Brilliant Info About Limited Liability Company Financial Statements Provision For Bad Debts In Profit And Loss Account

Basic data about the company.

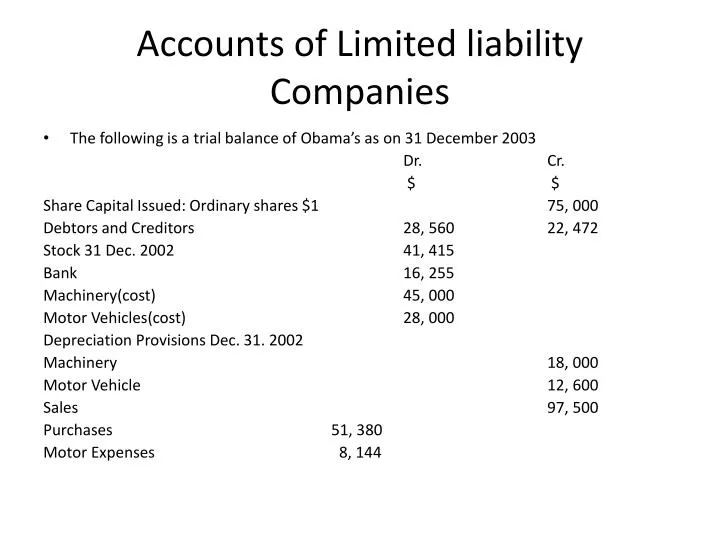

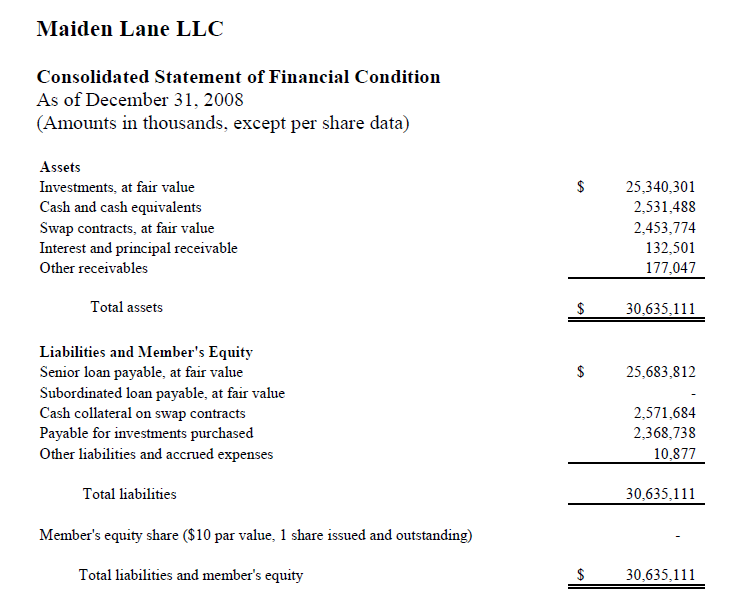

Limited liability company financial statements. We have audited the accompanying statement of financial condition of corporate credit facilities llc (a limited liability company consolidated by the federal reserve bank. Which of the following statements about limited liability companies’ accounting is/are correct? The legal differences with a quick quiz in acca fa.

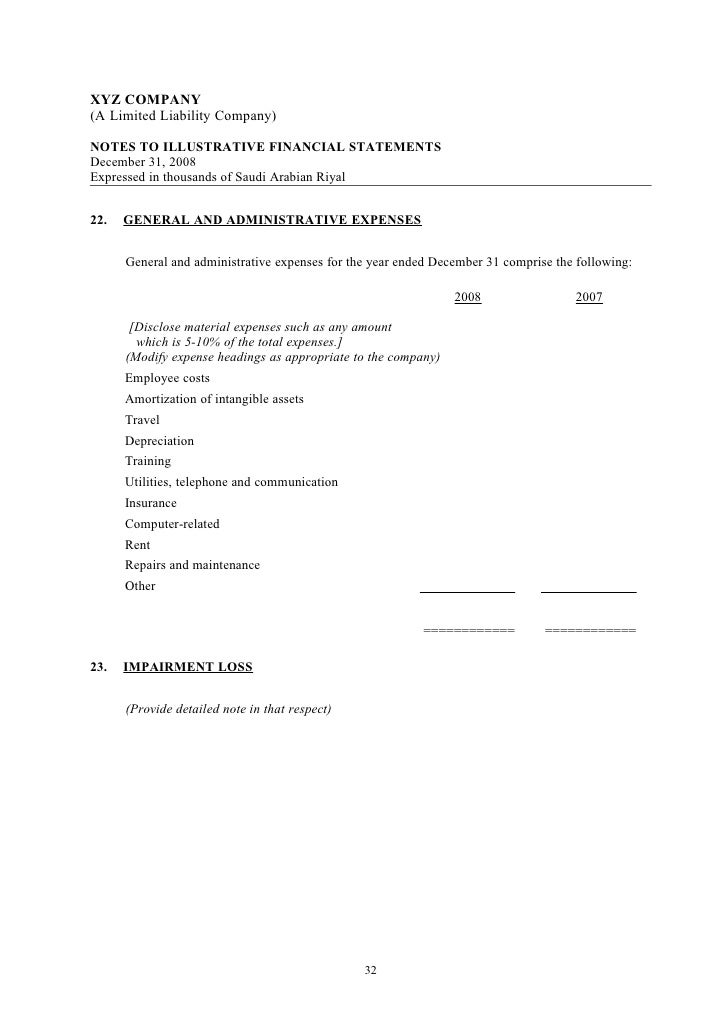

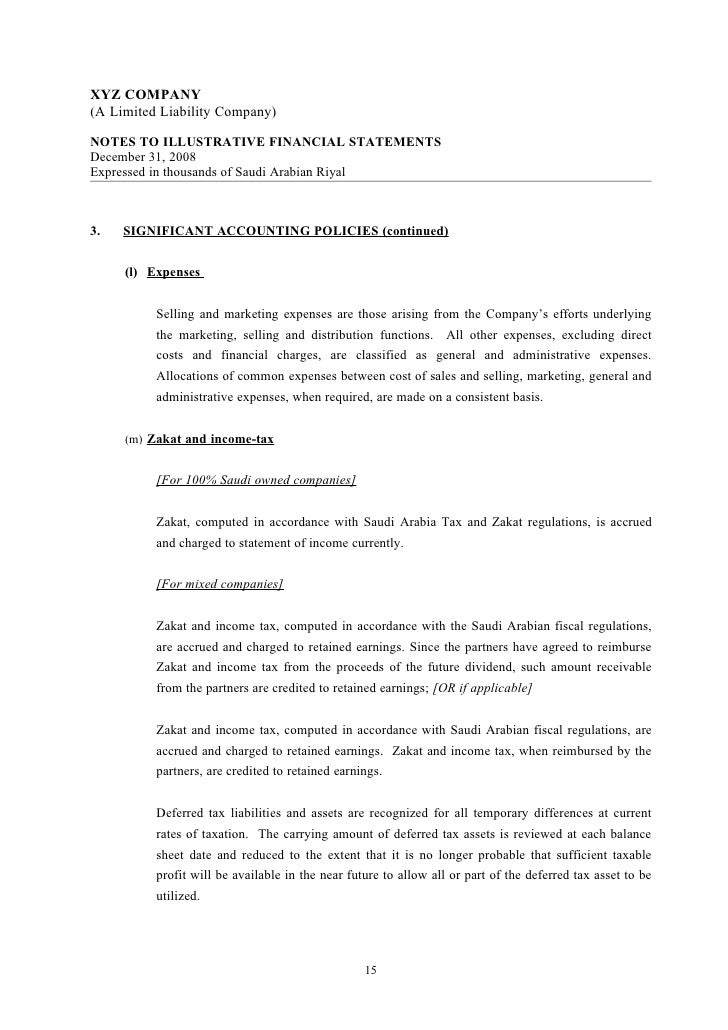

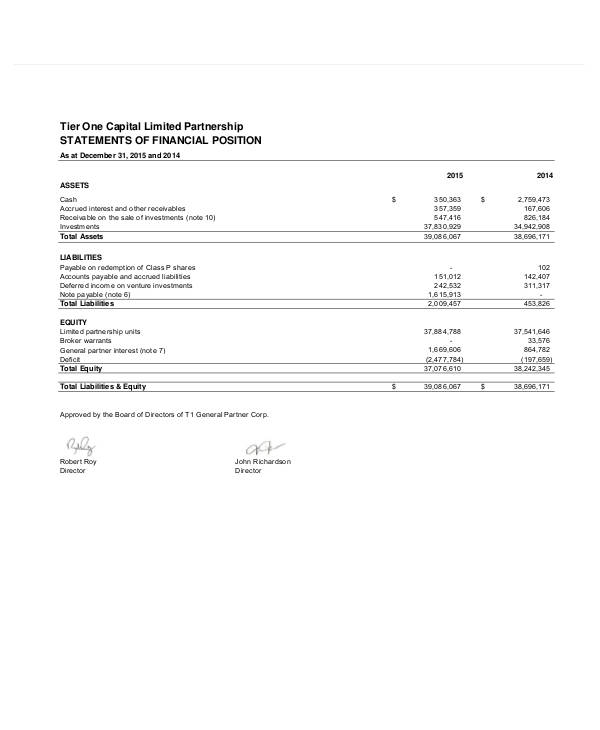

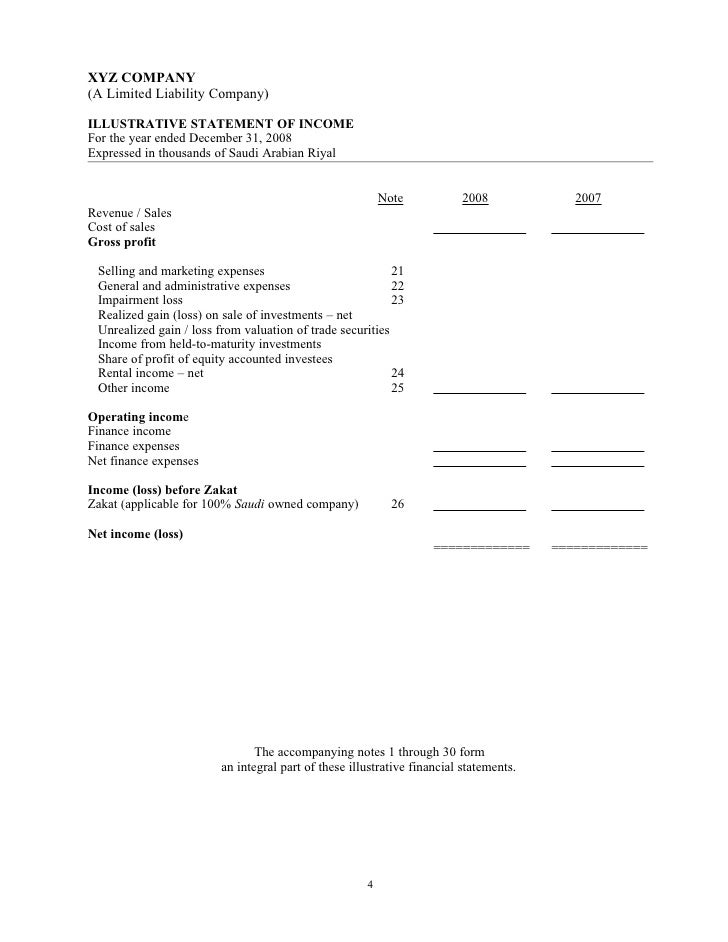

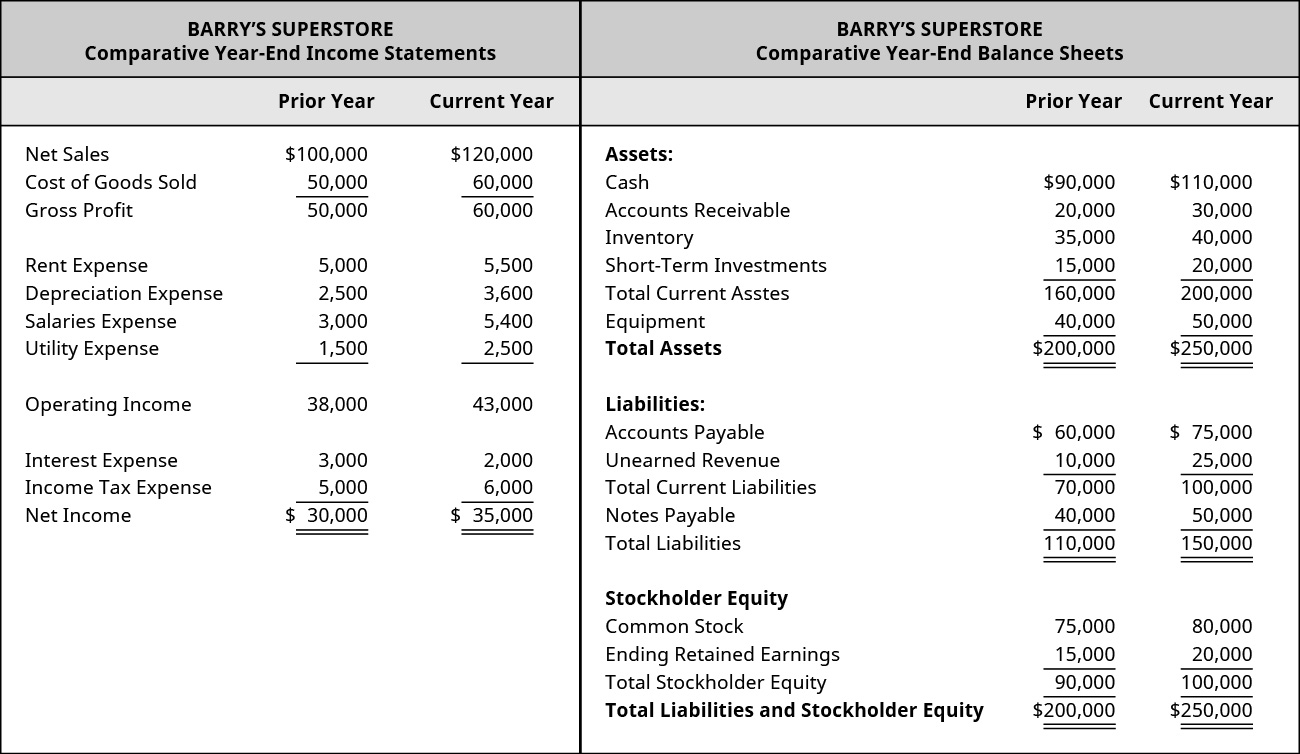

Find out how llcs report their income, assets, liabilities, and owners' equity, and how they compare with partnerships. Companies with business activities related to the management of. The financial statements of limited liability companies contents:

The limited liability company (llc) entity type provides many advantages—like reducing the owners’ personal liability,. On this page you can. Explain the difference between a sole trader and a limited liability company ;

Limited liability companies are incorporated to take advantage of ‘limited liability’ for their owners (shareholders). At the end of this lecture, students must be able to understand how to prepare financial statements of limited liability companies for publication. The federal reserve bank of boston audited the financial statements of ms facilities llc, a limited liability company consolidated by the bank, for the period from may 18, 2020 to.

Talf ii llc a limited liability company consolidated by the federal reserve bank of new york for the period from april 13, 2020 to december 31,. Llcs must show financial statements to the irs as part of their tax returns and in the event of an audit or request. Accounting for limited liability partnerships (llps) is a specialist area that requires expertise and an understanding of the business structure.

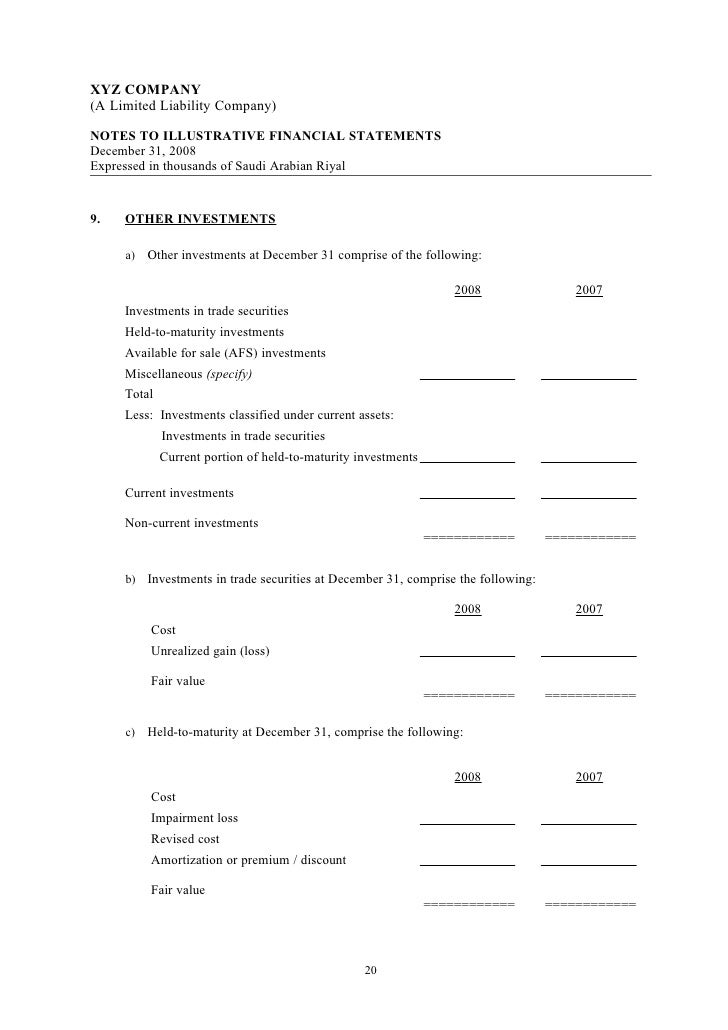

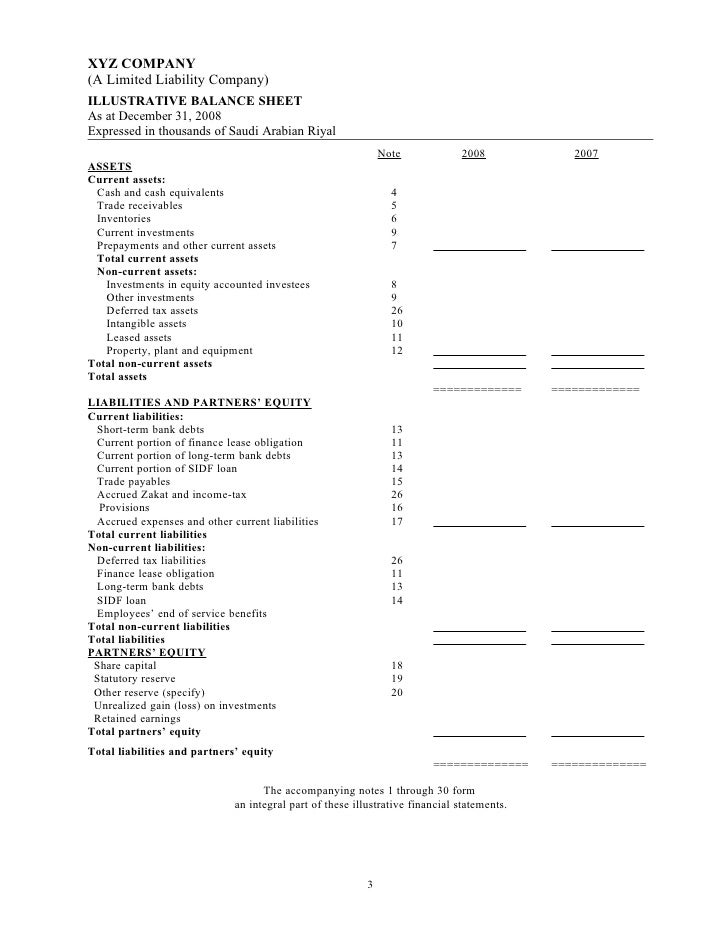

Statement of financial position, statement of profit or loss and other comprehensive income, statement of changes in equity and statement of cash. Llcs that contract with federal agencies may also be. Limited liability companies with one of the following criteria:

Learn what kind of financial statements do limited liability companies (llcs) have to file and why they are important for business owners. This financial statement is the responsibility of empirical research partners llc's management. In our opinion, the financial statements present fairly, in all material respects, the financial position of the llc as of december 31, 2022 and 2021, and the results of its operations.

Our responsibility is to express an opinion on this financial. The scope and purpose of, financial statements advantages and disadvantages of operating test your knowledge on a1c. On november 5, 2010, the company formed nfr holdings llc as a delaware limited liability company (nfr holdings), at which time nfr holdings formed nfr holdings ii,.

2.the structure of the financial statements of limited. Illustrate the ias1 required presentation of financial statements ; The first deregistration in 2024 now includes ca.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)