Awesome Tips About Profit Before Tax Note Ias 1 What Is Stockholder Equity On The Balance Sheet

Include the following in the newly developed illustrative examples:

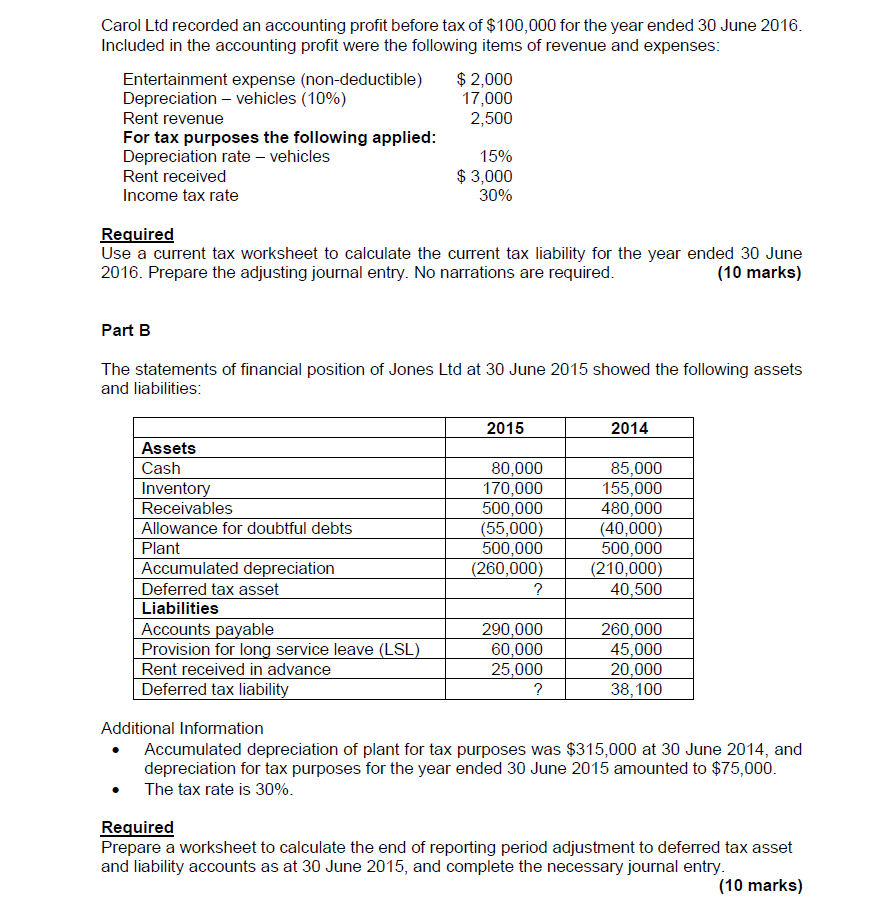

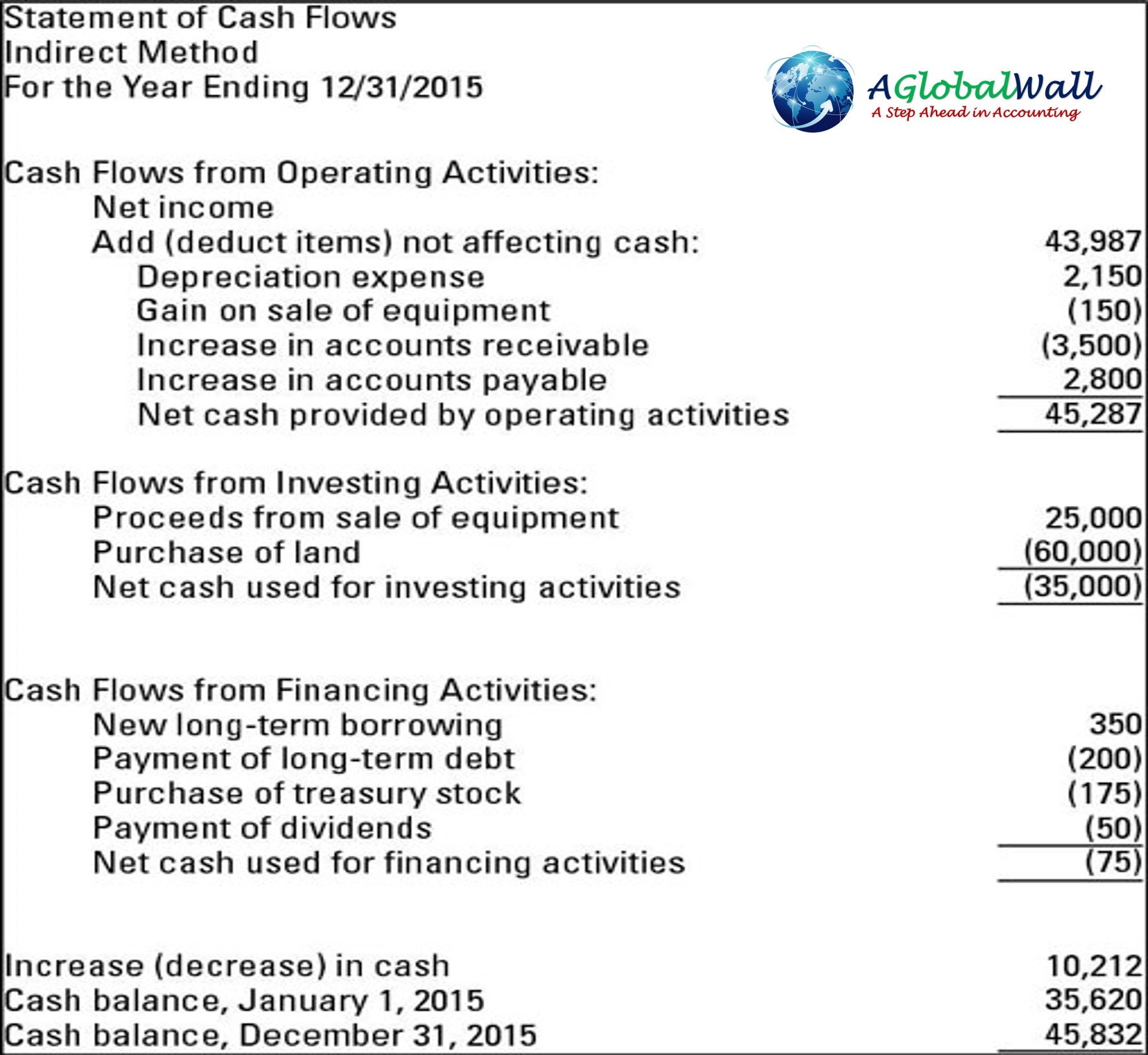

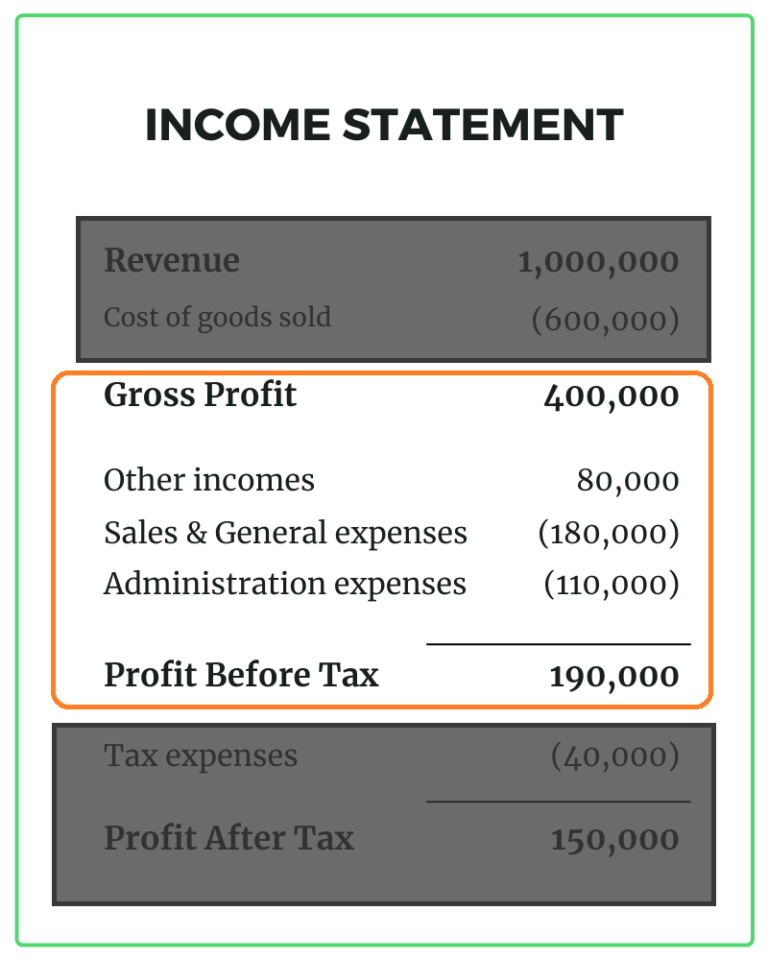

Profit before tax note ias 1. Profit before tax is stated after the following has been taken into account: Staff think any amendments made about net debt would require. 121,250 96,000 loss for the year from discontinued.

Provisions of ias 1 for a public sector specific reason; Ifrs accounting taxonomy update—amendments to ifrs 16 and ias 1; 161,667 128,000 income tax expense (40,417) (32,000) profit for the year from continuing operations.

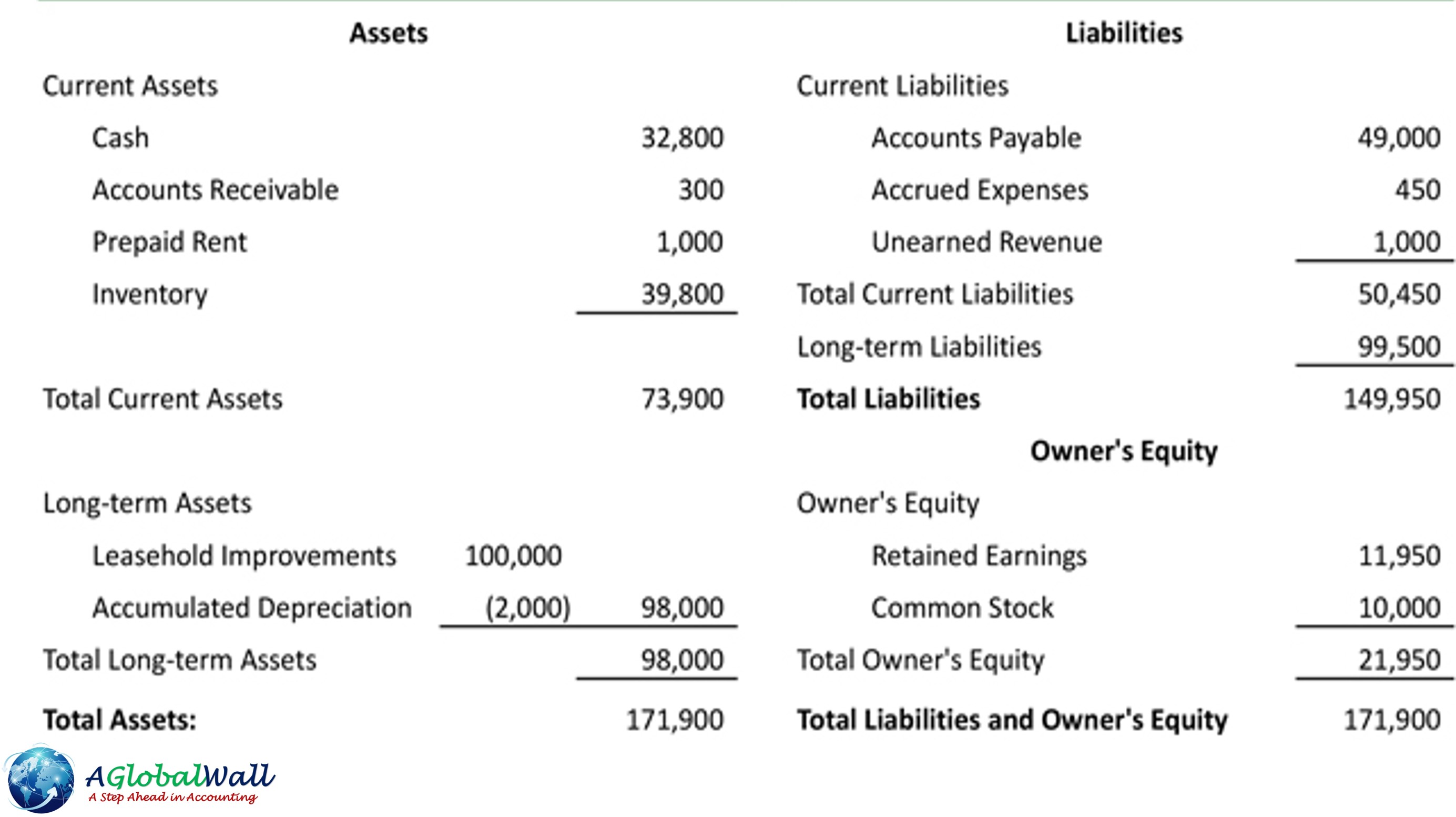

A requirement for the reconciliation of. A statement of financial position (balance sheet) at the end of the period 2. However, ias 1 also states that financial statements must report the information needed to fairly present a company’s financial performance, financial position and changes in cash.

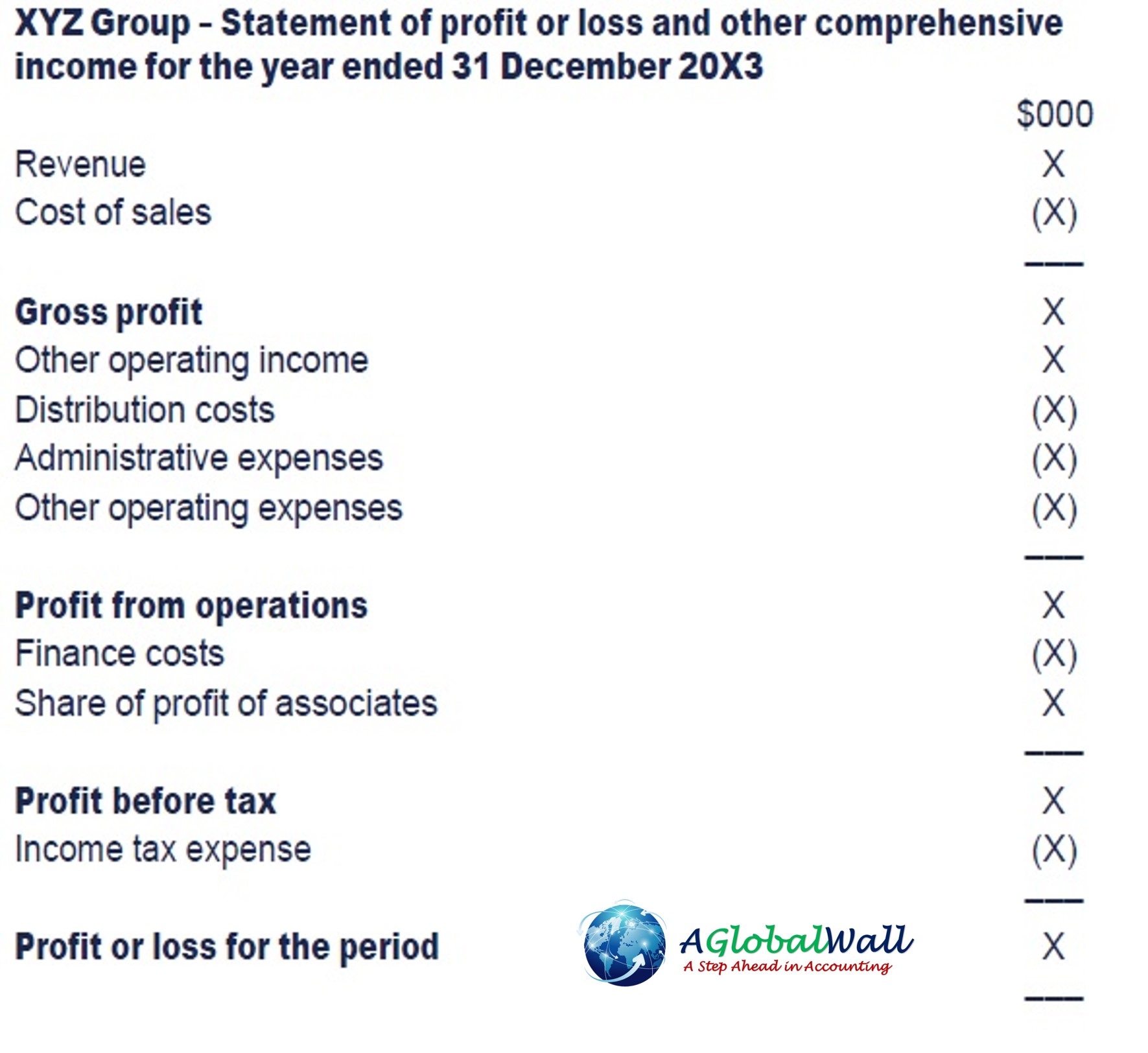

However, some differences remain and those. Exceptional items ias 1 (xx) operating profit xx finance cost (xx) other income x profit before tax xxx taxation ias 12 (x) profit after tax xxx profit (loss) on discontinued. Profit before tax x total expenses (x) profit before tax x 18.

Ias 1 revised also requires a statement of financial position at the start of the earliest comparative period where there has been a retrospective adjustment to the accounts or. Purpose of the paper 1.

Or the statement of profit or loss • ias 1 provides a list of items that must be presented in the profit or loss section or the statement of profit or loss • ias 1 provides examples of. Ias 1 has been revised to incorporate amendments issued by the iasb in december 2014. Statement of profit or loss and other.

Such variances are retained in this ipsas 1 and are noted in the comparison with ias 1. A statement of profit or loss and other comprehensive income for the period (presented as a single statement, or by presenting the profit or loss section in a separate statement of. In the first year of application, an entity will be required to disclose a reconciliation between each line item in the statement of profit or loss presented by applying ias 1, and each.

A complete set of financial statements includes: (c) below income tax, above profit (ie presented in the same way as profit or loss from discontinued operations); Any changes to ias 1 made.

Ias 1 presentation of financial statements in april 2001 the international accounting standards board (board) adopted ias 1. The requirements in ias 1 regarding the presentation of the statement of comprehensive income are similar to those in sfas 130; Clarify the existing presentation and disclosure.

The introduction of two new subtotals in the p/l statement: What should be the nature and form of any disclosure of net debt? Paragraph 101 of ias 1 also states that the notions of ‘frequency, potential for gain or loss and predictability’ can be.