The Secret Of Info About Cash Flows During The First Year Of Operations For S Corp Profit And Loss Statement

To support cash planning and to provide external financial statement users such as lenders and investors.

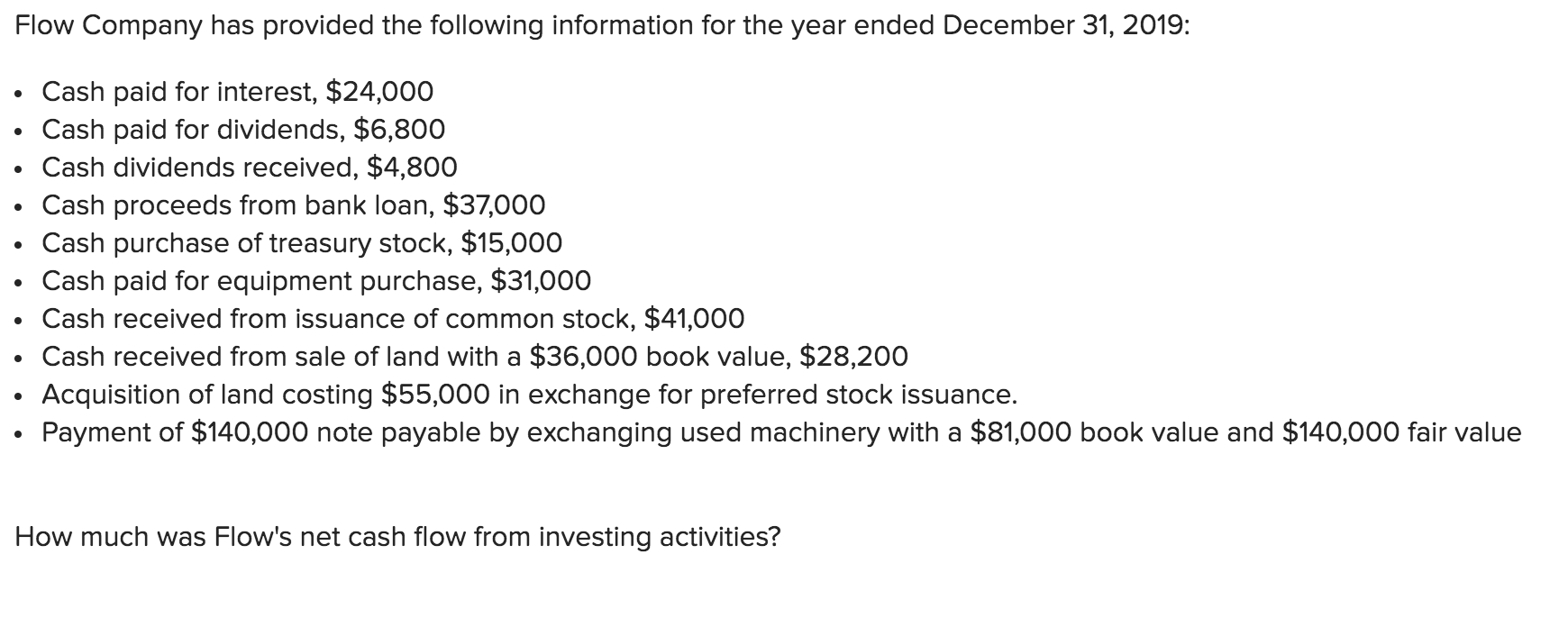

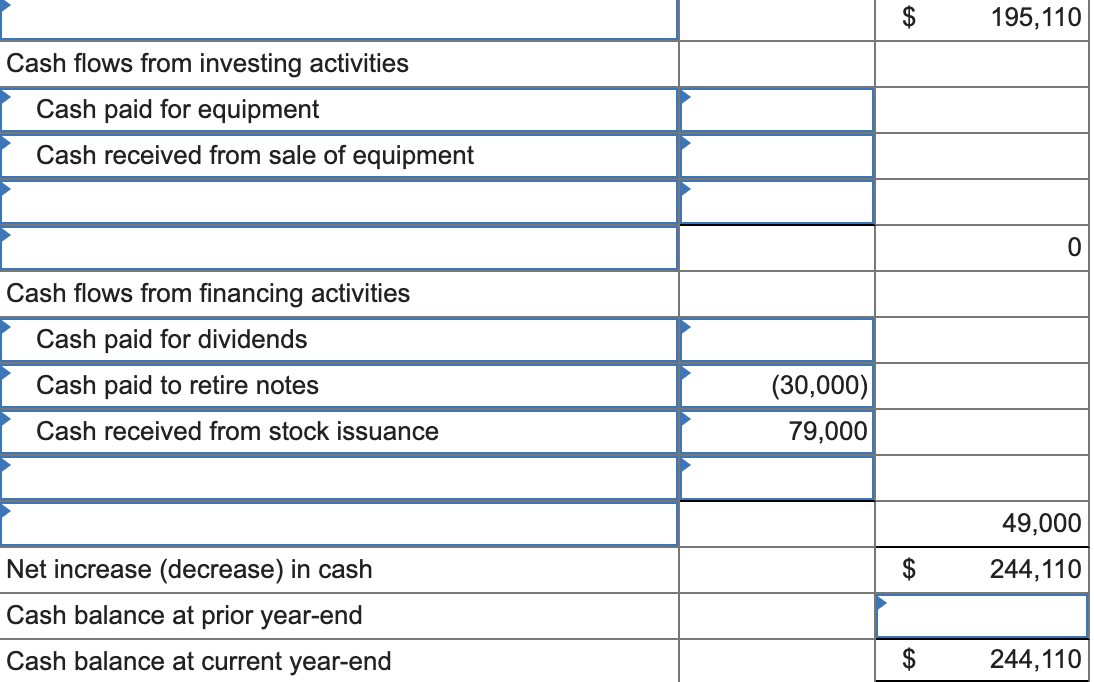

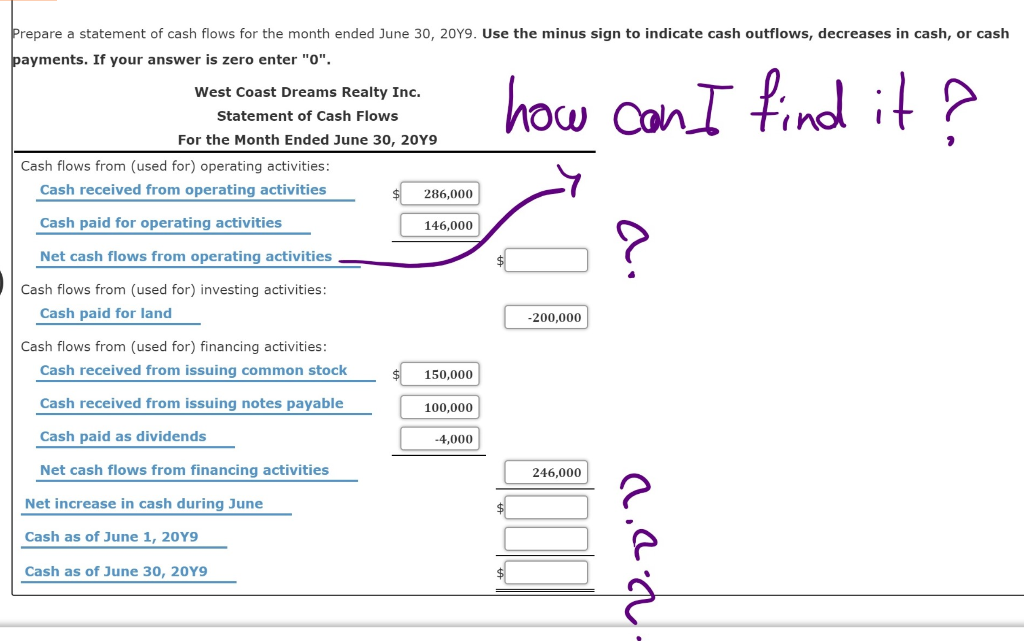

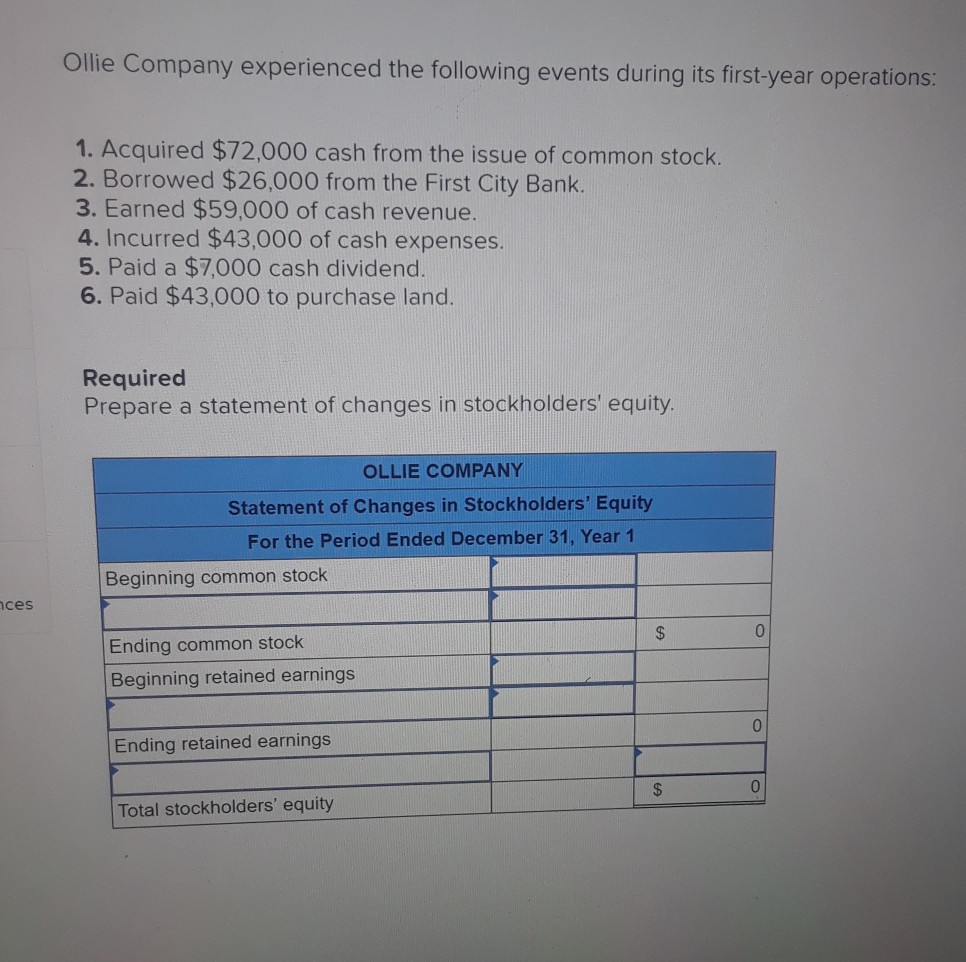

Cash flows during the first year of operations for the. Your total operating cash outflows are $195,500. Cash flows during the first year of operations for the harman kardon consulting company were as follows: This cash flow statement shows company a started the year with approximately $10.75 billion in cash and equivalents.

Cash flow for the month. Earlier we reported comments from the head of the un's nuclear watchdog, who said ukraine's zaporizhzhia nuclear plant has lost connection to its last external backup. Cash collected from customers, $300,000;

Cash collected from customers, $300,000; Cash collected from customers, $370,000; Operating cash flow can be found in the cash flow statement, which reports the changes in cash compared to its static counterparts—the income statement, balance.

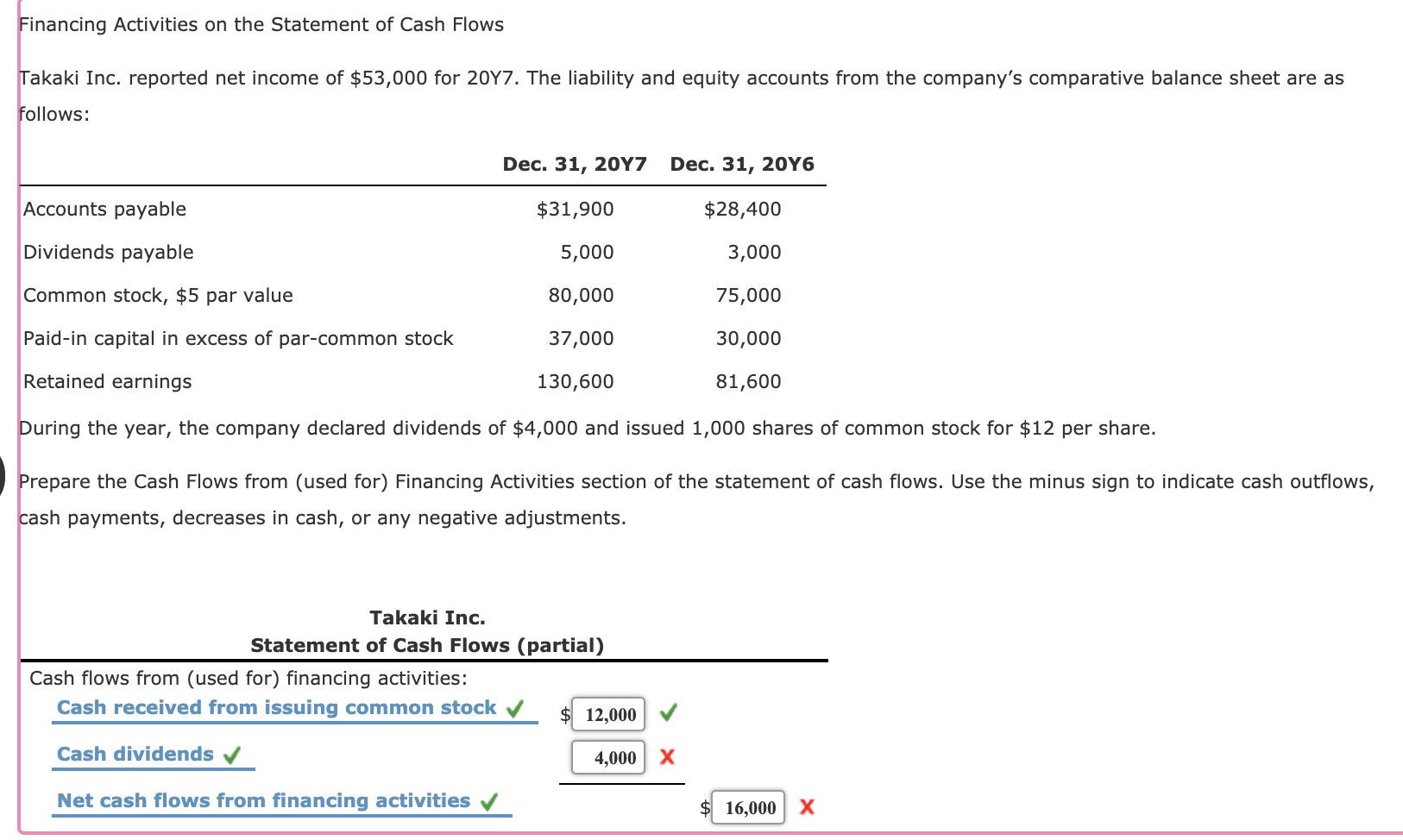

At the bottom of our cash flow statement, we see our total cash flow for the month: Begin with net income from the income. Operating cash flow—also referred to as cash flow from operating activities—is the first section presented on the cash flow statement.

Cash collected from customers, $335,000;. Cash collected from customers, $340,000;. Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting.

If you make the first payment on the first day of next year and continue to do so on the first day of each following year, and if your investment will always be earning 7% interest,. Acct 4101 chapter 1. Cash flow is broken out into cash.

Cash collected from customers, $315,000: Cash flows during the first year of operations for the harman kardon consulting company were as follows: Your operating cash flow in the first year is $5,000, or $200,500 minus.

It must also have adequate cash flow to support daily operations. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing.

Your total operating cash inflows are $200,500.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)