One Of The Best Tips About Insurance Expense In Income Statement Restaurant Brands International Balance Sheet

The new first home savings account (fhsa) is.

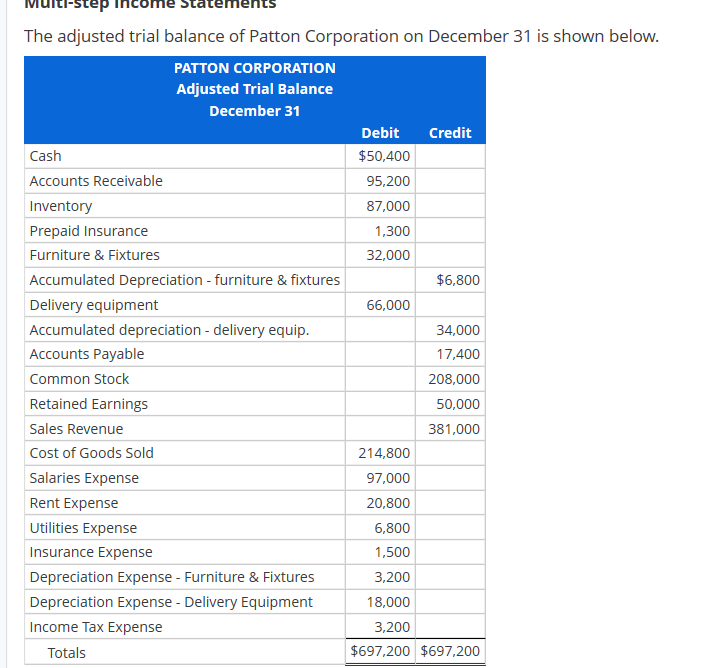

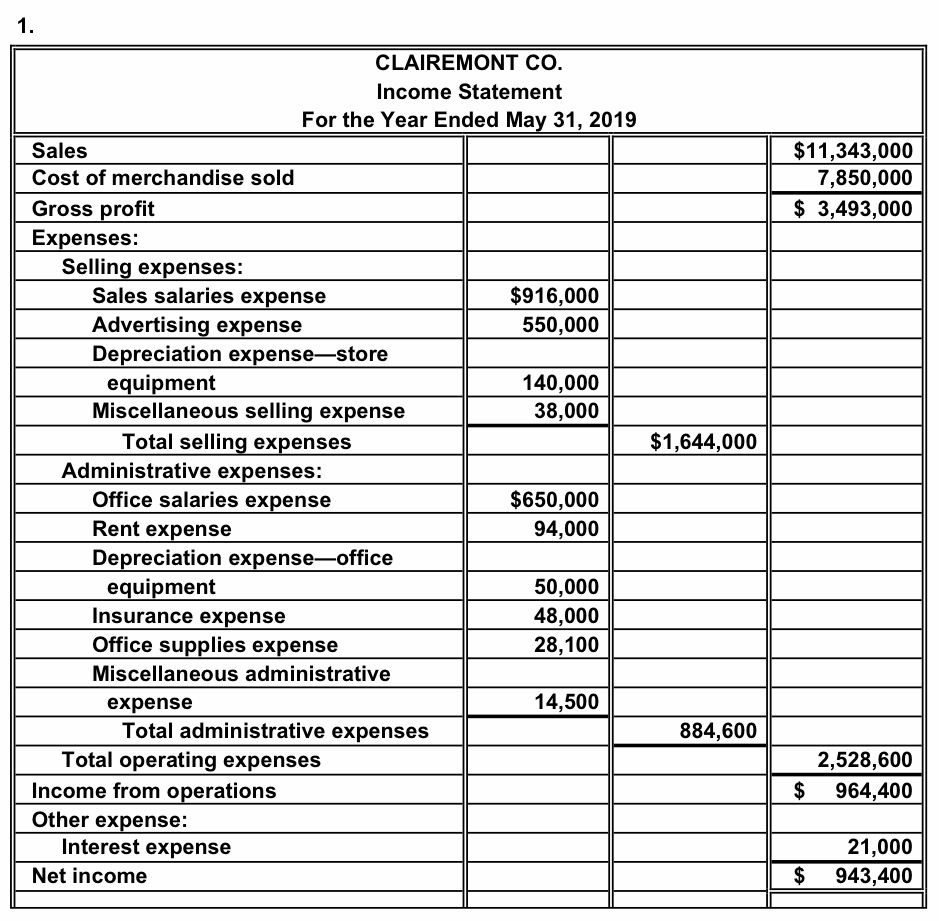

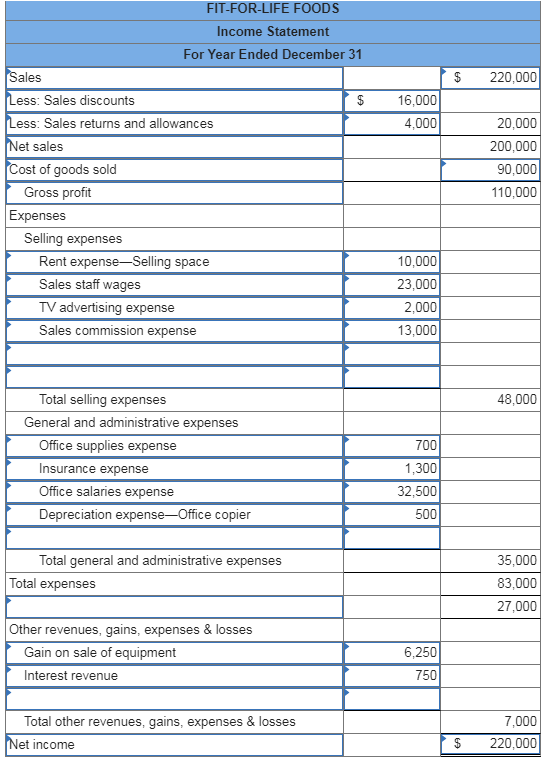

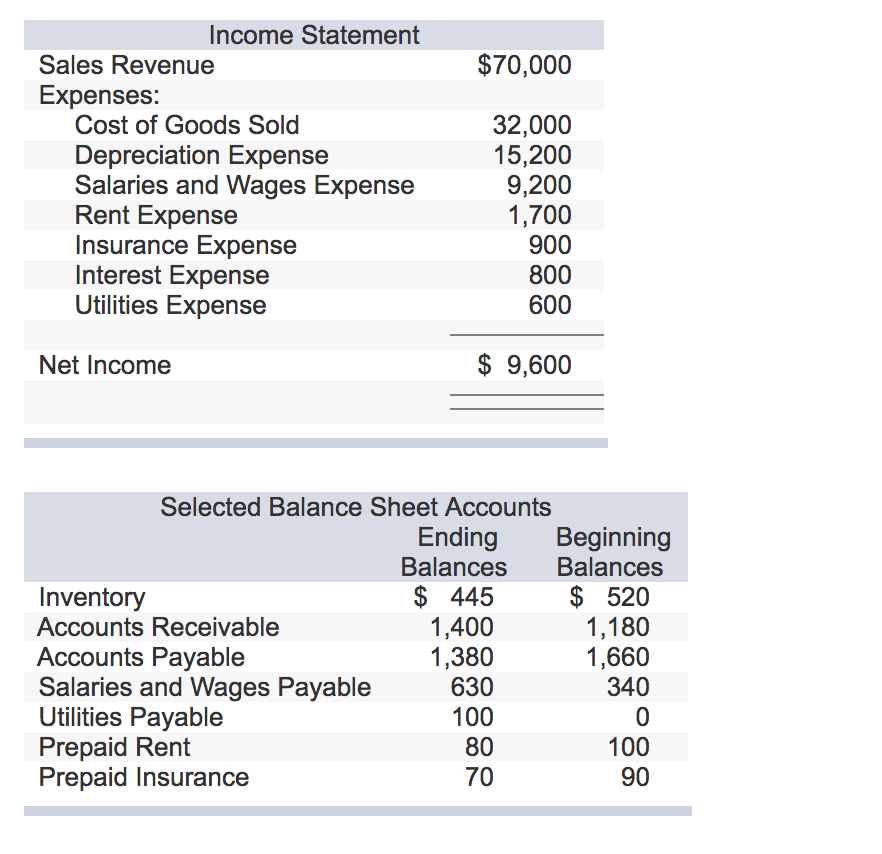

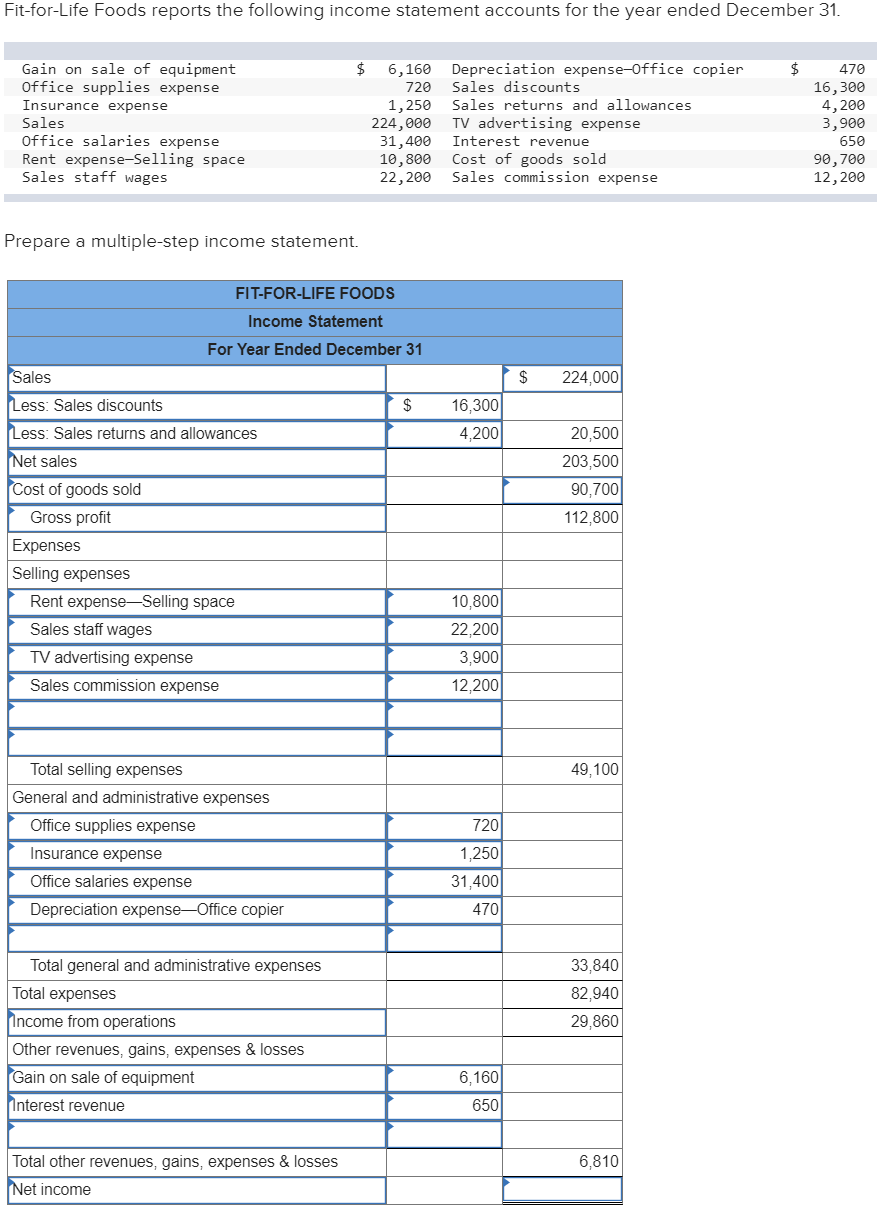

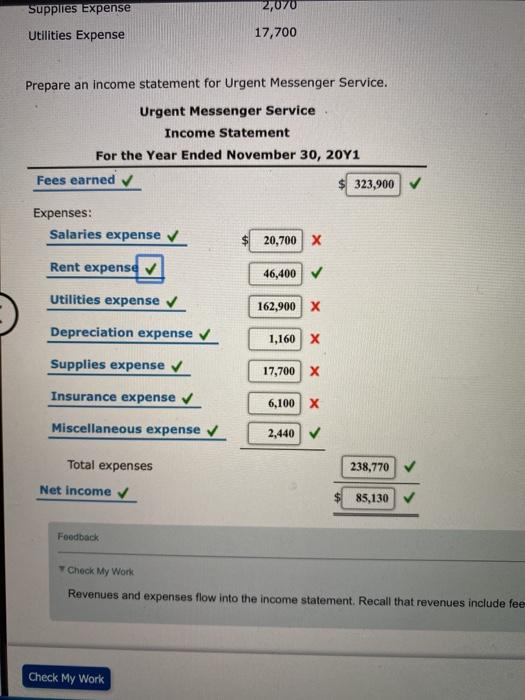

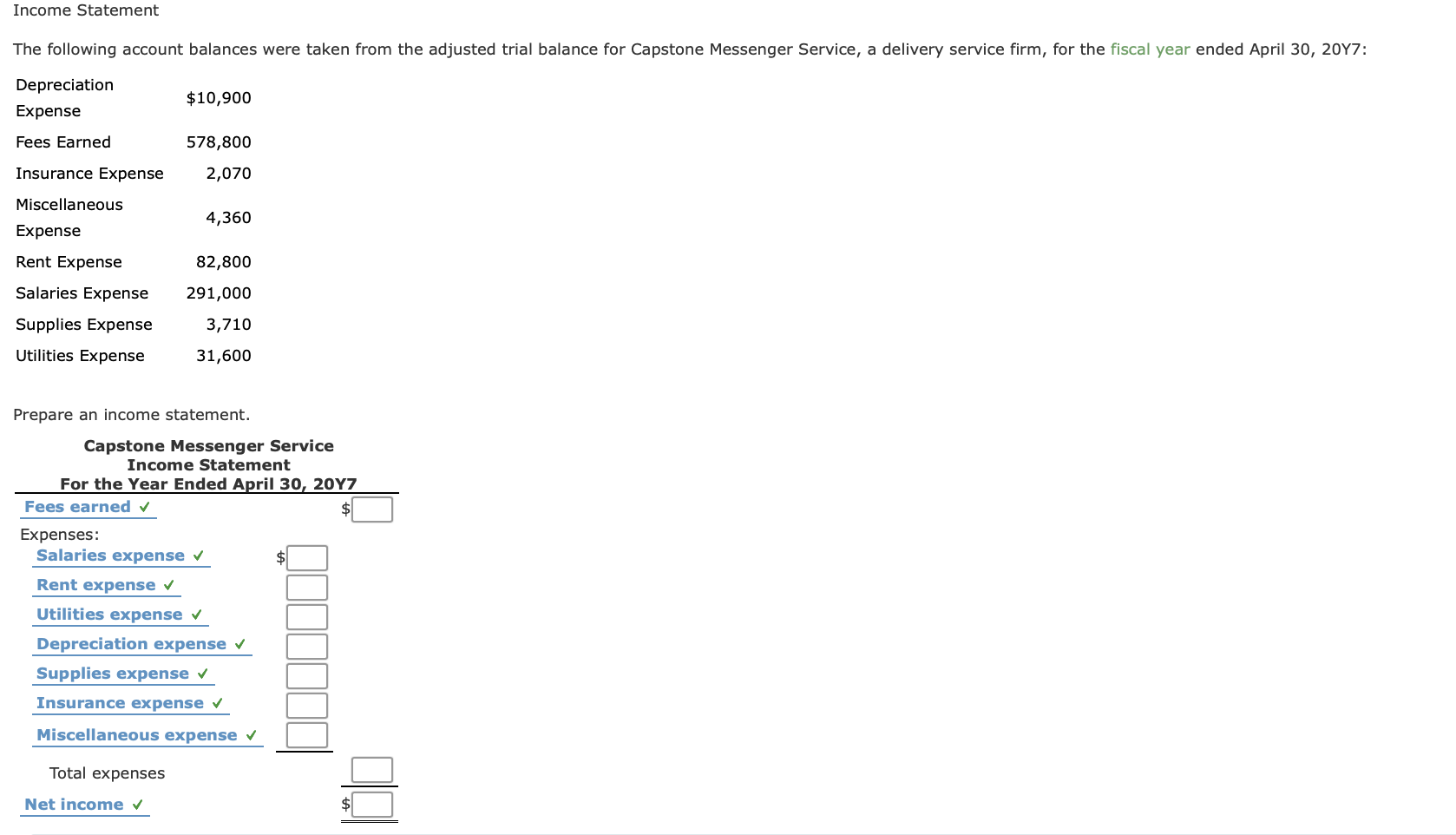

Insurance expense in income statement. Insurance expenses are a crucial component of a business’s income statement. Insurance expense definition the amount of insurance that was incurred/used up/expired during the period of time appearing in the heading of the income statement. Net income is the profit that remains after all.

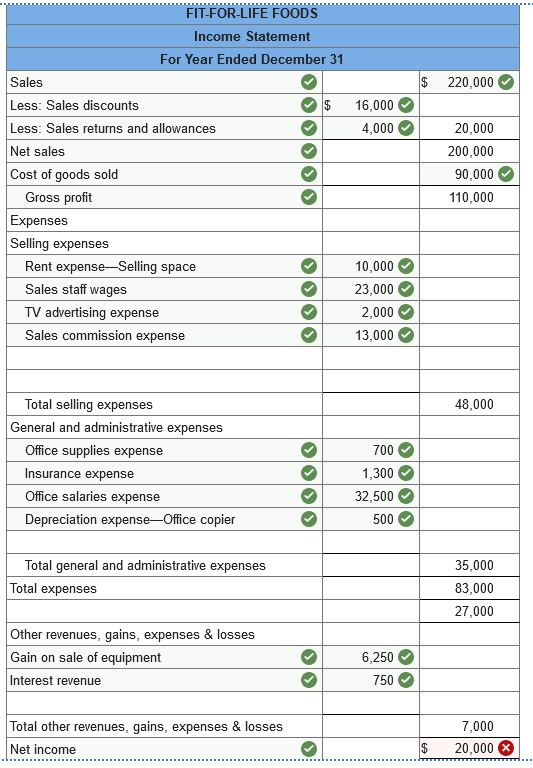

Consolidated statement of comprehensive income 11. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. A new registered account designed to allow eligible individuals to contribute up to $8,000 per year, with a lifetime.

November 17, 2023 what is insurance expense? This includes salaries and wages, rent and office expenses, insurance, travel expenses, and sometimes depreciation and amortization, along with other operational expenses. This expense is incurred for all.

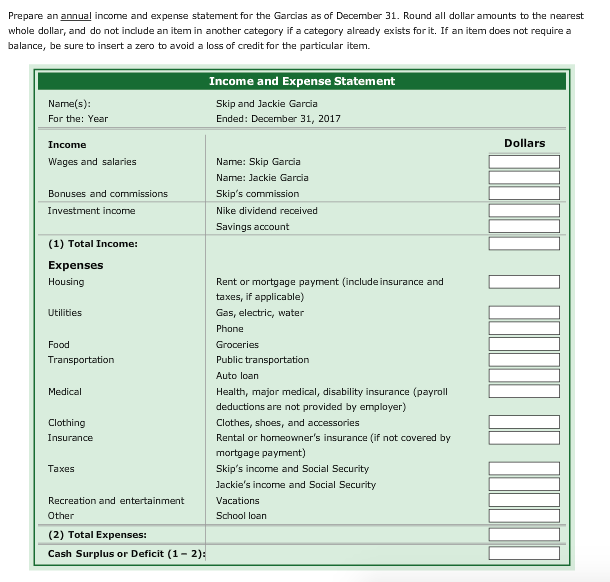

Insurance expense is part of operating expenses in the income statement. Add up all your gains then deduct your losses. All income statements have a heading that display’s the company name, title of the.

Insurance revenue and insurance service result 56 2.4.2. The amount of coverage to provide is set by the insurance company. Here's a recap for the cost of.

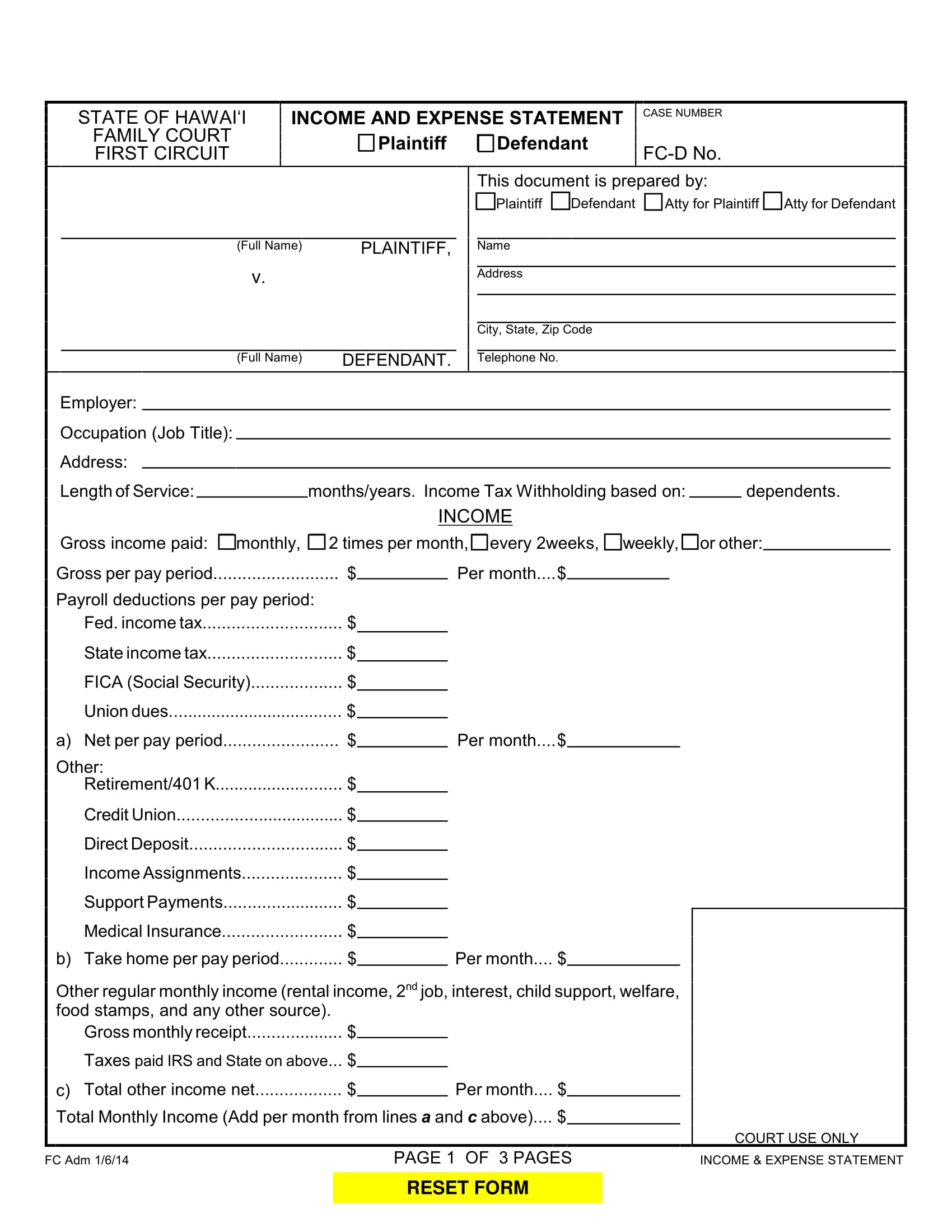

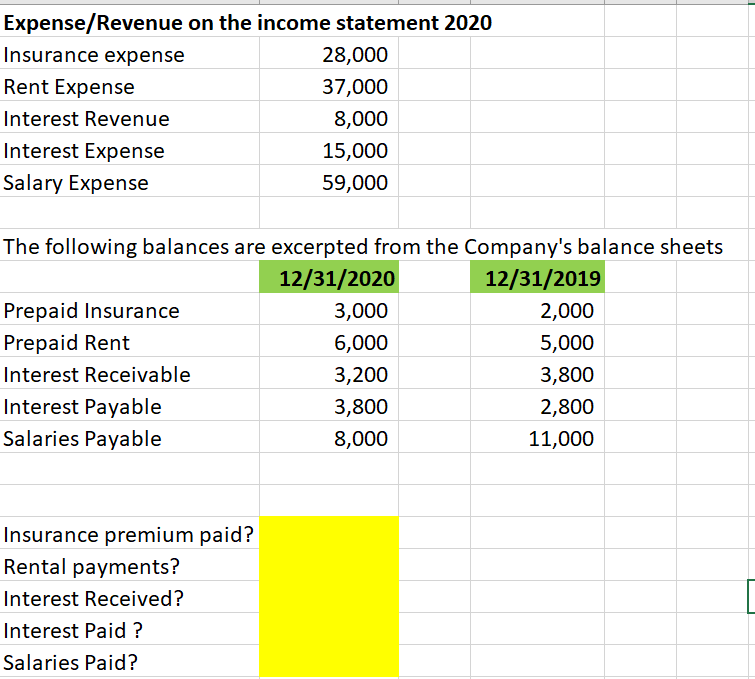

The premium is higher or. One objective of the adjusting entry is to match the proper amount of insurance expense to the period indicated on the income statement. Insurance expense, like other business expenditures, belongs on a company's income statement rather than on its balance sheet.

For example, if you itemize, your agi is $100,000. This is the most important item in the whole calculation. The amount paid to acquire a specific coverage is known as premium.

Total expense for bad debts. Once expenses are incurred, the prepaid asset account is reduced and an entry is made to the expense account on the income statement. Insurance expense is that amount of expenditure paid to acquire an insurance contract.

Example of payment for insurance. Ifrs 17 income statement 9 9 p&l 20x1 20x0 insurance revenue 9,856 8,567 insurance service expenses (9,069) (8,489) incurred claims and insurance contract. The costs that have expired should be reported in income statement accounts such as insurance expense, fringe benefits expense, etc.

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). The securities and exchange commission (sec) requires companies that file financial statements with them to follow gaap or ifrs depending on whether they are u.s. Often abbreviated as opex, operating expenses include.