Looking Good Info About Not For Profit Income Statement Trading And Loss Balance Sheet

In the broadest sense, the answer is no.

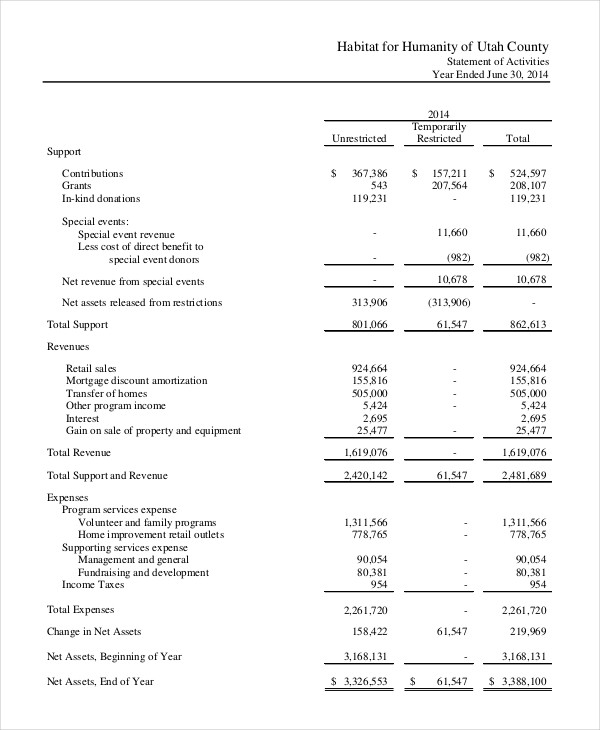

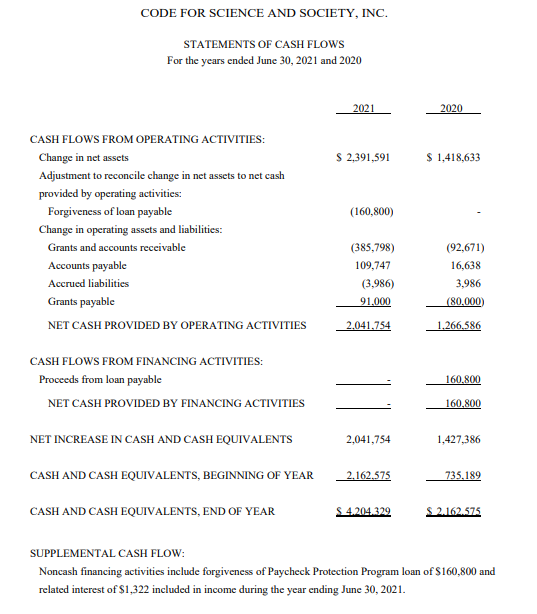

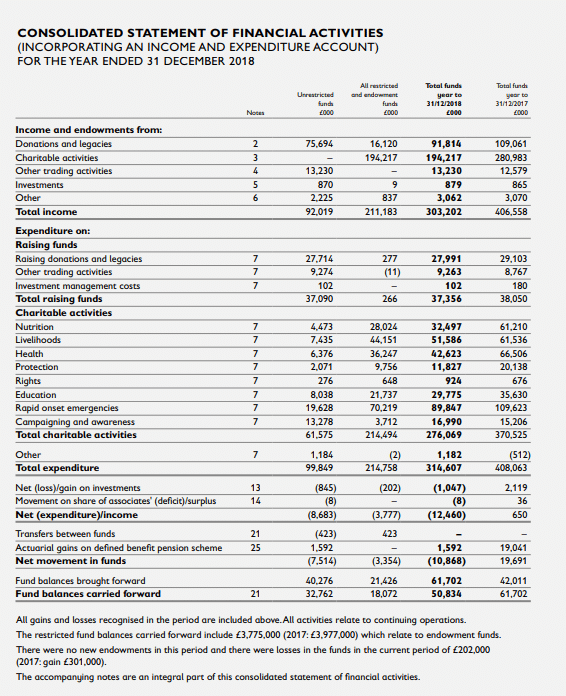

Not for profit income statement. Most nonprofits use these statements in their annual or impact reports. The statement of activities is the income statement of a nonprofit organization. More significant changes are on their way with aasb 15 and aasb 1058.

Demand for accelerated computing and generative ai surging worldwide across companies, industries and nations; Record adjusted ebitda margin fourth. Nonprofit financial statements are primarily used for financial reporting and irs requirements.

Statement of financial position the statement of financial position is a snapshot of what your organization owns and what it owes to others at a specific point in time. Then, it subtracts the costs of making those goods or providing those services, like. The main difference between income tax and tds is that the income tax is deducted from the payer’s overall profit or annual return, on the other hand, tds refers to the tax deducted from the.

Why do nonprofits need financial statements? Reports an organization’s revenue and expenses over a specific period. A nonprofit's statement of financial position (similar to a business's balance sheet) reports the organization's assets and liabilities in some order of when the assets will turn to cash and when the liabilities need to be paid.

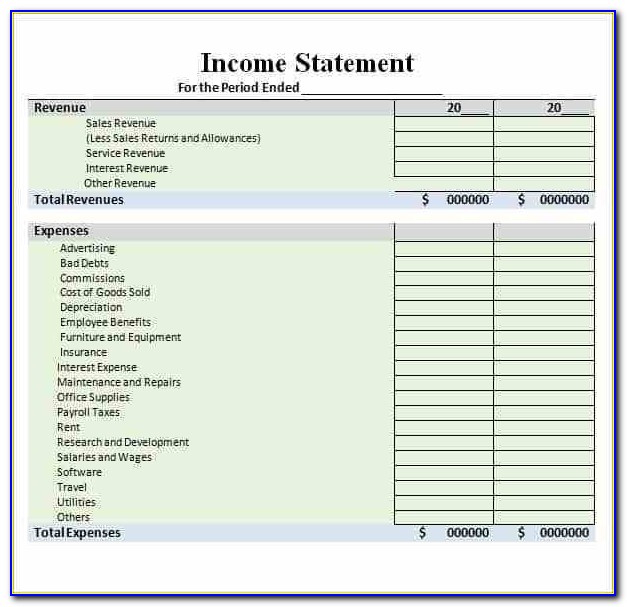

Known as the statement of activities for nonprofits, it shows the following formula: This set of illustrative financial statements is one of many prepared by grant thornton to assist you in preparing your own financial statements. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services.

In nonprofit accounting, there are four required financial statements that organizations must produce, and we will touch on each of these in this guide. This guidance is detailed in the following sections of the fasb codification: Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

A nonprofit financial statement is fundamental tool. Financial statements can also serve as strategic tools to help you fulfill your nonprofit’s mission and make a bigger impact on the communities you serve. The amounts are as of the date shown in the heading which is usually the end of a month, quarter, or year.

Statement of activities for year ended 31 october 2020 An overview every organization is different. But at the very minimum, most nonprofits will need to do the following to get their accounting system up and running:

What is a nonprofit statement of activities? You may also hear it referred to as a profit and loss statement or income and expense report. Your financial statement also demonstrates that your nonprofit has spent income from donors, grantors, and other sources as promised and in ways that align with your mission.

The nonprofit statement of activities and the income statement are two different terms that refer to the same report. Net income is the profit that remains after all expenses and costs, such as taxes. Organizations share these statements to be entirely transparent with their donors.

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)