Fine Beautiful Info About Pro Forma Statement Definition Microsoft Excel Income Template

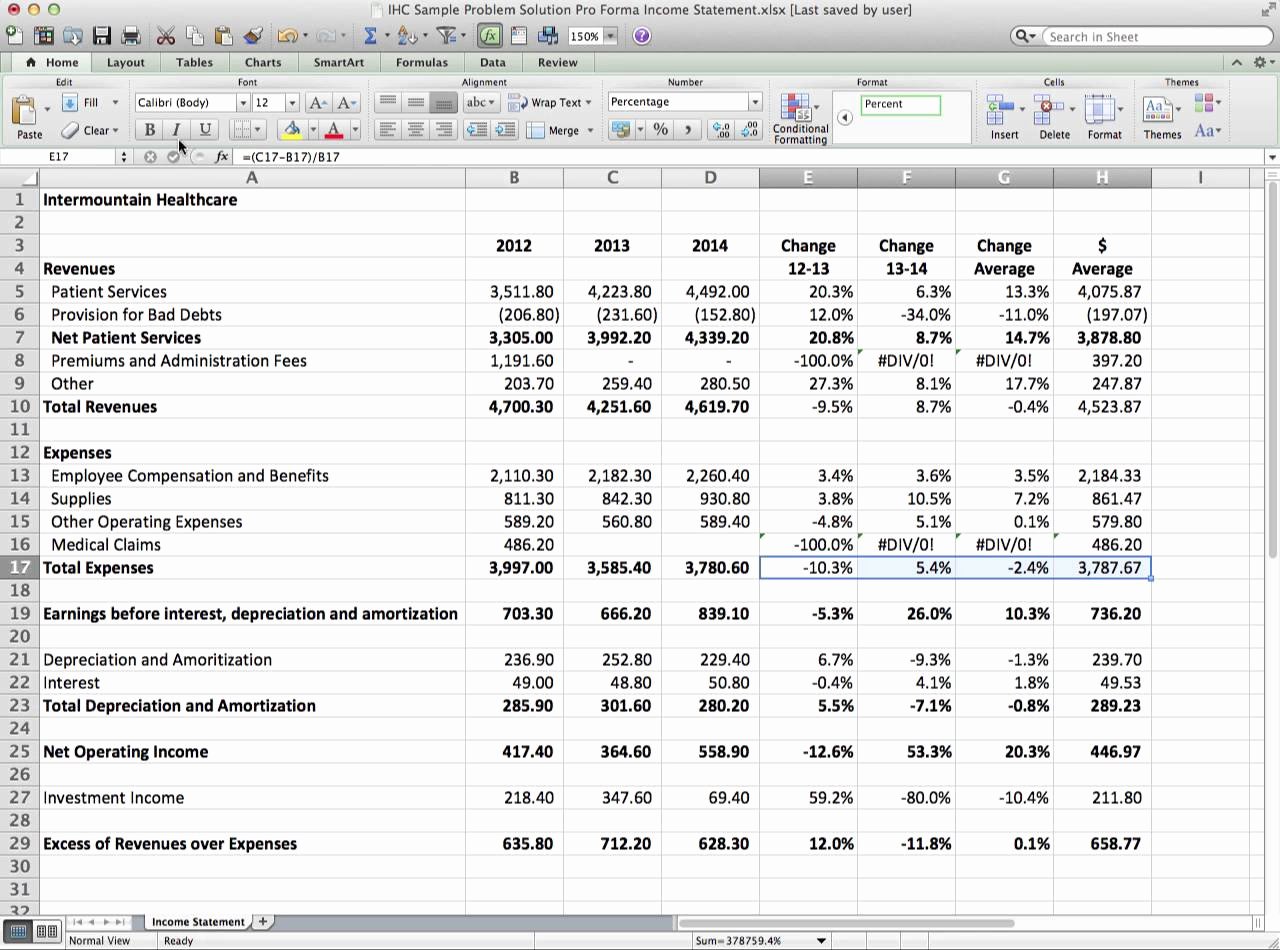

They are used to forecast a business’s performance over a period that hasn’t yet occurred.

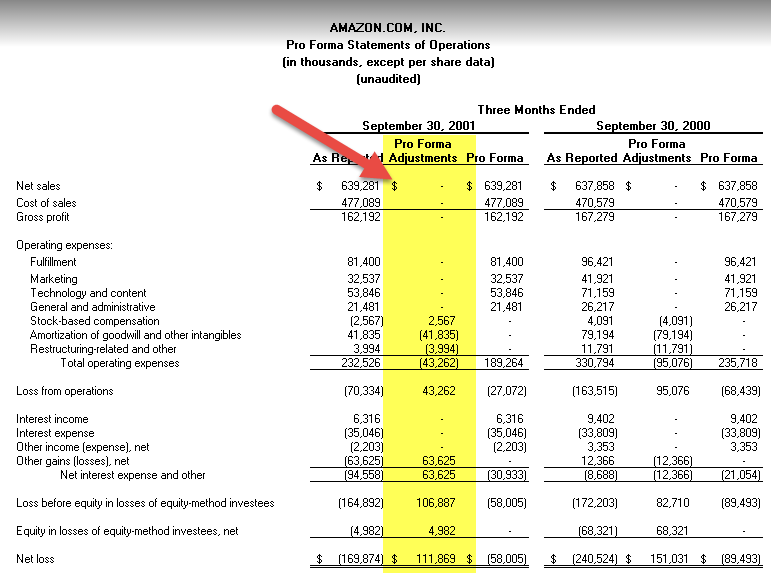

Pro forma statement definition. Pro forma financial statements are financial reports based on hypothetical scenarios that utilise assumptions or financial projections. Pro forma financial statements are projections of future financial performance based on hypothetical data or assumptions. The word pro forma means “for the sake of form”.

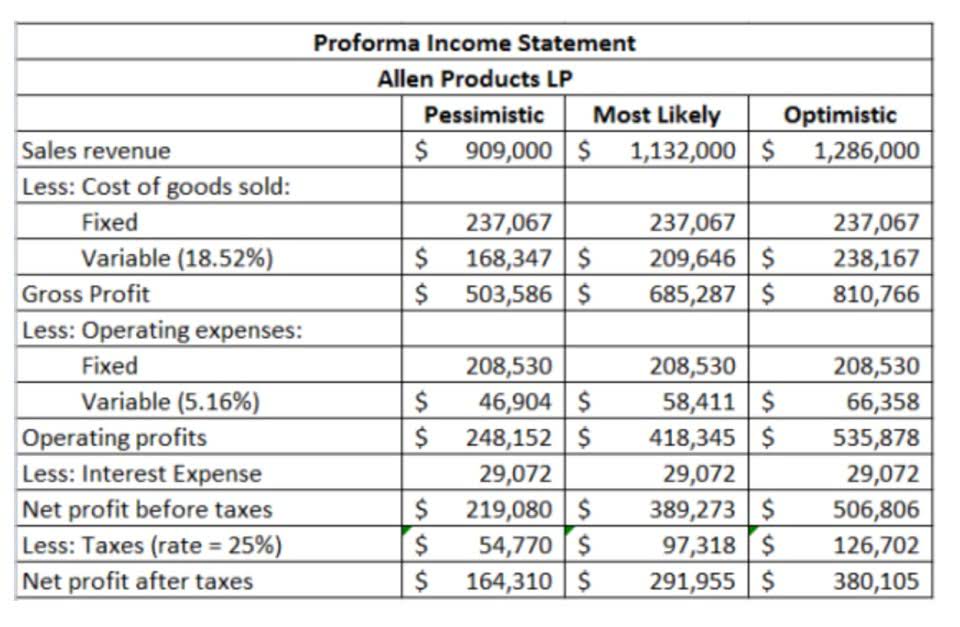

They are used for business planning, investment decision making, and to show the potential impact of a proposed transaction on the company’s financial health. Definition a pro forma financial statement is a projection showing numbers that do not reflect the actual results from a company’s history. In latin, the term “pro forma” is roughly translated as “for form” or “as a matter of form.” so, what is a pro forma statement?

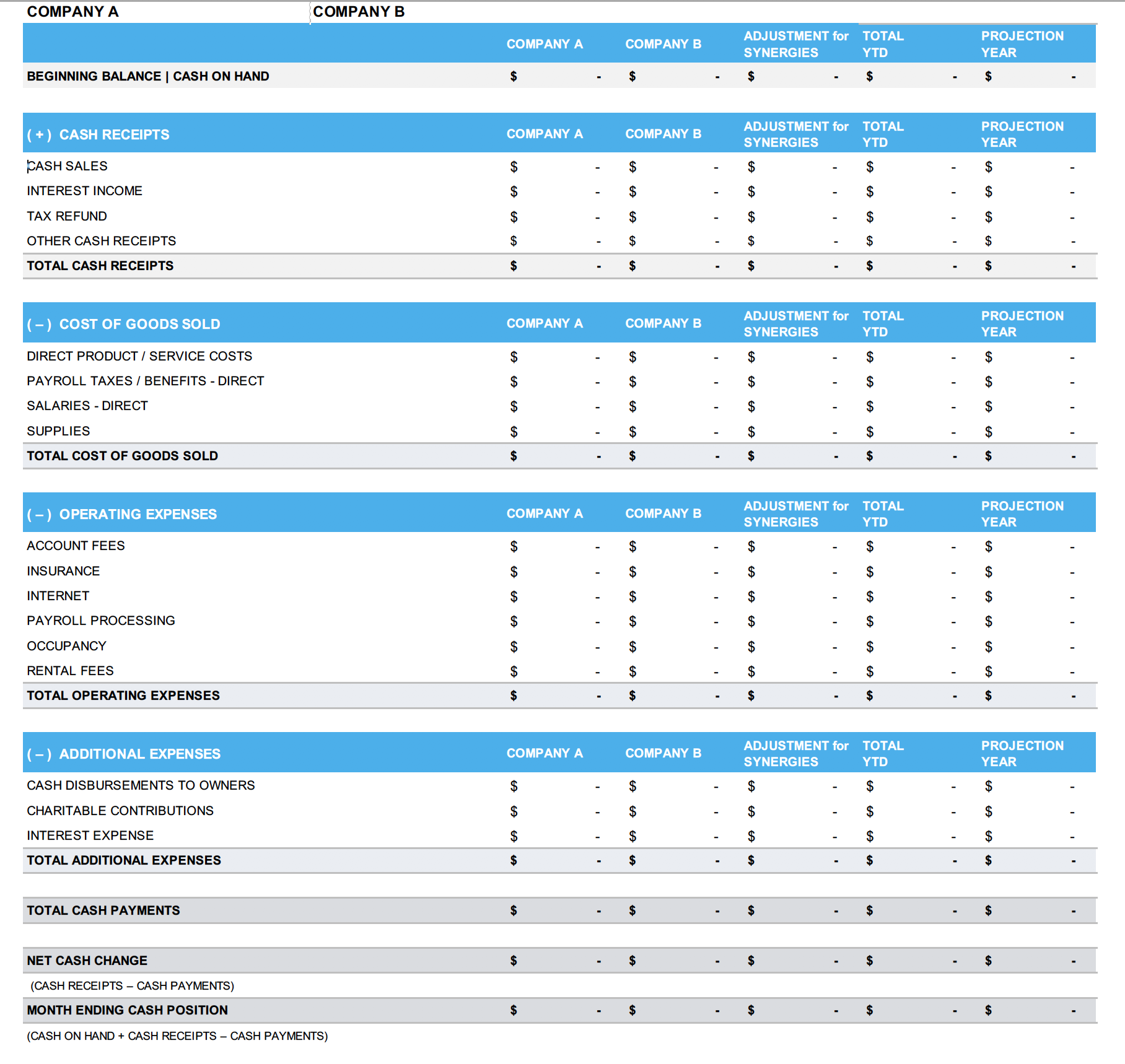

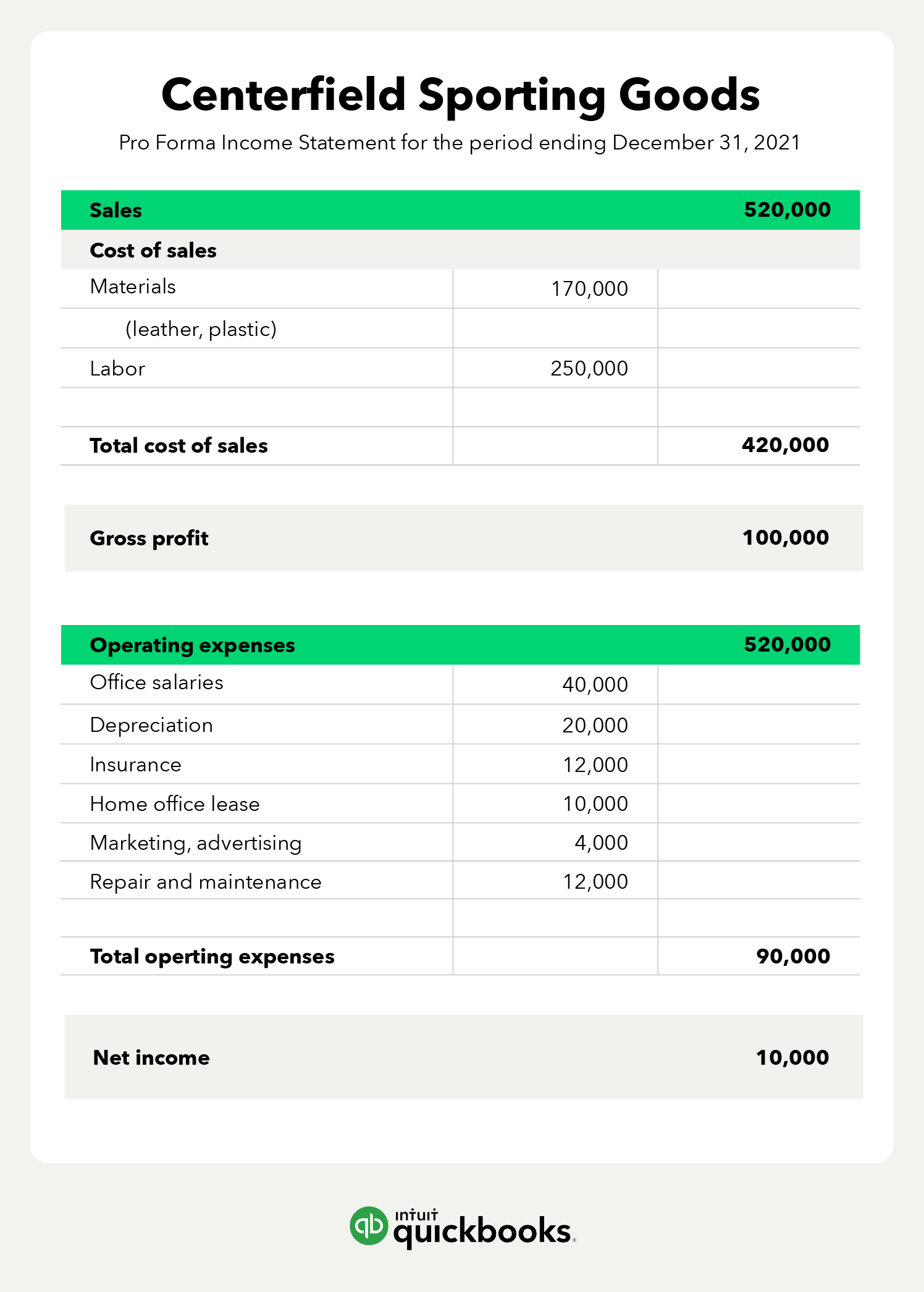

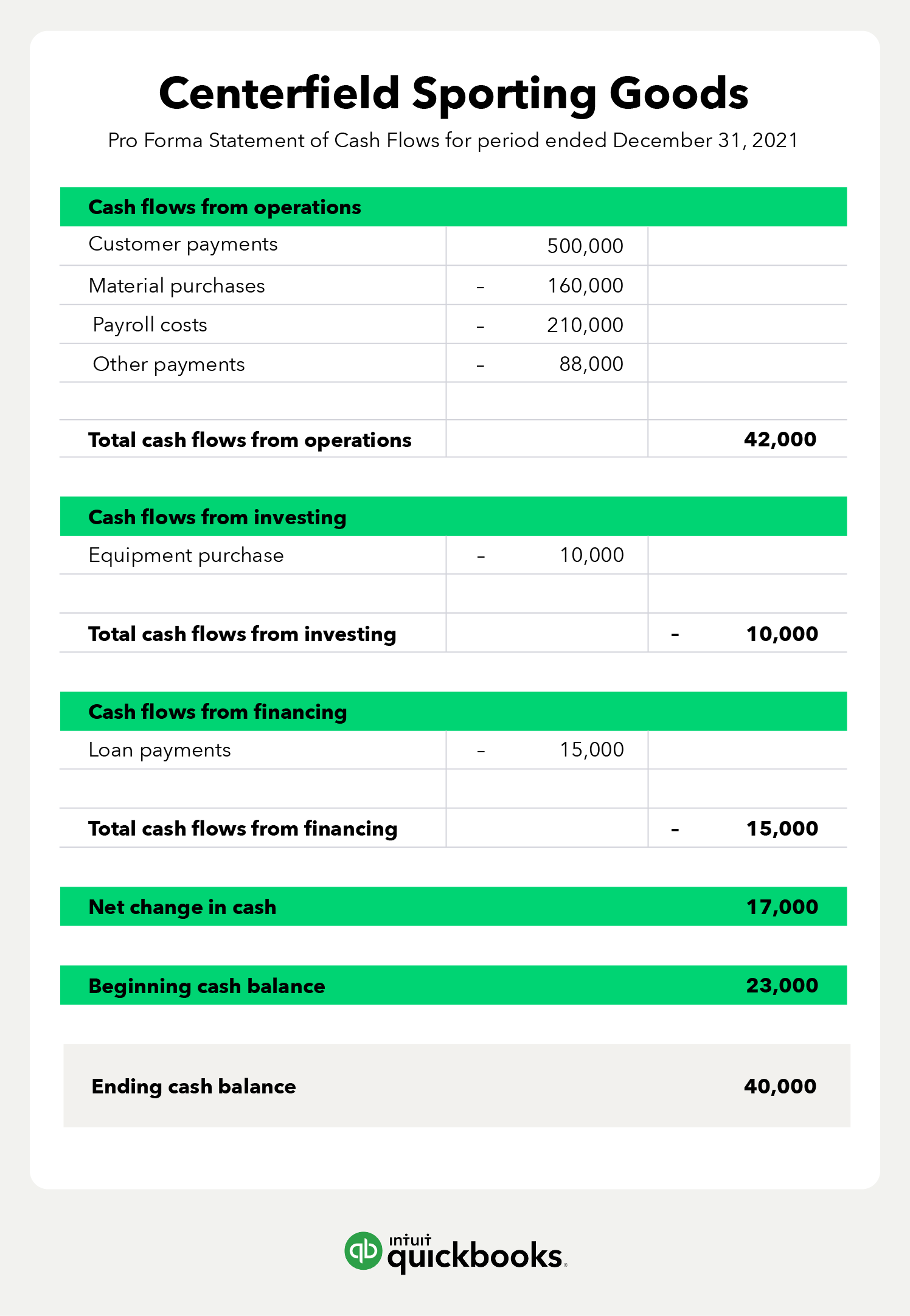

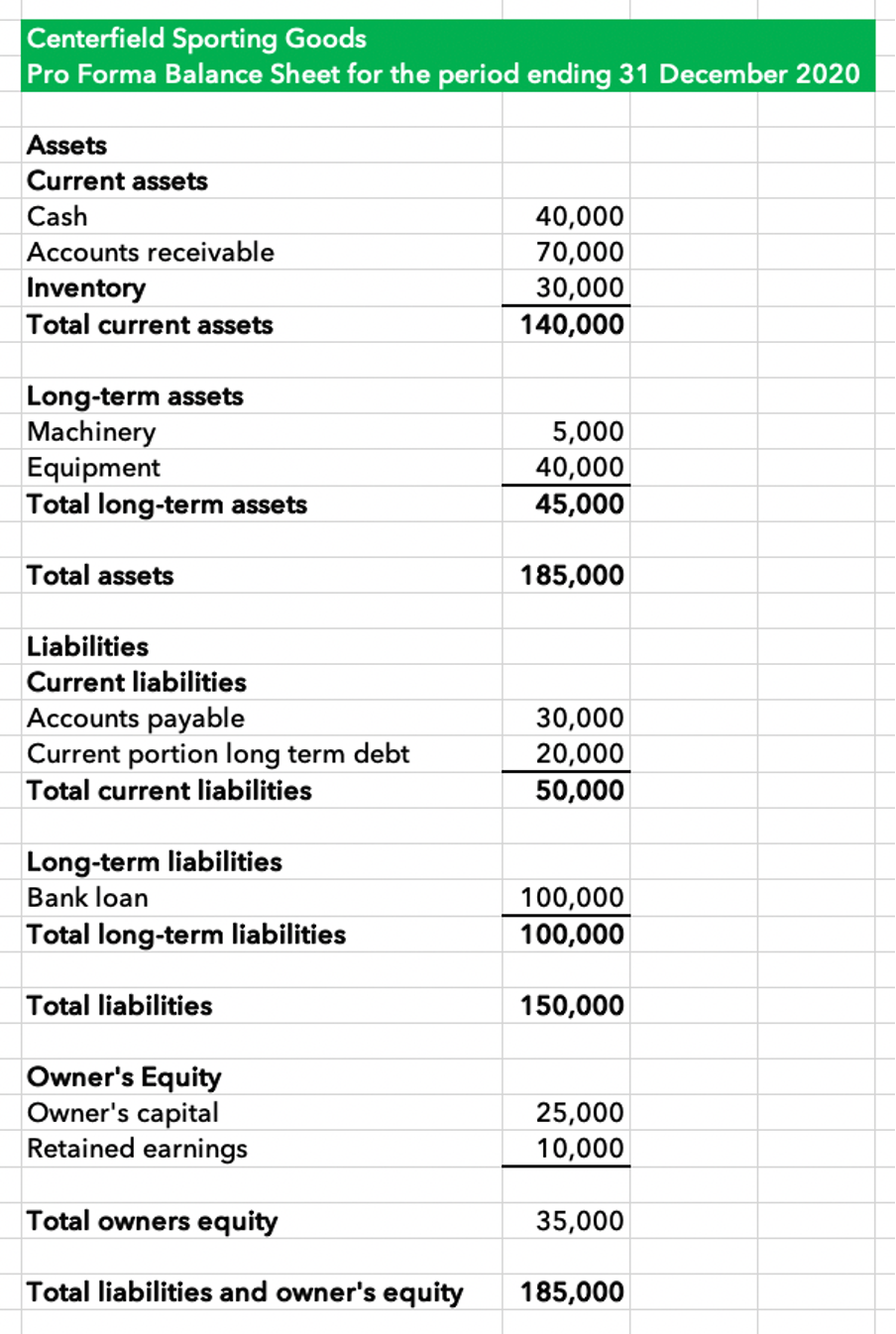

Pro forma statements can include various financial statements such as the balance sheet, income statement, and cash flow statement. A document showing the financial results that a company expects in a particular period: Key takeaways pro forma financial statements illustrate how a company’s financial position might change in.

Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future. Being able to project future financial performance can be valuable for an organization because it can help it adjust its processes or budgets to maximize revenue. It means preparing something with projections or assumptions.

Pro forma financial statements are hypothetical financial reports that project the future financial performance of a company, based on expected income, expenses, assets, and liabilities. Pro forma documents, in any form, are essentially like letters of intent, expressing what an invoice or transaction is anticipated to look like after completion. Pro forma financial statements are preliminary financials that show the effects of proposed transactions as if they actually occurred.

The term 'pro forma' means an estimate or forecast of a financial statement. In the online course financial accounting, pro forma financial statements are defined as “financial statements forecasted for future periods. They may also be referred to as a financial forecast or financial projection.”

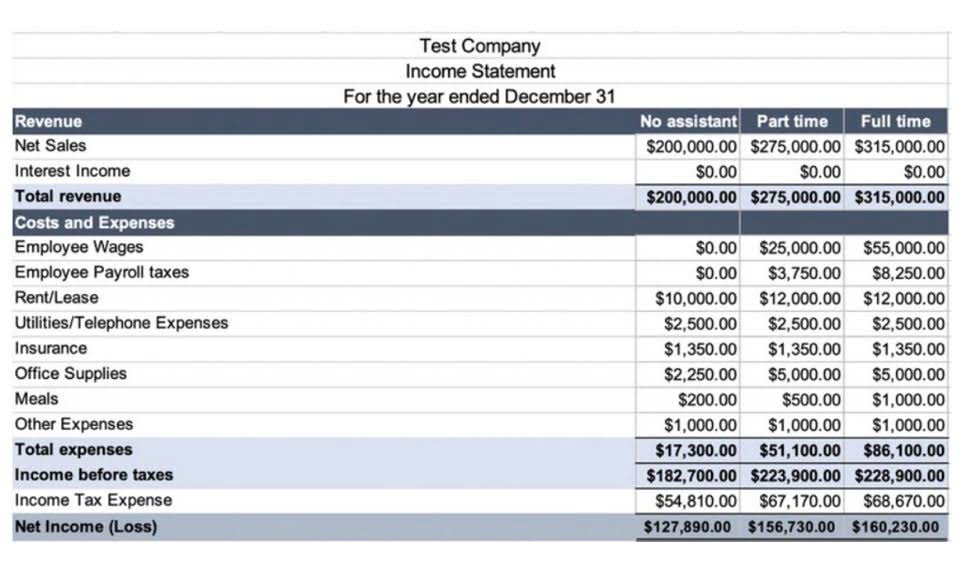

All of these statements and reports can be prepared on a pro forma basis. Pro forma statements allow you to make feasible guesses as to what your financial position will be in the next quarter and year. There are three major pro forma statements:

Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. A pro forma income statement in business plan is the statement prepared by the business entity to prepare the projections of income and expenses, which they expect to have in the future by following certain assumptions such as competition level in the market, size of the market, and growth rate, etc. The term pro forma (latin for as a matter of form or for the sake of form) is most often used to describe a practice or document that is provided as a courtesy or satisfies minimum requirements, conforms to a norm or doctrine, tends to be performed perfunctorily or is considered a formality.

The term pro forma in financial statements refers to the act of calculating future financial results based on projections and assumptions. Pro forma cash flow statements; In financial accounting, pro forma is used for invoices, budgeting, and financial statements.

Pro forma financials may not be. What it means and how to create pro forma financial statements the latin term pro forma, for “as a matter of form, is a method of calculating financial results using certain. Essentially, pro forma financial statements are financial reports based on hypothetical scenarios that utilise assumptions or financial projections.

/pro-forma-invoice--1053078376-3fb3269f97f84b93832c203f105ac972.jpg)