Glory Info About Insurance On Income Statement Management Responsibility For Financial Statements

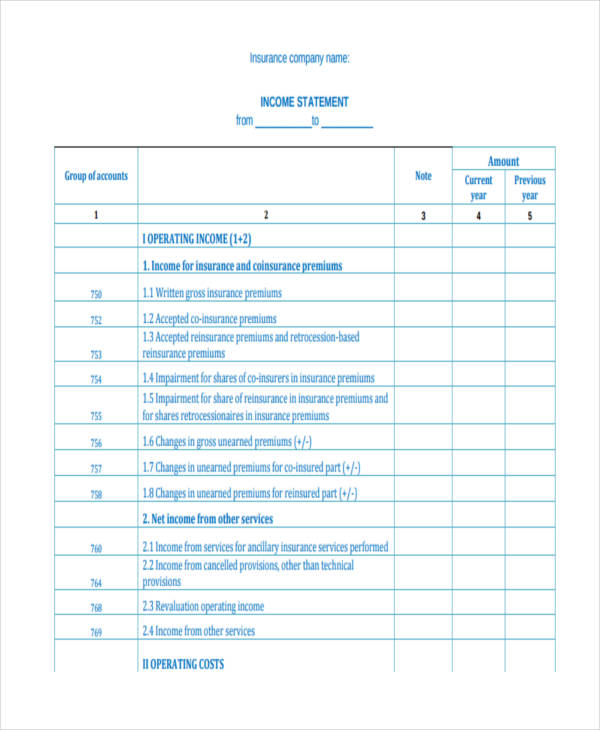

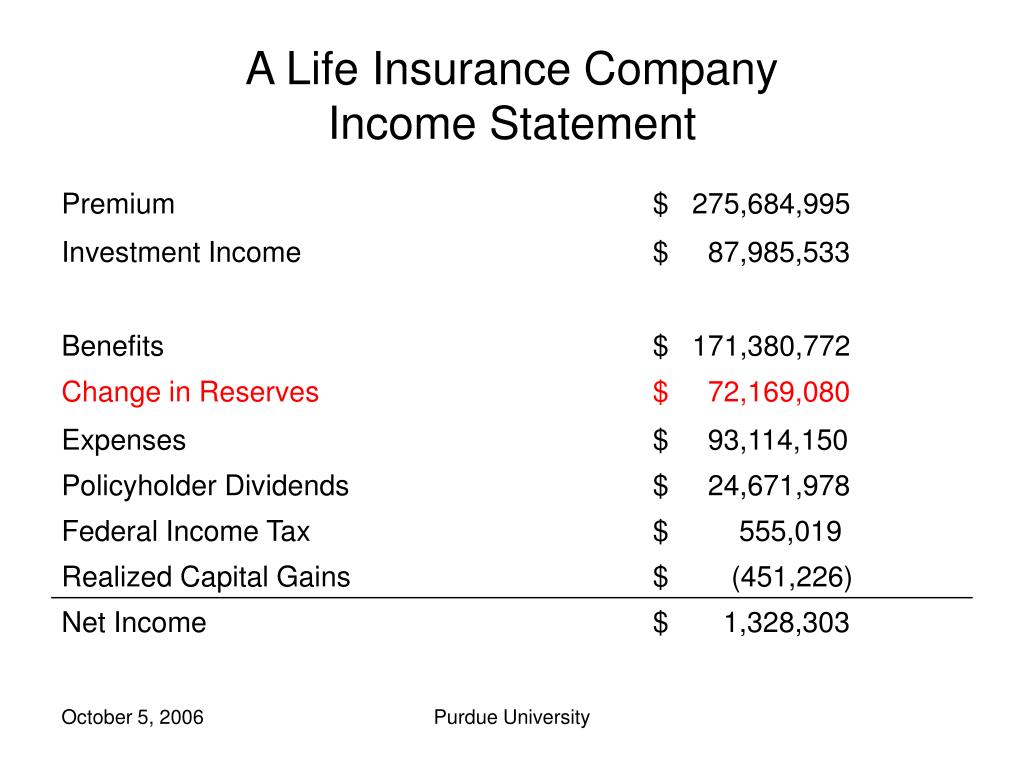

In statutory accounting, the initial section.

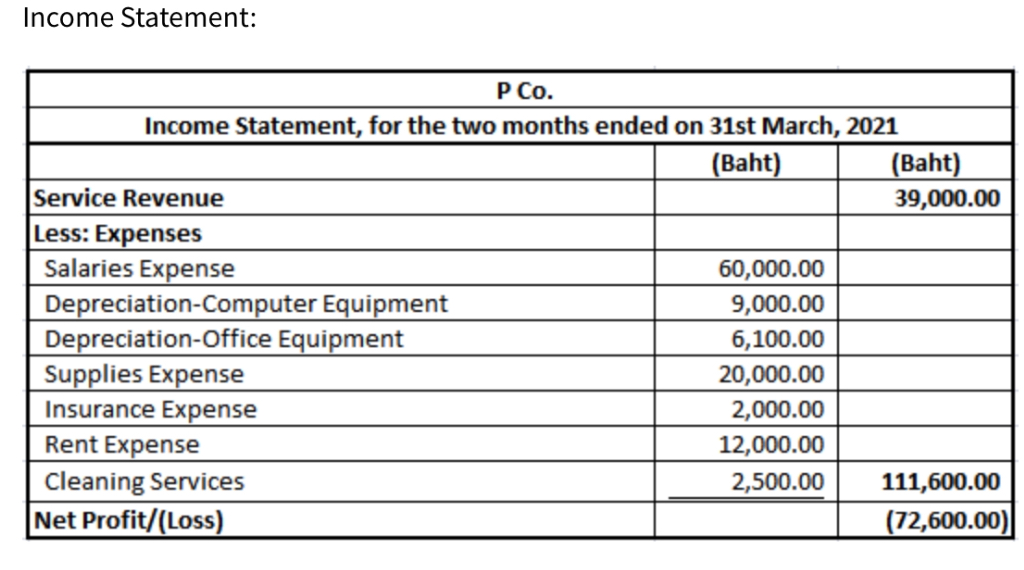

Insurance on income statement. Insurance expense is the amount that a company pays to get an insurance contract and any additional premium payments. Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows. Income tax and national insurance.

In accounting, these payments or prepaid expenses are recorded as assets on the balance sheet. Asc 944 provides specific guidance on the appropriate presentation of certain items related to. What is income tax?

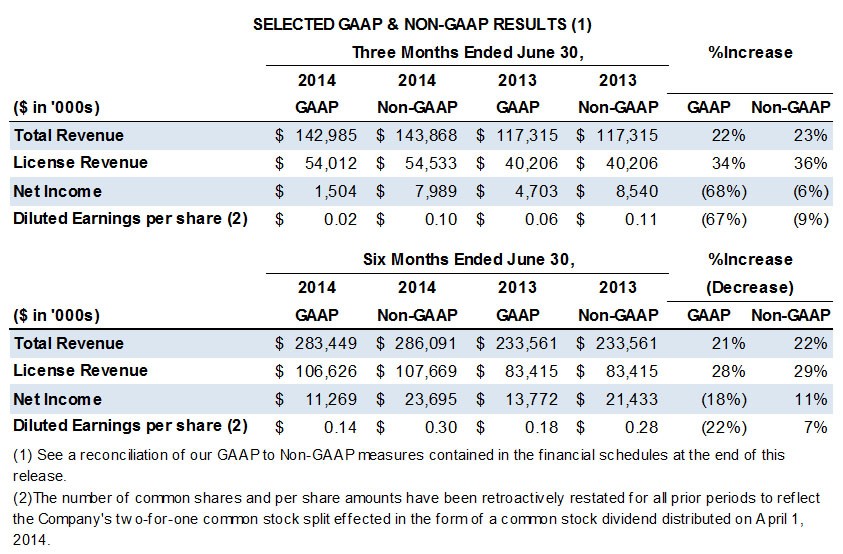

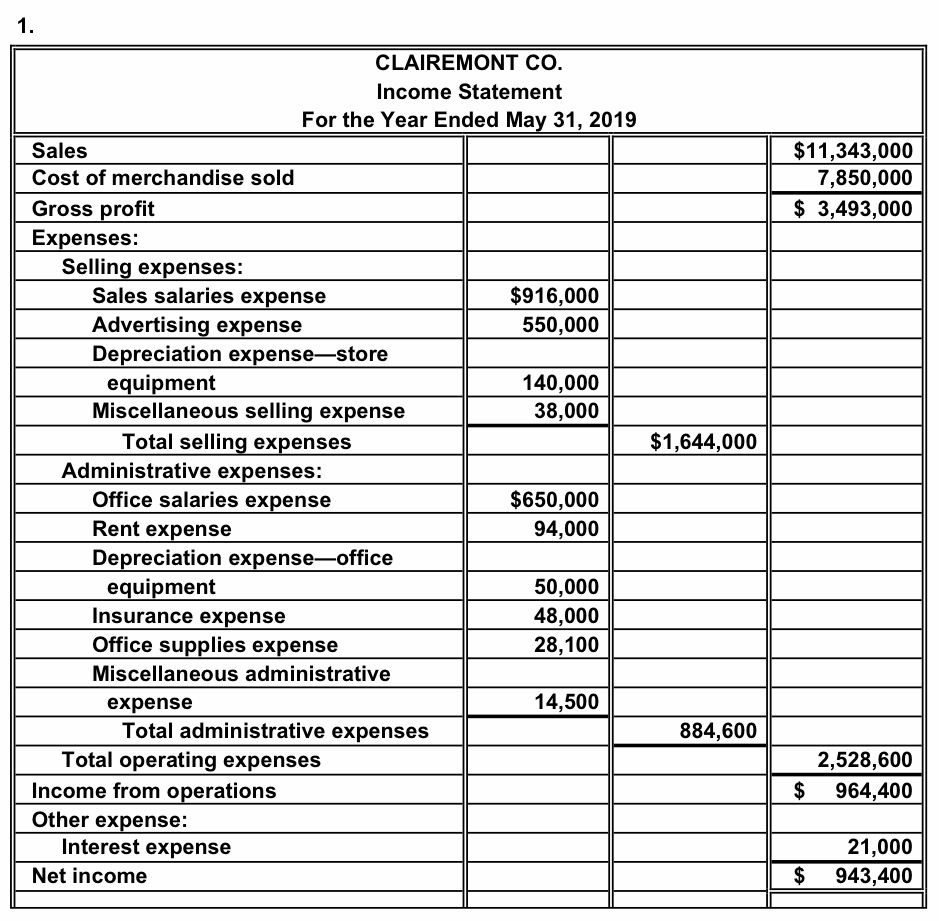

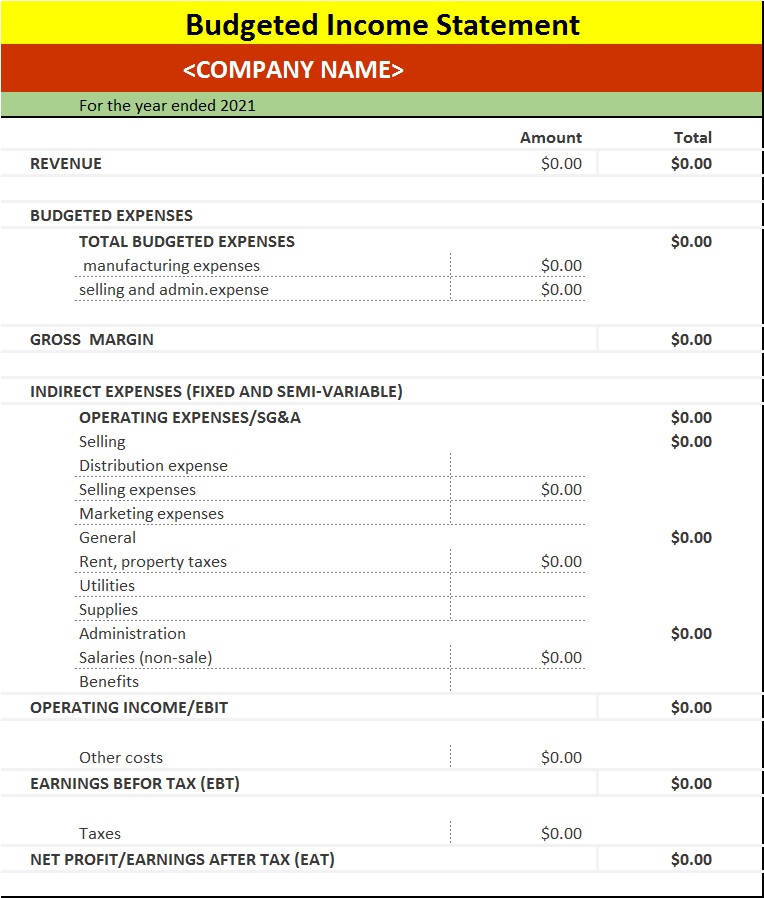

An insurance company’s annual financial statement is a lengthy and detailed document that shows all aspects of its business. It can also be referred to as a profit and loss. Statements balance sheet & income statements consolidated balance sheet as of december 31, 2022 swipe to.

What is insurance expense? Ifrs 17 establishes the principles for the recognition, measurement, presentation and disclosure of insurance contracts within the scope of the standard. 6 p&l 20x1 20x0 gross.

While the balance sheet loans. Qbi is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, s corporations, sole. Ifrs 17 insurance contracts.

It may be necessary to disclose in the financial statement footnotes the nature of the events resulting in insurance proceeds,. Income tax is a tax on the annual income earned by the individual or company during the fiscal year. An income statement portrays the specifics of how your business arrived at the financial situation reflected on your balance sheet.

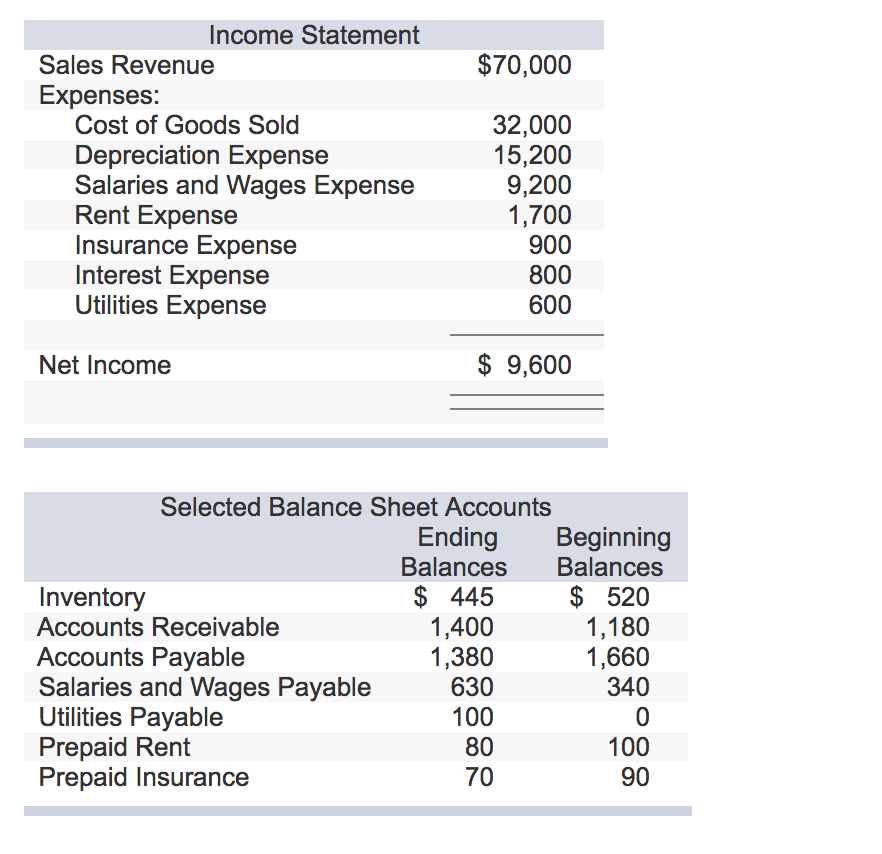

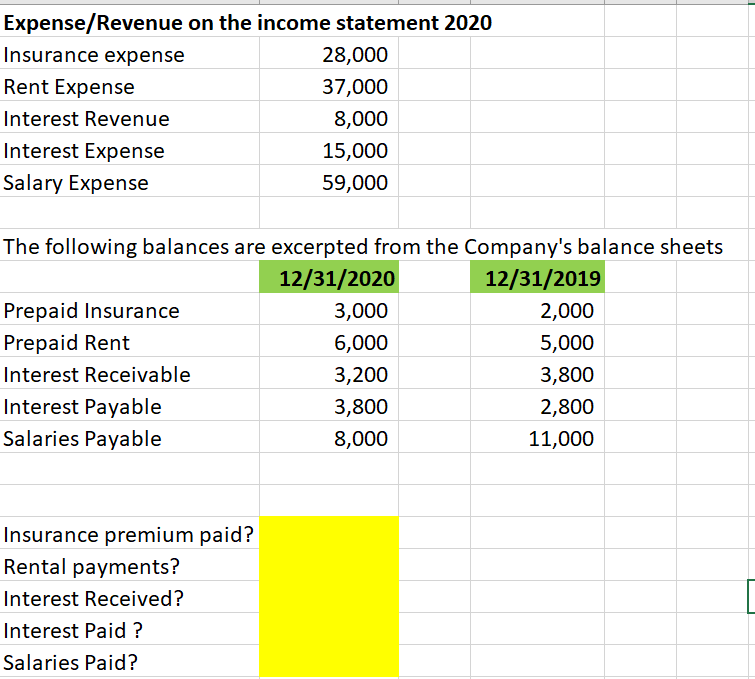

The statement displays the company’s revenue,. For insurance contracts, these include reconciliations of insurance contract balances, as well as new disclosures about insurance revenue, the contractual service margin,. One objective of the adjusting entry is to match the proper amount of insurance expense to the period indicated on the income statement.

Guidance is also provided on balance sheet and income statement presentation and disclosure of insurance activities. Investor relations results & reports fin. Example of payment for insurance.

Jeremy hunt floated the idea of slashing income tax last year, but once the autumn statement came around it was a different tax that. In addition, asc 944 provides incremental industry. How to disclose insurance proceeds.

Revenue, expenses, gains, and losses. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. Once incurred, the asset account is reduced, and the expense is.