Supreme Tips About Negative Owners Equity Sole Trader Profit And Loss Statement

If the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported.

Negative owners equity. A negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. As i make more and more money and take money out to pay myself, the owners equity account will just keep getting more into the negative? The owner's equity statement is one of four key financial.

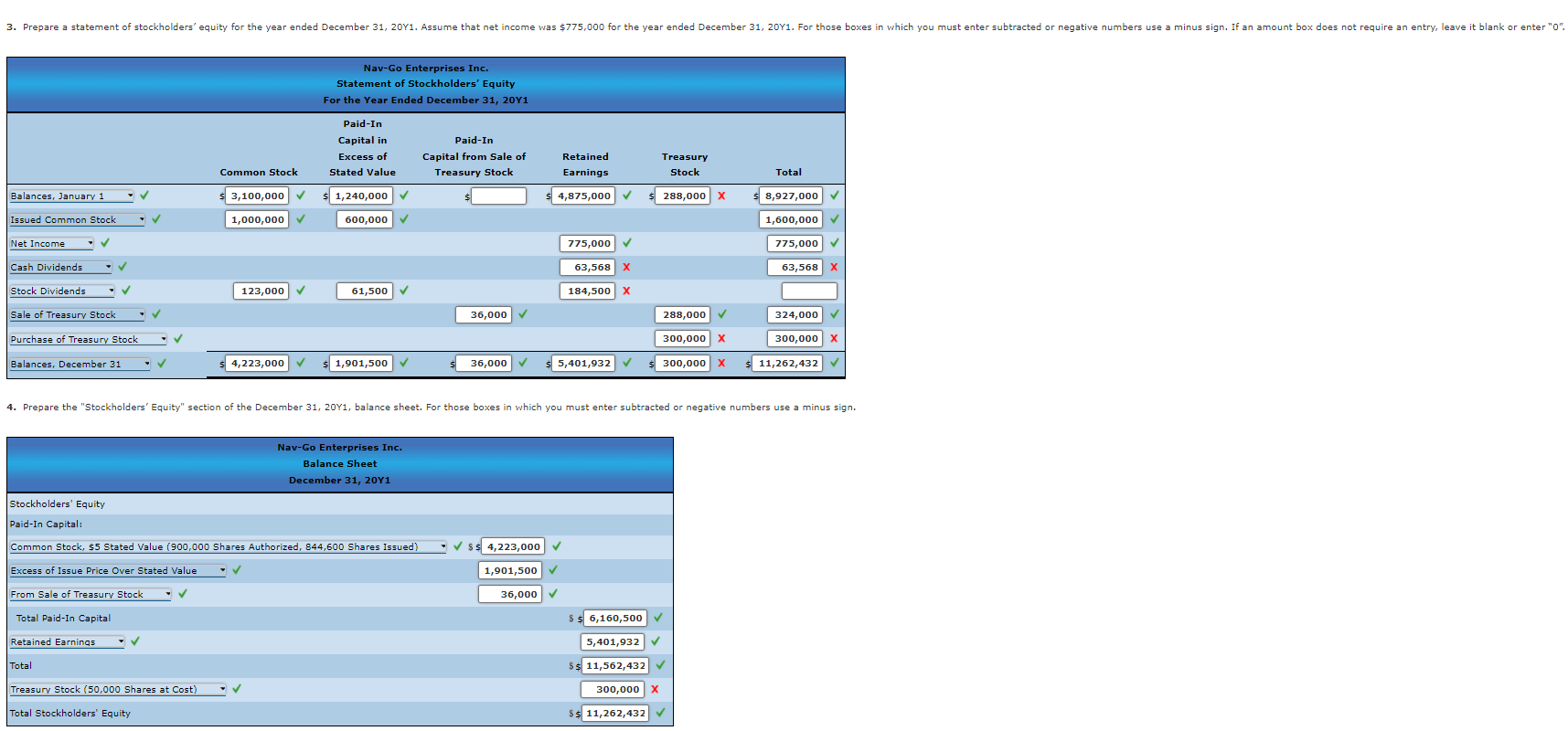

A negative balance in shareholders’ equity reflects that liabilities have outgrown the assets for reasons like accumulated losses over the years, large dividend payments, money borrowed instead of issuing new shares to cover accumulated losses, amortization of intangibles, etc. In this case, the owner may need to invest additional money to cover the shortfall. So is this setup right?

Closing a c corporation with negative equity. Negative owner's equity means the amount of a sole proprietorship's liabilities exceeds the amount of its assets. When a company has negative owner’s equity and the owner takes draws from the company, those draws may be taxable as capital gains on the owner’s tax return.

Negative equity is a deficit of owner's equity, occurring when the value of an asset used to secure a loan is less than the outstanding balance on the loan. Owner’s equity can be negative if the business’s liabilities are greater than its assets. Negative equity refers to the current state of being underwater. this essentially means that the value of the asset currently owned is worth less than the total amount of debt taken to finance its purchase.

Negative owner's equity definition. The owner’s equity is negative if a company’s total liabilities are greater than its assets. Here are some common reasons for negative shareholders' equity:.

Asked 12 years, 5 months ago modified 12 years, 5 months ago viewed 3k times 2 i just paid out my first distribution from my llc. Car owners can take various approaches to handling negative equity. Negative stockholders' equity is also known as negative shareholder equity.

It is the result of the reported amount of liabilities exceeding the reported amount of assets. Once a year, upon closing the books, should, along with the fiscal profit or loss, get posted to the overall equity</strong>> account, leaving the draw account fresh at zero for the next year.</p> The owners equity account is also a negative number, and it just keeps growing.

What is negative equity? When a company accumulates more debt than it can pay, even after liquidating all of its assets, financial analysts describe its equity as negative. The first question is to.

Example of negative owner's equity. Therefore, the negative equity would become a capital loss to the individual owners (shareholders) of the c corp upon its dissolution. Kansas city chiefs owner clark hunt celebrates after the afc.

What is negative equity? In this case, the owner may need to invest additional money to cover the shortfall. Negative retained earnings reporting interest income definition a negative balance may appear in the stockholders' equity line item in the balance sheet.

![Negative Equity The Latest Statistics [INFOGRAPHIC] Negativity](https://i.pinimg.com/originals/2c/ff/e6/2cffe6cf95e7eb9e19c7f431160ab5b4.jpg)

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)