Fun Tips About Ifrs 16 Cash Flow Statement Presentation Financial Analysis Balance Sheet

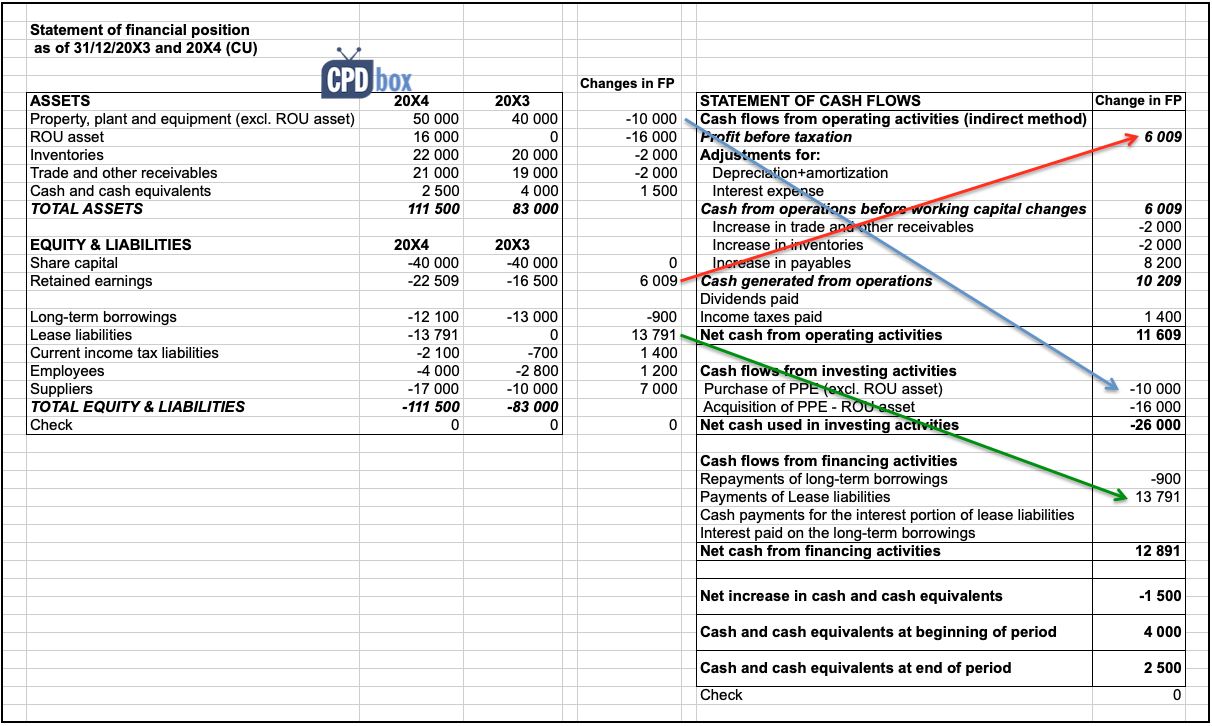

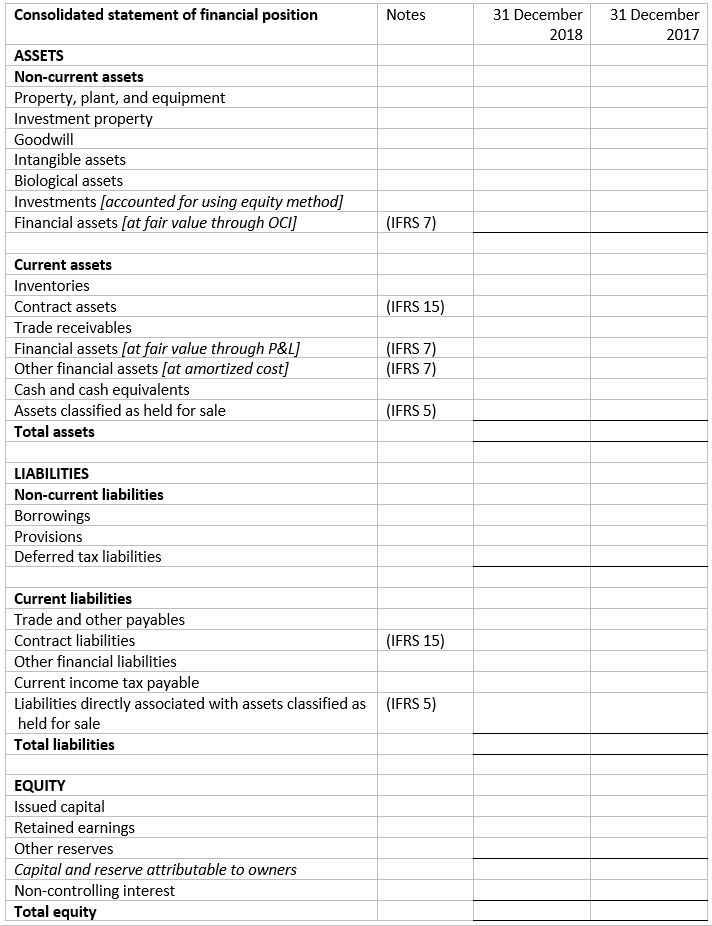

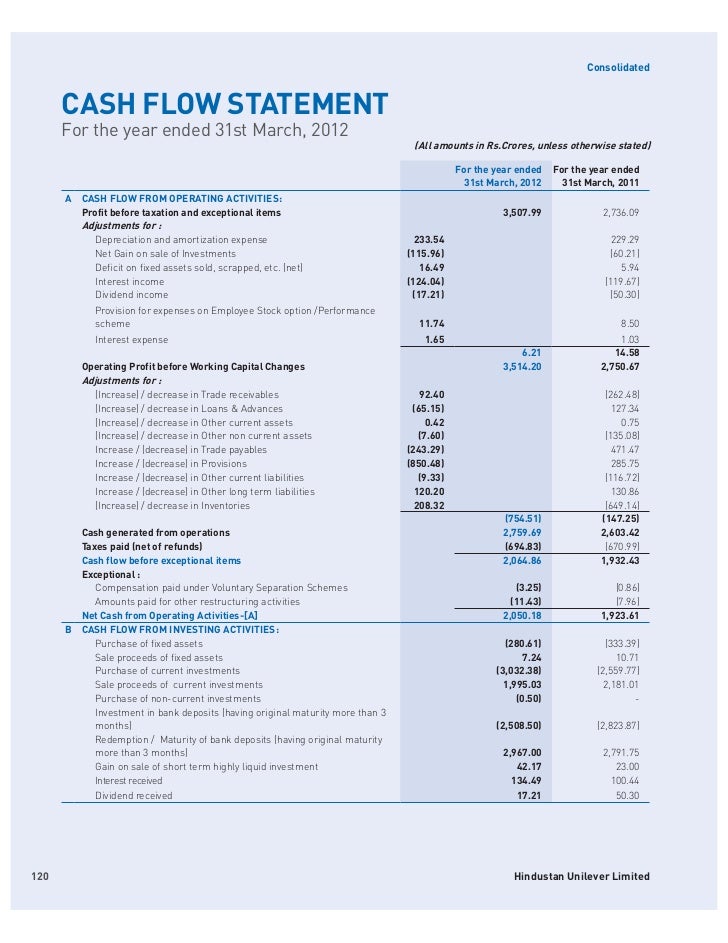

Presentation of a statement of cash flows operating activities investing activities financing activities reporting cash flows from operating.

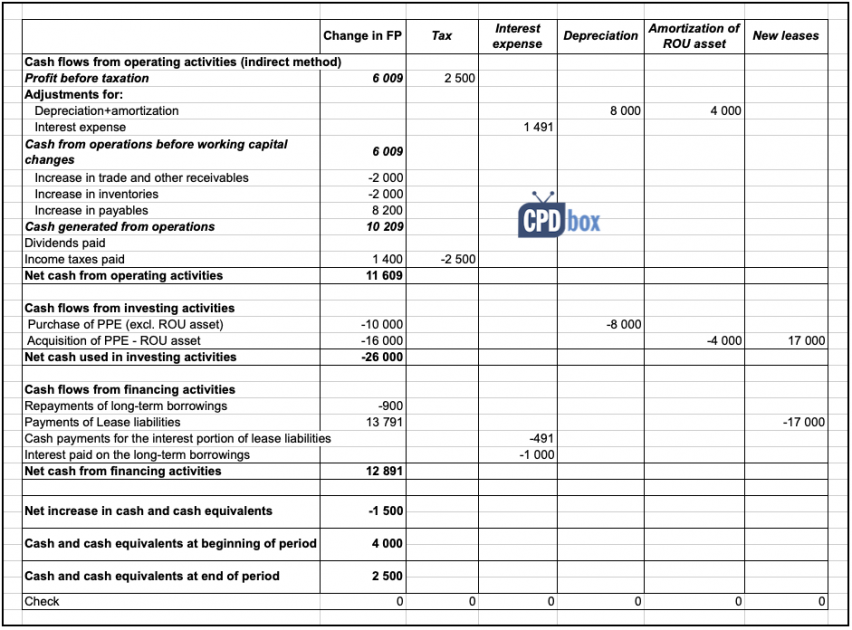

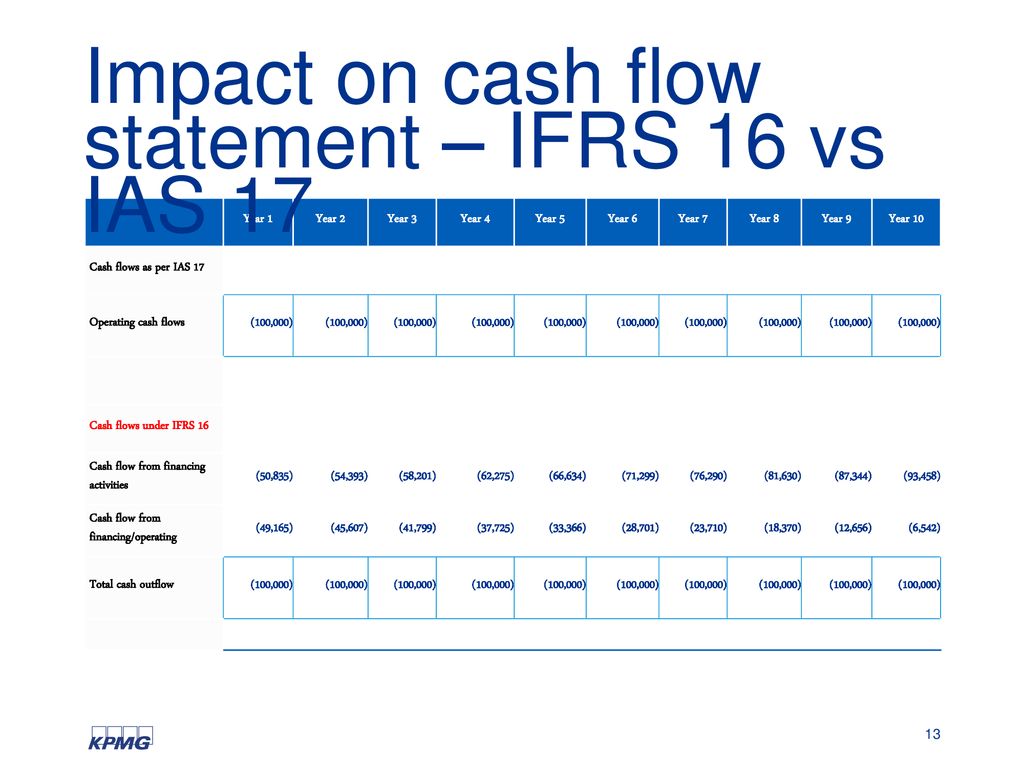

Ifrs 16 cash flow statement presentation. The impact of leases on the statement of cash flows includes (ifrs 16.50): The objective of the disclosure requirements is to give a basis for users of financial statements to assess. Presentation in the statement of cash flows paragraph 6 of ias 7 an entity that has entered into a reverse factoring arrangement determines how to classify cash flows.

The standard explains how this information should be. Examples from ias 7 representing ways in which the requirements of ias 7 for the. Most changes from ias 17/ifric 4 to ifrs 16 relate to lessees, the companies renting a car, office or.

Is not excluded from the scope of ifrs 16 and has elected to account for leases of intangible assets under ifrs 16), an entity should apply the provisions of ifrs 16 to the. Under ifrs 16 8, a lessee classifies cash payments for the principal portion of a lease liability as financing activities in the statement of cash flows. The details are as follows:

Sfrs(i) 16/frs 116 leases no longer makes a distinction between operating and finance lease for a lessee and is effective for financial periods beginning 1 january 2019. The following presentation is being made only to, and is only directed at, persons to whom such presentations may lawfully be communicated (‘relevant. A statement of cash flows is part of an entity’s complete set of financial statements in accordance with paragraph 10 of ias 1 ‘presentation of.

Ifrs eps was usd0.60 for the quarter, a decrease of 10% vs. The ifrs 16 and asc 842 guidance on identifying whether arrangements are or contain leases is nearly identical. Lease assets financial liabilities equity operating expenses finance costs operating cash outflows financing cash.

Ifrs 16 contains both quantitative and qualitative disclosure requirements. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of. Ifrs 16 requires lessees and lessors to provide information about leasing activities within their financial statements.

Notwithstanding this, application of the guidance may require. Repayments of the principal portion of the lease liability, presented within financing. Ifrs 16 leases in the statement of cash flows (ias 7) on 1 january 20x4, abc entered into the lease contract.

Ifrs 16 leases presentation in cash flows.