Breathtaking Info About Interpretation Of Balance Sheet Income Statement For Taxi Business

Accounting march 28, 2023 a balance sheet helps small business owners better understand their company’s financial health.

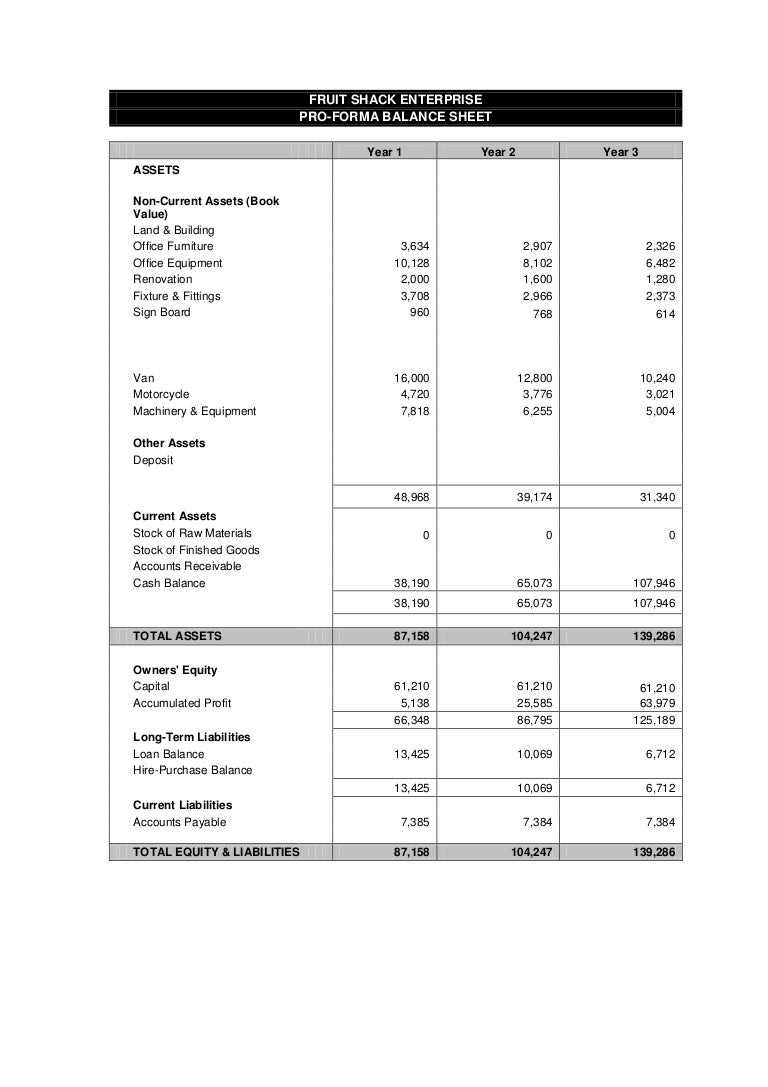

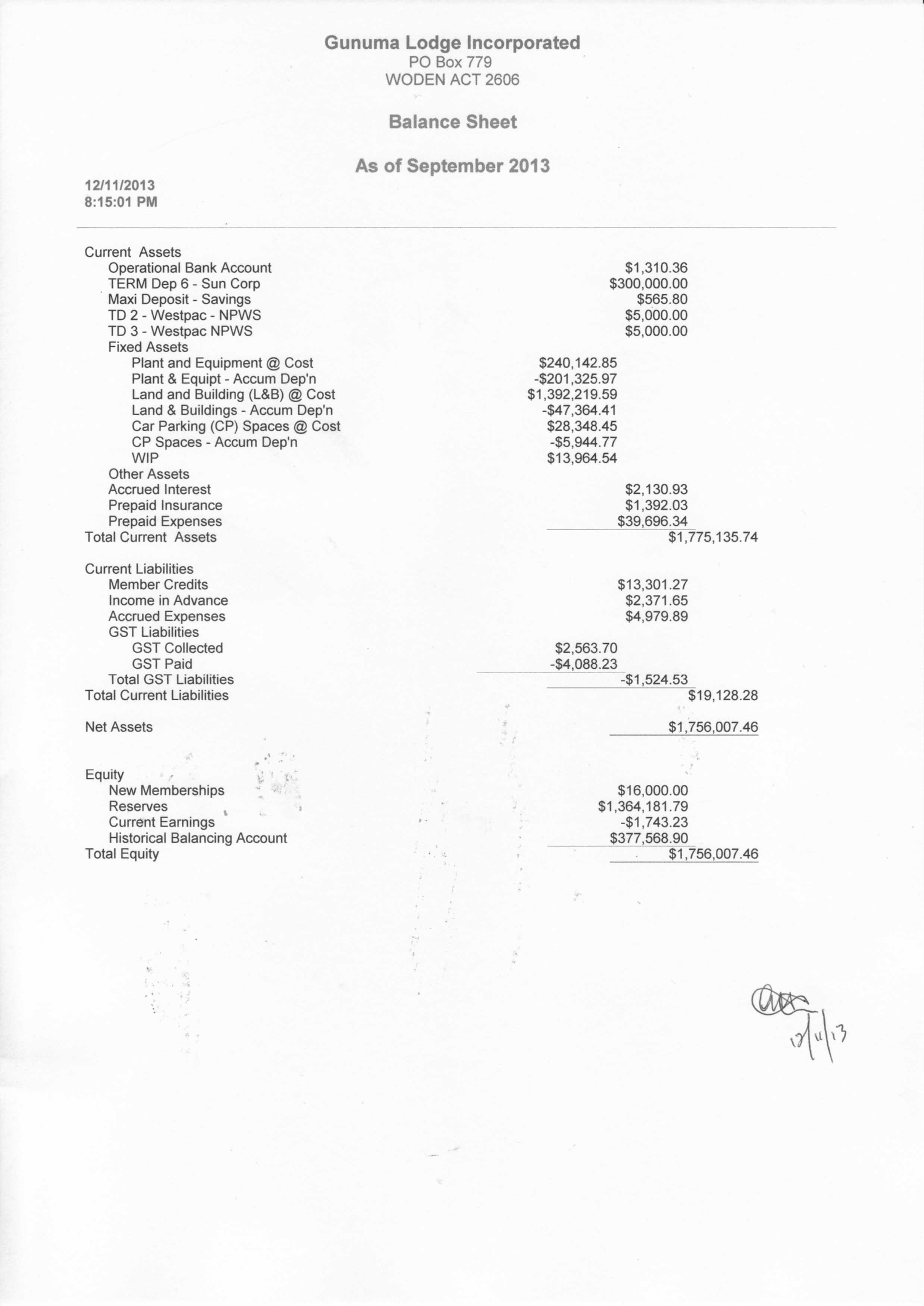

Interpretation of balance sheet. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. A statement released by a company to report its financial health at a given point in time.it is important for accountants and business owners to know how to read and interpret the balance sheet and act on it to avoid negative business outcomes. The balance sheet, as its name suggests, always balances out:

A company's balance sheet is a snapshot of assets and liabilities at a single point in time. This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering: The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

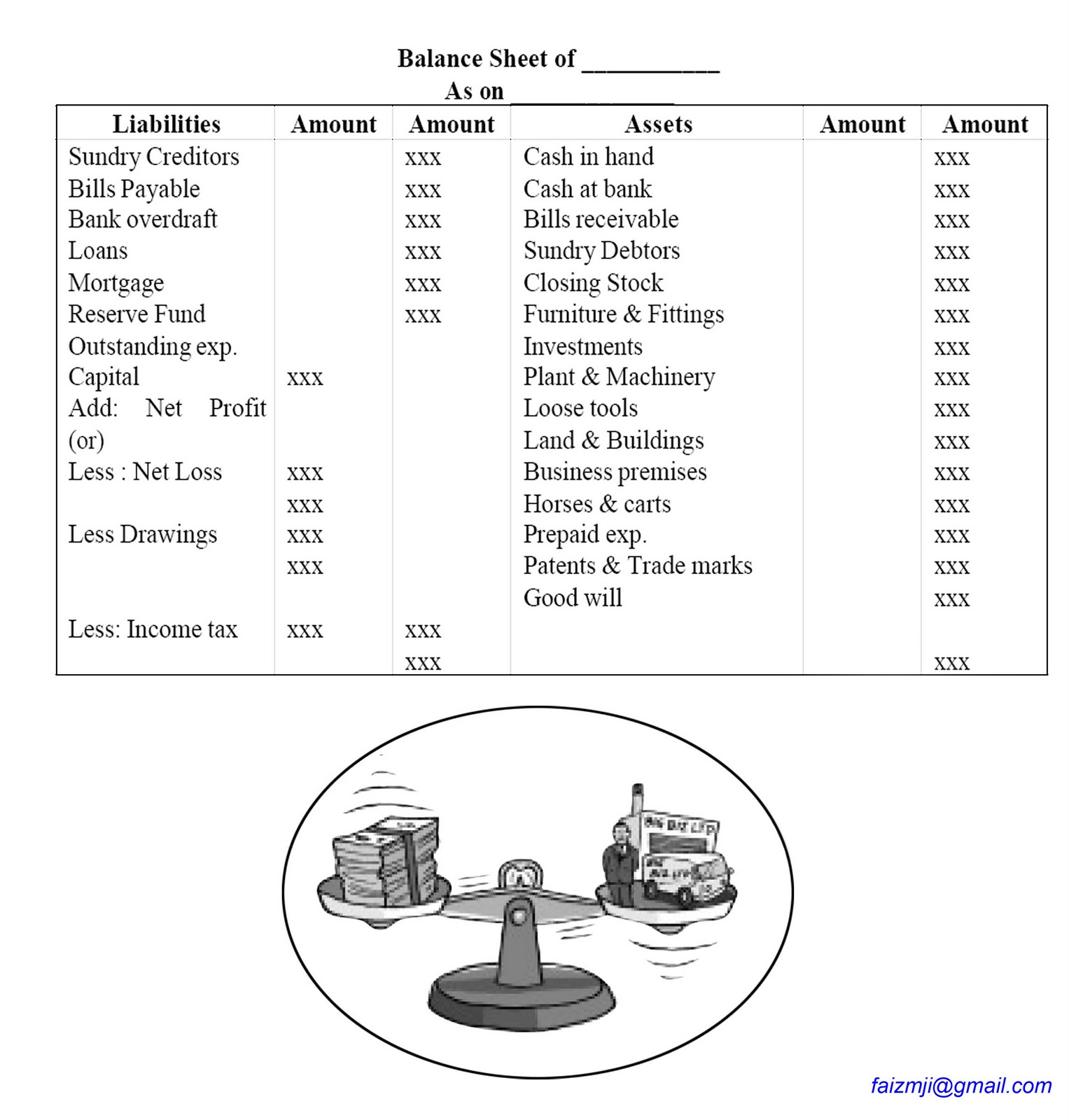

(1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return. It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet has three sections, each labeled for the account type it represents.

What is a balance sheet ratio? Examples include property, machinery, heavy plant and land. Consequently, its use is somewhat restricted.

The format of the sheet is based upon the following accounting equation: A balance sheet conveys the “book value” of a company. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders).

Assets = liabilities + equity to summarize, we can state that your balance sheet provides a glimpse into the future and the current financial health of your business. Finance and capital markets > unit 5 economics > finance and capital markets > accounting and financial statements > three core financial statements interpreting the balance sheet google classroom you might need: Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners ( owner’s equity ).

The information includes the following: Essentially, a balance sheet is a historic statement showing the financial position of a business at a given point in time; This is your balance sheet:

A company's balance sheet should be interpreted when considering an investment as it reflects their assets and liabilities at a certain point in time. A balance sheet lists the value of all of a company's assets, liabilities, and shareholders' (or owners') equity. It is performed by various stakeholders to obtain an accurate financial business position at a specific period.

Balance sheets provide the basis for. Balance sheet analysis refers to the company’s assets, liabilities, and owner’s capital analysis. Assets = liability + owner's equity (aloe).

This brings us to talk about the balance sheet ratios, which further our cause of estimating the company's financial structure. Interpreting the balance sheet (practice) | khan academy course: To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.