What Everybody Ought To Know About Insurance Expense In Balance Sheet Loreal Financial Statement

One does not exist without the other.

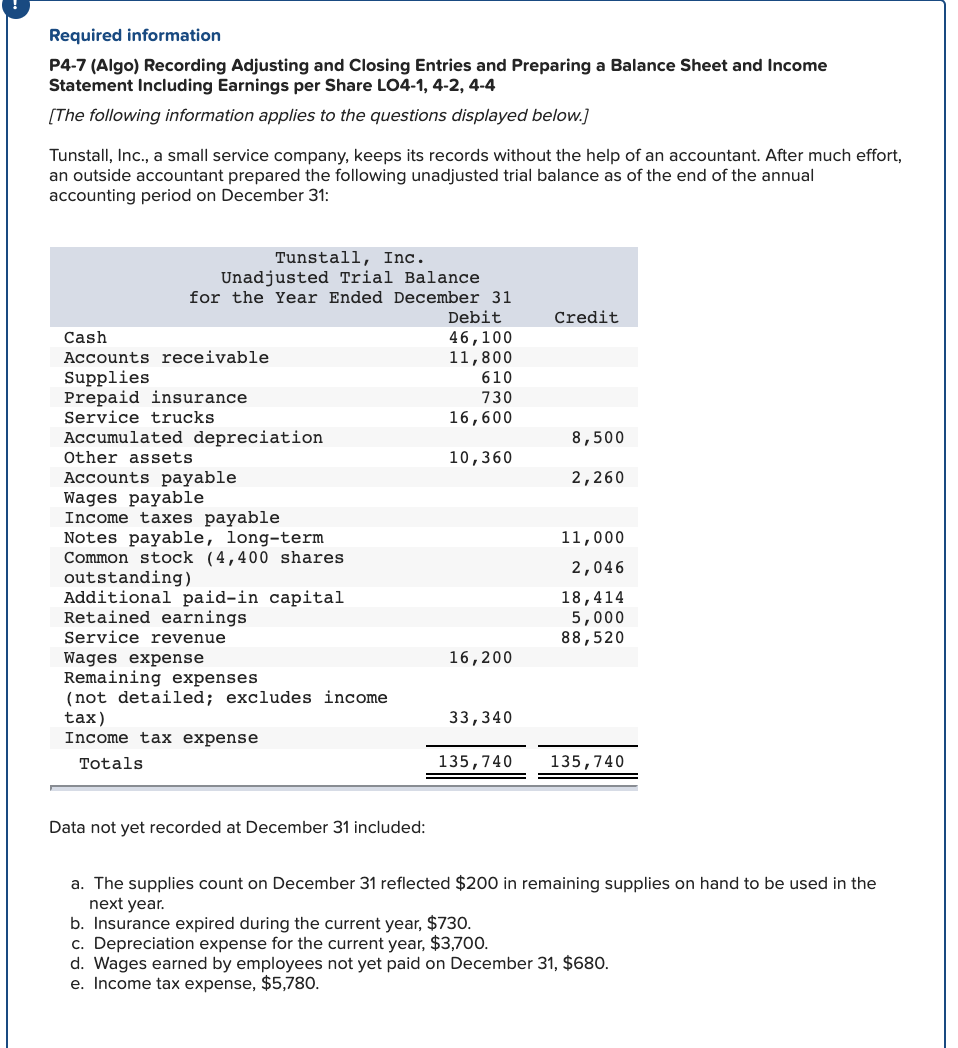

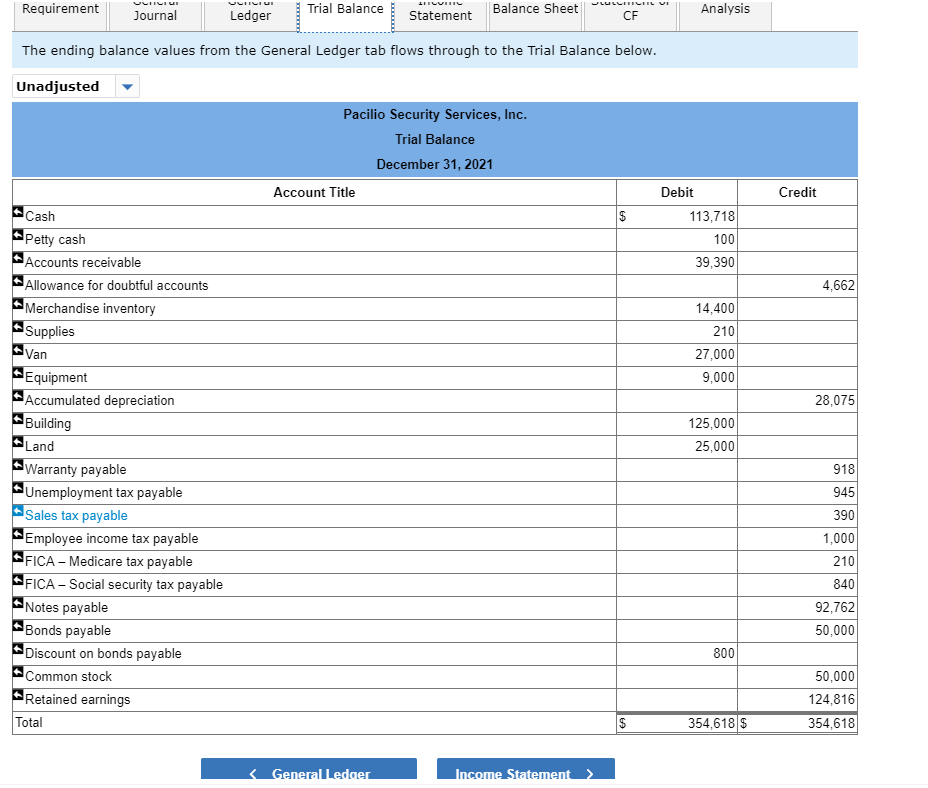

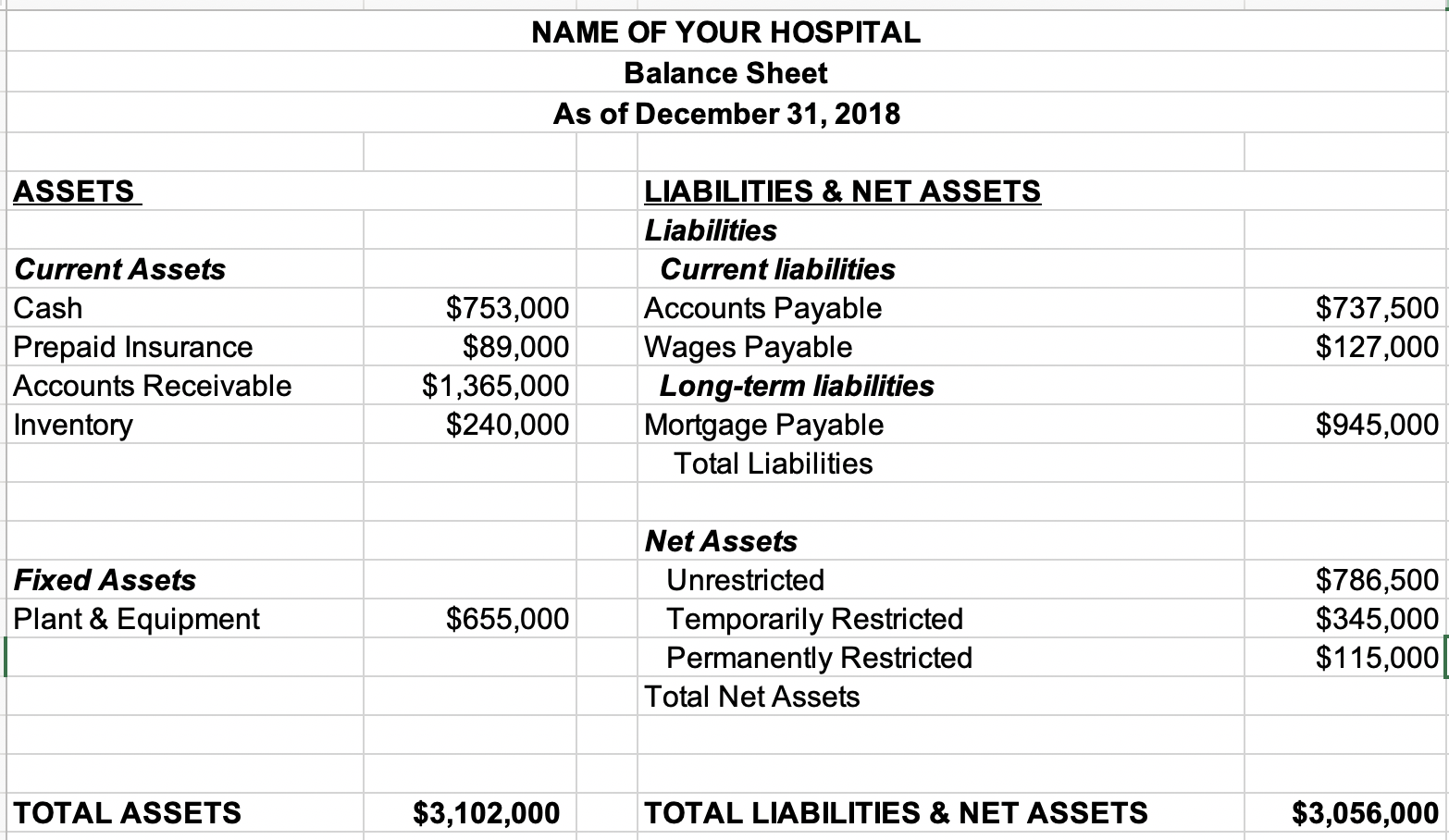

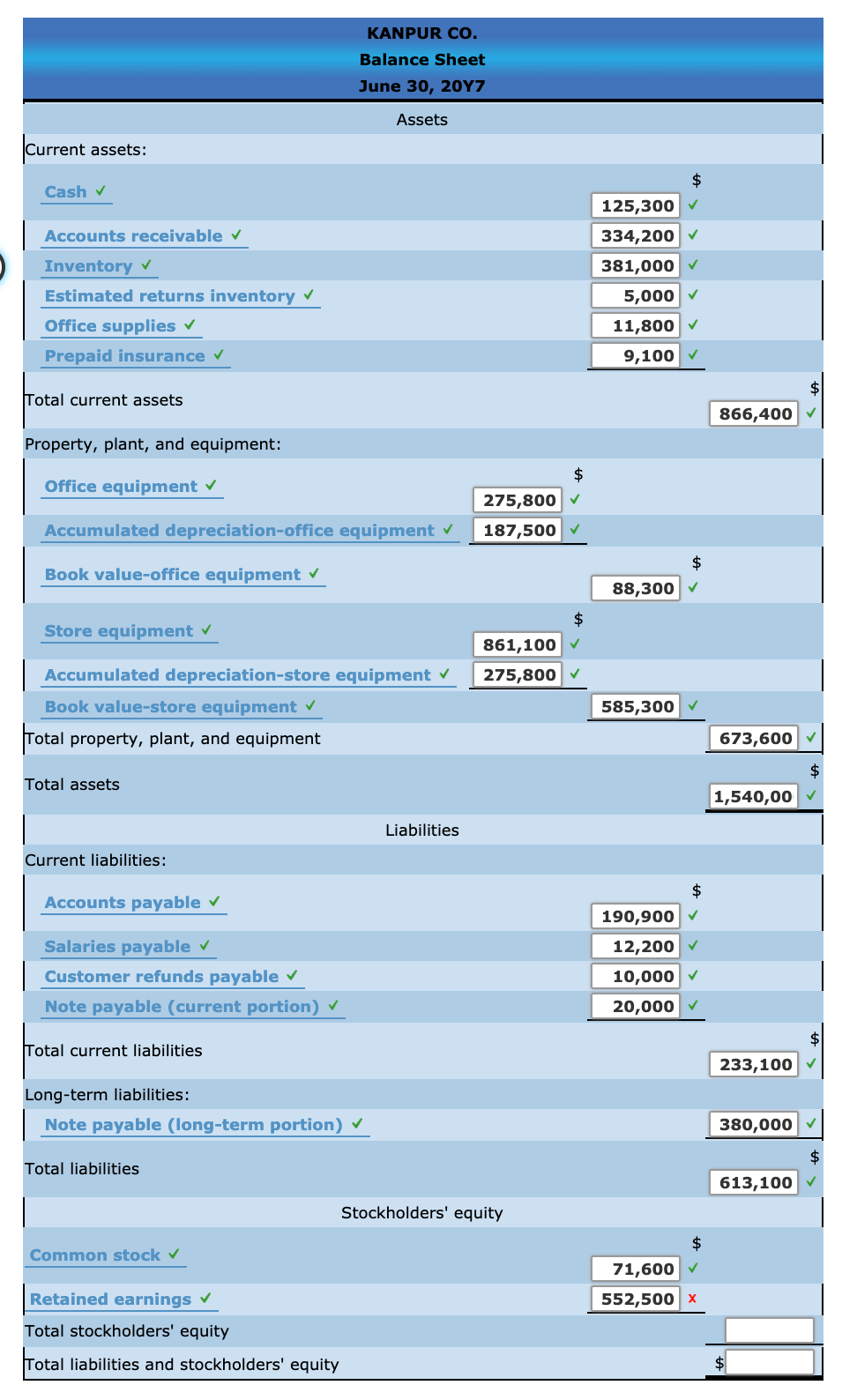

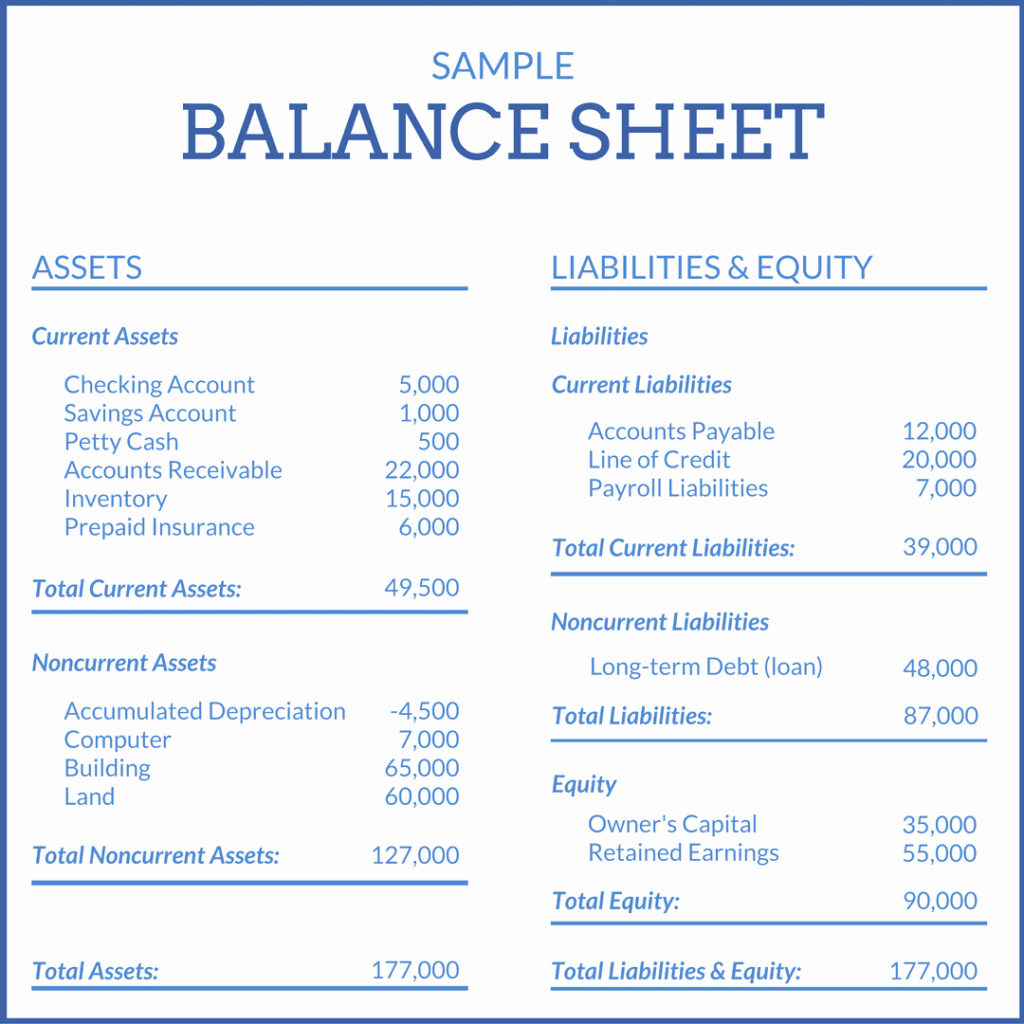

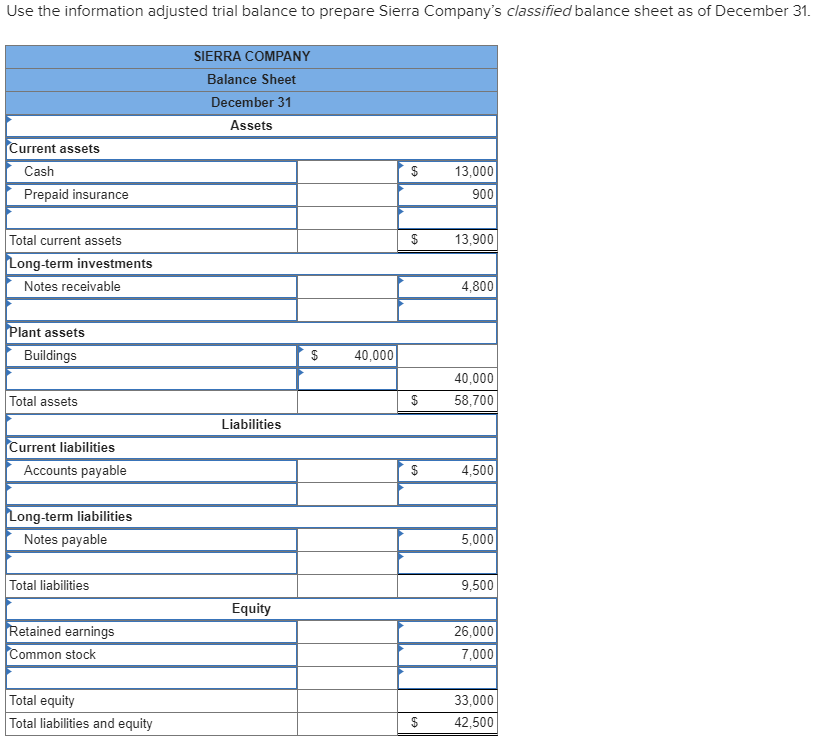

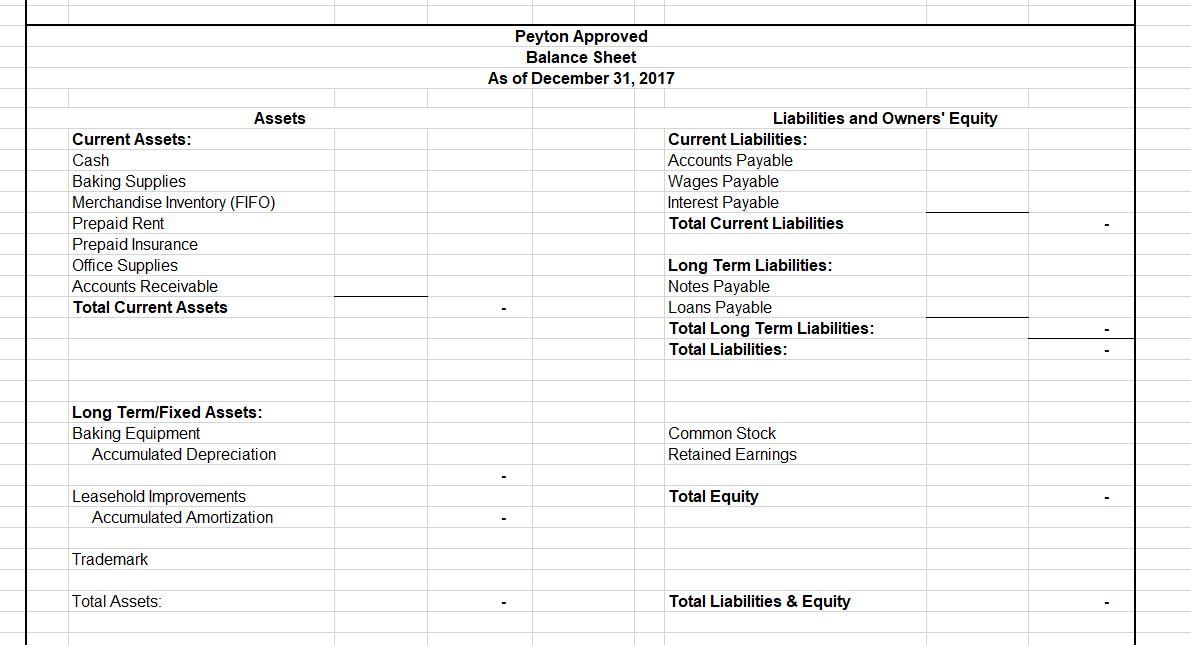

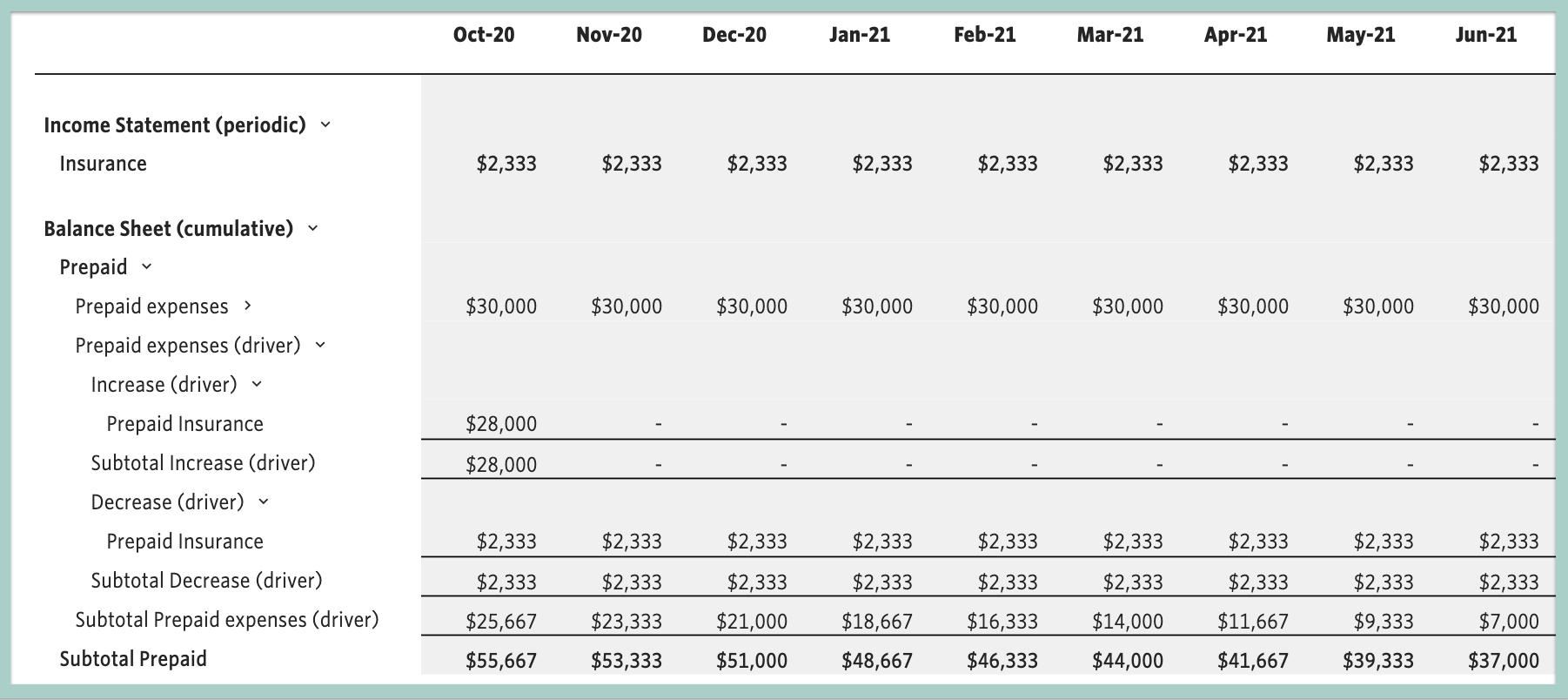

Insurance expense in balance sheet. Adjusting journal entry as the prepaid insurance expires: The current year expense is shown as expenditure in the profit & loss account & insurance expense about future periods is shown as a prepaid expense as current assets in the balance sheet. The balance sheet is one of the three fundamental financial statements.

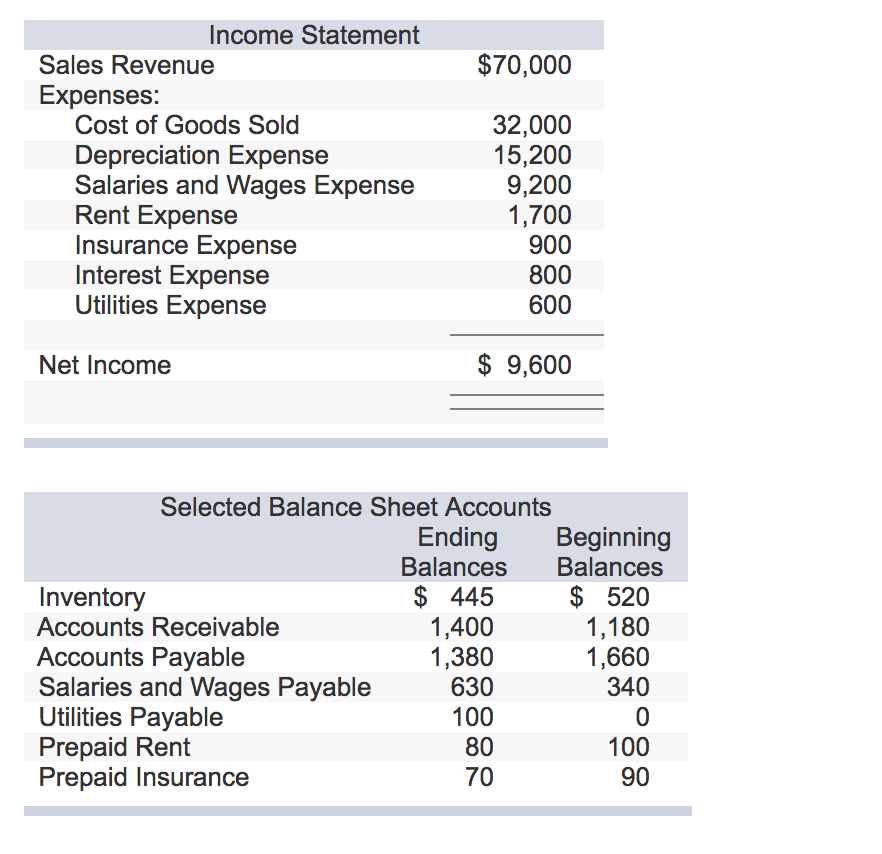

The amount of insurance premiums that have not yet expired should be reported in the current asset account prepaid insurance. Insurance expense does not go on the balance sheet because it reflects a specific amount you have spent, rather than an asset or liability at a particular moment in time. The financial statements are key to both financial modeling and accounting.

Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet. For example, the following screenshot from the balance sheet of tesla (tsla) for fiscal year 2022 illustrates where to find prepaid expenses. An insurance expense occurs after a small business signs up with an insurance provider to receive protection cover.

Insurance payable exists on a company’s balance sheet only if there is an insurance expense. When insurance expense is paid: Insurance expense is also known as the insurance premium.

There would be no need for an insurance payable account if there were no insurance expense. Accounting for insurance expense the amount paid is charged to expense in a period, reflecting the consumption of the insurance over a. The insurance provider charges an annual fee, called a premium, which will cover the business for 12 months.

Most of a company's expenses fall into the following categories: Insurance payable is a part of a corporate balance sheet. The balance in the account prepaid insurance will be the amount that is still prepaid as of the date of the balance sheet.

Therefore, it is shown below in the sample income statement. For insurance companies, balance sheet reserves represent the amount of money insurance companies set aside for future insurance claims or claims that have been filed but not yet reported. In statutory accounting, the initial section includes a balance sheet, an income statement and a section known as the capital and surplus account, which sets out the major components of policyholders’ surplus and changes in the account during the year.

Insurance revenue and expenses 56 2.4.1. Insurance expense and insurance payable are two different things, yet they are interrelated. Insurance service expenses (9,069) (8,489) incurred claims and insurance contract expenses (7,362) (7,012) insurance contract acquisition costs (1,259) (1,150) gain or (loss) from reinsurance (448) (327) insurance service result 787 78 balance sheet 20x1 20x0 financial assets 226,297 196,700 reinsurance contract assets 20,572 17,882

Insurance expense is that amount of expenditure paid to acquire an insurance contract. Composition of the balance sheet 55 2.4. What is insurance expense?

This expense is incurred for all insurance contracts, including property, liability, and medical insurance. Expected recognition of the contractual service margin 61 2.5. Insurance spending does demonstrate up on the balance sheet sidelong, though, because a business will have less cash remain after it makes its insurance online.