Smart Info About Directors Loan On Balance Sheet Cash Flow Simple Example

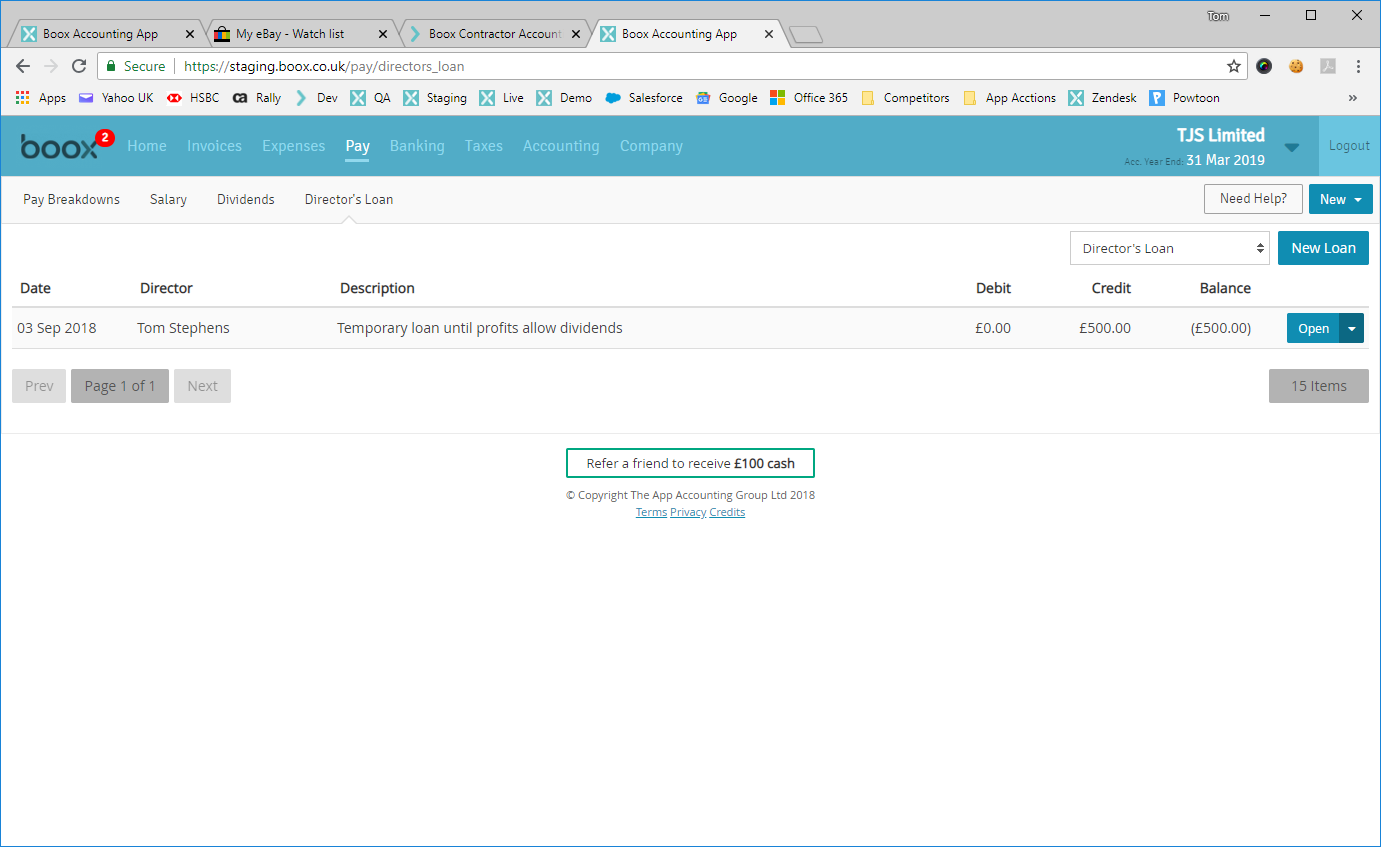

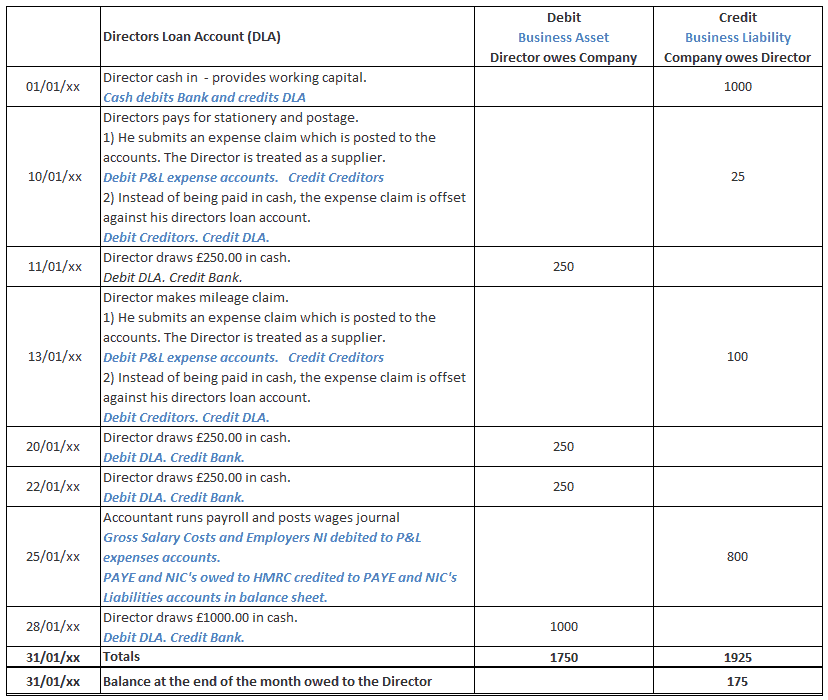

A director’s loan is when you take company money from your limited company’s bank account that can’t be classed as salaries, dividends or legitimate.

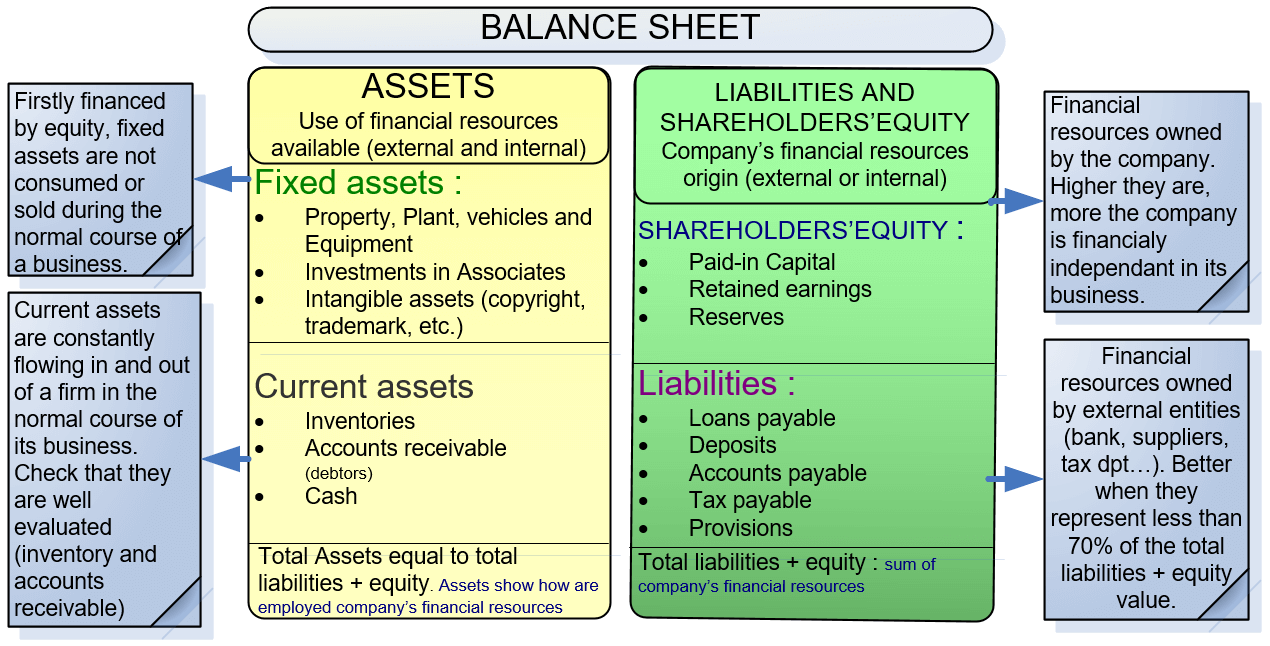

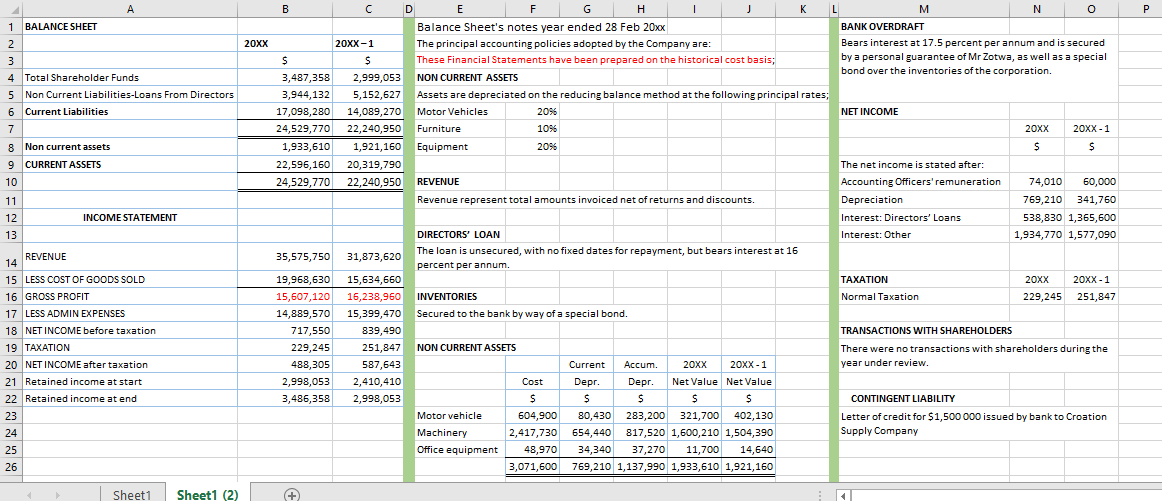

Directors loan on balance sheet. So, if a director initially introduced £10,000 to the company when it first started and has since taken cash from the company of £4,000 the loan account will. Generally, asc 310 permits loans and receivables to be presented on the balance sheet as aggregate amounts. Major categories of loans or receivables should be presented.

What are director’s loan accounts? Director's loan accounts html details a director’s loan is when you take money from your company that is not: Tax on loans you may have to pay tax on director’s loans.

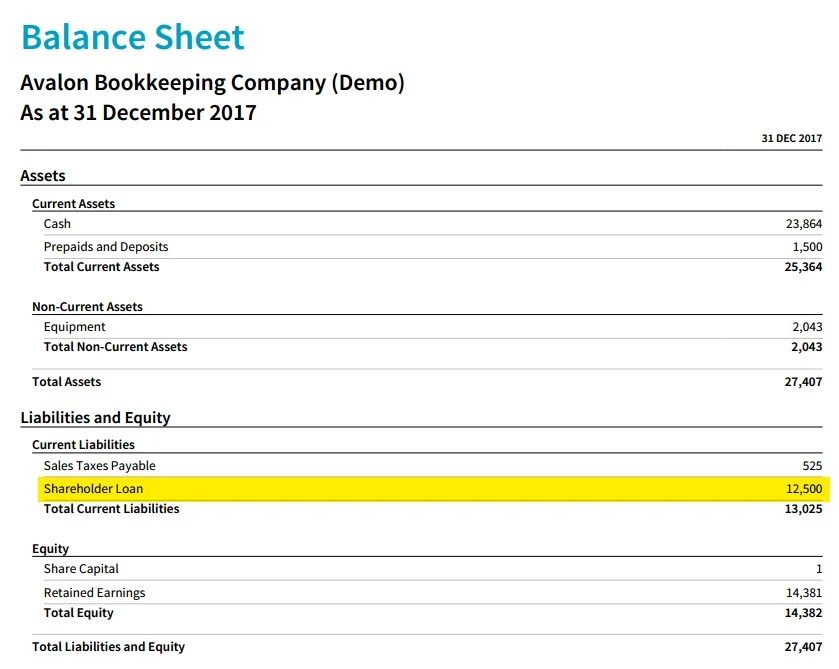

Tomorrow it’s another new month and we’re getting ever closer to the dreaded tax return deadl. We now have around 14 to 15% share of loans on the stock of our balance sheet as against to 10 to 11% of deposits,” jagdishan said. At the end of the financial year, the directors loan account balance is recorded in the balance sheet as either an asset (money owed to the company by the.

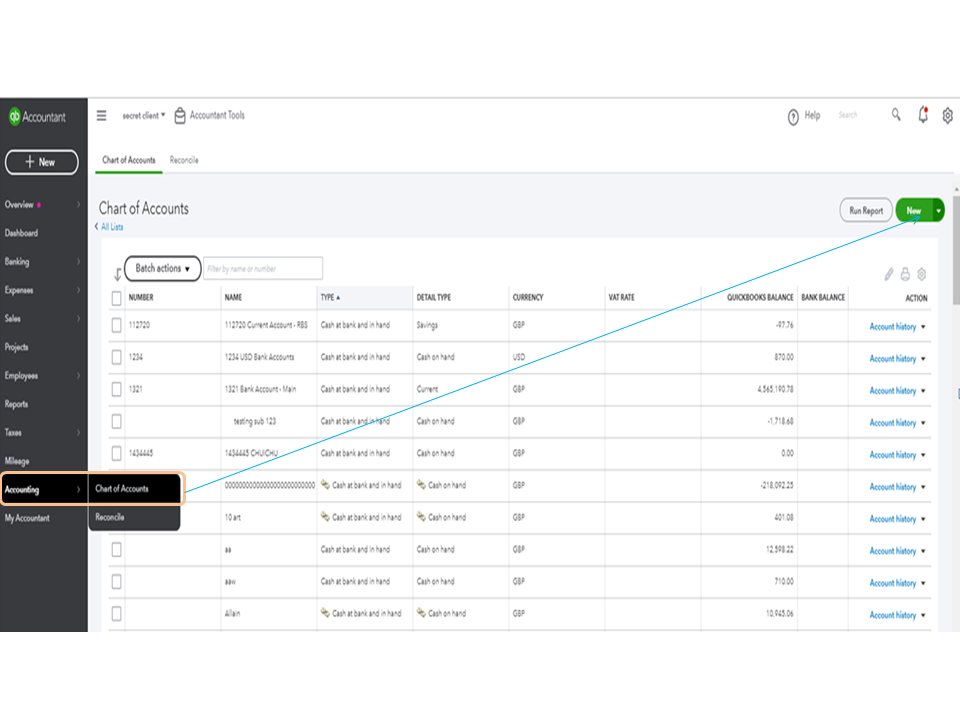

So you need to find out if the loan is a directors loan (debt) or a shareholder loan (possibly debt or equity) and then consider how that should be treated under frs 102 (assuming it applies). A salary, dividend or expense. The director’s loan account often causes confusion because it doesn’t actually exist except in the balance sheet of your accounts.

Include any money you owe the company or the company owes you on the ‘balance sheet’ in your annual accounts. Although the money in your limited company bank account belongs to the company, as a director of the company, you can. There's tons of guidance on the weird and wonderful things you.

The dla on the balance sheet falls under assets if the loan is overdrawn and money is owed to the company or under liabilities if the company owes money to the director. A director’s loan is defined as funds a director deposits and takes from the business that fall outside of an expense repayment, salary or dividends.