Here’s A Quick Way To Solve A Tips About Calculate Free Cash Flow From Statement Non Items

Innovation rate increased to 20%;

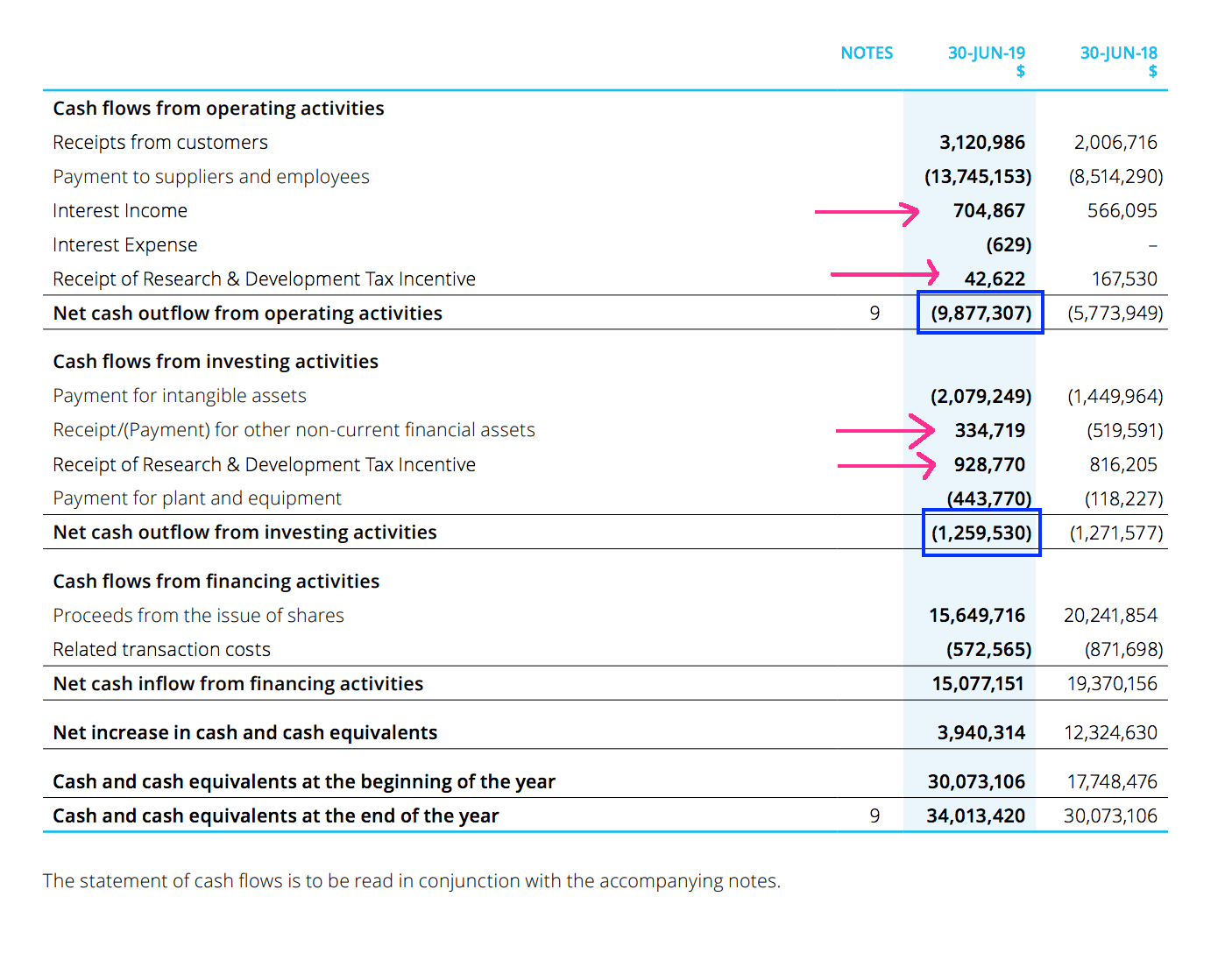

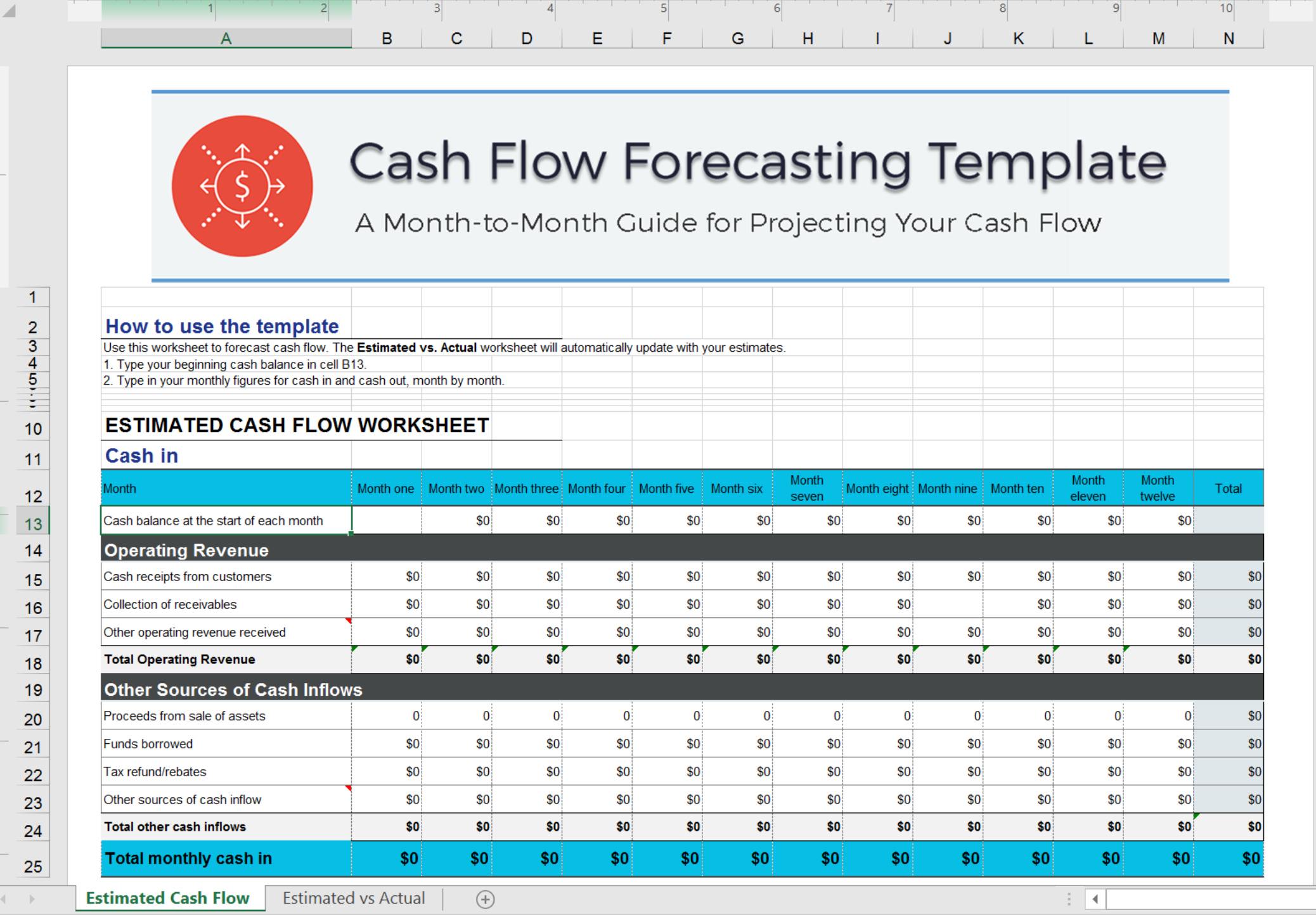

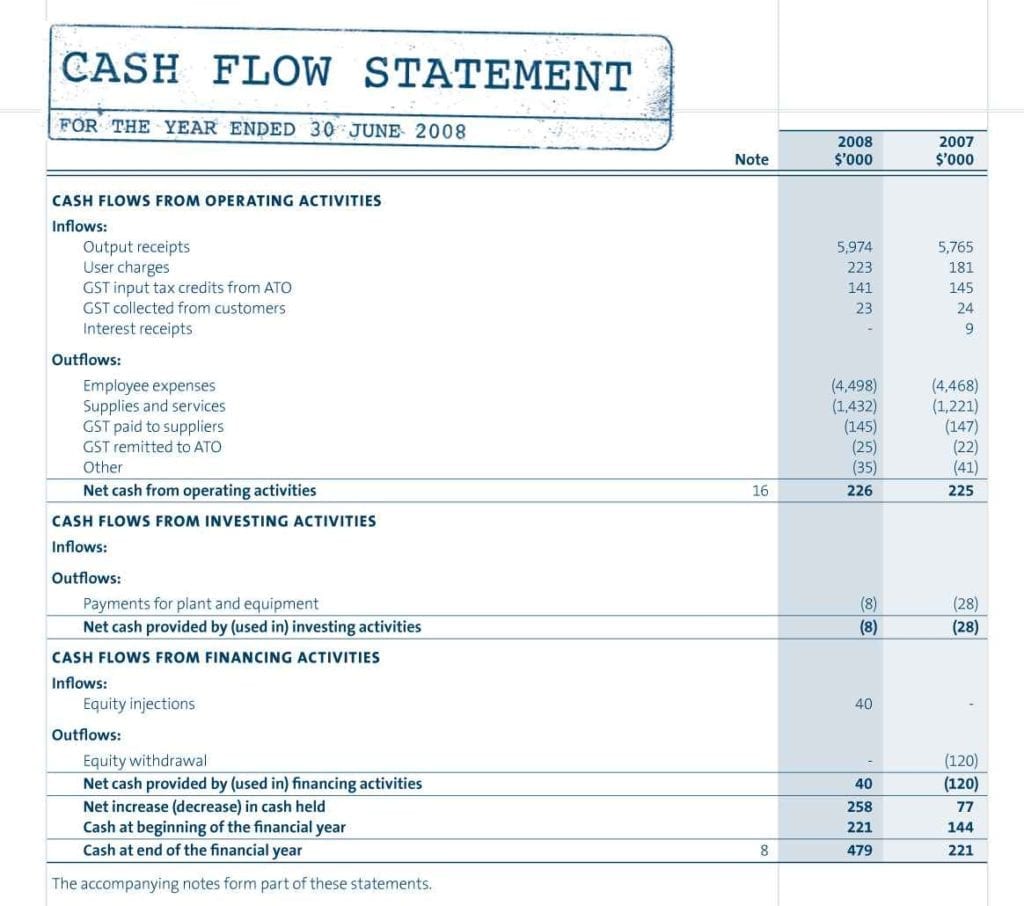

Calculate free cash flow from cash flow statement. Learn how to analyze amazon’s consolidated statement of cash flows in cfi’s amazon advanced financial modeling course. Formula to calculate and interpret it Get your free cash flow statement template operating cash flow refers to any money generated through the normal operation of the business, minus any taxes paid.

There is another formula to calculate free cash flow: Let’s look at how to calculate free cash flow to equity (fcfe) by examining the formula. While net income measures the company's profitability, free cash flow.

You can also use amortization and depreciation to account for. To calculate fcf, read the company's balance sheet and pull out the numbers for capital expenditures and total cash flow from operating activities, then subtract the first data point from the. Key takeaways free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors.

Fcf gets its name from the fact that it’s the amount of cash flow “free” (available) for discretionary spending by management/shareholders. Key takeaways free cash flow to the firm (fcff) represents the cash flow from operations available for distribution after accounting for depreciation expenses, taxes, working capital, and. Streamline your financial management with our free cash flow statement template.

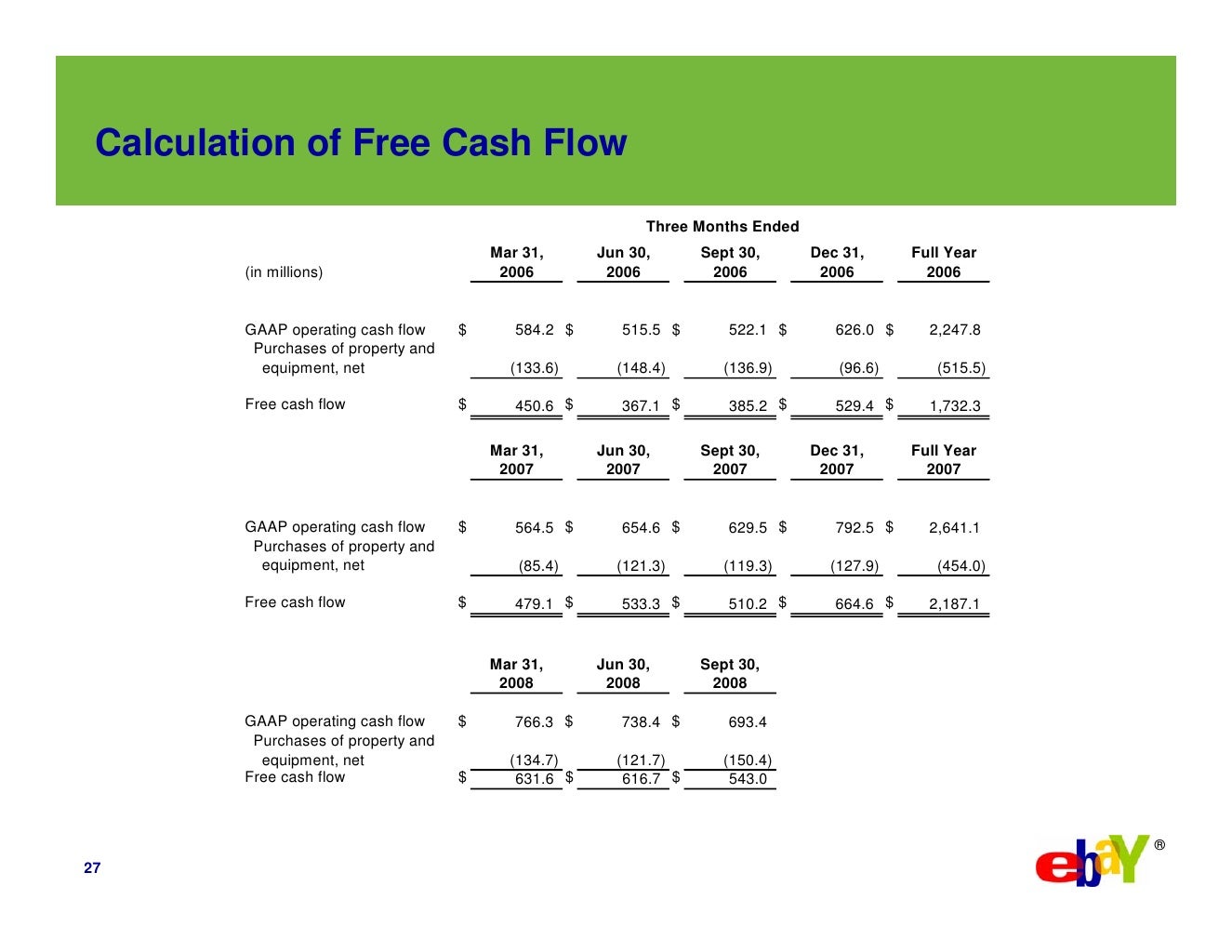

Free cash flow eur 423 million; The cash flow statement calculator works by using a cash flow statement formula that takes into account the cash that comes in from operations, investments, and financing. More free cash flow (fcf):

Payroll and other expenses) for a set period. To the general meeting we propose a cash dividend of eur 1.13 per share (2022: You figure free cash flow by subtracting money spent for capital expenditures, which is money to purchase or improve assets, and money paid out in dividends from net cash provided by operating activities.

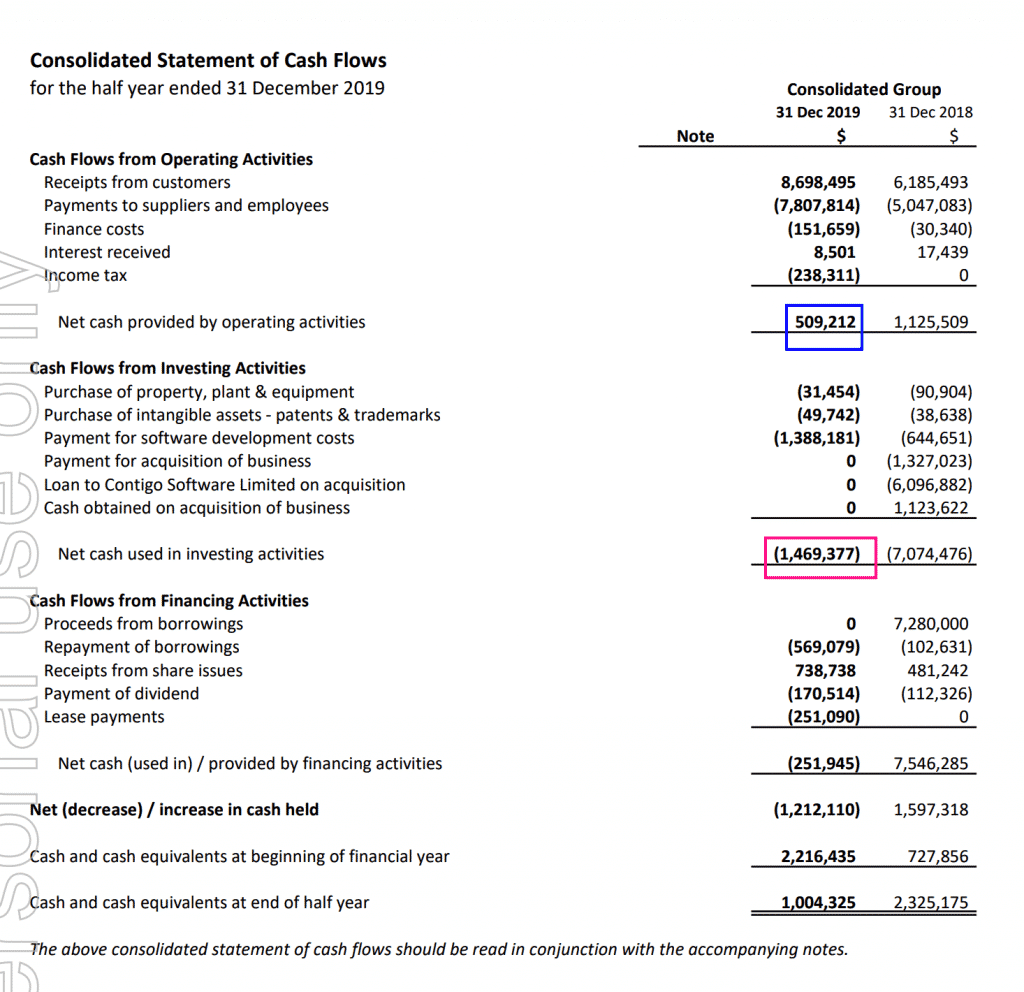

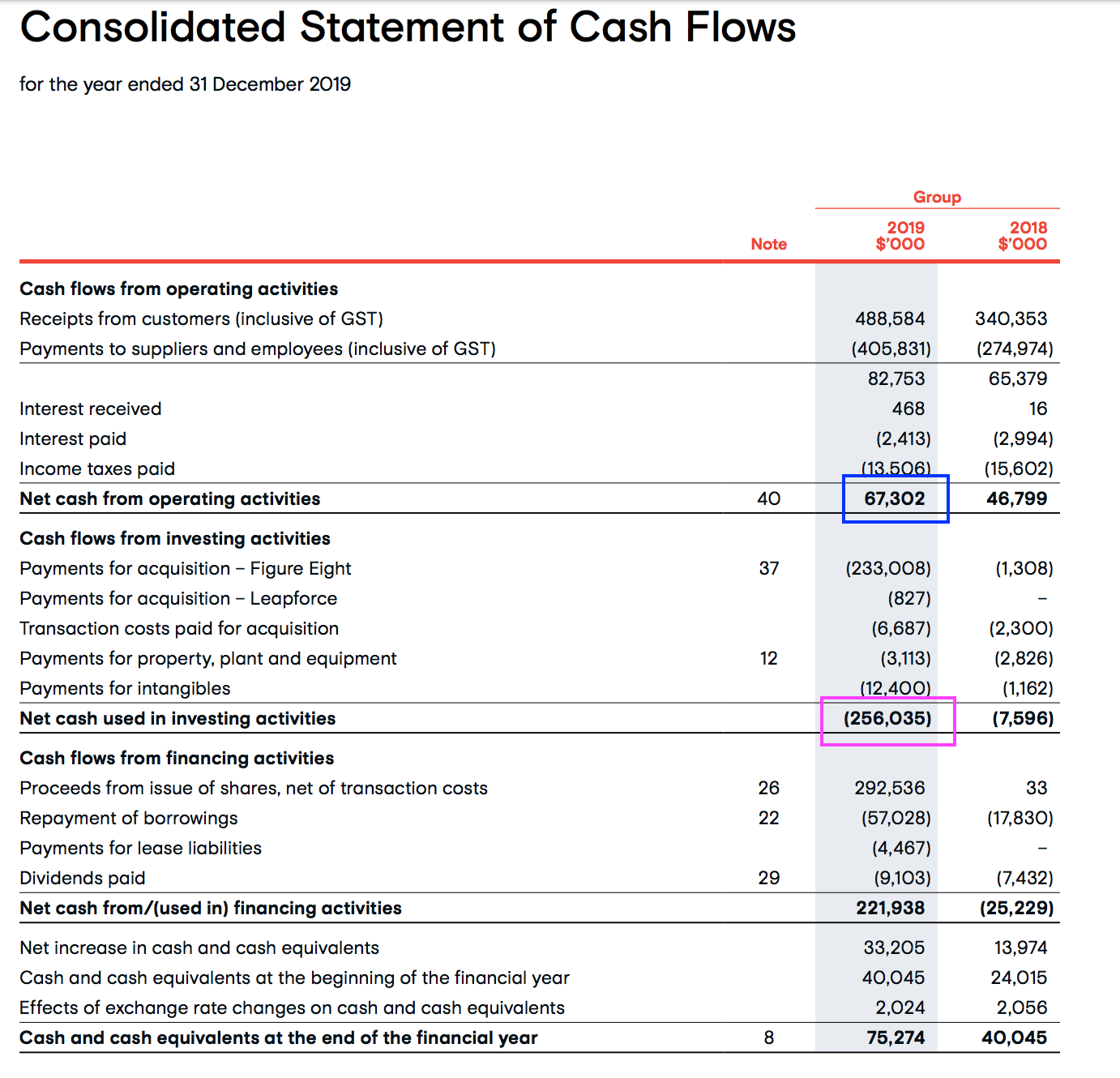

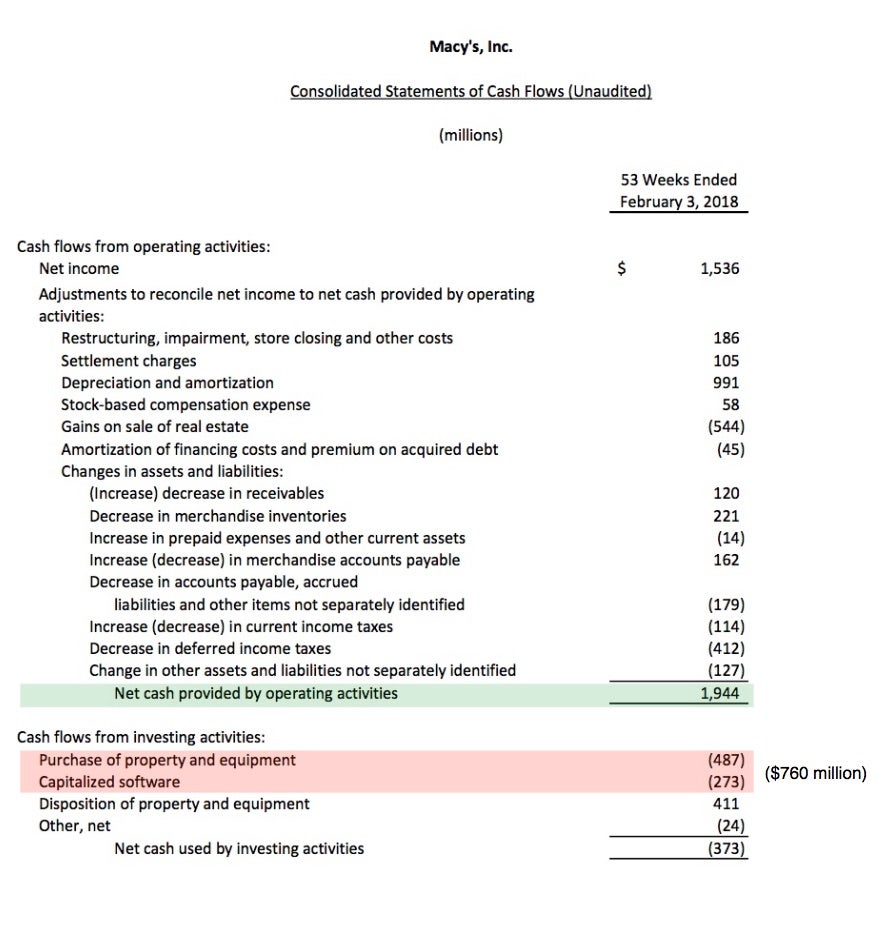

Statement of cash flows example. Free cash flow is not the same as net income. Operating cash flow is the money a company makes from its main business activities, like selling goods or services.

Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing activities. It can easily be derived from a company’s statement of cash flows. Get the cash flow statement for plum acquisition corp.

To calculate company a’s free cash flow, you can use the following formula: This is the type of math you will be doing when building financial models. Free cash flow can be easily derived from the statement of cash flows by taking operating cash flow and deducting capital expenditures.

Calculation of free cash flow. View as % yoy growth or as % of revenue. It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-3c51e1263e6f488daa2d923e2a43a33d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)