Fun Info About Operating Activities Indirect Method What Is A Cash Flow Budget

The indirect method and the direct method.

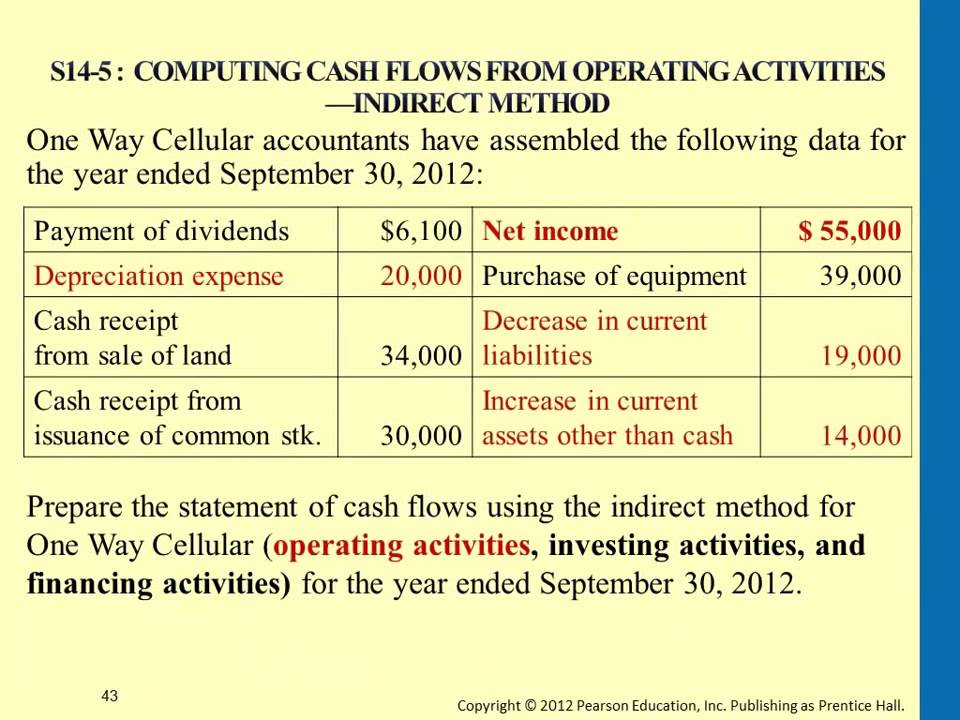

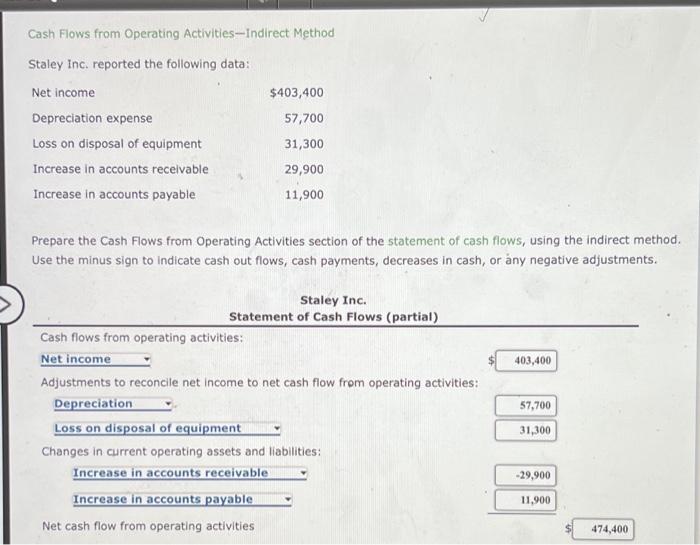

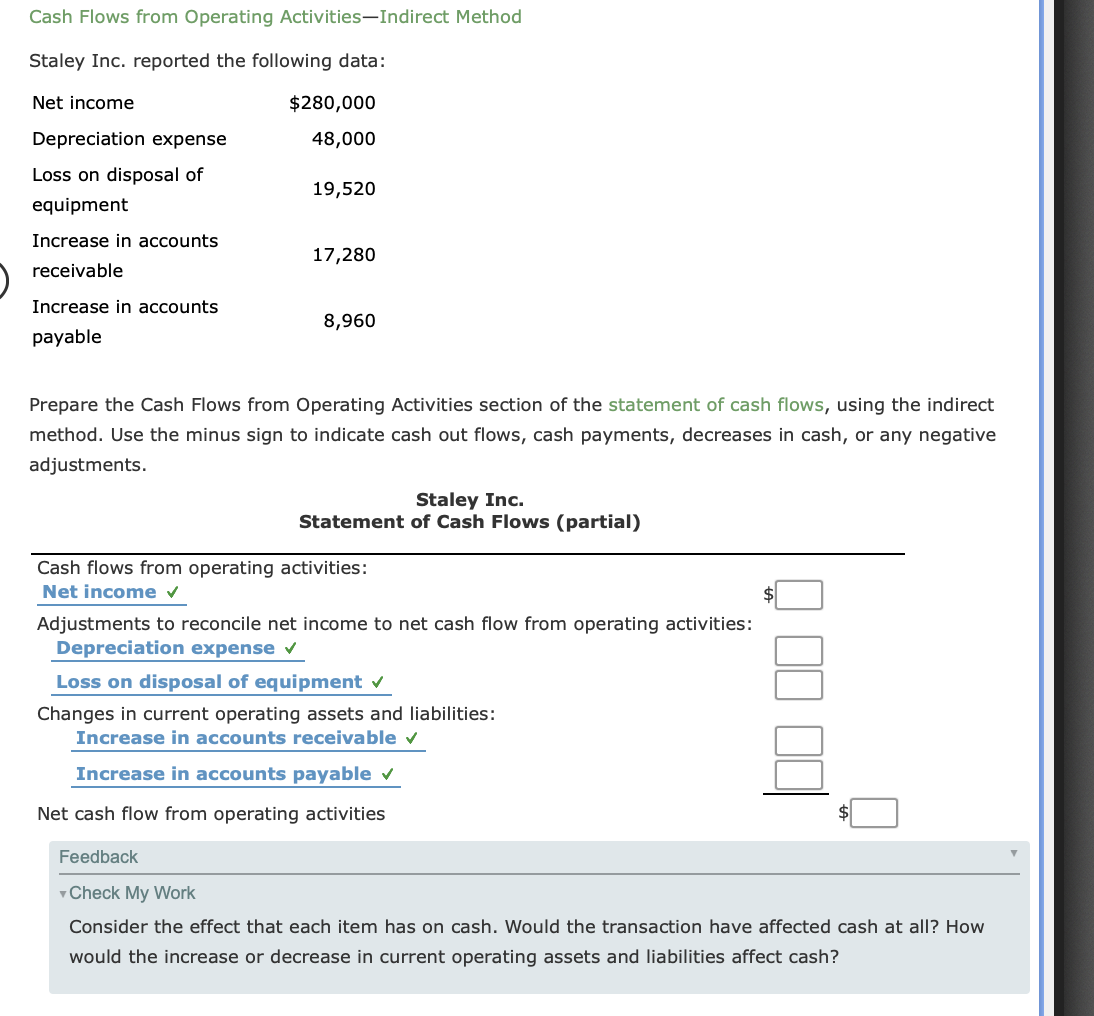

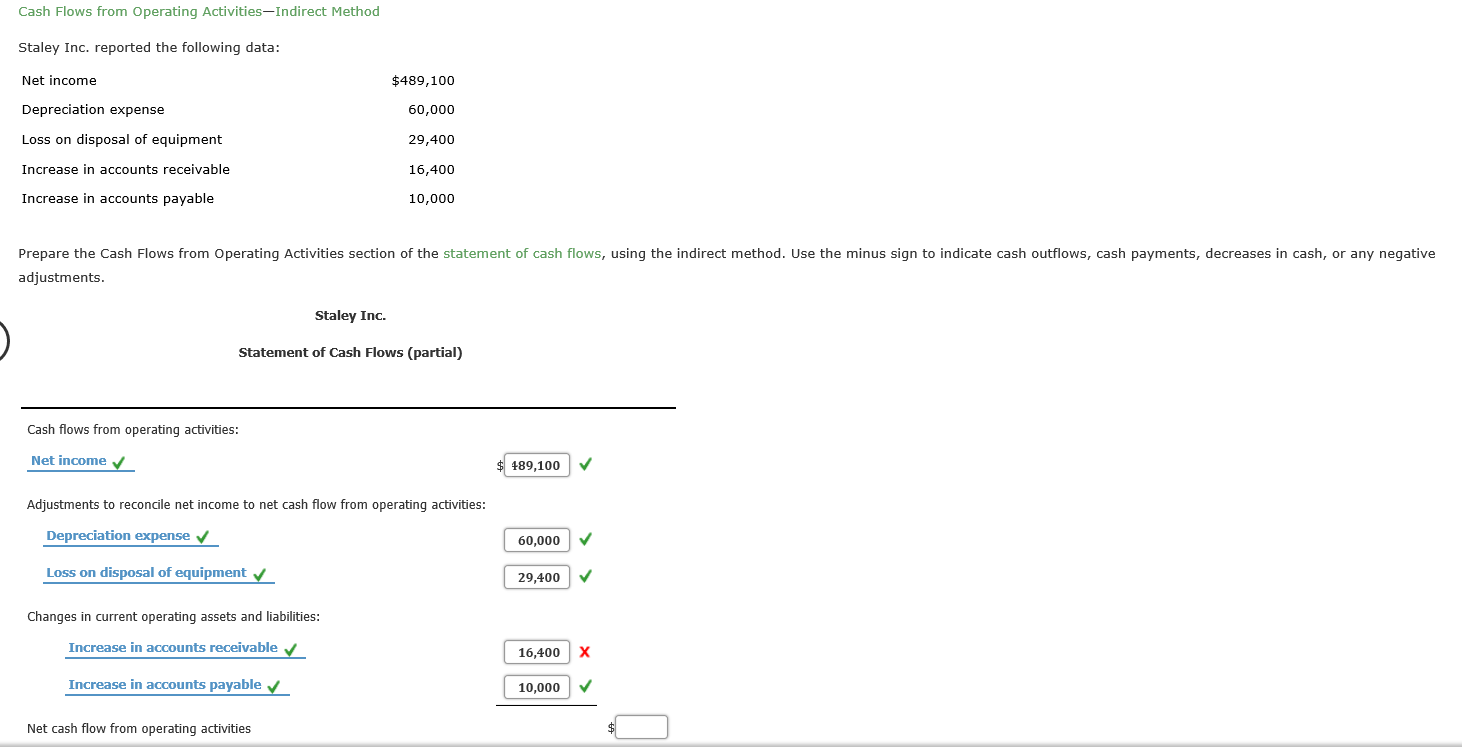

Operating activities indirect method. The indirect method actually follows the same set of. It is the first and perhaps. Determine net cash flows from operating activities.

How does the indirect method of reporting operating activity cash flows differ from the direct method? What is the cash flow statement indirect method? Under indirect method (also known as reconciliation method), we convert net operating income (or loss) to net cash provide (or used) by operating activities during the.

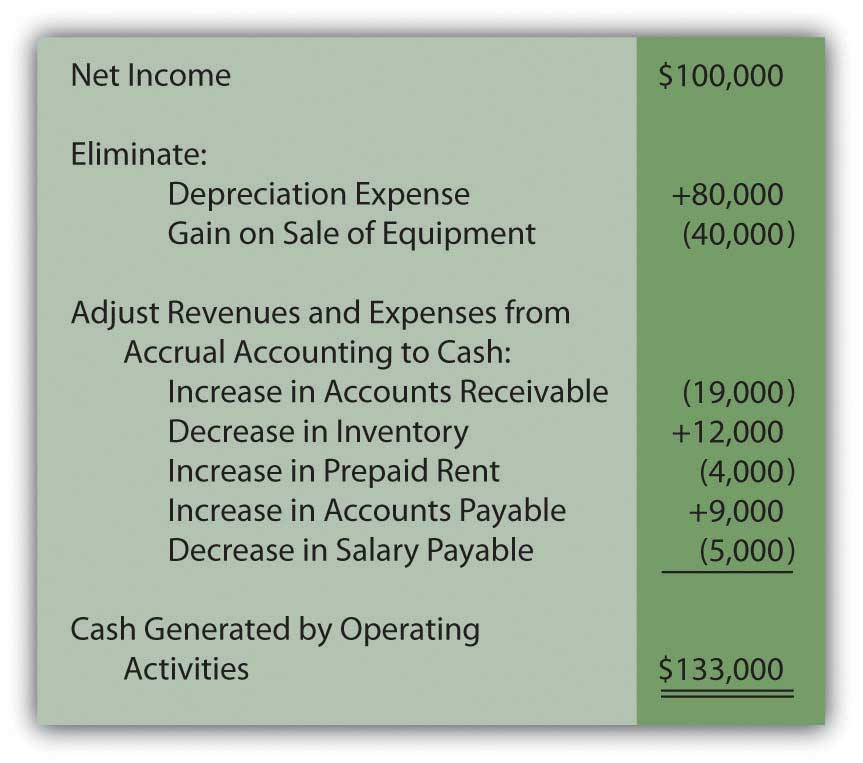

Determine net cash flows from operating activities. Using the indirect method, operating net cash flow is calculated as follows: The following is the indirect method formula to calculate net cash flow from operating activities:

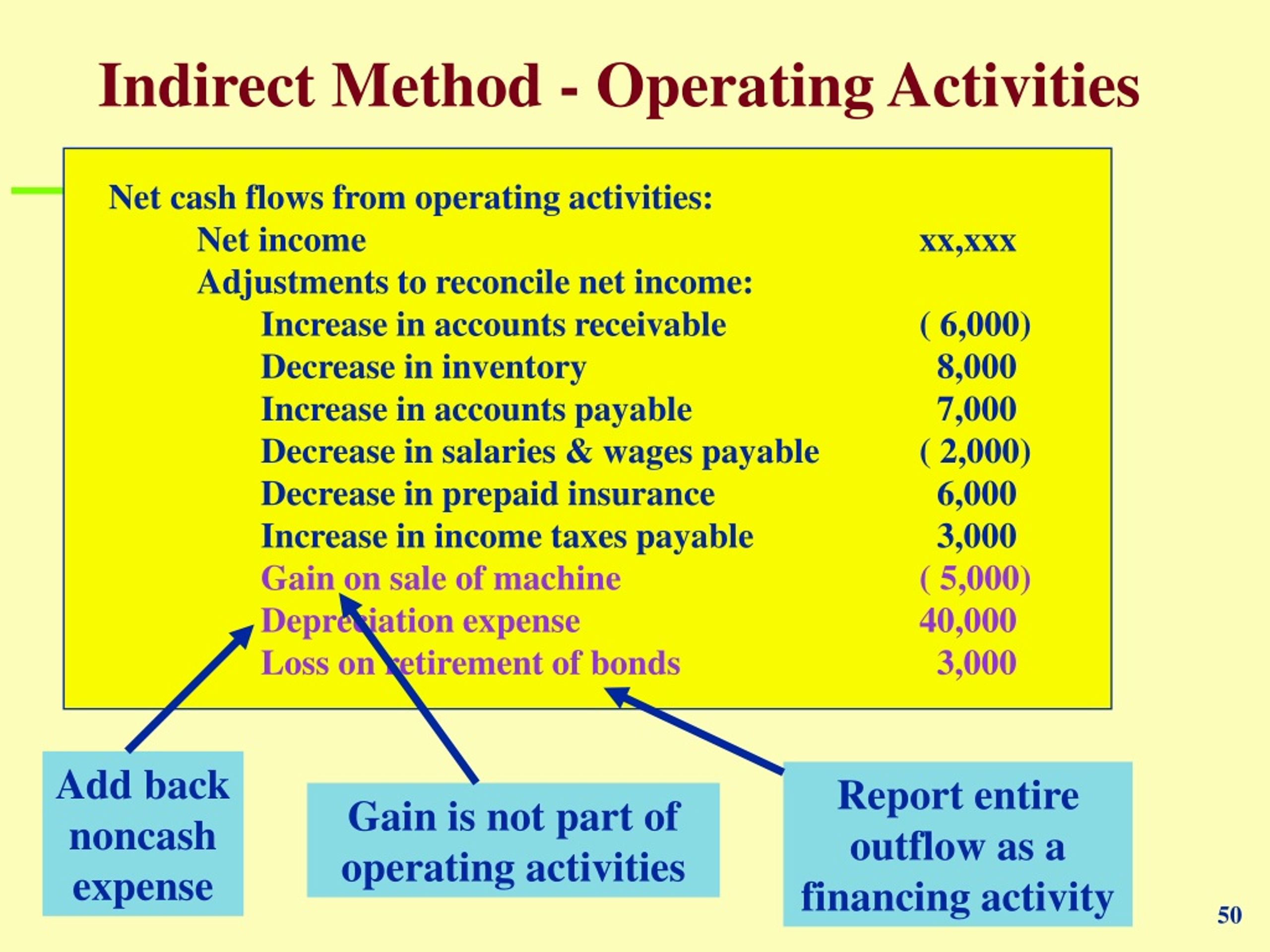

The indirect method only provides the net results of receipts and payments. In this method, you begin with the net income and adjust it to calculate. The operating cash flows section of the statement of cash flows.

The following example shows the format of the cash flows from. Determine net cash flows from operating activities. There are two different ways of starting the cash flow statement, as ias 7, statement of cash flows permits.

How does the indirect method of reporting operating activity cash flows differ from the direct method? Using the indirect method, operating net cash flow is calculated as follows: The indirect method.

The cash flow statement indirect method is one way to present a company’s total cash flow. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with. The operating activities section reports the cash flows that arise from the operating activities of a company during its reporting period.

There are two methods for depicting cash from operating activities on a cash flow statement: Net income, the starting point for the indirect method, is. Begin with net income from the income.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)