Have A Info About Liabilities Reported On The Balance Sheet Include Condensed Statement

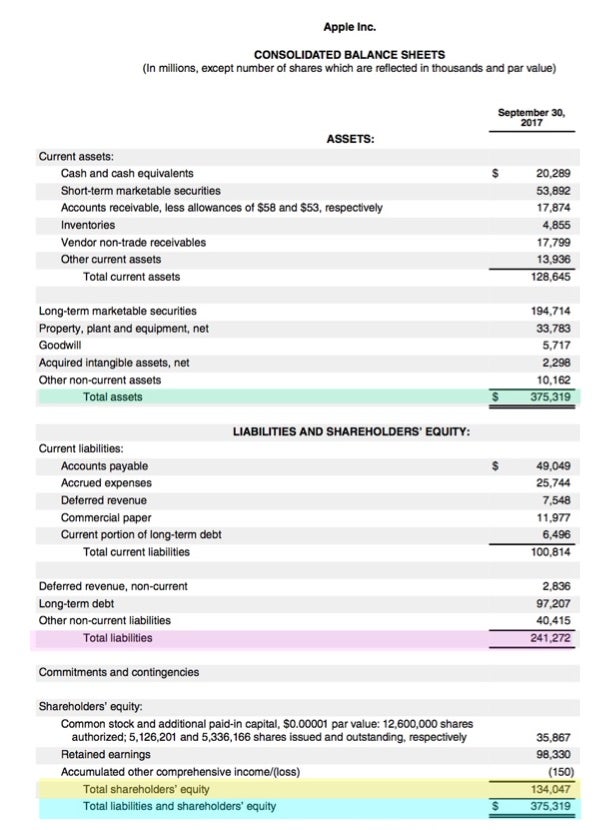

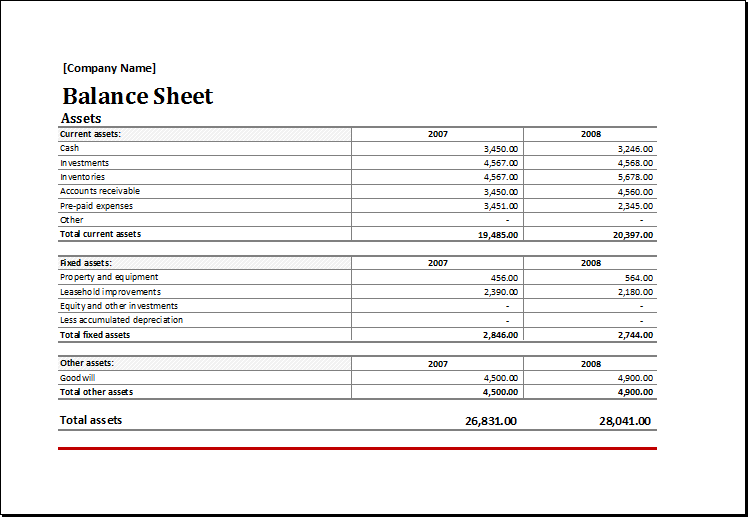

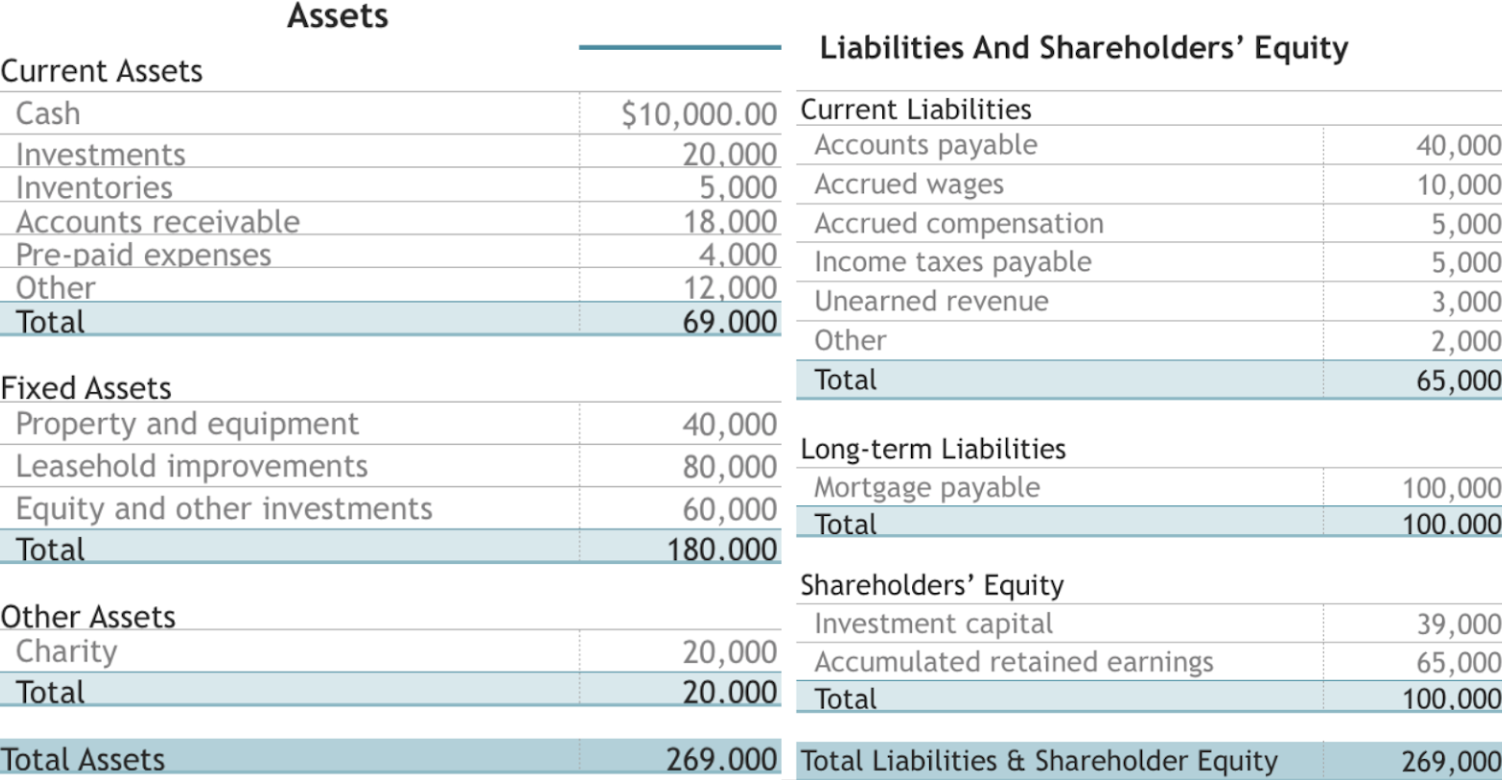

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

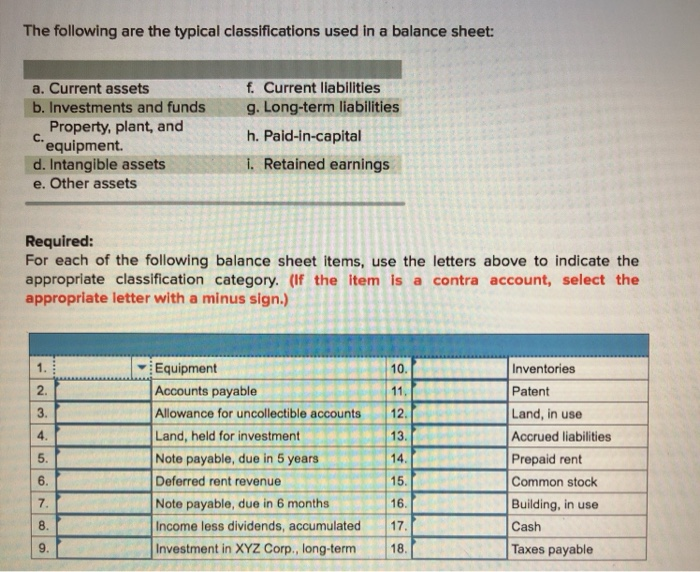

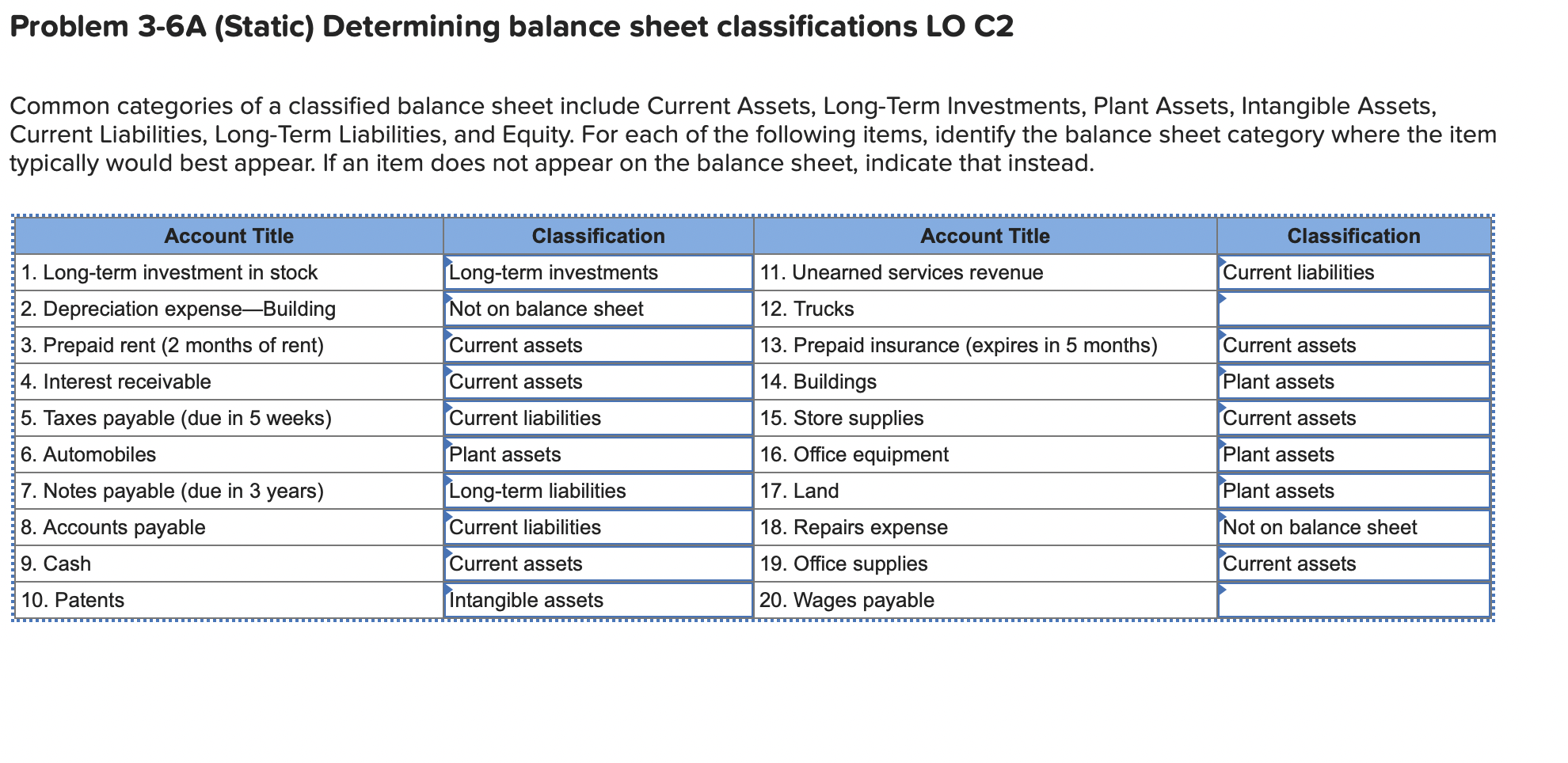

Liabilities reported on the balance sheet include. Current liabilities are reported on the classified balance sheet, listed before noncurrent liabilities. For example, the amounts reported on a balance sheet dated december 31, 2012 reflect that instant when all A) accounts receivable, supplies expense, and retained earnings.

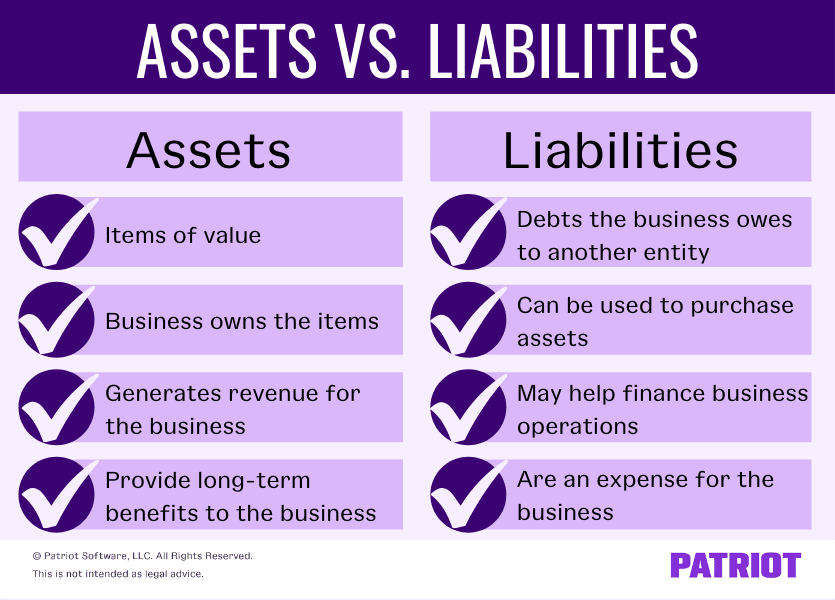

Liabilities can include: B) common stock, retained earnings, and notes payable. The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock.

Las vegas, nv., feb. Common stock, retained earnings, and note payables. A liability is a financial obligation representing a probable future outflow of cash and has a legal priority over shareholders’ claims.

Balance sheets provide the basis for. A balance sheet includes a summary of a business’s assets, liabilities, and capital. Deferred tax liabilities arise from temporary timing differences between a company’s income as reported for tax purposes and income as reported for financial statement purposes.

Assets = liabilities + equity. These items are assets and liabilities of the company, even if they don't show up on the balance sheet. Financial obligations that have a repayment period of.

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. The general liquidity and capital structure of a corporation must be understood through liabilities. These actions will create a cleaner balance sheet for future financings.on may 1…

Liabilities reported on the balance sheet include: The balance sheet shows what a company owns and owes, as well as the amount. Accounts receivable, supplies expenses, and retained earnings b.

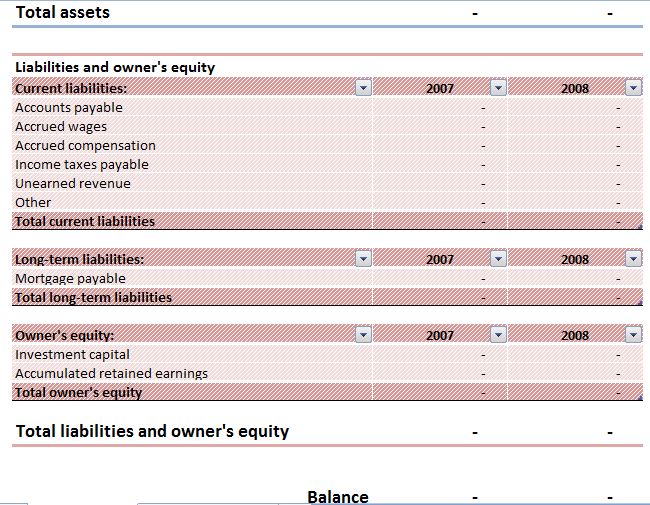

Current liabilities are payable within 12 months. Common current liabilities include: Changes in current liabilities from the beginning of an accounting period to the end are reported on the statement of cash flows.

Current liabilities are reported on the classified balance sheet, listed before noncurrent liabilities. Changes in current liabilities from the beginning of an accounting period to the end are reported on the statement of cash flows. According to the accounting equation, the total amount of the liabilities must be equal to the difference between the total amount of the assets and the total amount of the equity.

The balance sheet presents a company's financial position at the end of a specified date. Learn what a balance sheet should include and how to create your own. Accounts payable, notes payable, and salaries and wage payables.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)