Casual Tips About Difference Between Cash Flow Statement And Profit Loss How Account Is Prepared

Together, alongside the cash flow statement (cfs) and balance sheet , the p&l statement provides a detailed depiction of the financial state of a company.

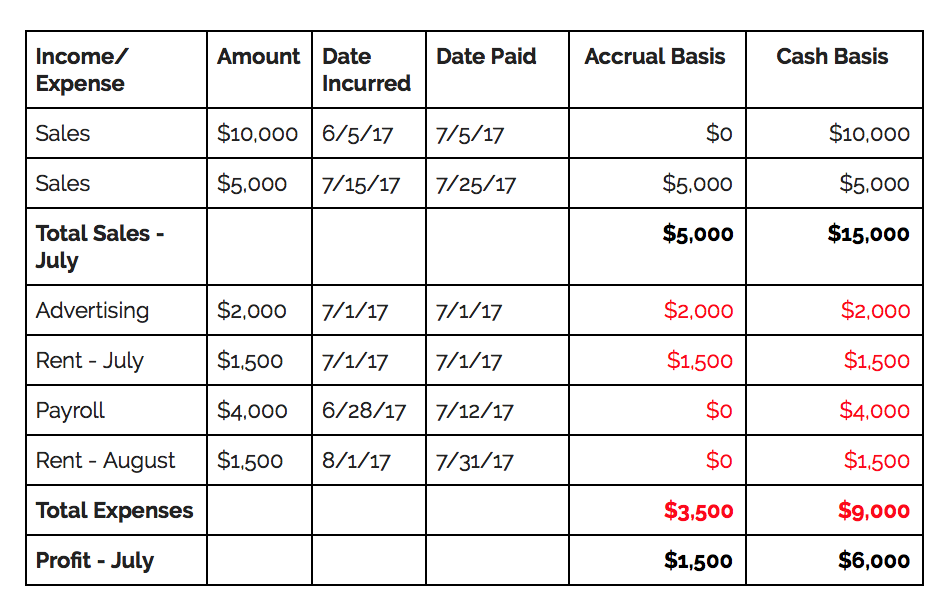

Difference between cash flow statement and profit and loss statement. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income. The main difference between a profit and loss statement and. Income statement is a statement which is prepared in order to show the operating result of a firm;

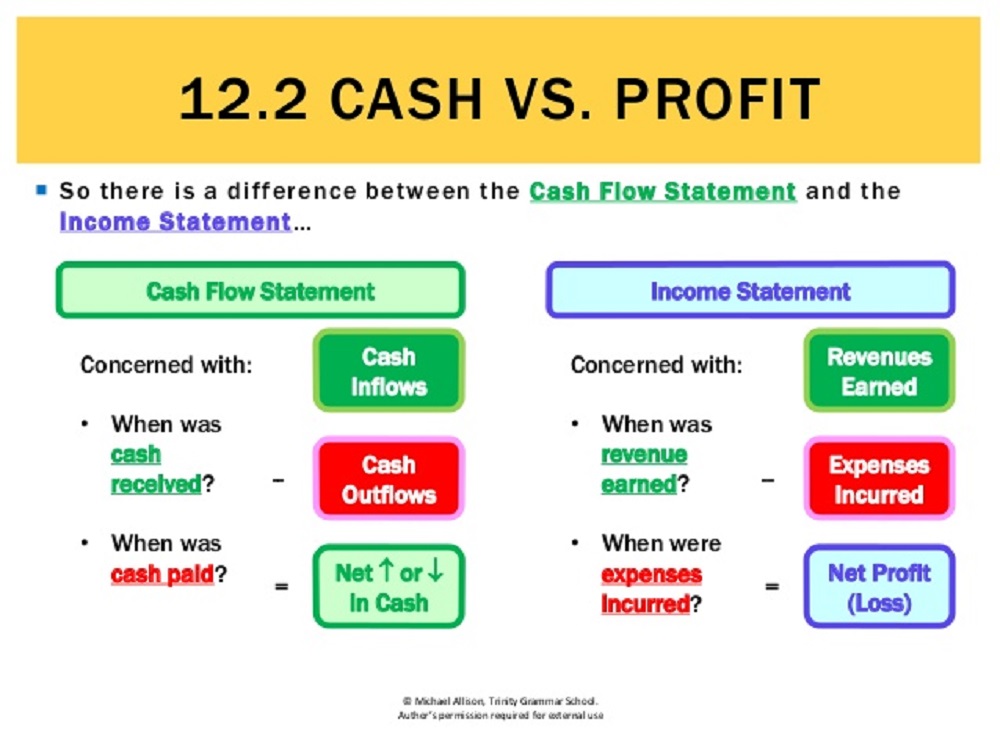

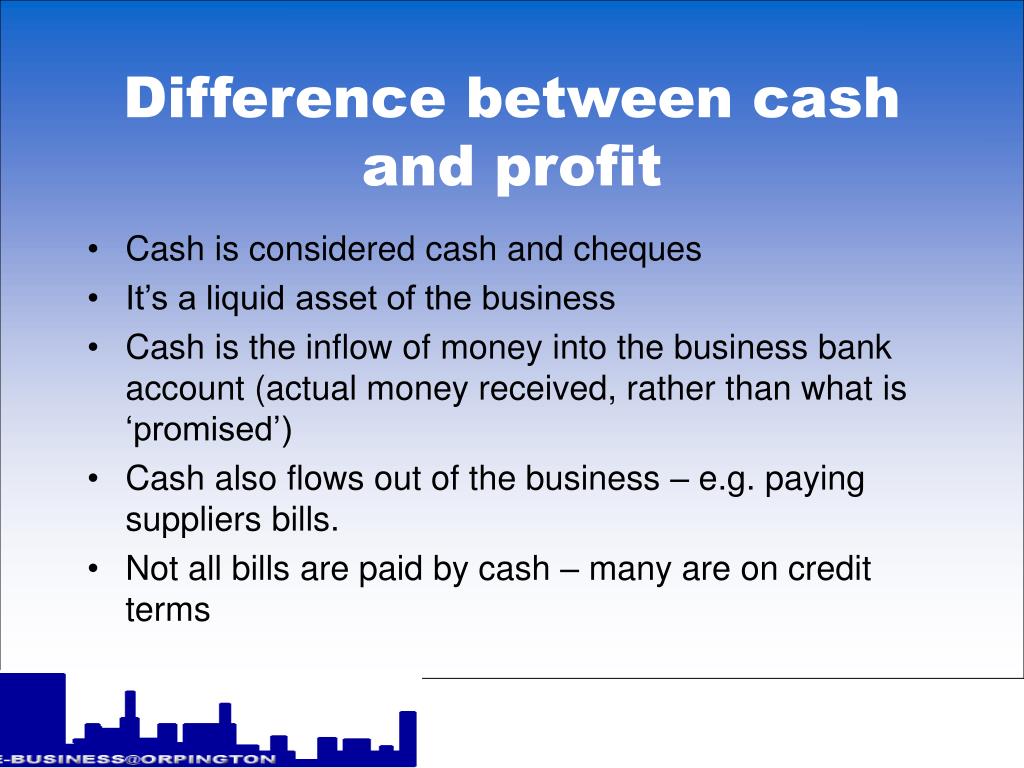

There are cash inflows where money enters the business, and cash outflows where money leaves the business. There are several differences between a cash flow and profit and loss statement since. Those are 3 of the most important types of financial statements you’ll need to prepare if you’re a.

Profit and loss (p&l) statement refers to a financial statement that. No, a profit and loss statement isn’t the same as a cash flow statement. Profit and loss account is a statement which is prepared in order to show the operating result of a firm;

A profit & loss statement(p&l statement) can also be referred to as an “income statement” by accountants and financial experts. The difference between a cash flow vs profit and loss statement. Unlike the p&l statement, the cash flow statement lists the cash sources stemming from investment.

Cash flow is tracked on the aptly named cash flow. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A profit and loss statement shows you what your sources of income are versus your expenses.

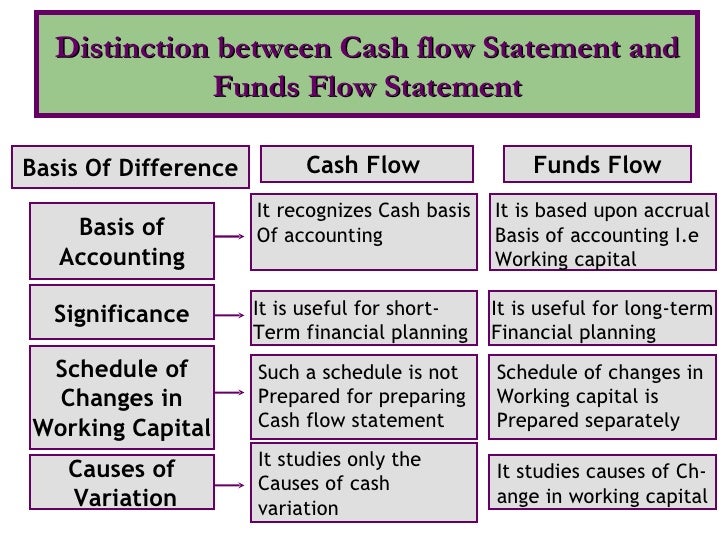

Free cash flow focuses more on cash reporting, while profit from the net income statement uses the accrual accounting method to. Balance sheet, cash flow statement, profit and loss statement. In other words, the balance sheet shows the assets and.

The cash flow statement shows the cash inflows and outflows for a company during a period. The main difference between a profit and loss statement and a cash flow statement is that a profit and loss statement measures the profitability of the business. To show the surplus or profit and deficit or.

Somer anderson fact checked by ariel courage the cash flow statement and the income statement are integral parts of a corporate balance sheet. A profit means you have revenue remaining after subtracting your costs, while a loss means your costs exceeded your revenue. Yarilet perez dennis madamba / investopedia what is a profit and loss (p&l) statement?

A profit and loss statement is different than a cash flow statement because it illustrates the company’s profit (not cash) and losses over a period of time, which can be monthly,. To show the surplus or profit and. Net income includes both of these items.

When examining the financial statements for a business, the statement of cash flows and the income statement (also called the profit and loss statement) differ. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)