Best Of The Best Info About Income Statement For Individual Noncontrolling Interest Balance Sheet

Revenue, expenses, gains, and losses.

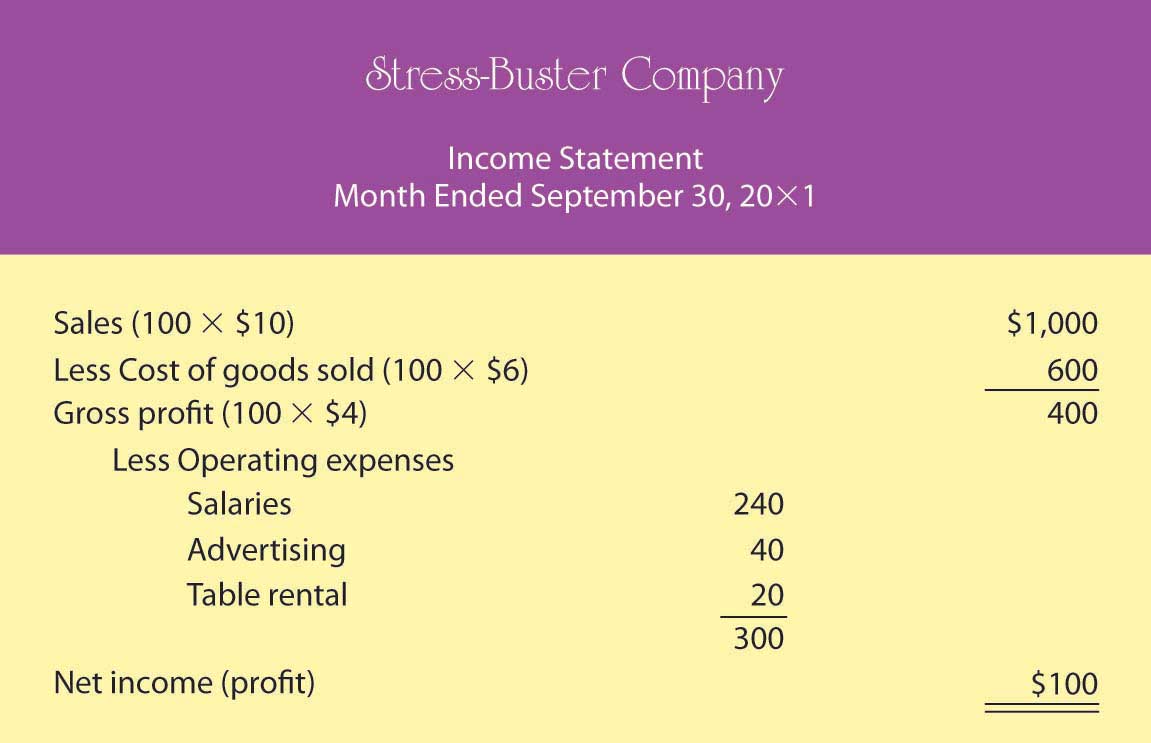

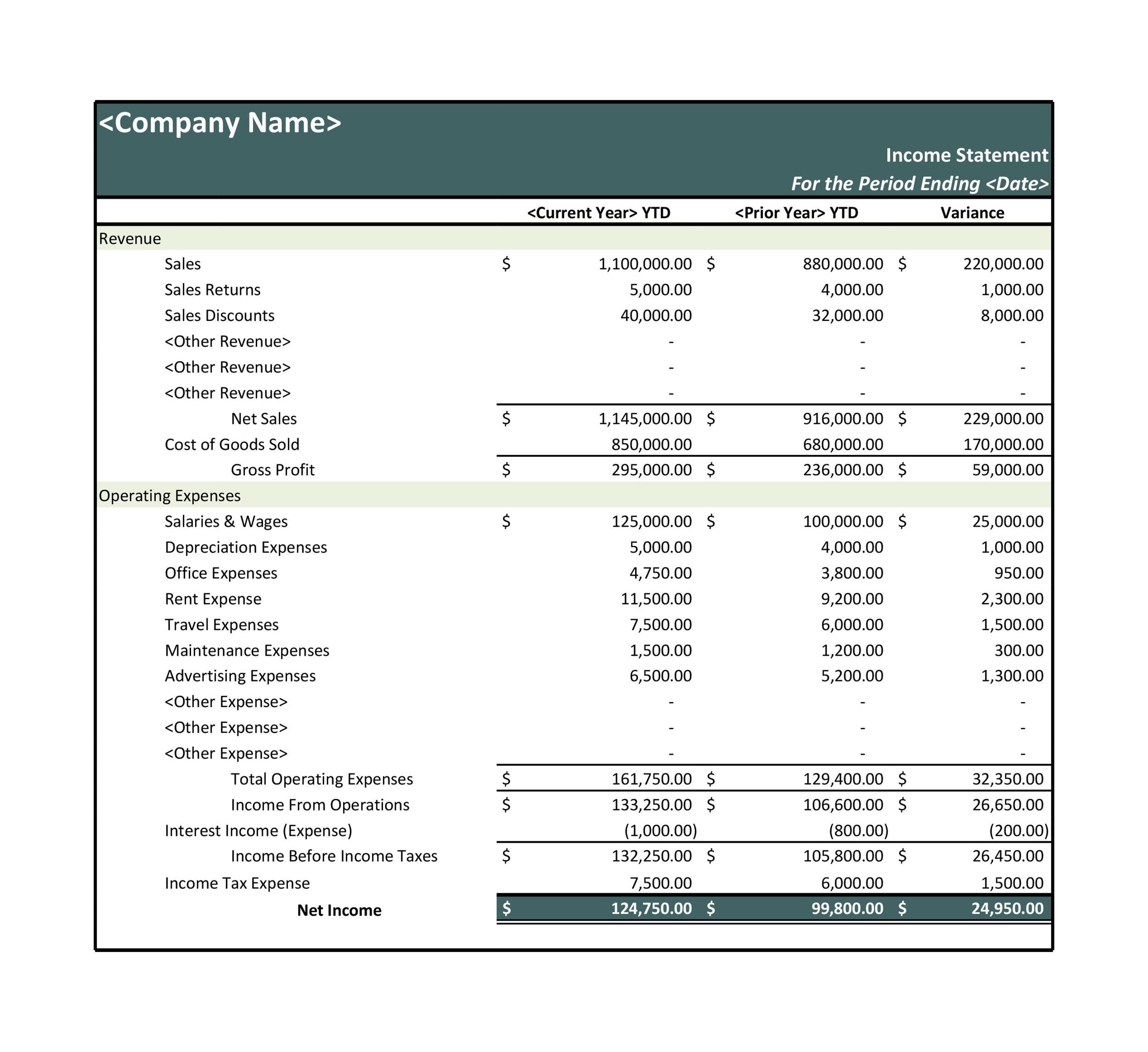

Income statement for individual. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. Income, expenses and net profits. Income for aiman to construct an income statement for the month of january, he first has to determine how much money he has from his various sources of income.

Record adjusted ebitda margin fourth. The income statement can either be prepared in report format or account format. On the screen you will see your income from your employer or employers for the income year, and the tax that has been withheld.

An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period. The portion of a pfs exhibits your assets and liabilities, or net worth. Tax changes and enterprise disbursements.

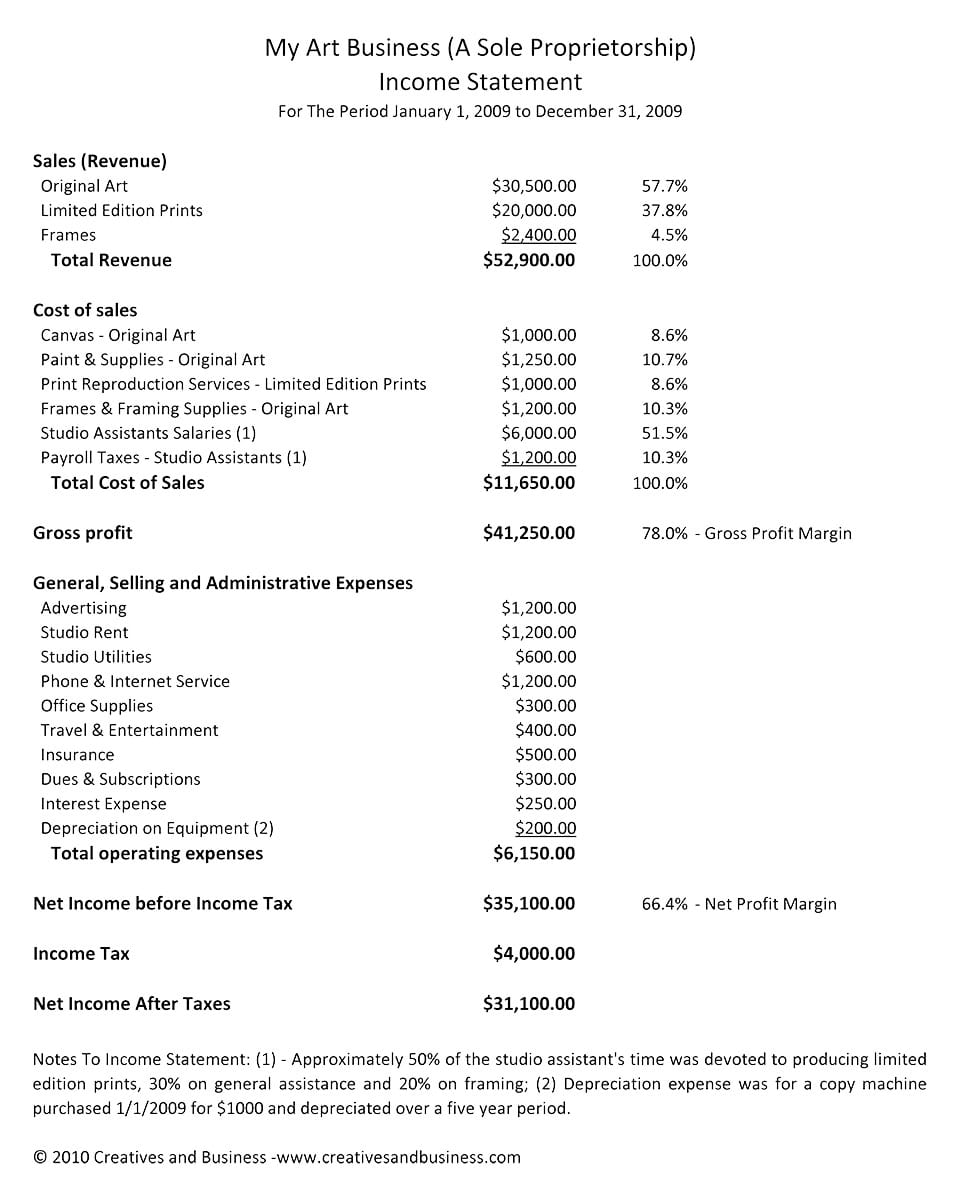

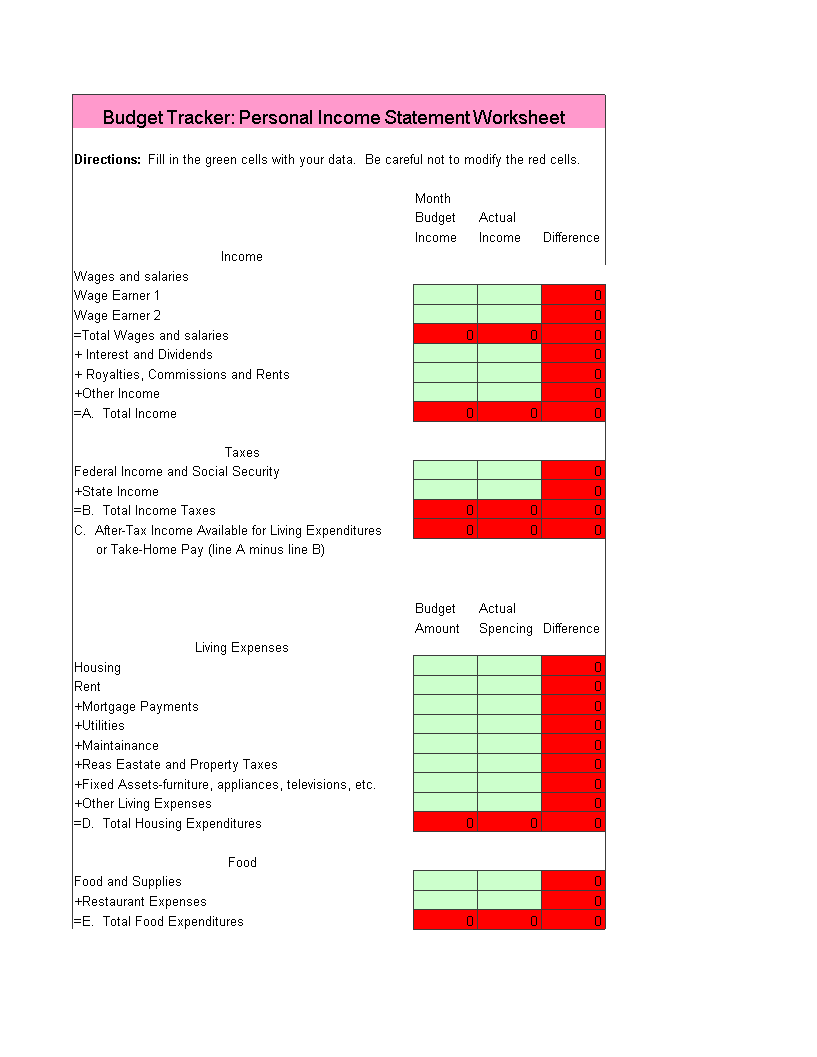

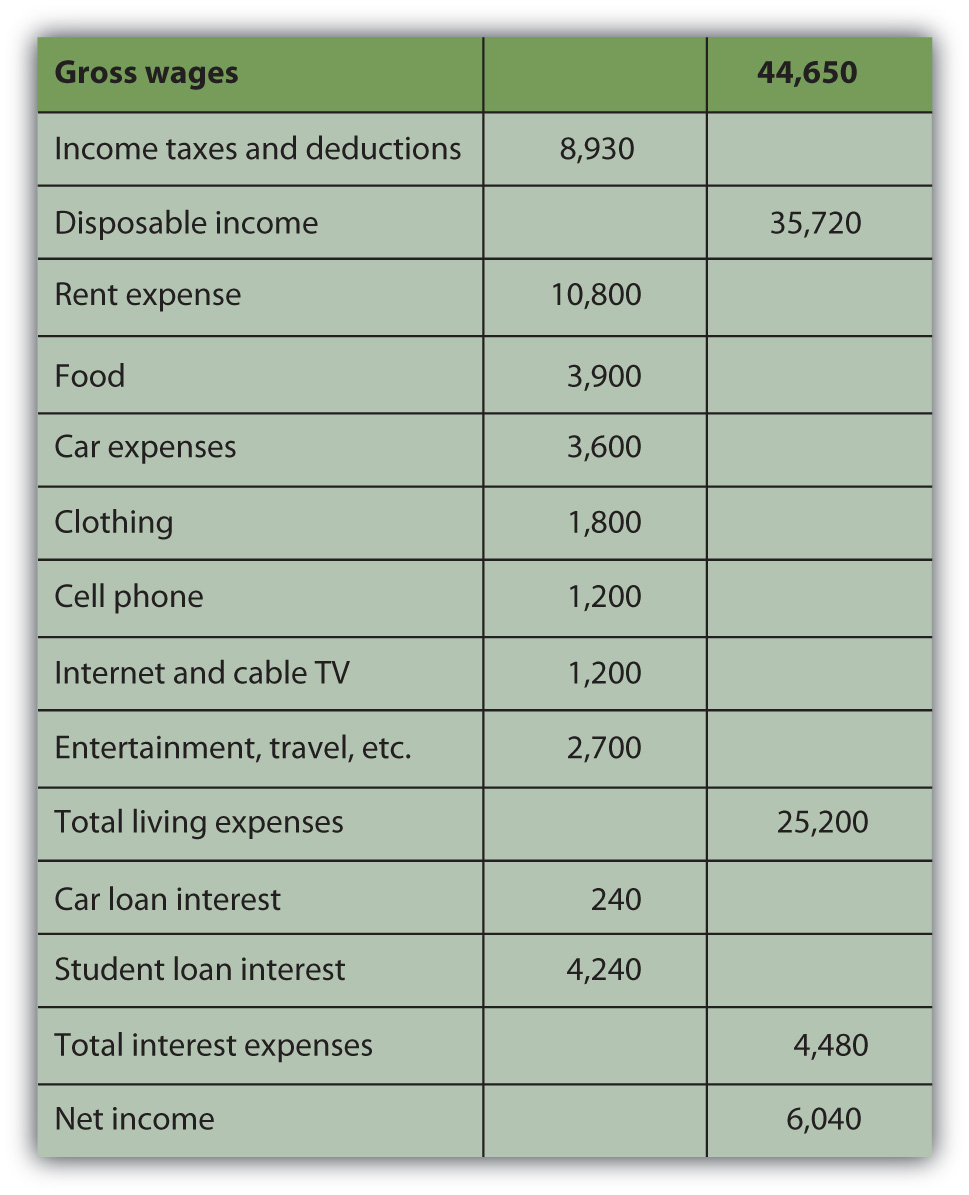

Salary comes from doing a job/business. The income statement of an individual signifies the inflows and outflows of money. The sample personal income statement shown above lists john’s monthly income and expenses.

The balance sheet provides a breakdown of assets and liabilities, while the income statement summarizes income. For an average person, there can be two source income: States and the district of columbia is 42.32 percent as of january 2024, with rates ranging from 37 percent in states without a state income tax to 50.3 percent in california.

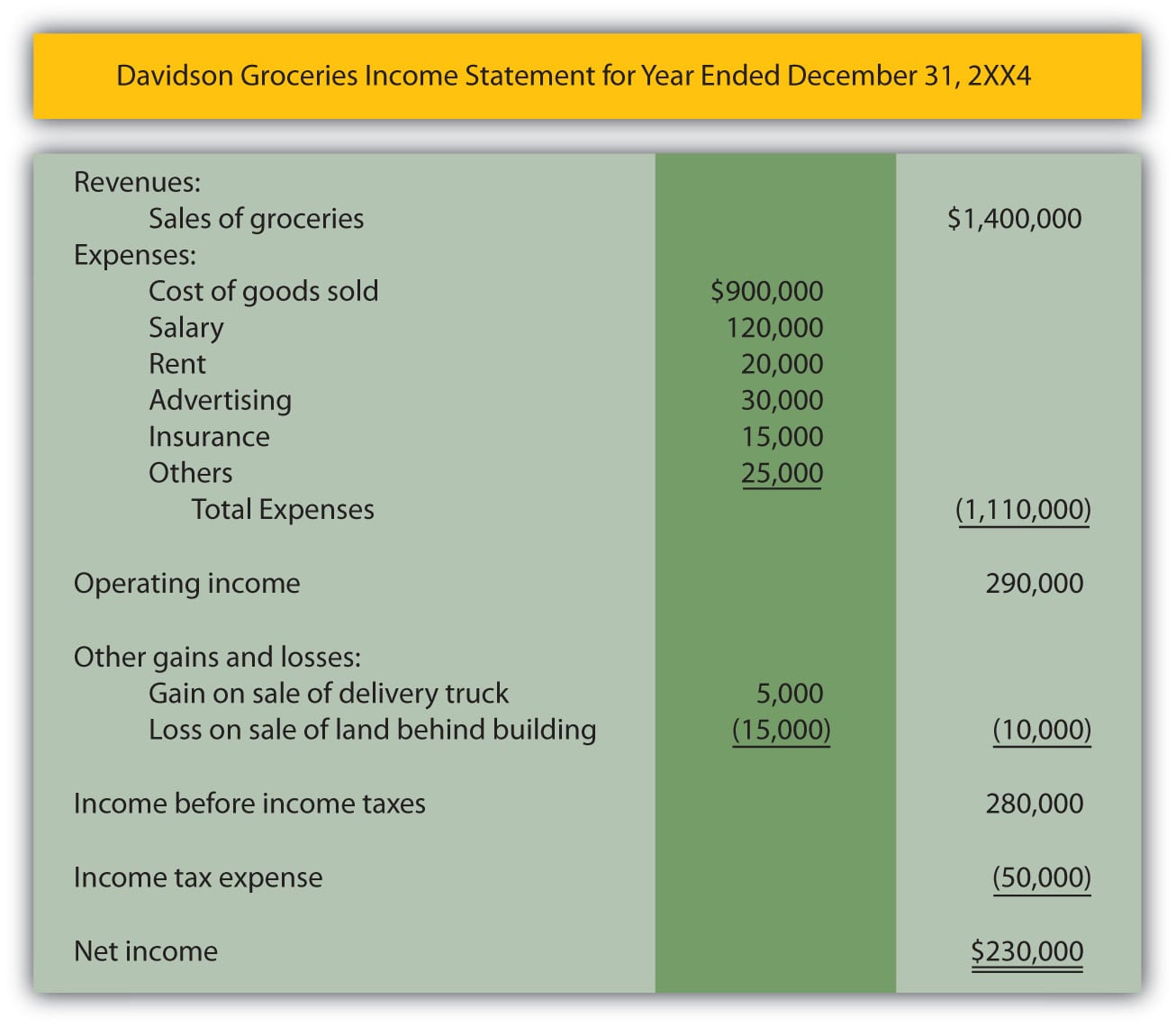

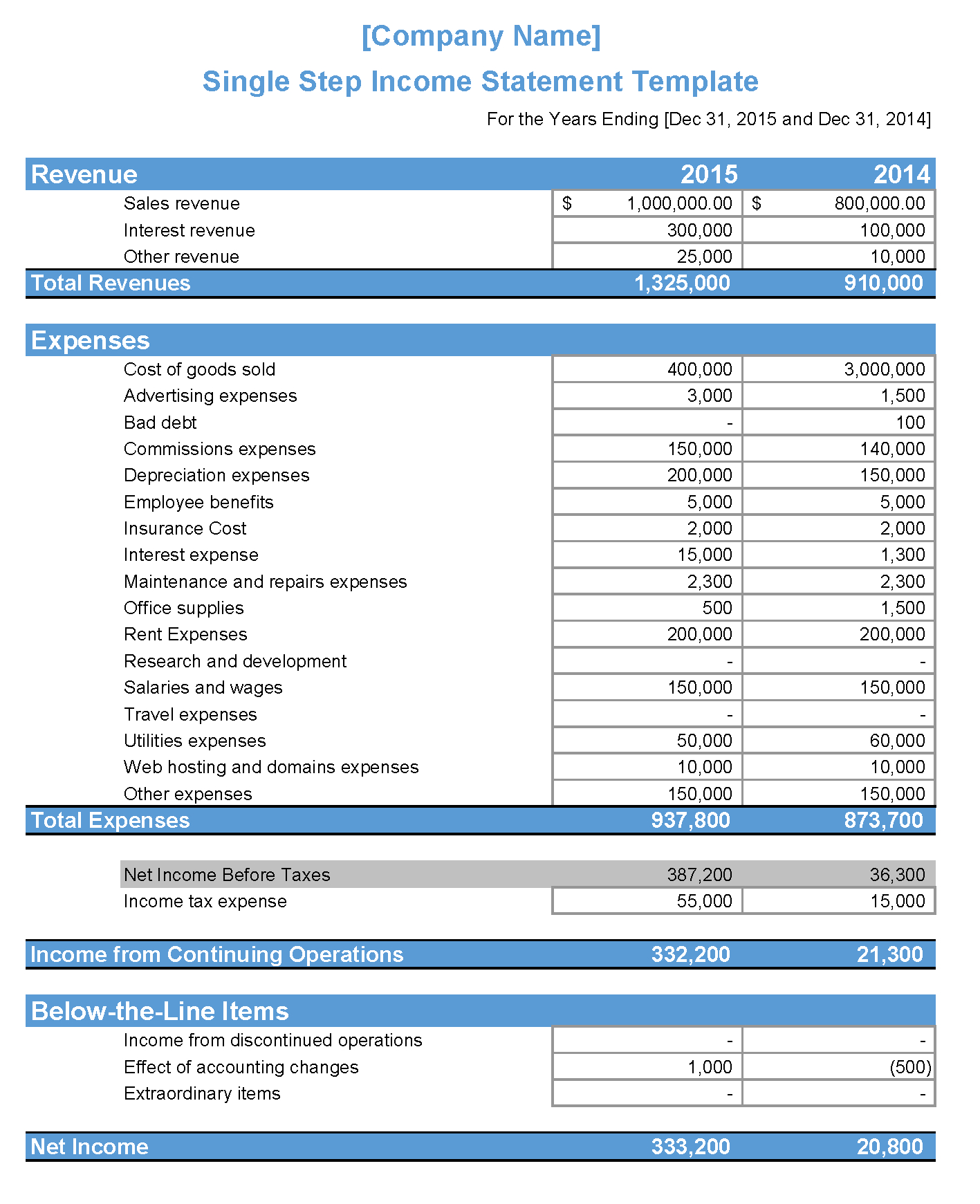

Here's what you need to know: For comparison, the average combined state and federal top income tax rate for the 50 u.s. According to the article, an income statement can be divided into three parts:

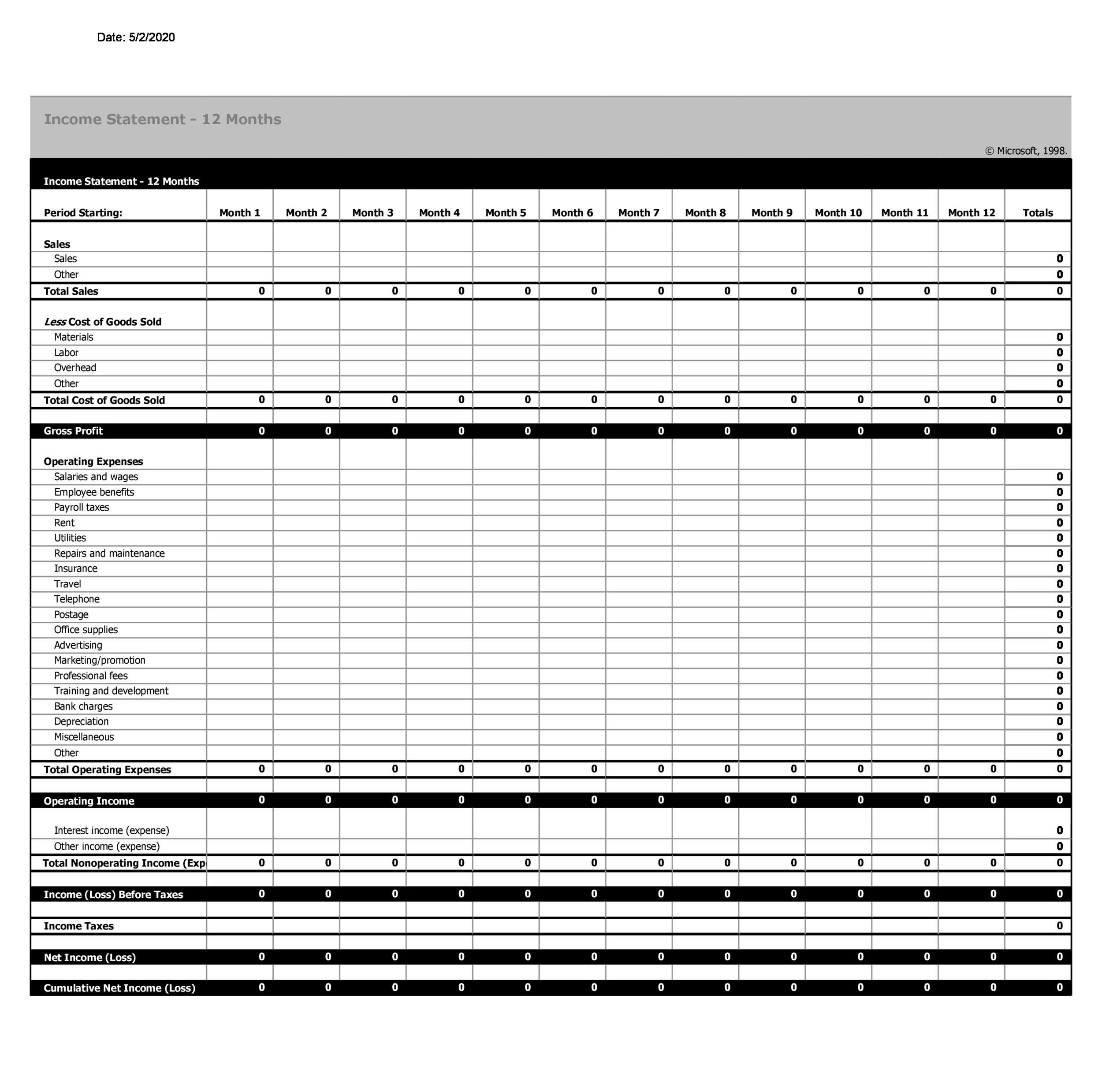

For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. Finance / income statement 41 free income statement templates & examples the income statement is one of three key financial statements used by all companies, from small businesses to large corporations. Income statements or profit and loss accounts are financial statements used to calculate the financial health of the company.

Income statements depict a company’s financial performance over a reporting period. (a) salary & (b) alternative income. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

These offer an inside look at a company. This diagram highlights the main constituents of a personal balance sheet suitable for an individual: It shows whether a company has made a profit or loss during that period.

A personal financial statement, or pfs, is a document or set of documents that outlines a person or family’s financial position. It is evaluated as the difference. This personal financial statement also contains all the living expenses that you might incur over time such as rent, utility payments, and mortgage payments.