Awe-Inspiring Examples Of Info About Net Non Operating Income Advance Tax Treatment In Balance Sheet

Strong increase in revenue and recurring operating income which are expected to continue in 2024 paris, february 15, 2024 fy 2023 adjusted data revenue:

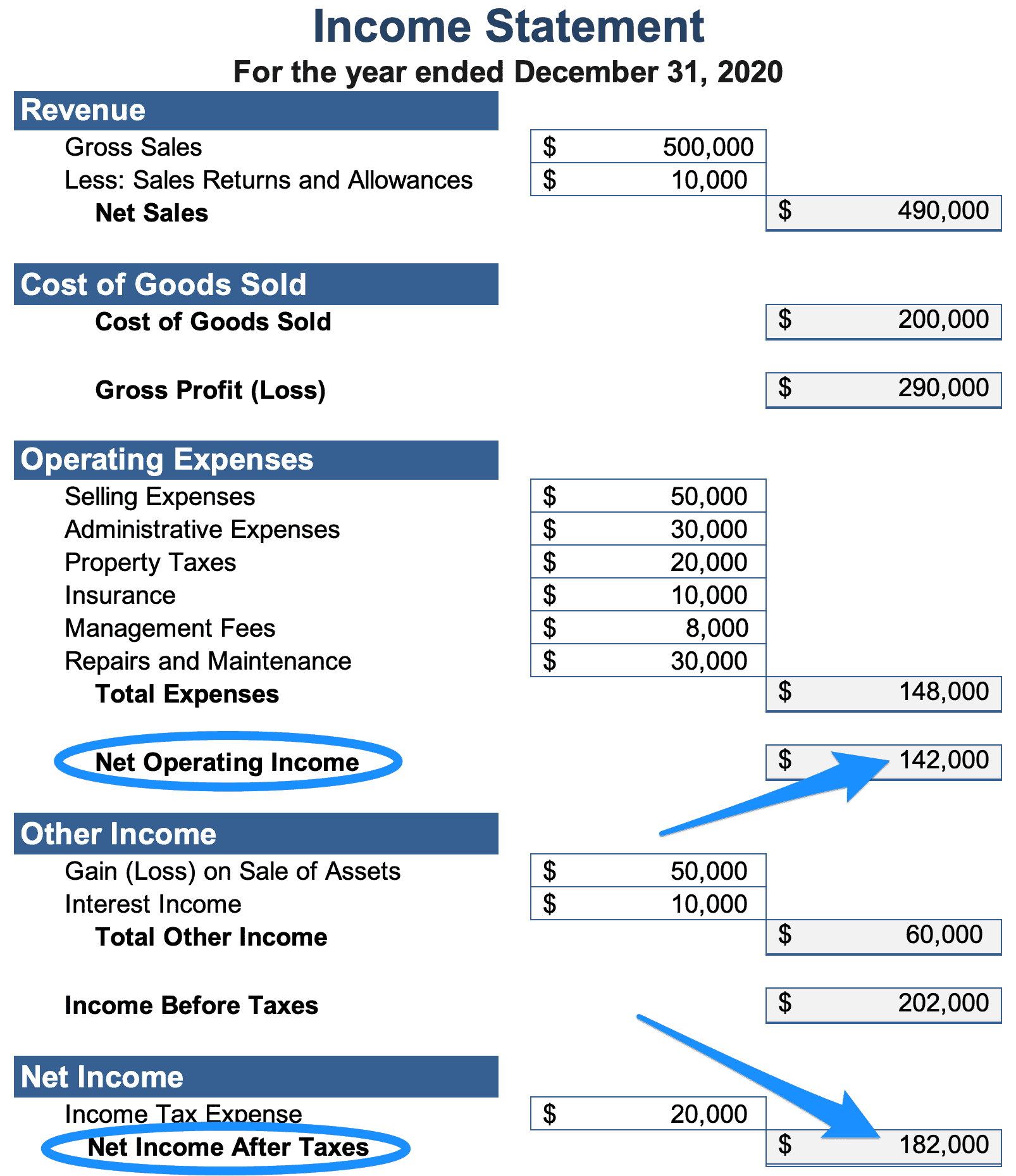

Net non operating income. Net operating income is the property's generated revenue minus the operating expenses, excluding taxes and debt service. Hence it is also called indirect income. Noi formula the net operating income (noi) formula is the sum of the property’s rental income and ancillary income, subtracted by its direct operating expenses.

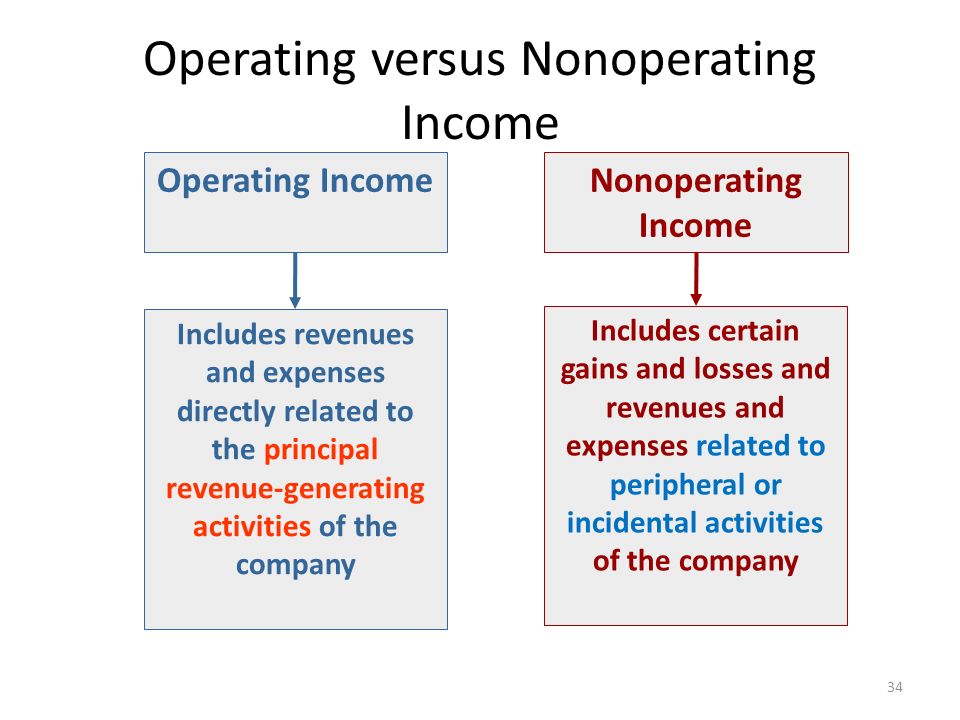

The net non operating income are the ones that the entity earns from sources other than the main business activities of the organization. Noi is not the same as net profit. The buying and selling of goods is the main activity of retail companies, which calls for a significant quantity of cash and liquid assets.

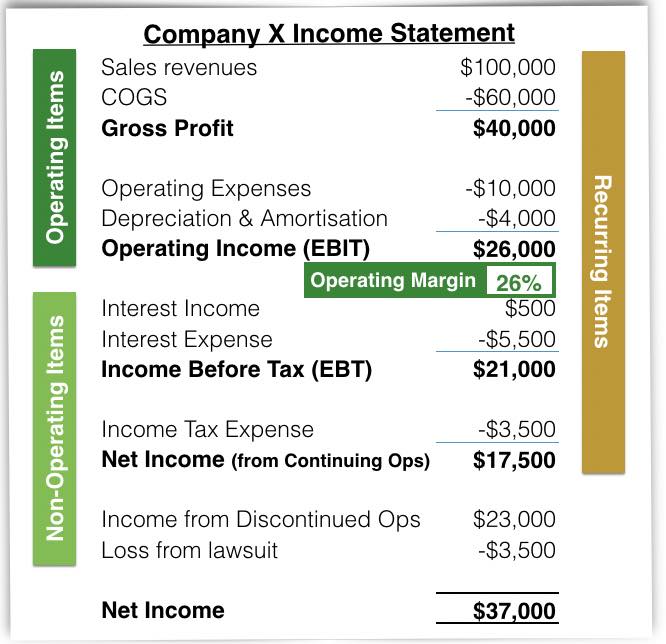

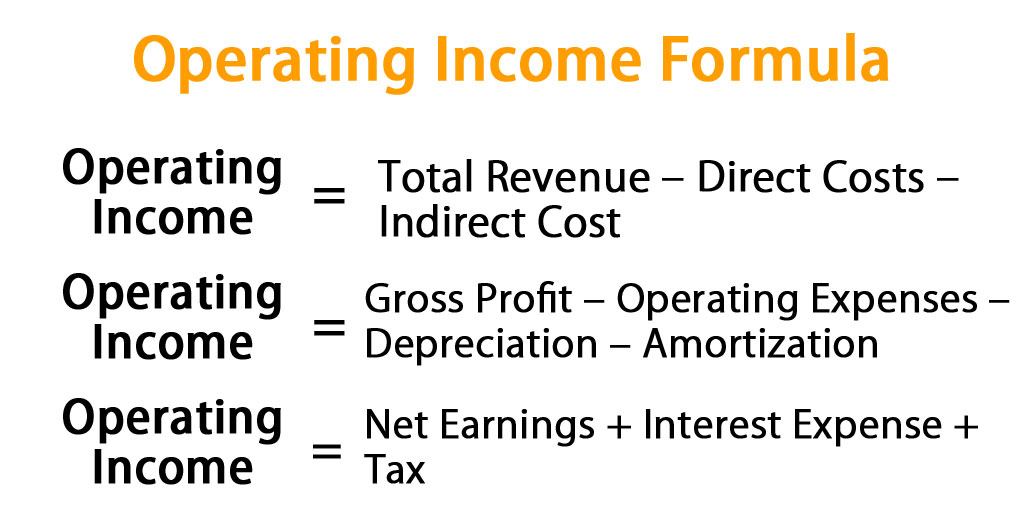

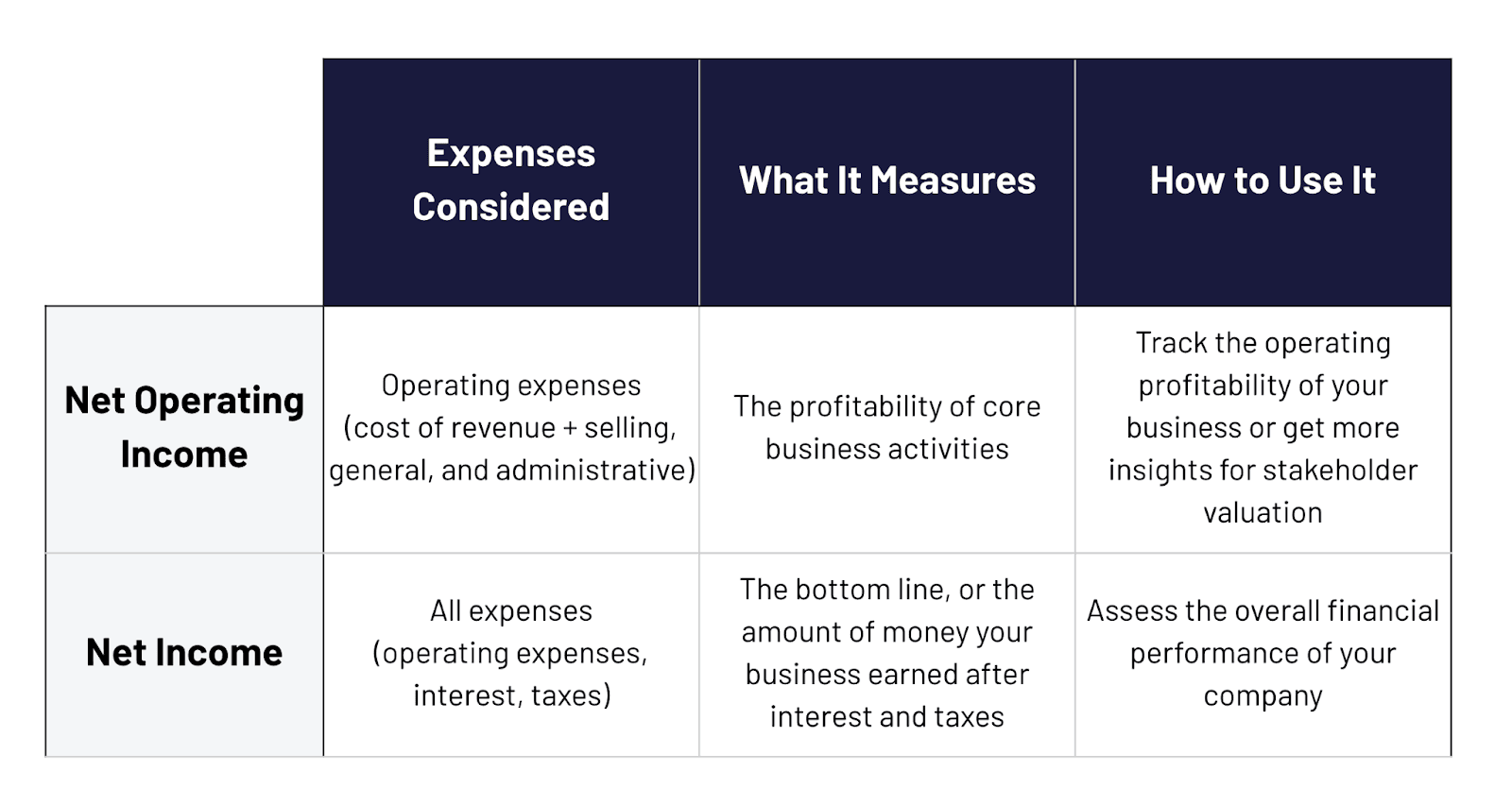

Net operating income (noi) is a measure of profitability that represents the amount the company has earned from its core operations and is calculated by deducting operating expenses from operating revenue. Income from operations of $652 million;

Total income after deducting all expenses. The concept is used by outside analysts, who strip away the effects of these items in order to determine the profitability (if any) of a company's core operations. Some examples include profits/loss from the sale of a capital asset or foreign exchange transactions, income from dividends, profits, or other income generated from the investments of the business, etc.

The key difference between ebit and operating. Net income is the profit remaining after all expenses, including business taxes—which is why it’s also sometimes referred to as net income after taxes (niat). Net operating income (noi) = (rental income.

Gains/losses from investment, foreign exchange, and sale of assets are some examples. An overview operating income and net income both show the income earned by a company, but the two. It forms part of the calculation of profit as though the income is not directly related to the business, but it is earned through the surplus invested from the business.

As a result, the lender’s total income climbed 20% year on year to s$13.9 billion. In the income statement, after the operating profit line item (operating income line), non.

Uob’s core net profit came in at s$6.1 billion, surpassing the s$6 billion mark for the first time, and was up 26% year on year. Record adjusted ebitda margin fourth. +23.6% organic recurring operating income:

Cash flow from operations was $11.6 billion for the full year, up 5%; A store may decide to invest its idle cash to make it work for it. These types of expenses include monthly.

What is net operating income (noi)? With operating expenses rising by just 15% year on year, the bank’s operating profit jumped 24% year on year to s$8.2 billion. Deduct the capital expenditures incurred on the existing assets.

:max_bytes(150000):strip_icc()/Term-Definitions_noi-4eae808a643c4ca9b130f12fed343370.jpg)

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

:max_bytes(150000):strip_icc()/non-operating-income-final-d3154875b2944bd8b6592741aa791f1c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)