Lessons I Learned From Tips About Need Of Balance Sheet Gasb Management Discussion And Analysis

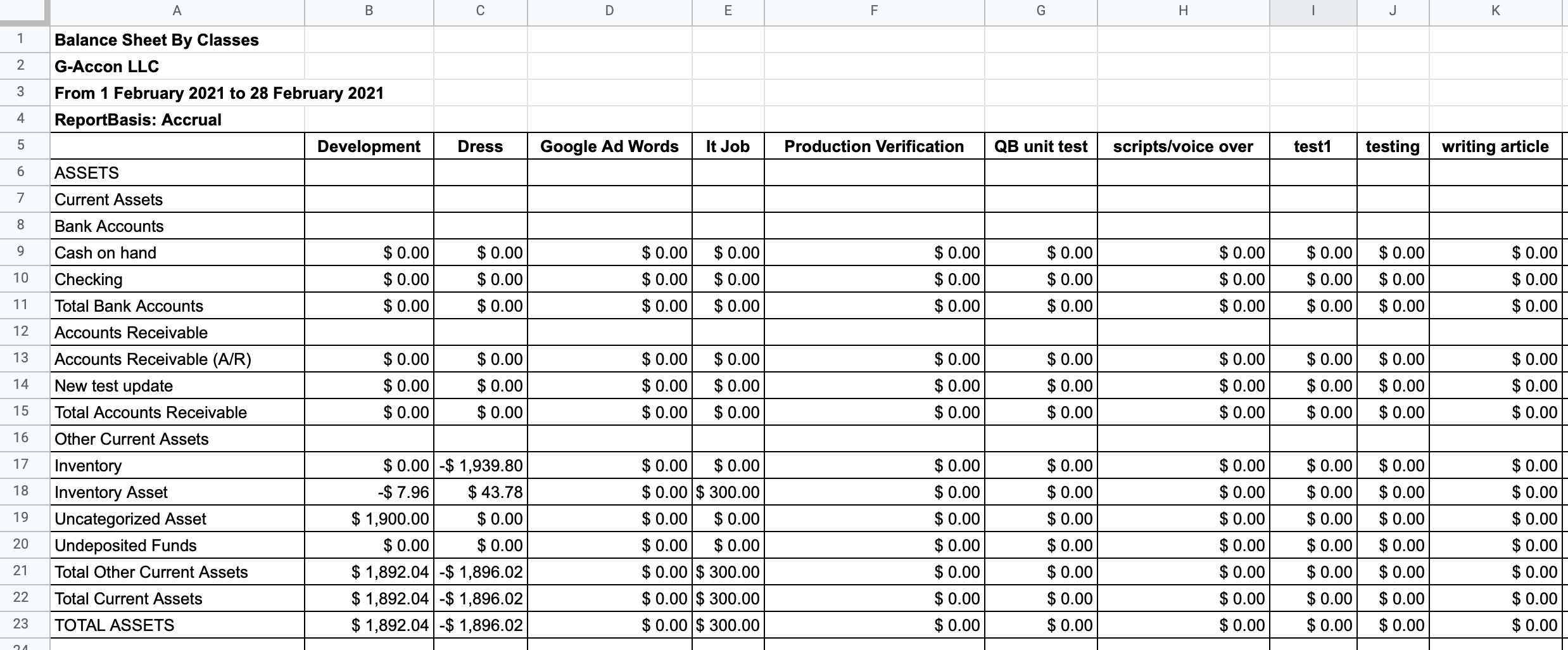

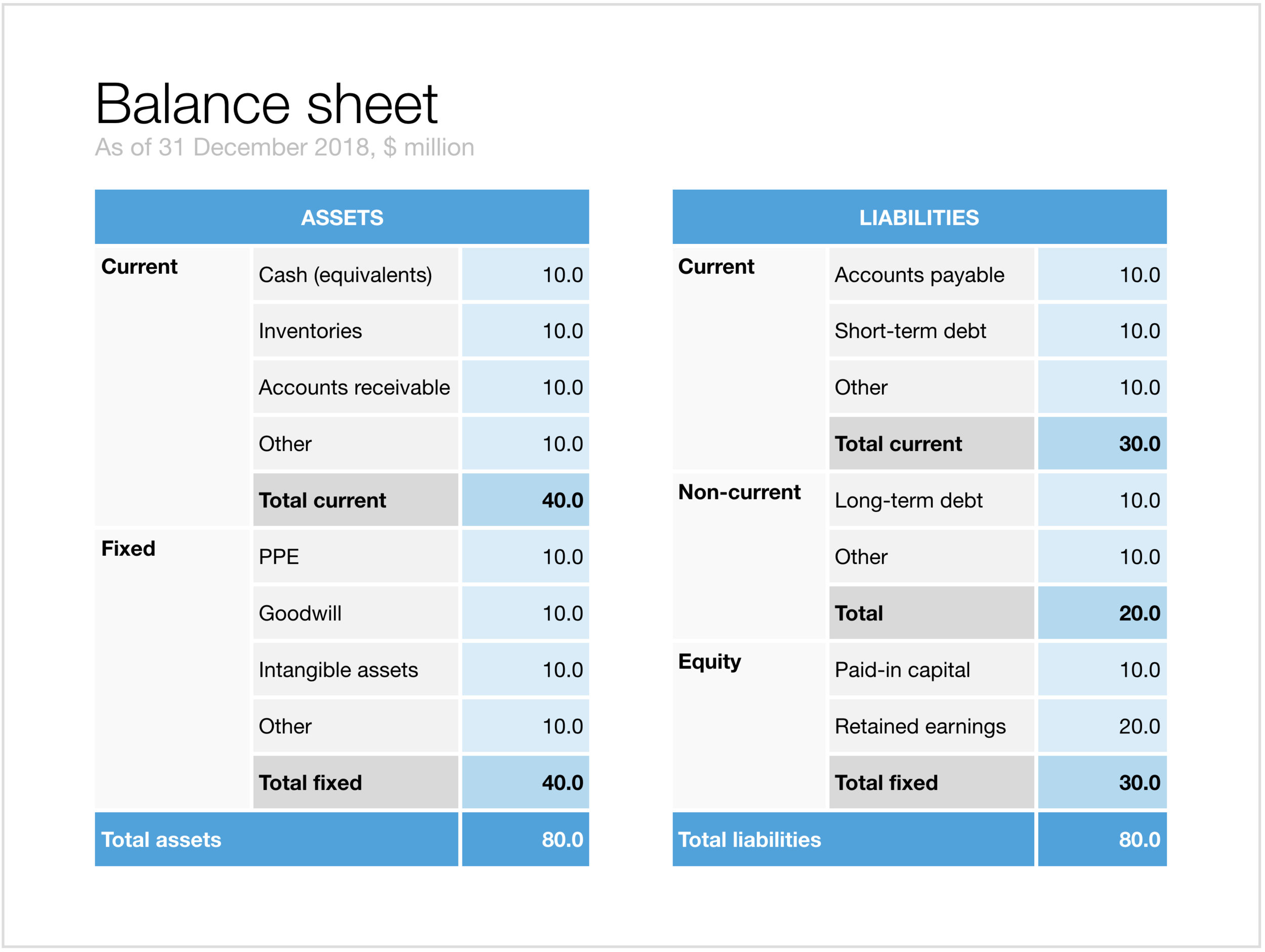

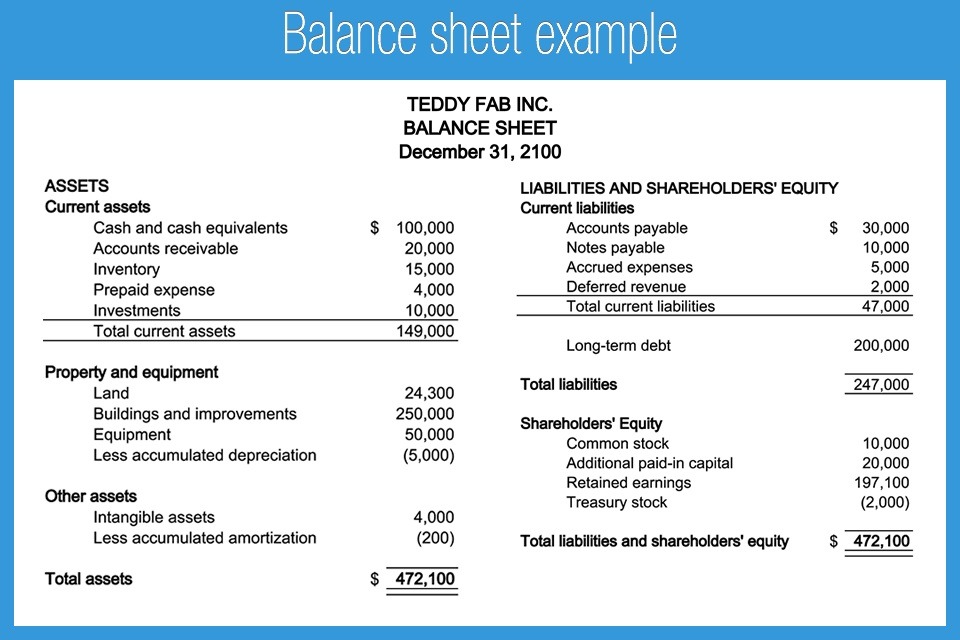

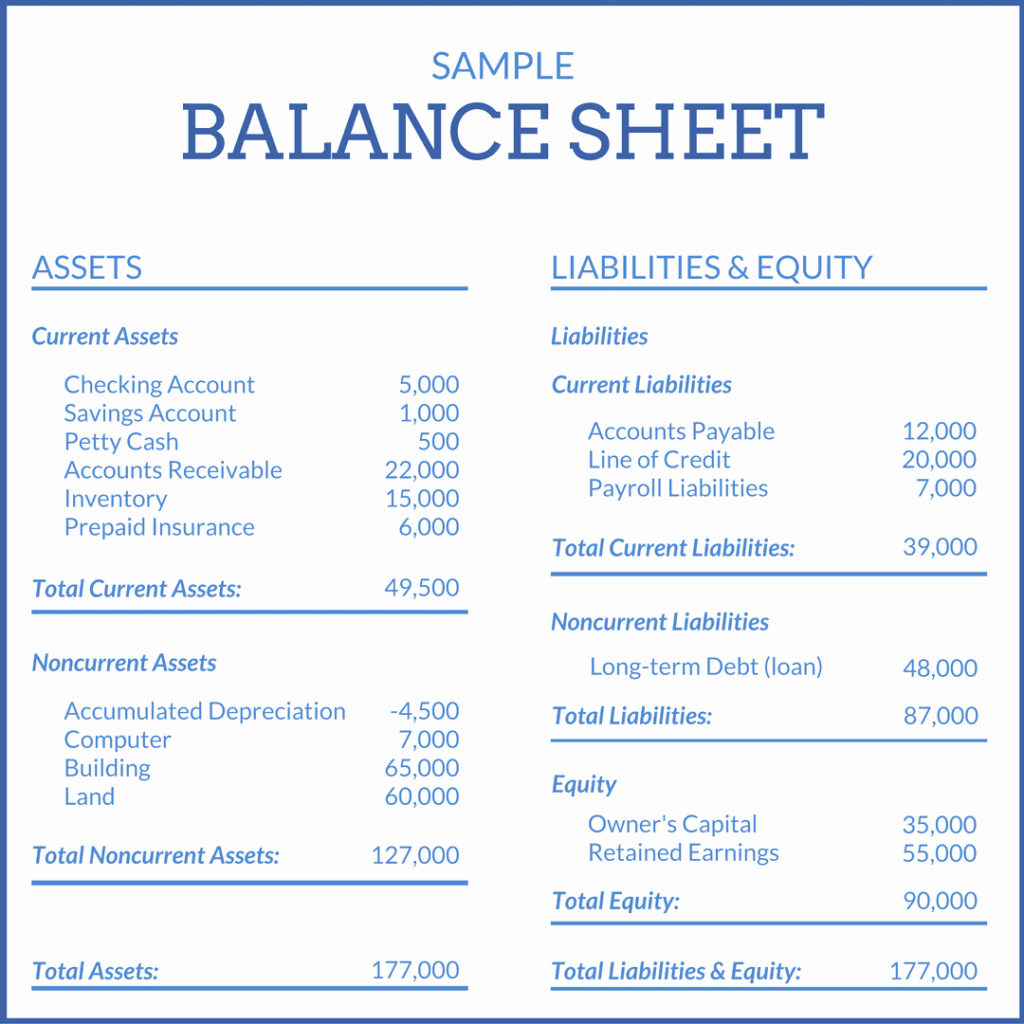

A balance sheet is guided by the accounting equation:

Need of balance sheet. The balance sheet, also known as the statement of financial position, is one of the three key financial statements. At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations or derailing its broader. This means that the assets of a company should equal its liabilities plus any shareholders’ equity that has been issued.

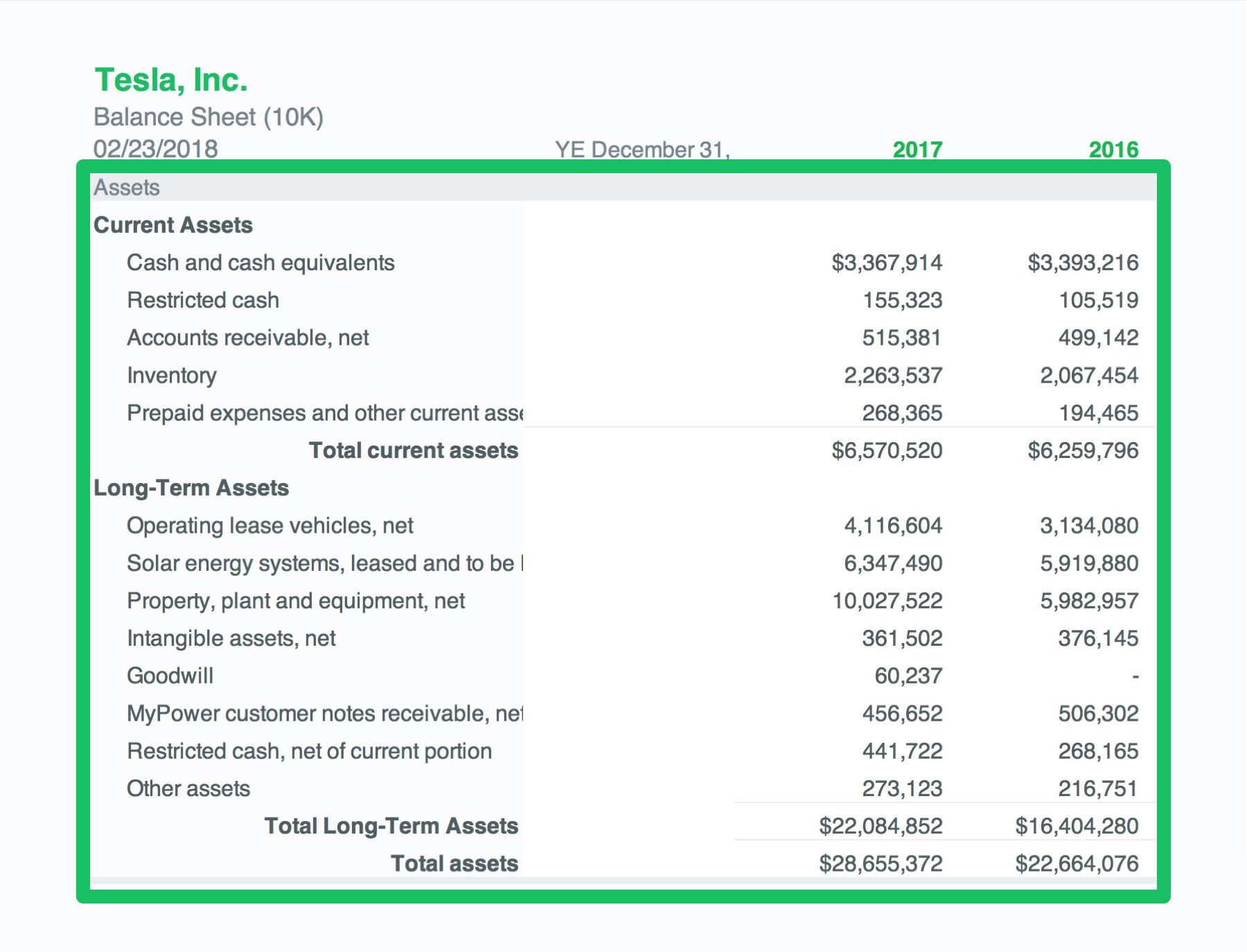

The latest balance sheet data shows that intel had liabilities of us$28.1b due within a year, and liabilities of us$53.6b falling due after that. A balance sheet is a detailed financial statement that breaks down all of a company's assets, liabilities, and equity at a specific time, such as the end of a month, the end of a quarter or the. This loss takes into account the full release of the provision for financial risks, amounting to €6,620 million, which.

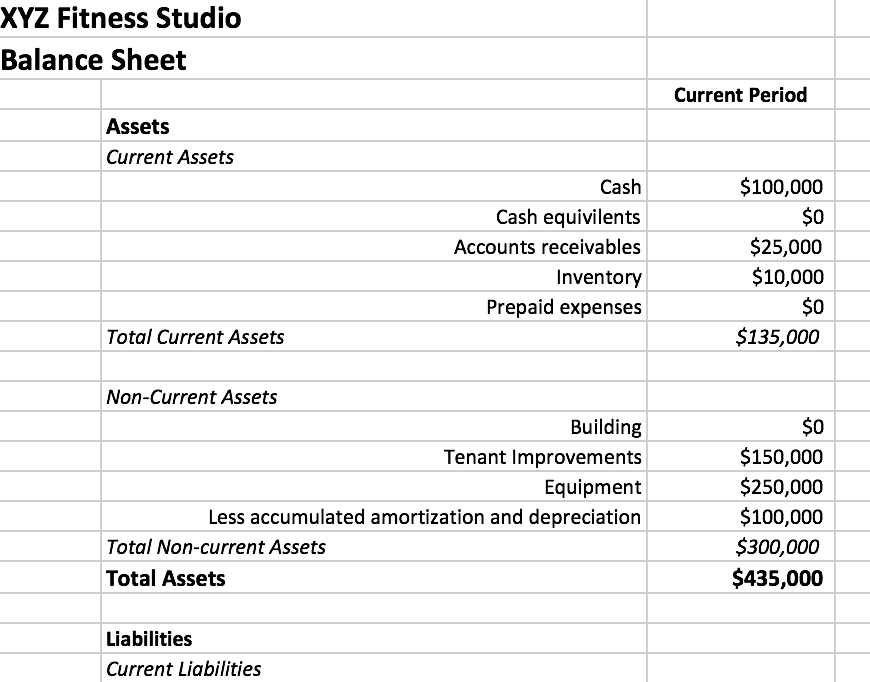

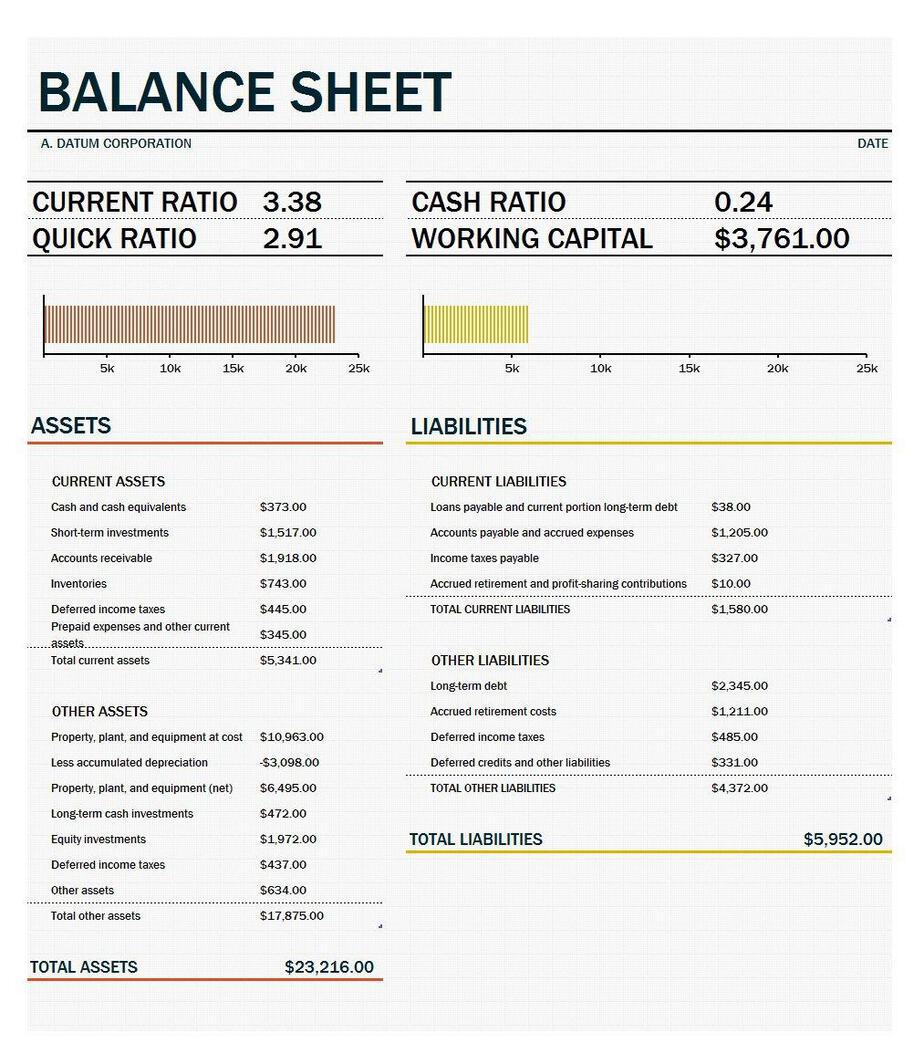

This is an important document for potential investors and loan. Balance sheets report a company's assets, liabilities, and equity at a certain time. Assets go on one side, liabilities plus equity go on the other.

The two sides must balance—hence the name “balance sheet.”. Increasing your liabilities) or getting money from the owners (equity). Why you need a balance sheet the balance sheet provides a picture of the financial health of a business at a given moment in time.

Zero) which will be carried forward on the ecb’s balance sheet to be offset against future profits. A balance sheet provides a summary of a business at a given point in time. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. The balance sheet is a financial statement that is an important component of a company’s final account. The european central bank’s (ecb’s) audited financial statements for 2023 show a loss of €1,266 million (2022:

The balance sheet is based on the fundamental equation: You can begin by adding a series to combine with your existing series. Table of contents the balance sheet explained the balance sheet is one of the three financial statements businesses use to measure their financial performance.

Balance sheet shows the financial position of the business in a systematic and standard form. It is made for use within the company. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity.

It can also be referred to as a statement of net worth or a statement of financial position. Conceptually, the assets of a company (i.e. A company's balance sheet is a snapshot of assets and liabilities at a single point in time.

The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. Dollars, not seasonally adjusted (qbpbstas) units: The cash flow statement shows the.