Real Tips About Net Working Capital Cash Flow Statement Current Assets And Liabilities Examples

Fundamentals of corporate finance what is net cash flow?

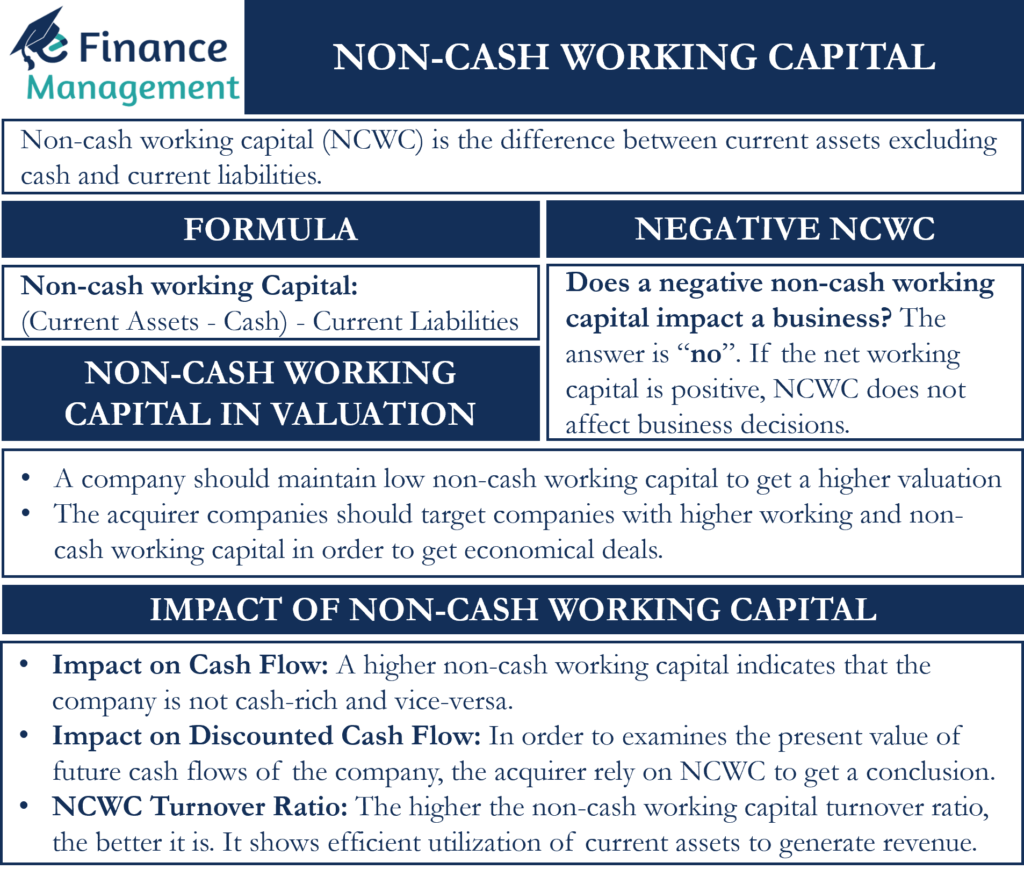

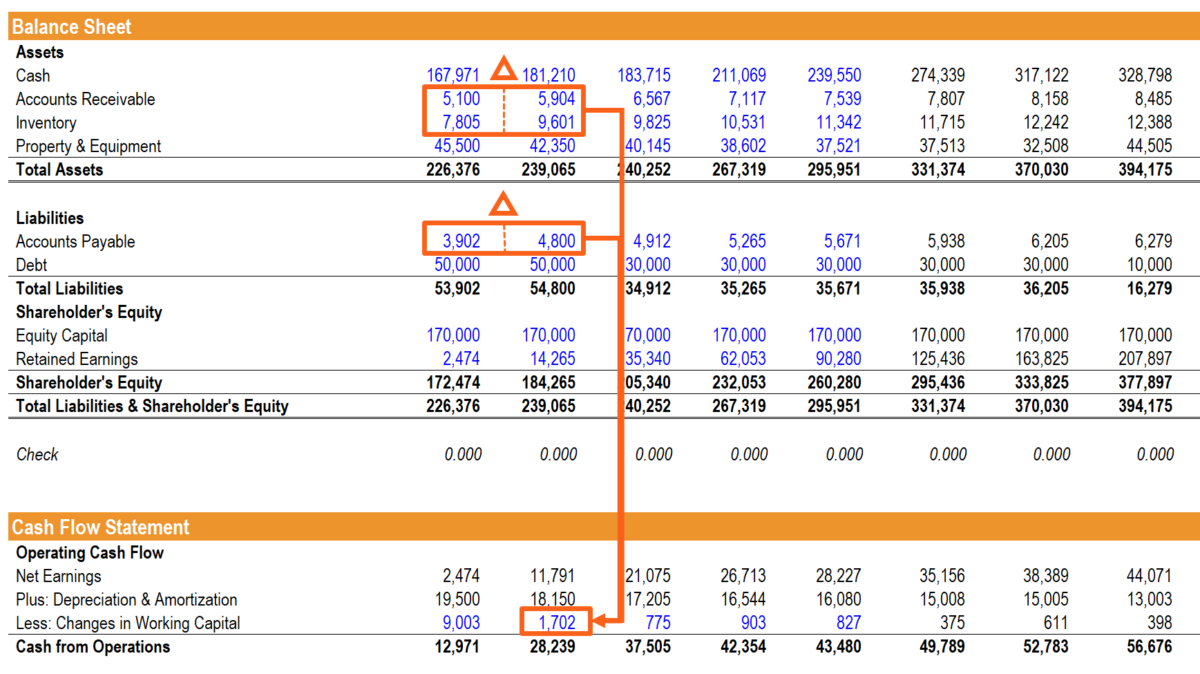

Net working capital cash flow statement. In accounting, the “change in nwc” section of the cash flow statement tracks the net change in operating assets and. How is working capital presented on the cash flow statement? The above steps are commonly used by the management and stakeholders to calculate the value of net working capital equation.

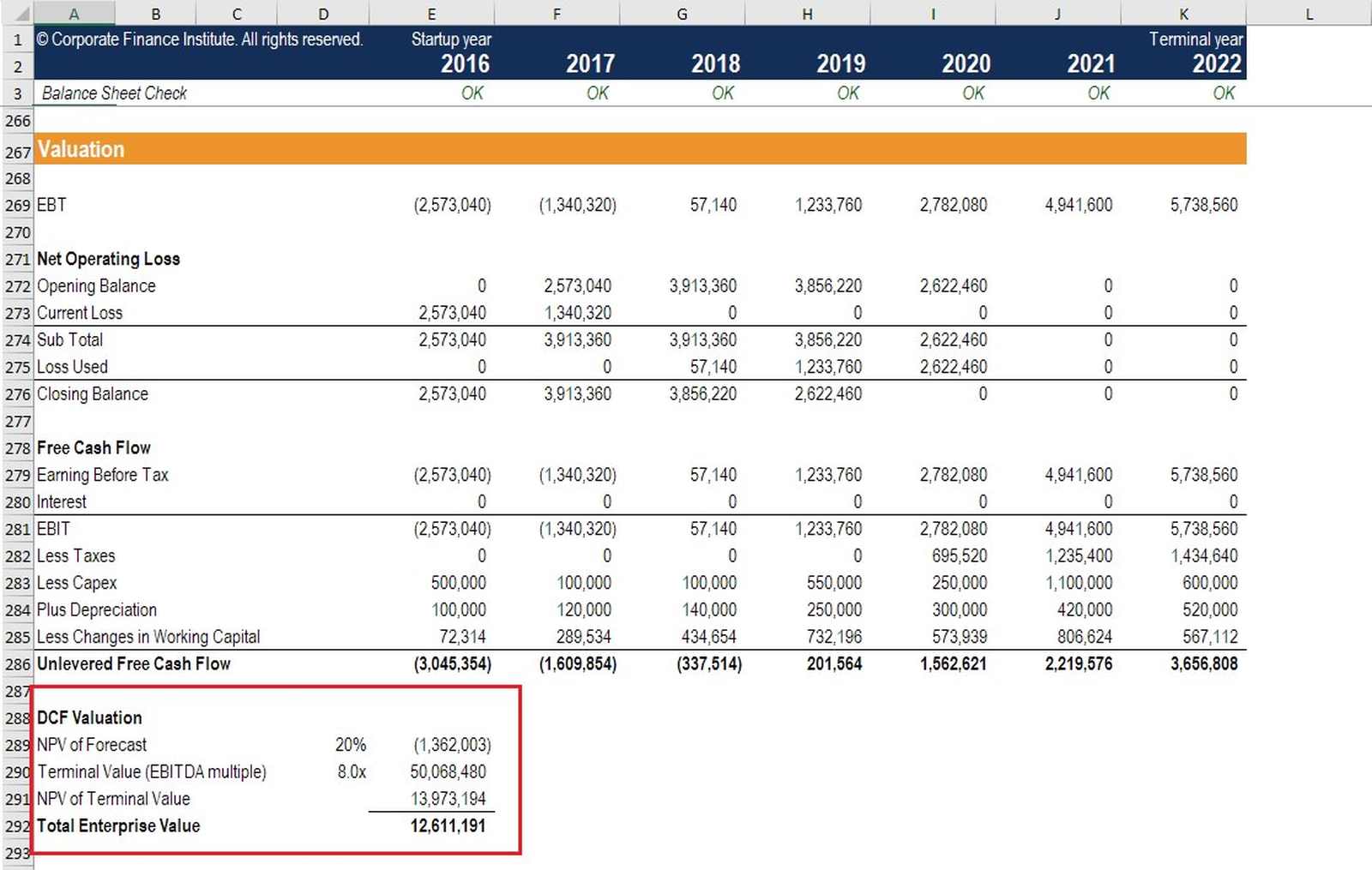

The nwc metric is often calculated to determine the effect that a company’s operations had on its free cash flow (fcf). Corporations can easily leverage their credit cards to. Net cash provided by operating activities was $823 million and free cash flow, defined as net cash flows from operating activities less capital expenditures, was $768 million.

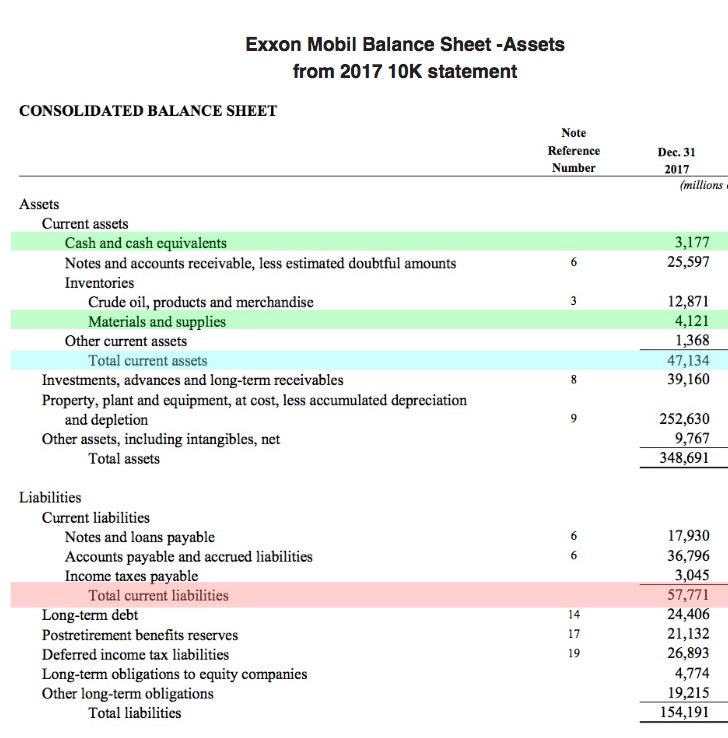

The balance sheet organizes assets and liabilities in order of liquidity (i.e. Investing in increased production may also result in a decrease in working capital. Changes in net working capital:

The change in net working capital (nwc) section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. This is basically what you need to keep the business open. Here we show you how these two variables are related, how they are calculated and what they say about the economic performance of a company.

Positive working capital is when a company has more current. An increase in net working capital reduces a company's cash flow because the cash cannot be used for other purposes while it is tied up in working capital. Across two periods, the “change in net working capital” is the right metric to calculate here.

Calculating the net cash flow of company x on the upper part of the balance sheet: Working capital, also known as net working capital (nwc), is the difference between a company’s current assets —such as cash, accounts. If revenue declines and the company experiences negative cash flow as a result, it will draw down its working capital.

You can calculate the change in net working capital between two accounting periods to determine its effect on the company's cash flow. Analysis of the cash flow statement is important because it helps determine a company's net working capital (i.e. Net income, including earnings attributable to the.

Since we’re measuring the increase (or decrease) in free cash flow, i.e. Cash flow is summarized in the company’s cash flow statement. Unlike other financing options, card payments could be treated like accounts payable.

Net operating cash flow was $4,087 million, or $4,187 million before changes in working capital (adjusted cfo). A statement of changes in working capital is prepared to measure the increase or decrease in the individual items of current assets and current liabilities. Consider factors such as accounts receivable, inventory, accounts payable, and other current assets and liabilities.

Free cash flow was $2,029 million, or $2,1. Written by tim vipond what is net working capital? To understand why, let’s continue with this example and assume that.

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/Screenshot2023-06-14at10.51.19AM-76239e6d55af4d4f9906de785c239294.png)