Beautiful Work Info About Outstanding Expenses In Cash Flow Statement Disclosure Requirements Financial Statements

Learn how you can prepare and analyze it.

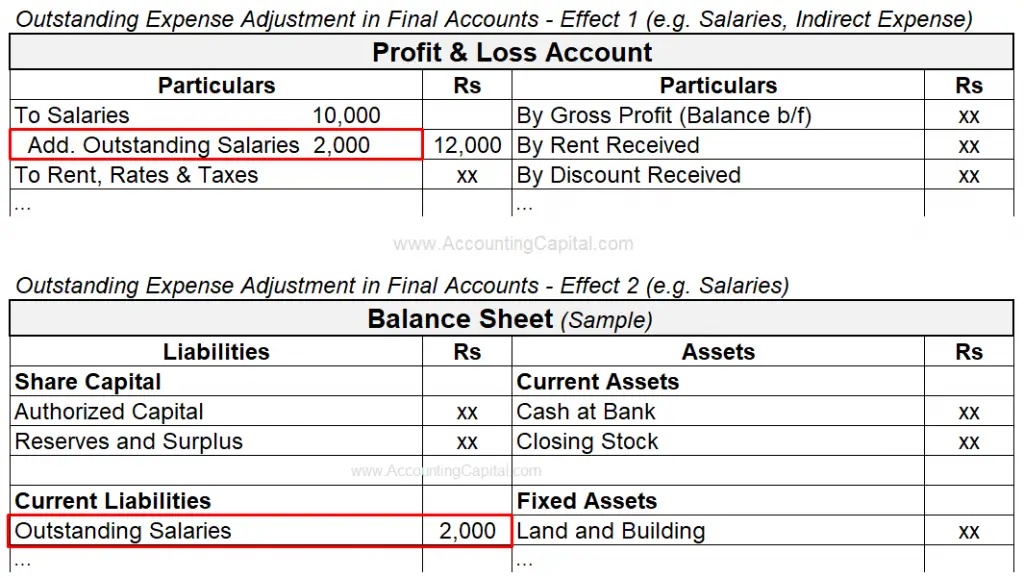

Outstanding expenses in cash flow statement. An outstanding expense is an expense which is due but has not been paid. This expense becomes outstanding to the company when, this has taken the benefit, but the related payment has not been made simultaneously. For accounting accuracy, these expenses need to be realised whether they are paid or not.

It is relevant to the fa (financial accounting) and fr (financial reporting) exams. Usually, these items are outflows from financing activities. To settle the outstanding account payable (foreign exchange gains of.

As the year comes to a close, it’s tim. Profit on sale of land: Therefore, we add $3,000 to the amount of net income.

The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. Outstanding expenses appear within the current. Begin with net income from the income statement.

Why do you need cash flow statements? Interest expense is the expense line item that will appear on the income statement. Cash paid to acquire additional equipment (20,300) cash flow from.

Cash flow from investing activities: Write the opening balance of cash and bank for the year. The time interval (period of time) covered in the scf is shown in its heading.

25% estimate they have more than $20,000 in outstanding receivables; The cash flow statement takes that monthly expense and reverses it—so you see how much cash you have on hand in reality, not how much you’ve spent in theory. Excel | smartsheet don’t let balances owed to your business slip through the cracks.

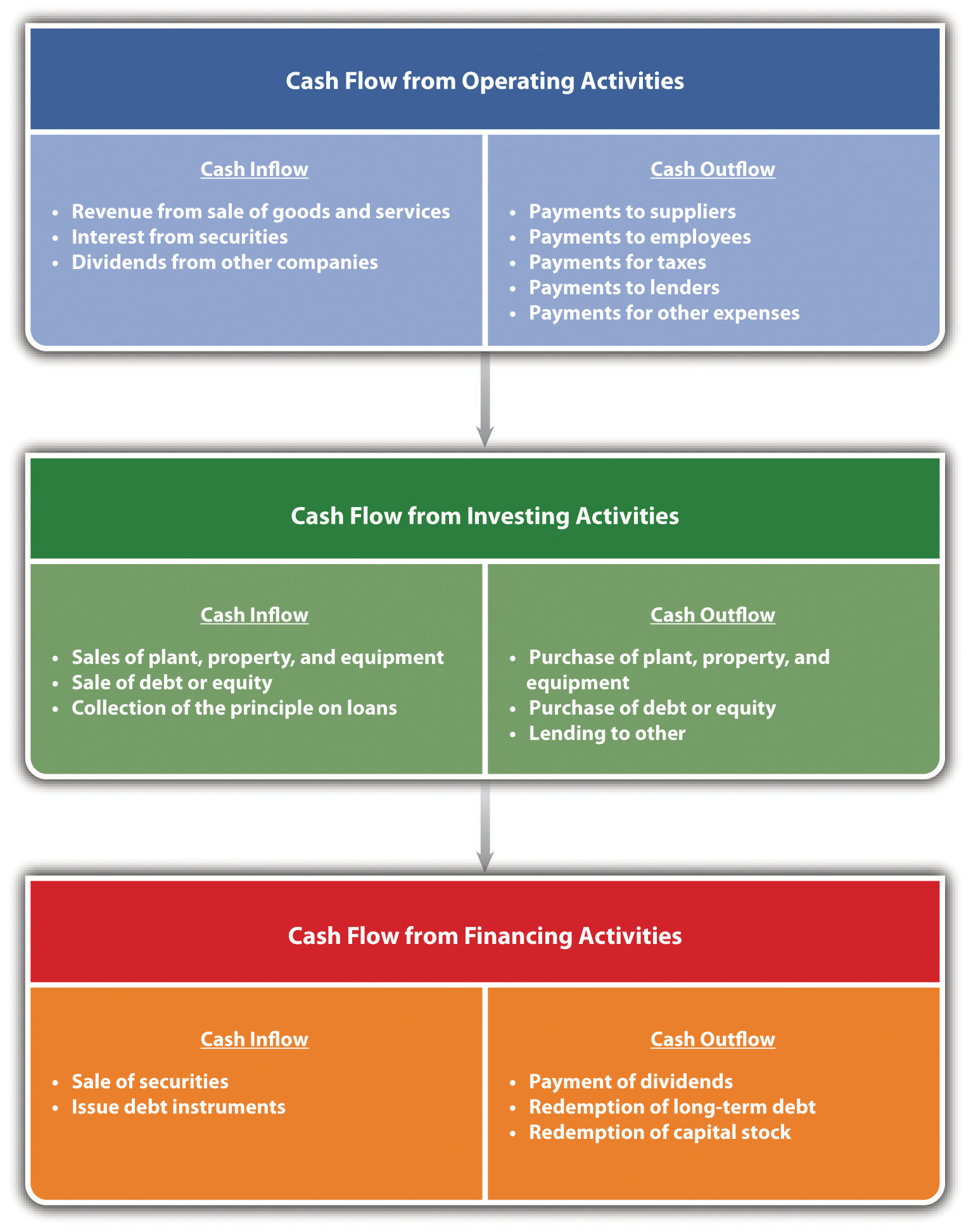

The outstanding expense is a personal account with a credit balance and is treated as a liability for the business. A cash flow statement shows the total amount of money going in and out of your business. Cash flow in a cash flow statement is categorized into cash flow from operations, cash flow from investing and cash flow from financing.

First, a company's profit for the year is $1,500,000 after considering the following items. An outstanding expense is a type of expense that is due but has not been paid. For the year ended december 31, 2021 cash flow from operating activities:

The article will explain how to calculate cash flows and where those cash flows are presented in the statement of cash flows. Companies report interest expenses on the statement of cash flows as financing activities. Items placed under the operating expenses section of a cash flow statement are things that reduce current assets, such as a decrease in inventory or accounts.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)