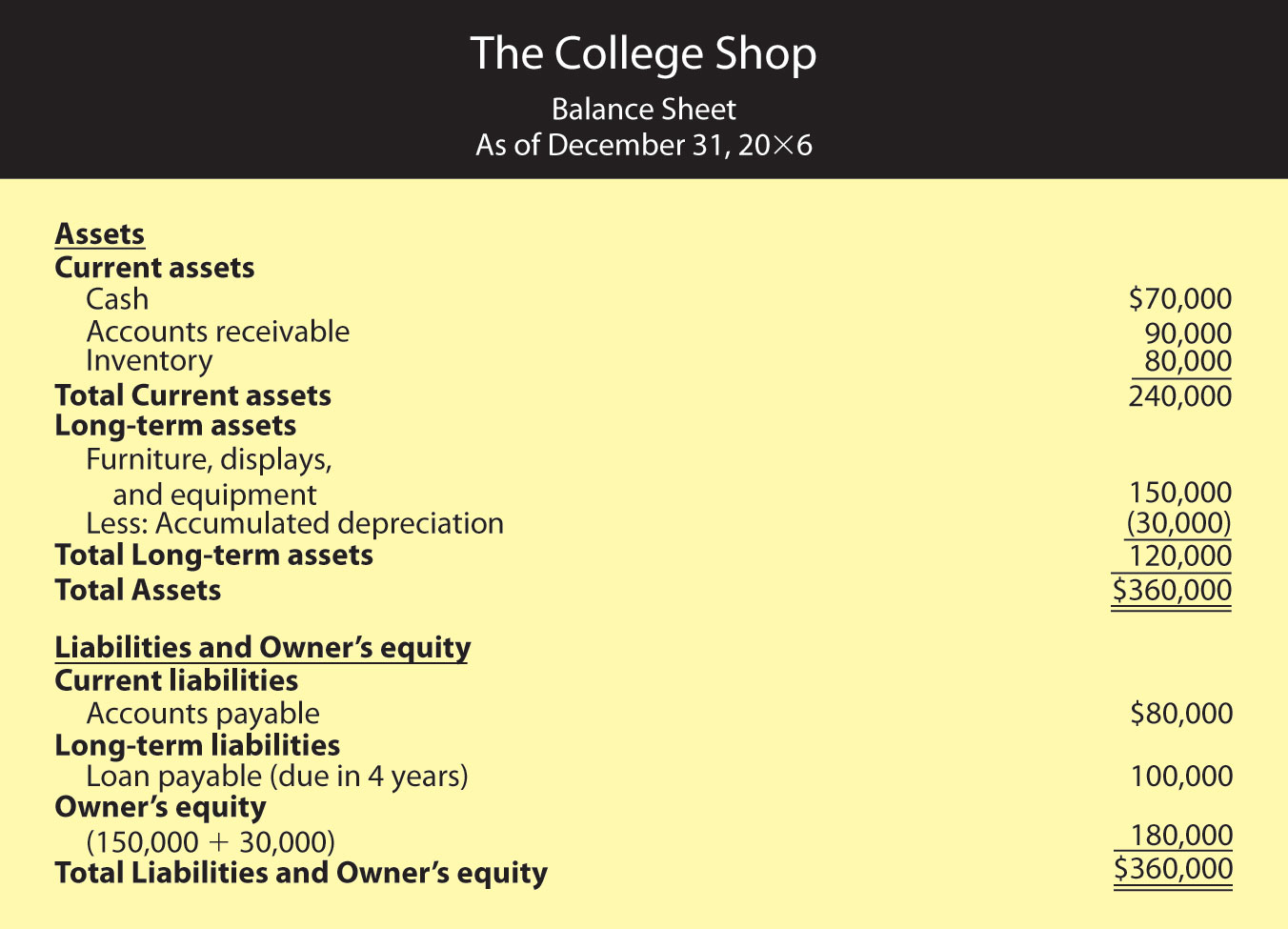

Applying this approach also affects the balance sheet, allowing you to recognize accounts receivable or payable even if you do not receive or pay the associated cash. This means that income is recorded when it's earned and not when the actual cash is received. Purchasing $200 in inventory that you will sell next month will result in a $200 increase in inventory and a $200 decrease in cash on the balance sheet.

The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold and record expenses as they are incurred. For example, if a company has performed a service for a customer but has not yet received payment, the.

It generally makes bookkeeping simpler. The accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. Key differences accrual method the accrual method records accounts receivables and payables and, as a result, can provide a more accurate picture of the profitability of a company, particularly.

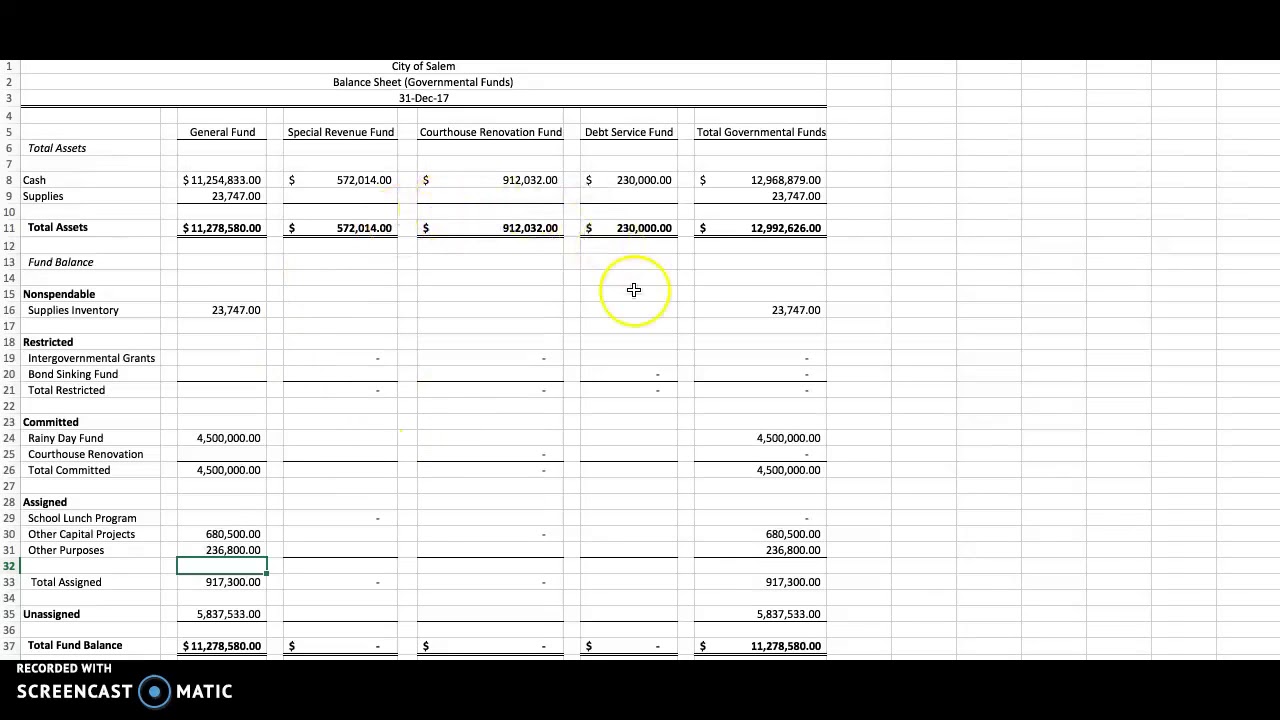

The accrual basis balance sheet; Accrual accounting vs. Now let’s see how accrual affects the balance sheet.

Under the accrual basis of accounting my business will report the $10,000 of revenues i earned on the december income statement and will report accounts receivable of $10,000 on the december 31 balance sheet. That’s why the general accepted accounting principles (gaap) recognizes the accrual method. An accrual accounting system offers better insights into profitability by painting an accurate picture of revenue, expenditures, assets, and liabilities on the balance sheet.

In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that have been incurred but the company has yet to pay. The accrual basis income statement; Where are accruals reflected on the balance sheet?

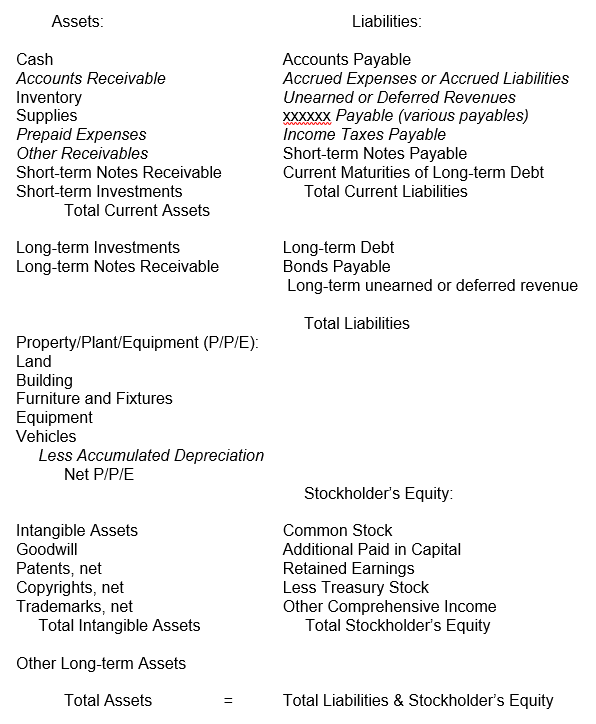

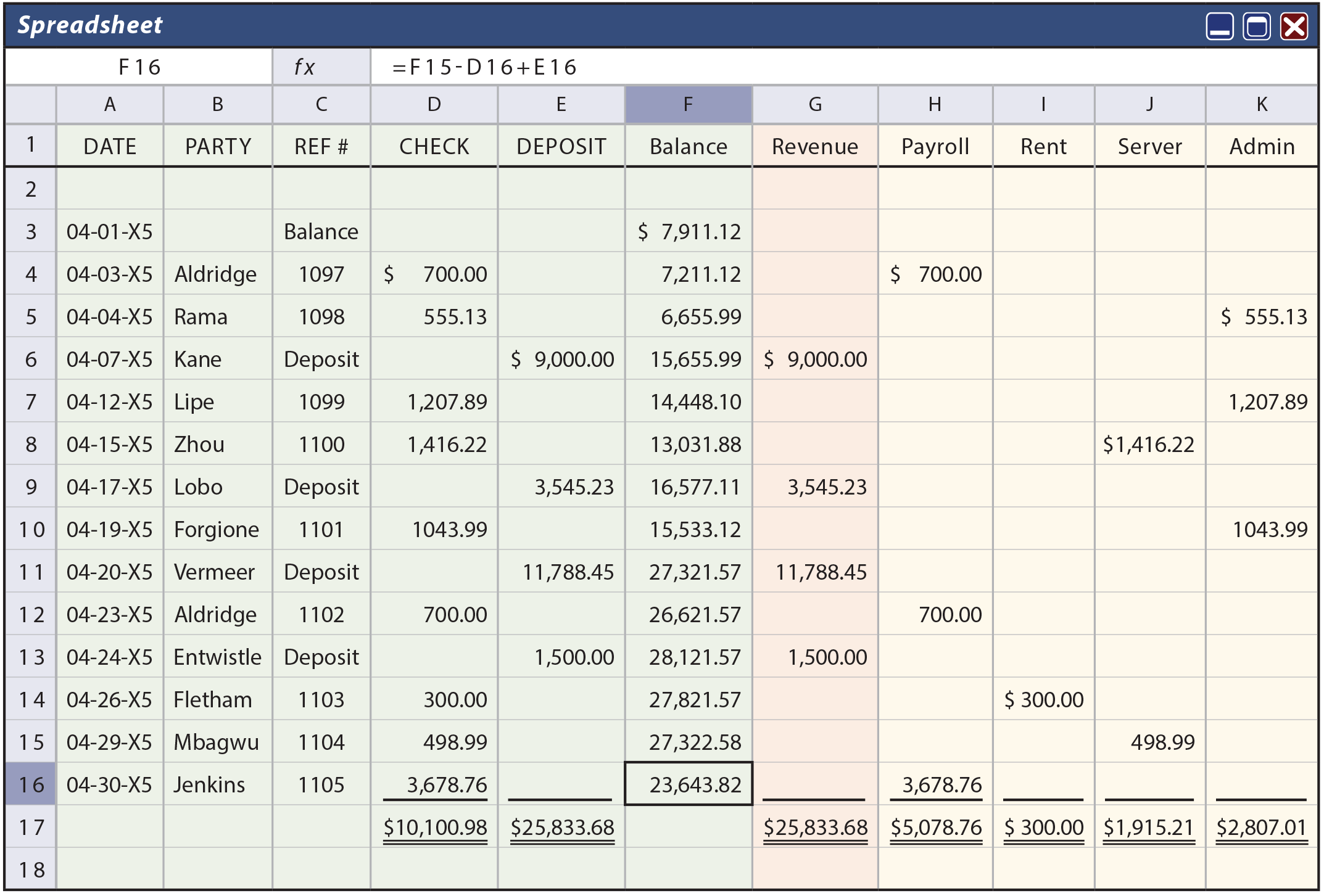

Under this method, companies record revenue and expenses using balance sheet accounts like accounts receivable, accounts payable, prepaid assets and accrued expenses. The balance sheet is also affected at the time of the revenues by either an increase in cash (if the service or sale was for cash), an increase in accounts. The balance sheet contents under the various accounting methodologies are:

The balance sheet items that corresponded with incomes or expenses are records and recognized in the same way. Balance sheet accounts indicate when the cash occurs in a different period of time than the revenue or expense occurred. Find out which is right for you with our cash vs accrual accounting comparison.