Nice Tips About Other Income In Profit And Loss Account Footnotes Accounting

The profit and loss account is compiled to show the income of your business over a given period of time.

Other income in profit and loss account. Less cost of goods sold. Comprehensive income for a period includes profit or loss (net income) for that period and other comprehensive income recognised in that period. Balance sheet vs profit & loss account

The p&l account (p&l a/c) of a company shows its ability to. A profit and loss account, in simplest terms, is a record of all the income and expenses of the business during a particular period of time. Does not come from sales.

Other operating (income) expenses: Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period. A profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to revenue.

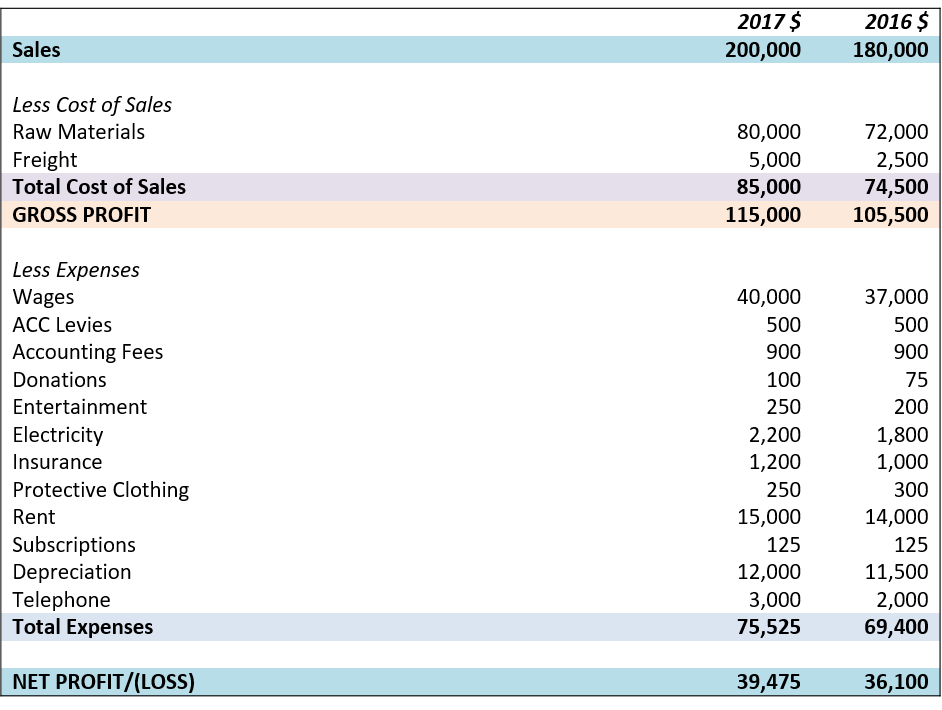

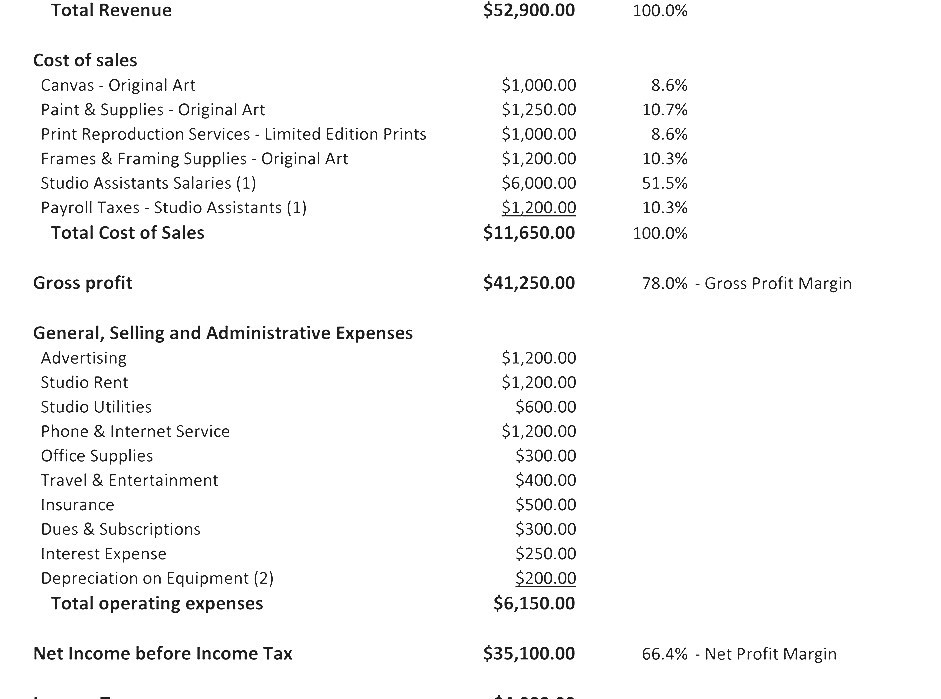

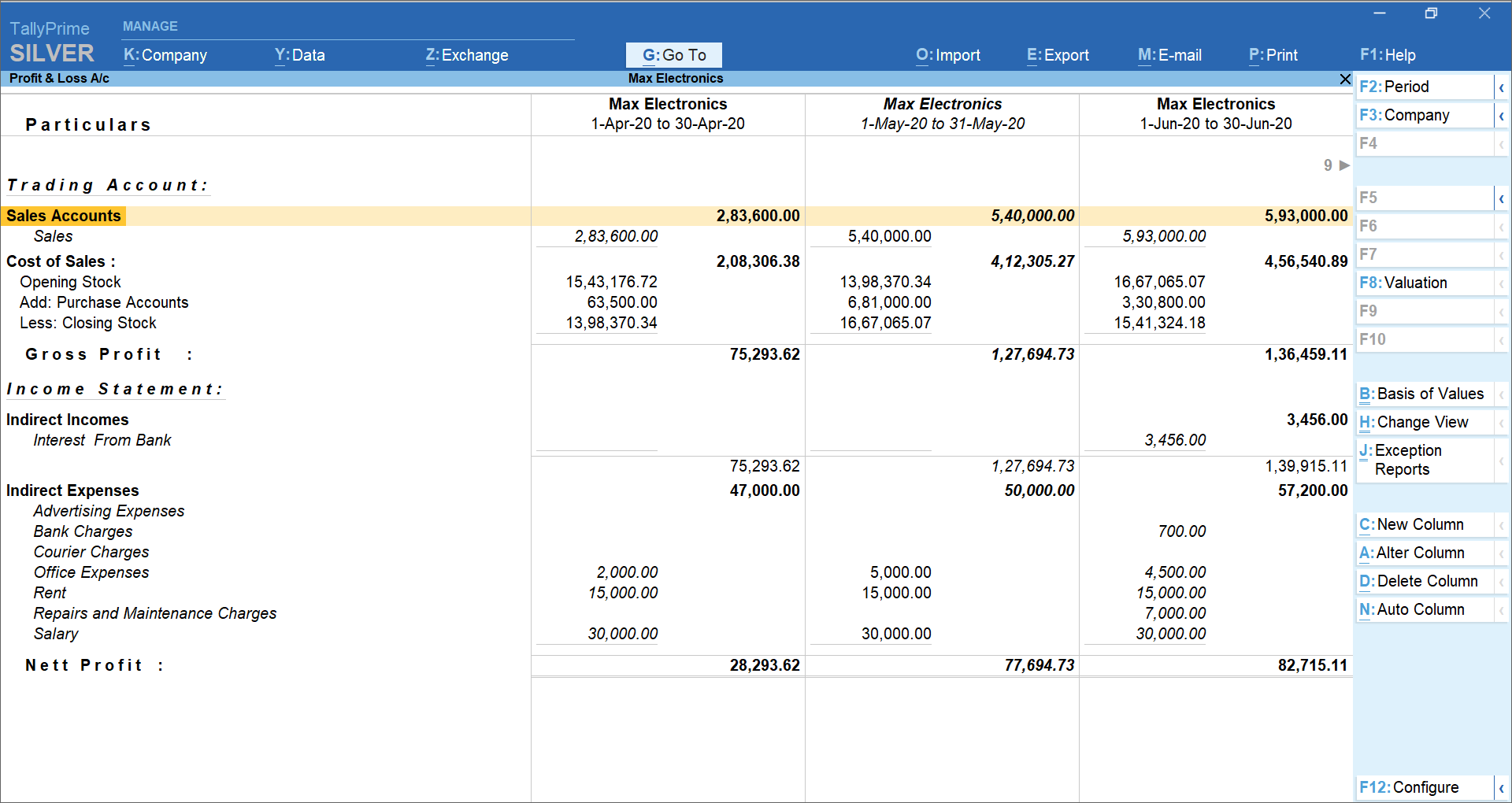

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. P&l statements tend to follow a standard format: The segregated view of the financial inflows and outflows enables organizations to track their financial performance and implement ways to keep up the same or improve it.

The statement should be classified and aggregated in a manner that makes it understandable and comparable. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. The net profit is calculated.

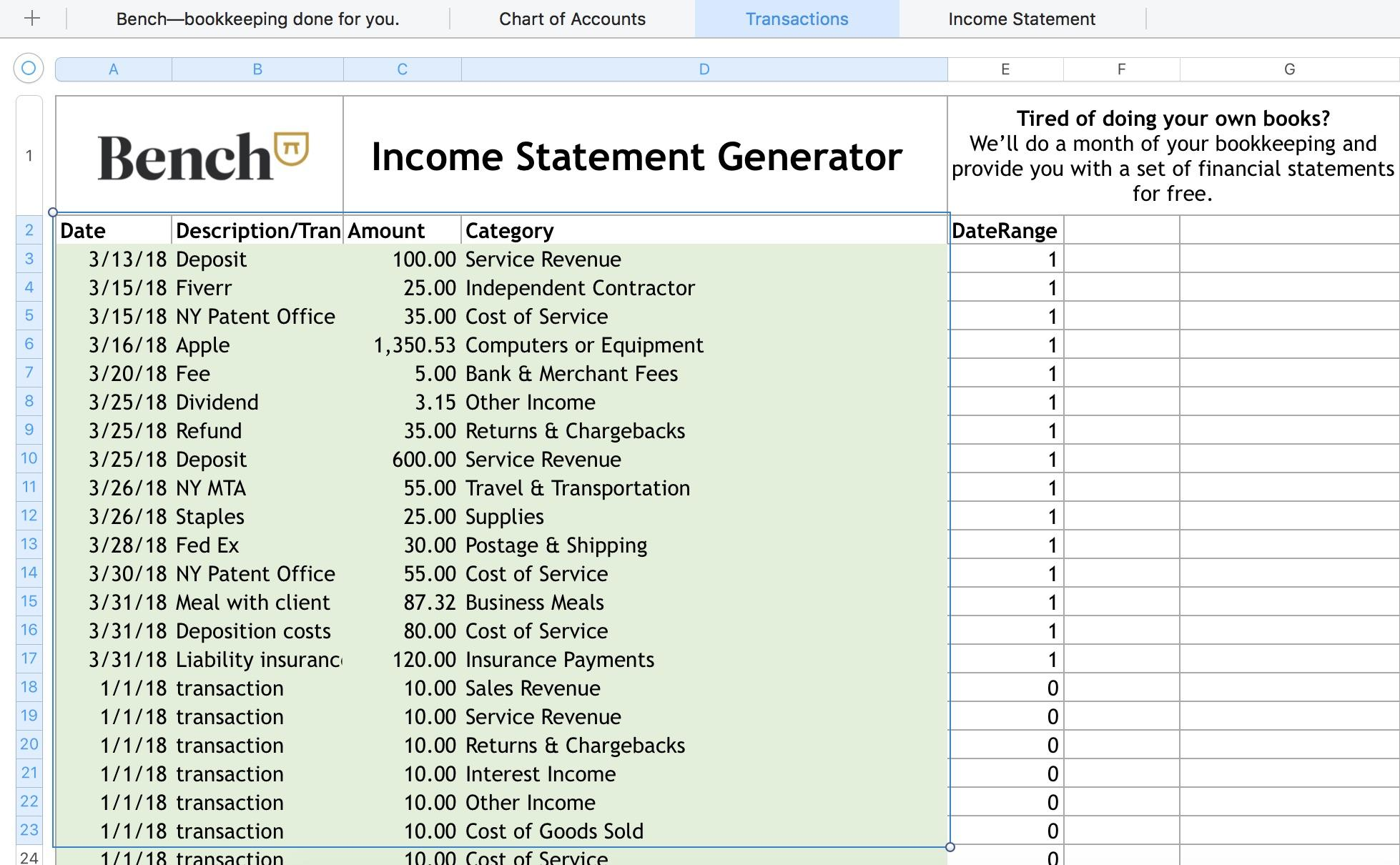

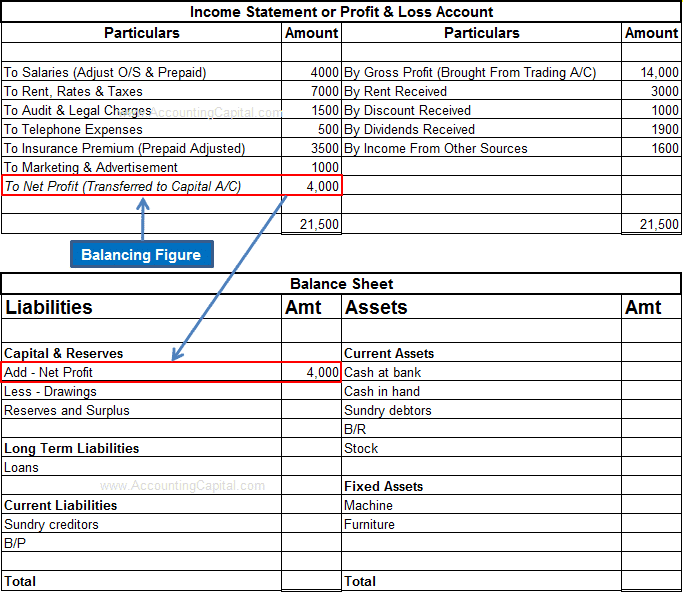

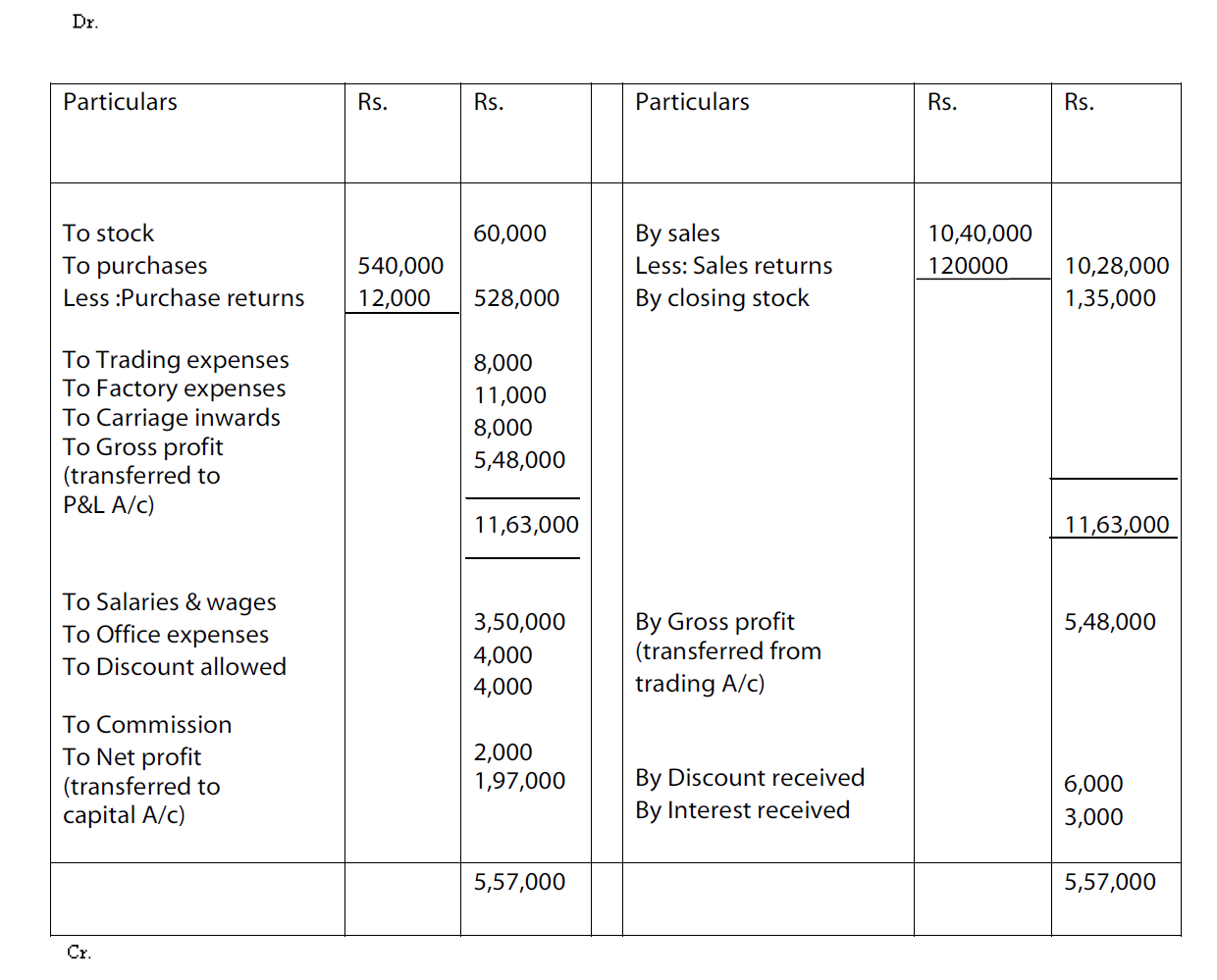

Example of a p&l statement. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second part of the account, which is used to determine the net profit of the business.

The company’s incomes and expenses of a certain period are compiled and used to measure the company’s performance during that period. The p&l account is a component of final accounts. Other income refers to those sources of income of an individual or business which arise out of activities besides the main activity to be recorded separately in schedule 1 of form 1040 or on the income statement.

Entities may present all items together in: The answer is that each company presents this information differently. The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of users.

A profit and loss (p&l) account is a financial statement that shows the outcome of the various business transactions in an accounting period. In the income statement, other income is presented after the other gross profit. The profit and loss account shows the net profit which is the determined by deducting the expenses of the business from the trading account gross profit and adding other income.

It is prepared to determine the net profit or net loss of a trader. Net income is the profit that remains after all expenses and costs, such as taxes. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-27-790x1231.jpg)