Formidable Tips About Loss Account Consider A Bank With The Following Balance Sheet Net Income In Cash Flow Statement

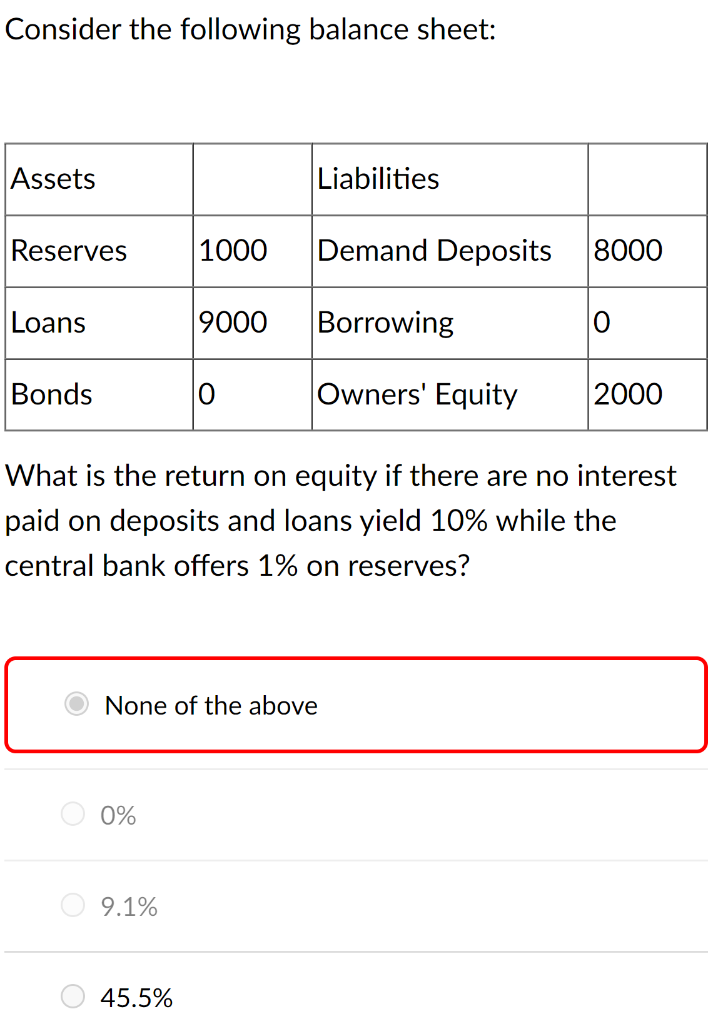

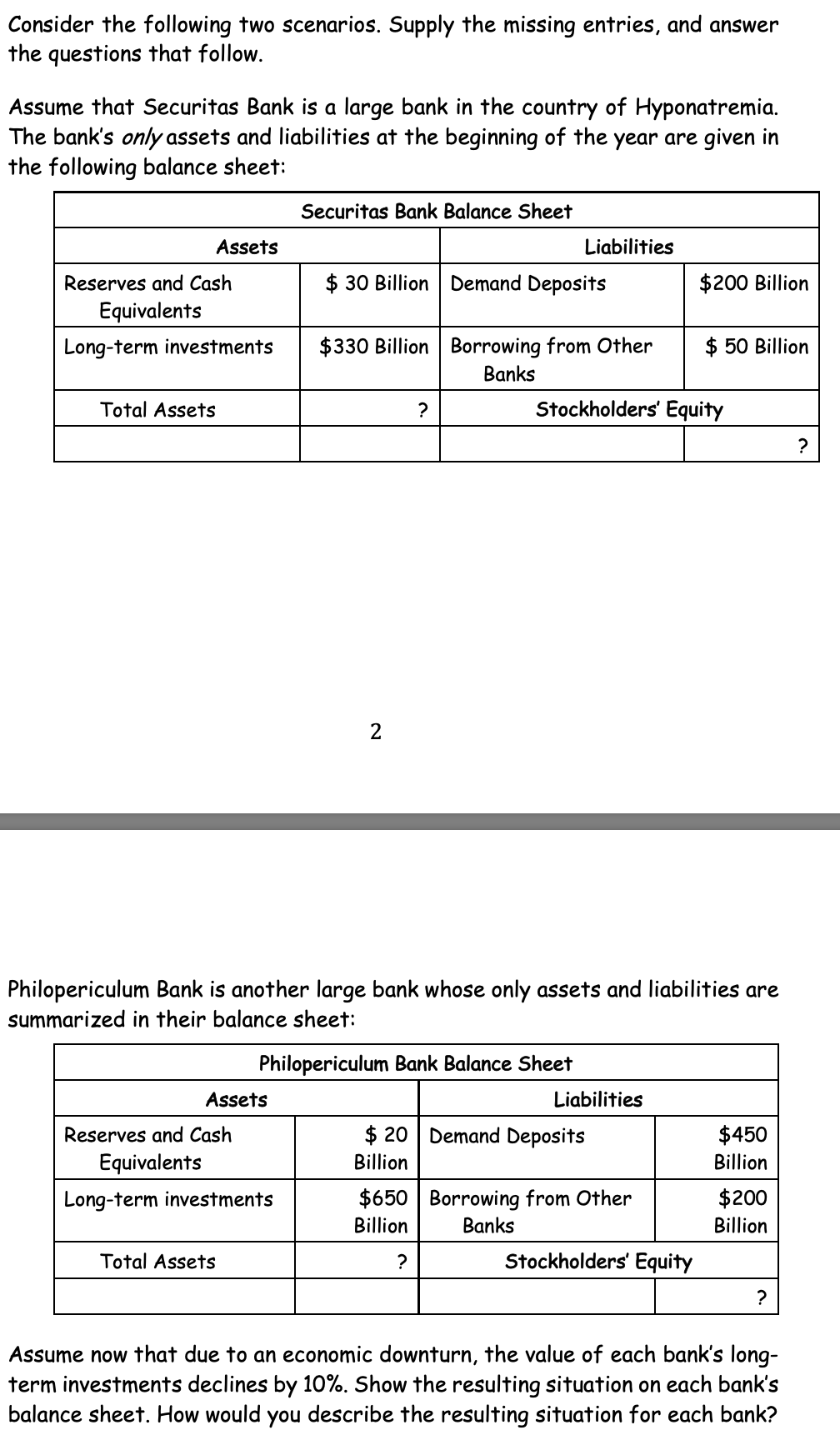

Consider a bank with the following balance sheet:

Loss account consider a bank with the following balance sheet. Banks hold both stocks and bonds. You read in the local newspaper that the bank's return on assets (roa) was 2 percent. Frequently asked questions (faqs) a bank’s balance sheet provides a snapshot of its financial position at a specific time.

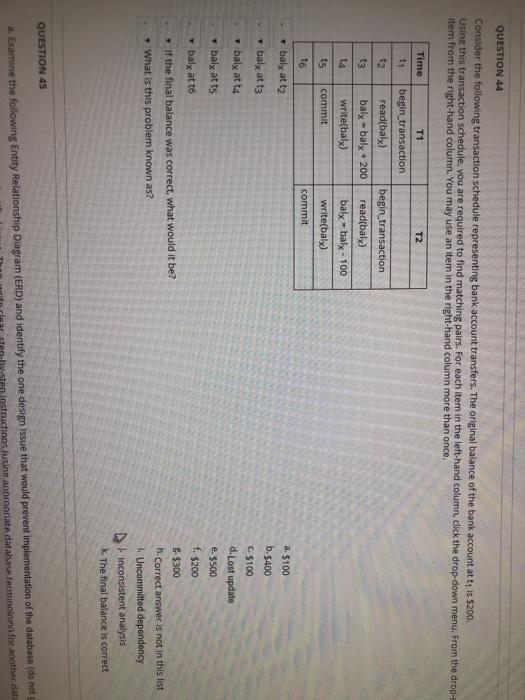

Assets liabilities required reserves $ 8 million checkable this problem has been solved! Assets reserves toan securities bank balance sheet (in thousands) liabilities and capital $100 deposits $1,000 $1,000 borrowing $0 $900 bank capital $1,000 the bank's. Business economics economics questions and answers q3:

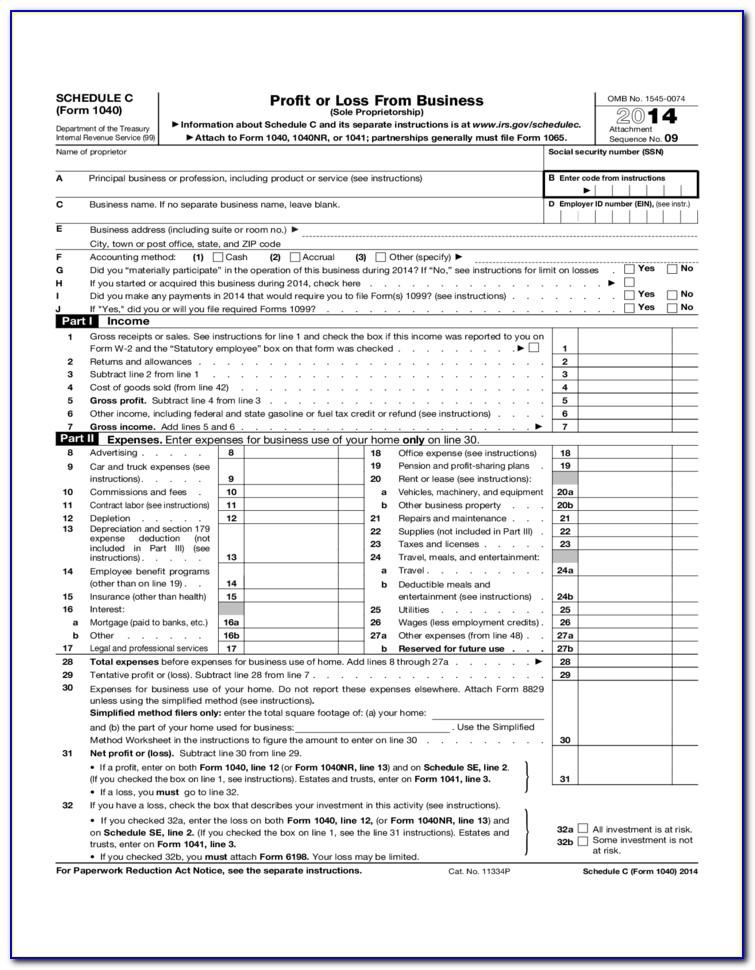

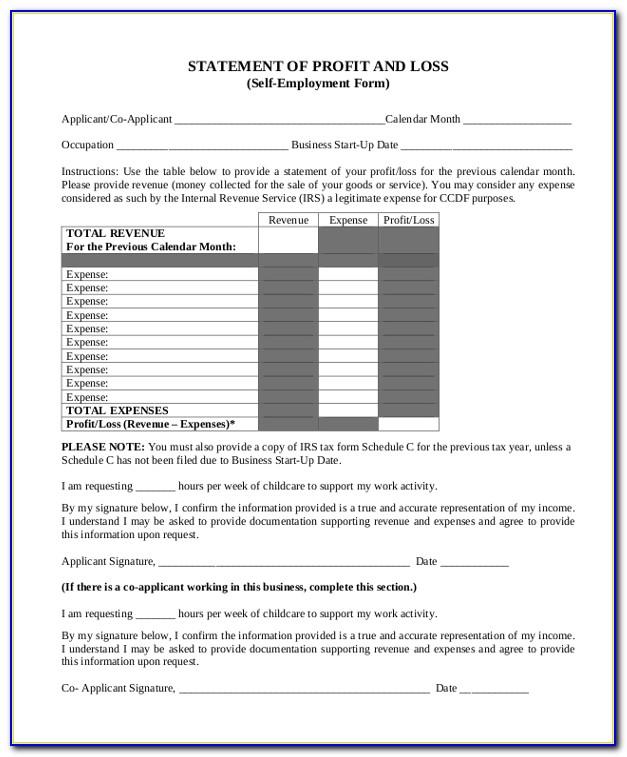

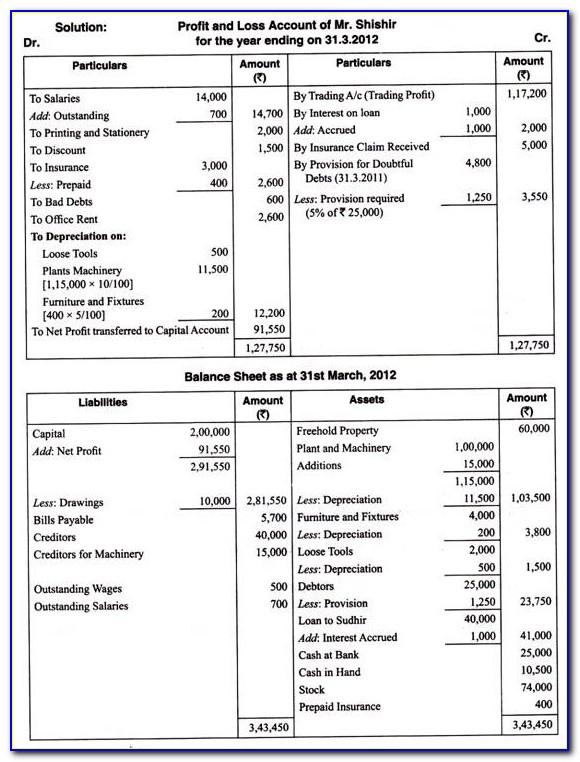

Consider the following bank balance sheet and the associated yields for earning assets and costs of liabilities. A statement of financial position, or balance sheet, considers key financial information that allows a business to monitor where the money comes from and where is has been spent, along with the. The p&l statement corresponds to the income statement.

Analysts must go beyond the profit and loss statement to get a full picture of a company’s financial health. Liabilities show what a company owes to others, such as loans or accounts payable. The other two are the profit and loss statement and cash flow statement.

Consider a bank with the following balance sheet. It is prepared to determine the net profit or net loss of a trader. Assets liabilities required $17 million checkable $205 million reserves deposits excess $3 million bank $10 million reserves capital assets municipal $65 million residential $70 million commercial $60 million liabilities bonds mortgages loans calculate the bank's.

But for banks, it’s a different story. To properly assess a business, it’s critical to also look at the balance sheet and the cash flow statement. You'll get a detailed solution that helps you learn core concepts.

The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. It comprises three main components: Assets represent what a company owns, such as cash, equipment, or inventory.

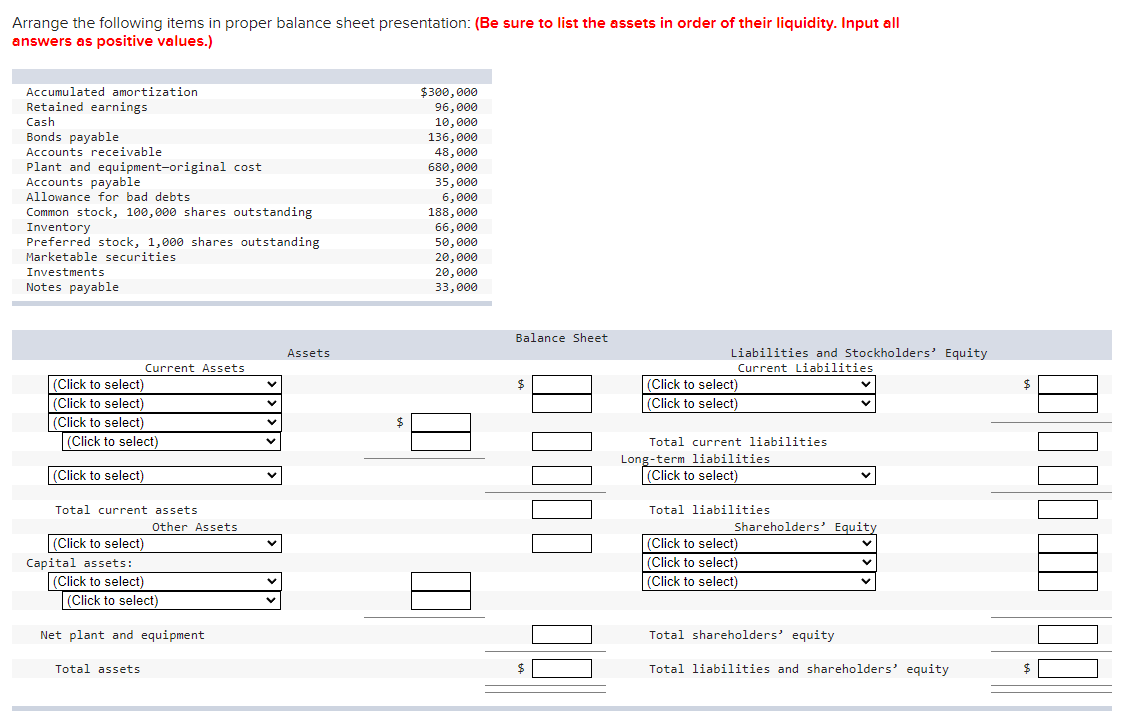

Current assets cash and equivalents the most liquid of all assets, cash, appears on the first line of the balance sheet. Finance finance questions and answers consider a bank with the following balance sheet: 2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses

The balance sheet shows a company’s. Consider a bank with the following balance sheet. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. Banks may also keep cash for other banks. A balance sheet reports your assets/liabilities at a point in time.