Heartwarming Info About Income Tax Treatment In Cash Flow Statement Pro Forma Financial Statements Definition

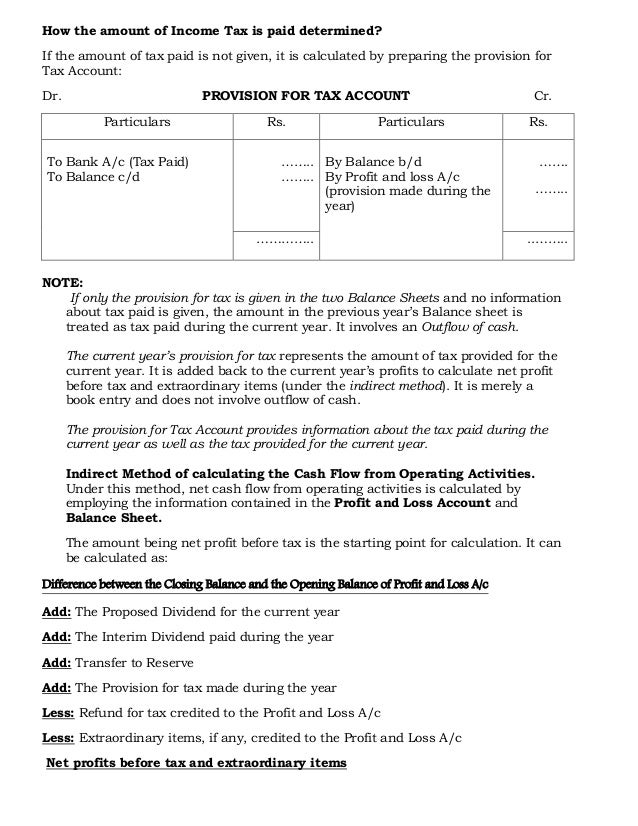

Subtracted to calculate net profit before tax and.

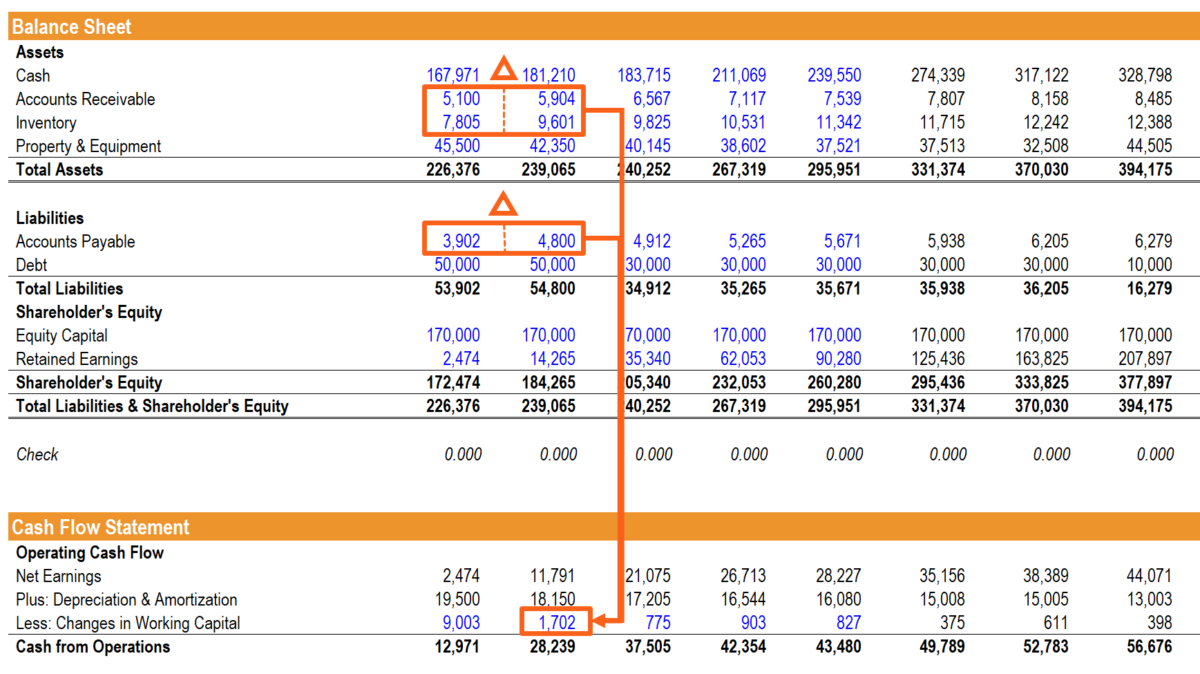

Income tax treatment in cash flow statement. Along with balance sheets and income statements, it’s one. Income tax paid = ₹2,00,000 income tax provision during the year = ₹2,50,000 case 4: How to prepare cash flow statement?

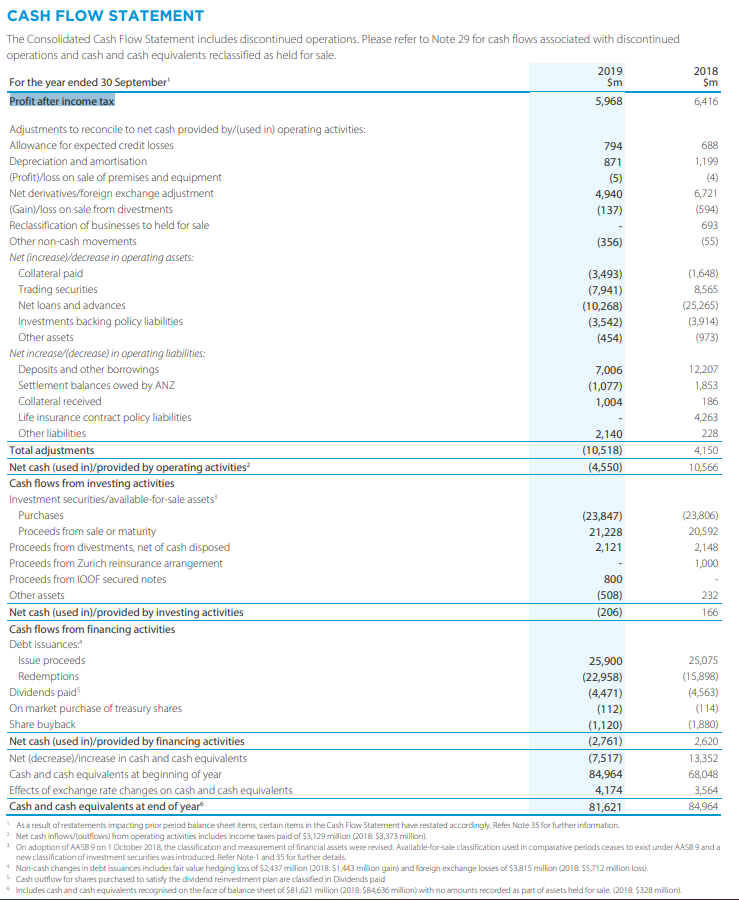

The statement of cash flows is governed by ias 7, which mandates the classification of cash flows into operating, investing, and financing activities in a manner that is most. Dividends received (dividends paid are. All entities that prepare financial statements in conformity with ifrss are required to present a statement of cash flows.

It happens due to the temporary difference between accounting and tax. The cash flow statement or statement of cash flows measures the sources of a company's cash and its uses of cash over a specific period of time. [ias 7.1] the statement of cash flows.

Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. It is relevant to the fa (financial accounting) and fr (financial reporting) exams. This article considers the statement of cash flows of which it assumes no prior knowledge.

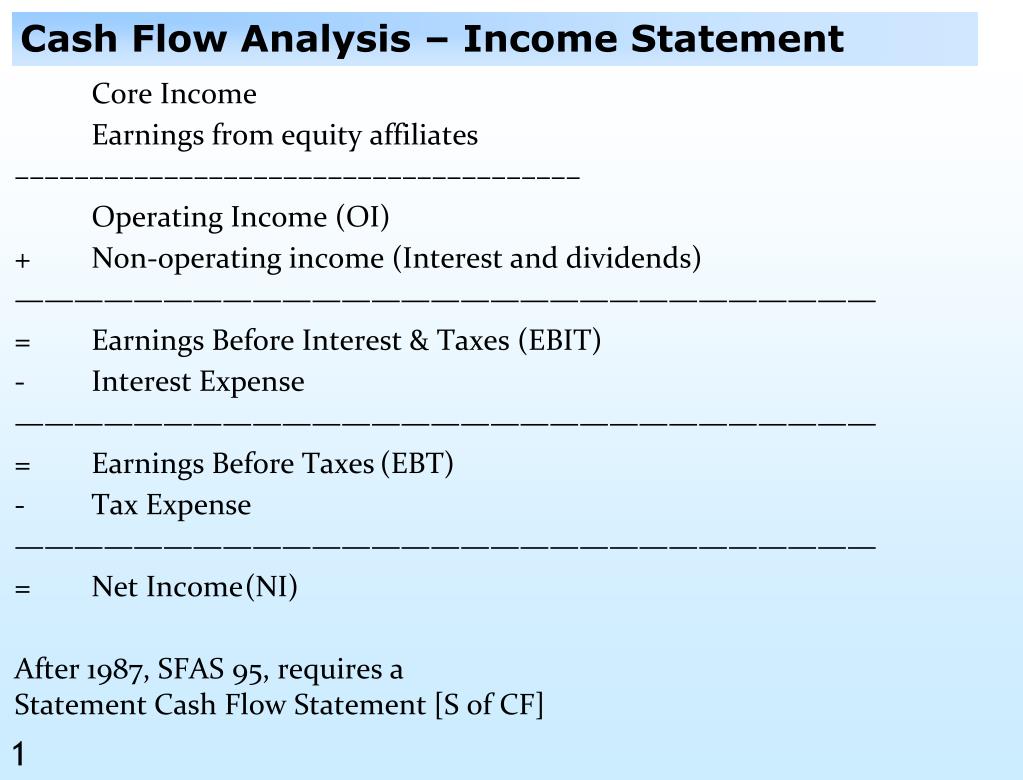

Classification of cash flows of the entity by activity will enable the users of financial statements to understand the effect of each category of cash flows upon the. To illustrate how operating cash flows (prepared on the cash basis of accounting) relate to net income (prepared on the accrual method of accounting), as discussed in asc 230. The income tax expense shown in the reconstruction of the deferred tax liability account is the deferred component of income tax expense, that is, the amount of income tax.

Tip you report income tax payable on your current profits as a liability on the. When the opening and closing balance of income tax provision is. Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement.

A cash flow statement, when used in conjunction with the other financial statements, provides information that enables users to evaluate the changes in net. Operating activities investing activities financing activities Deferred tax is the difference between a company’s tax liability and tax paid to the government.

As described in paragraph b65 of ifrs 17, cash flows within the boundary of an insurance contract are those that relate directly to the fulfilment of the contract. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)