Neat Tips About Profit And Loss Balance Ifrs Accounting Certification

Key differences between profit and loss statement vs balance sheet.

Profit and loss balance. A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. The formats of the annual balance sheet and the profit and loss account of the ecb are set out in annexes ii and iii of decision (eu) 2016/2247.

A profit and loss statement (p&l) is an effective tool for managing your business. All income and expenses are added together to gather the net income, which reports as retained earnings. This mainly reflects the phasing impact arising from the difference between transaction date and delivery date;

Meanwhile, national central banks (ncbs) are recommended to adapt the format of their published annual balance sheets and profit and loss accounts in accordance with annexes viii and ix of guideline. How to read an income statement. Key differences difference between balance sheet and profit & loss account a balance sheet, or otherwise known as a position statement.

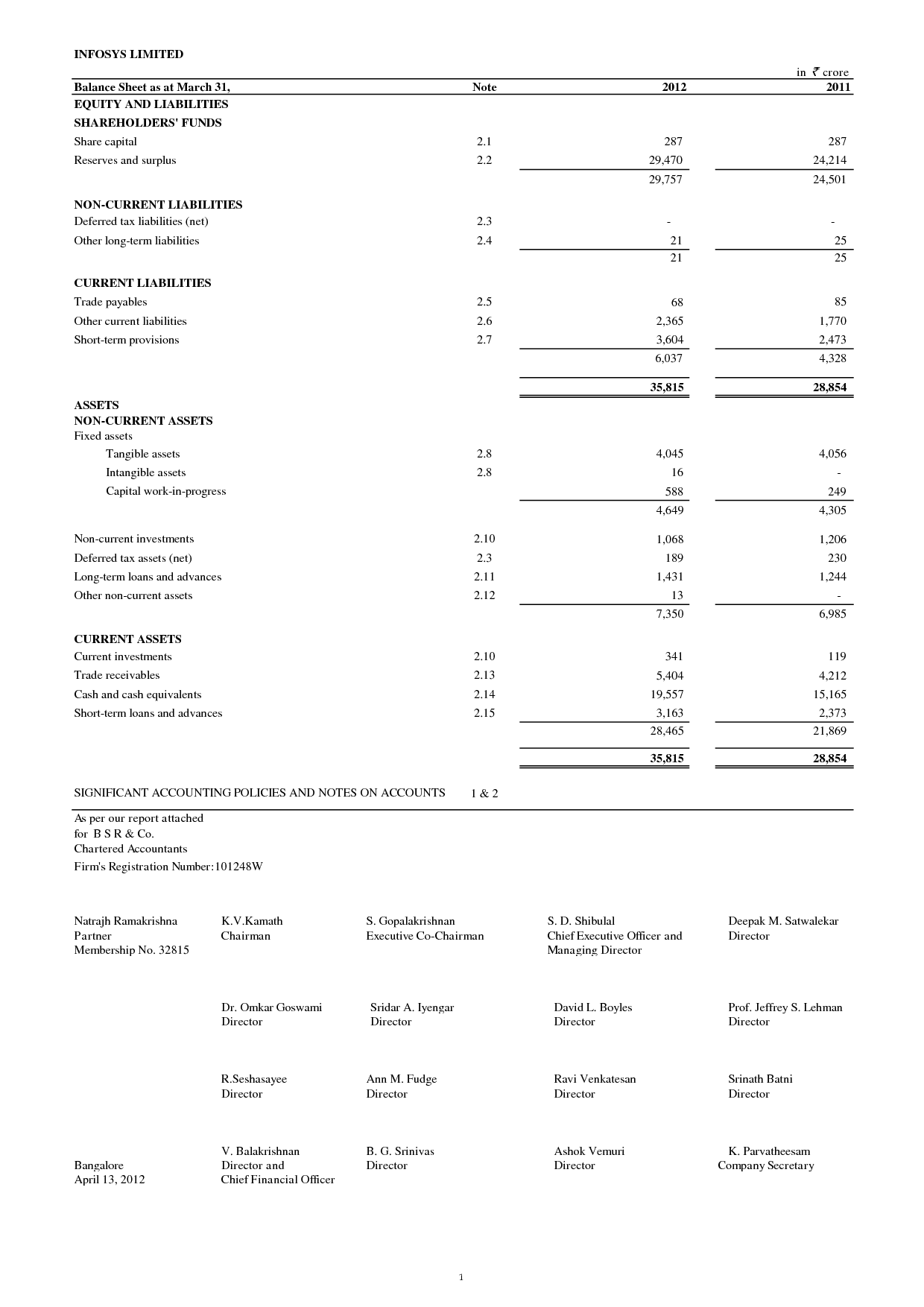

Following is the profit and loss account of pqr for the year ending dec 20yy in the above example, the debit total is 20,000, and the credit total is 10,000. Firms will prepare the balance sheet based on the transferred balance from the p&l. Balance sheets, however, provide a snapshot of the entire company’s financial position, with each report sharing some of the same line items (e.g.

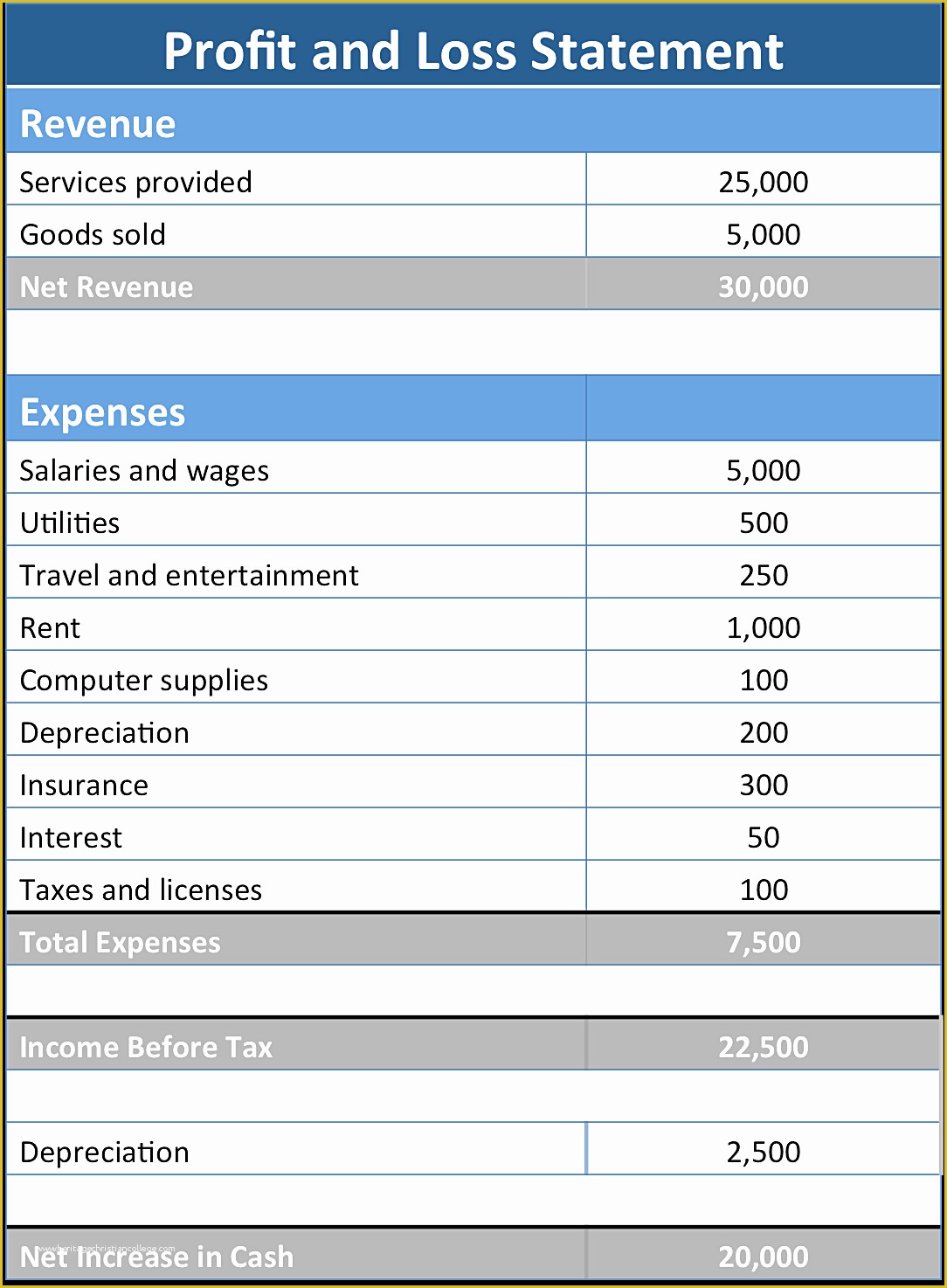

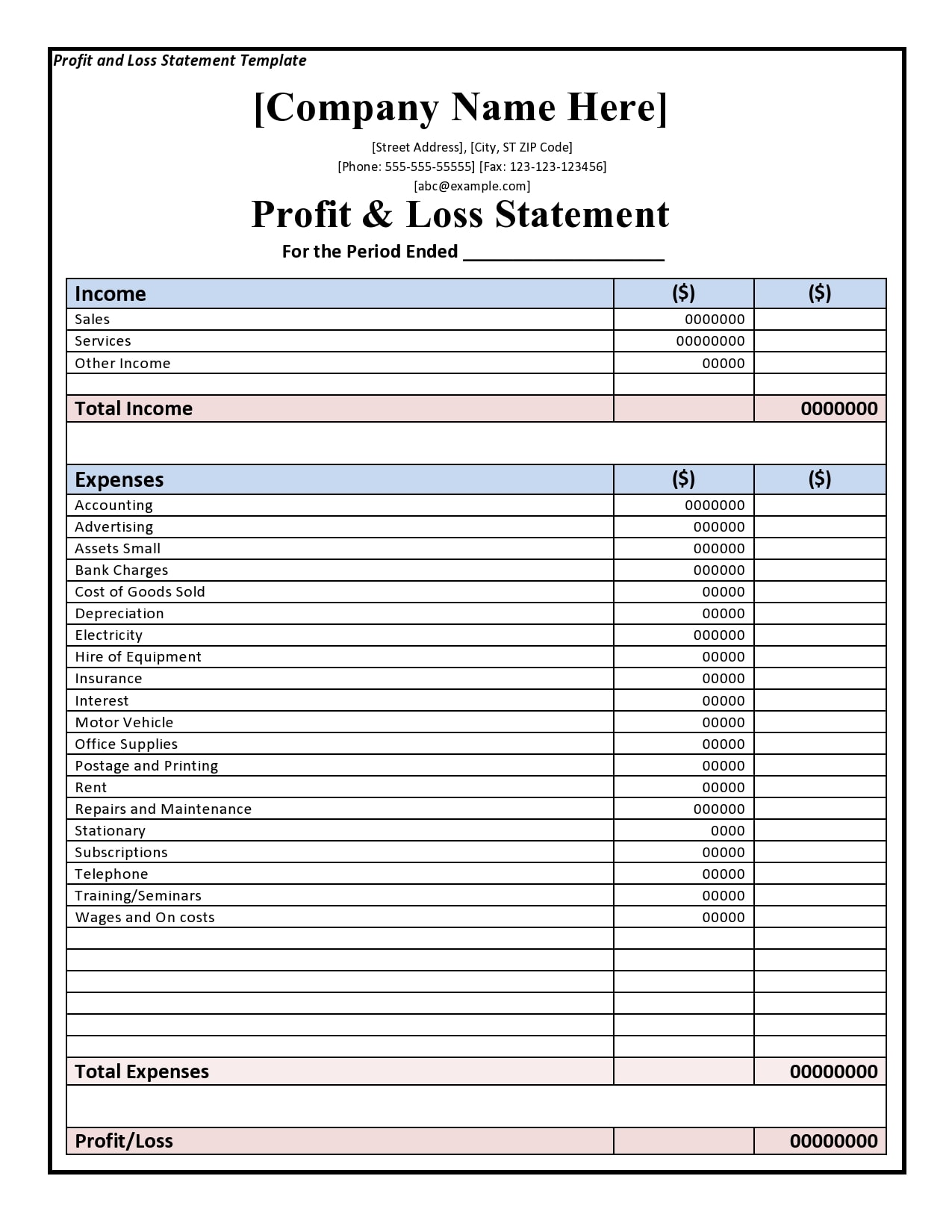

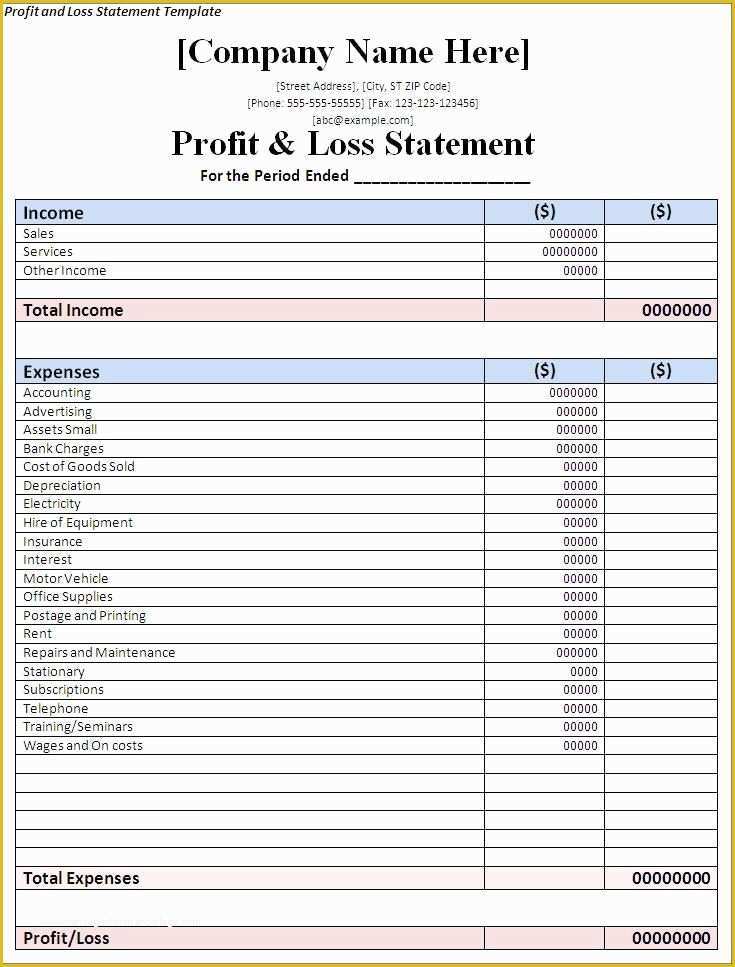

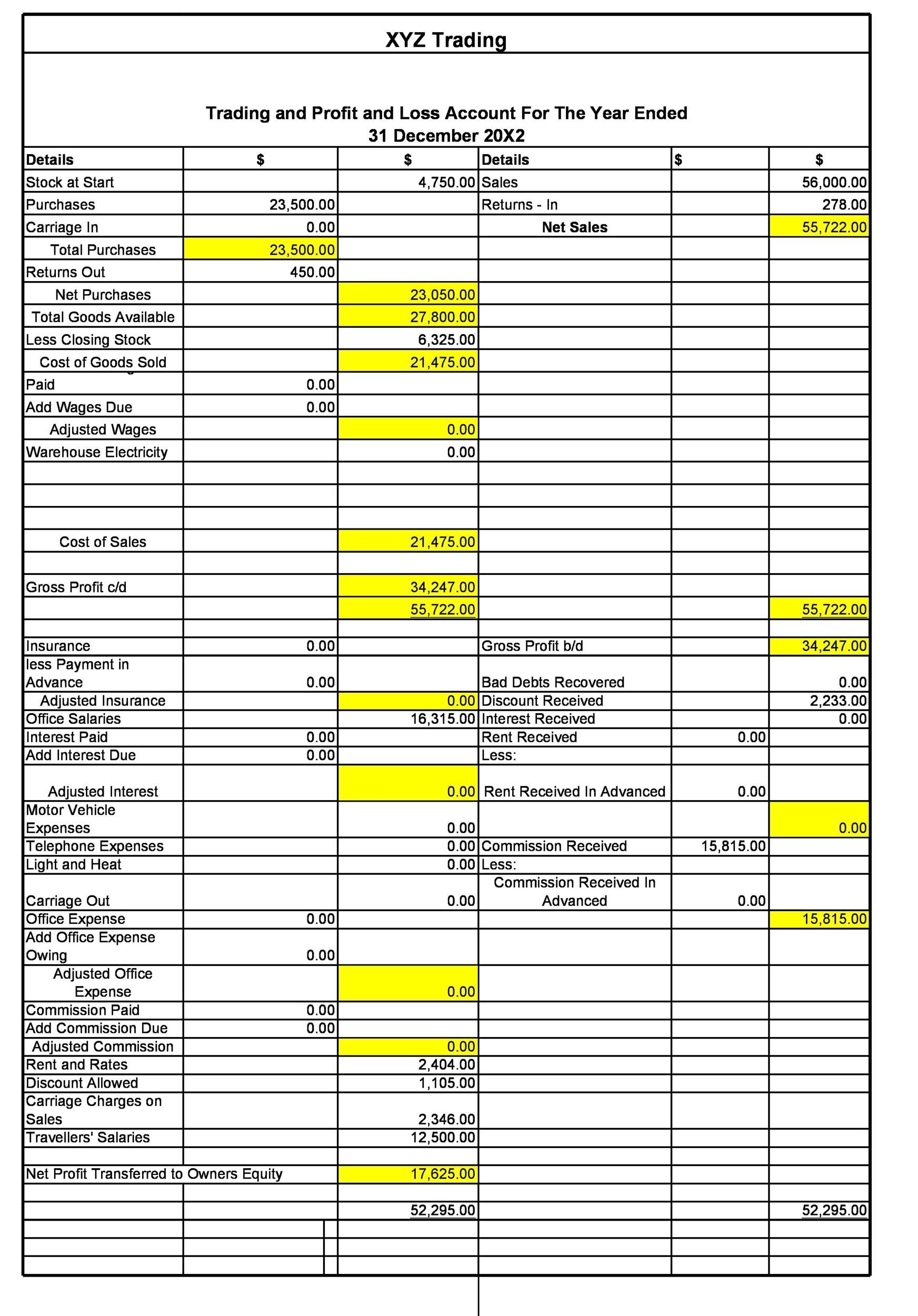

The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. Budget & accounting how to create a profit and loss statement in excel try smartsheet for free by andy marker | april 6, 2022 creating a profit and loss statement can be daunting, but using a template can help simplify the process. The p&l account reveals the performance of the business finance.

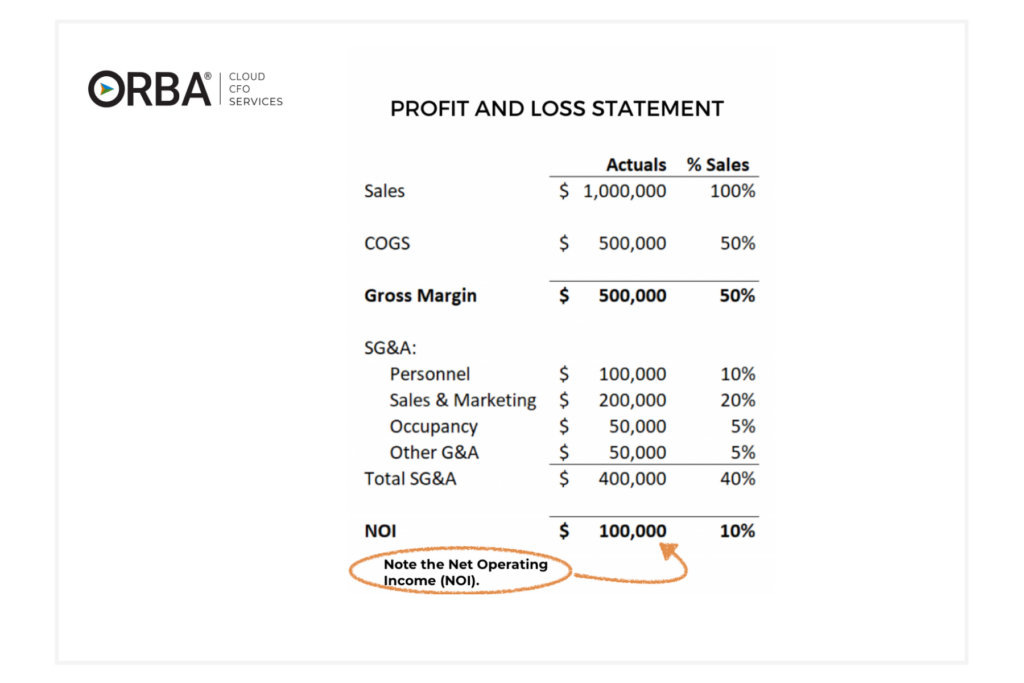

The basic formula for a profit and loss statement is: A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the year/period. This report helps you understand what’s behind a company’s profitability by categorizing revenues and expenses.

A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report. That net income becomes a retained earnings line item on the balance sheet, which is used to locate the ending cash balance. A p&l statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll.

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. You’ll sometimes see profit and loss statements called an income statement, statement of operations, or statement of earnings. A p&l statement, also known as an “income statement,” is a financial statement that details income and expenses over a specific period.

You can obtain current account balances from your. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Marketing agencies that do this successfully stand to benefit from sustained.

They focus on a company’s profit (or lack of profit). The profit and loss statement: The profit and loss balance sheet, also known as the income statement, is a crucial financial document that provides insights into a company’s revenue, expenses, and overall profitability.