Here’s A Quick Way To Solve A Info About Balancing Accounts Receivable Stock Adjustment In Profit And Loss Statement

The balance sheet provides a snapshot of a company's financial health.

Balancing accounts receivable. Sometimes mistakes happen that need to be adjusted, other times balances become uncollectible and need to. Accounts receivable is considered an asset and is listed as such on a business’s balance sheet. Accounts receivable is created when a company lets a buyer.

If your accounts receivable balance is going up, that means you're invoicing more. Quickbooks financial reporting software easily keeps track of your unpaid invoices, customer bala. The left side of the balance sheet outlines all of a company’s assets.

The period of time can be a month or a financial year. Accounts receivable (ar) is an asset account on the balance sheet that represents money due to a company in the short term. Accounts receivable (ar) is crucial for business success.

Divide your total accounts receivable by your average daily credit sales and compare that ratio to other businesses in your industry. Compiling a balance sheet report can be time consuming and complicated, so automated accounting software like bokio can be. Accounts payable normal balance:

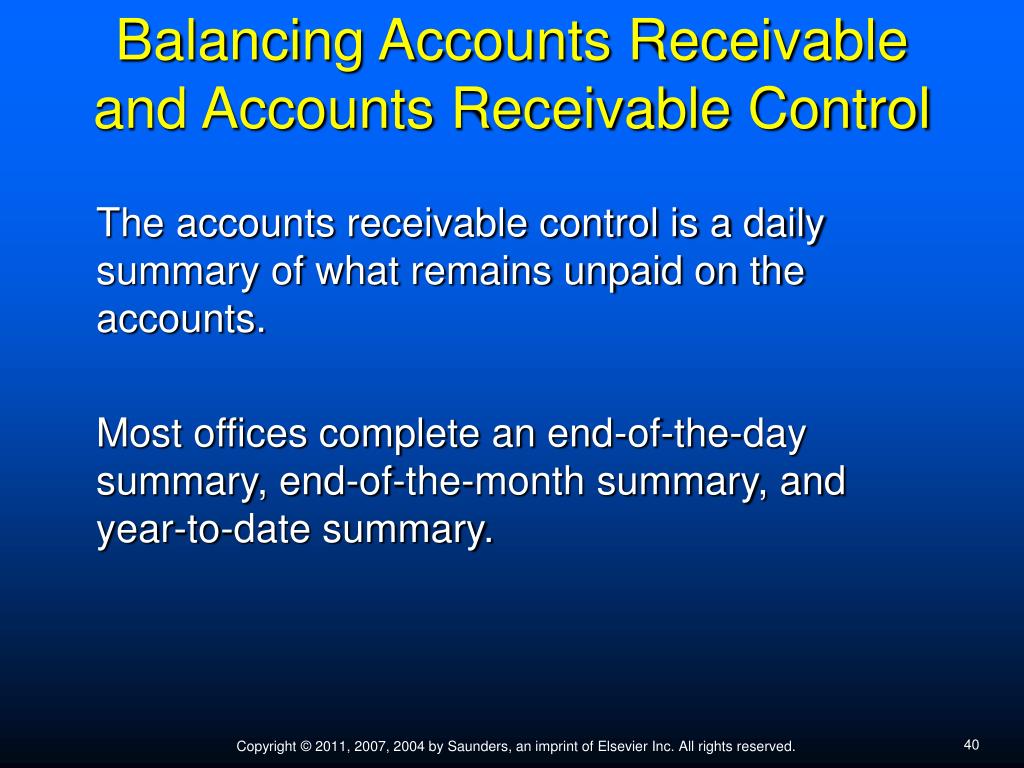

A guide to understanding ar and its importance. The reconciliation of accounts receivable is the process of matching the detailed amounts of unpaid customer billings to the accounts receivable total stated in the general ledger. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past.

The easiest way to adjust accounts receivable balances is to directly write off a customer's account that is deemed uncollectible. Here are some examples of current assets: Accounts receivable are a current asset on the balance sheet.

Accounts receivable appears as a current asset on the balance sheet. The balance sheet method involves taking the total accounts receivable balance on the balance sheet and subtracting any allowances for doubtful accounts. Accounts payable is a liability on the right side of the accounting equation and is normally a credit balance.

Accounts receivable is a type of asset and accounts payable is a type liability. The easiest way to show the process of balancing off accounts is by looking at an example. By understanding the main reasons behind a negative ar balance and implementing the tips provided, you can effectively address the issue and restore financial balance.

By effectively managing these two aspects, companies can maintain healthy cash flow, improve relationships with suppliers and customers, and ultimately drive growth. Assets = liabilities + equity. So, here’s how to calculate accounts receivable on balance sheets:

Accounts receivable represent money a company has invoiced for goods or services that have been delivered but not yet paid for. What is the journal entry for accounts receivable? What kind of account is accounts receivable?