Outrageous Info About Fake Profit And Loss Statement One Step Income

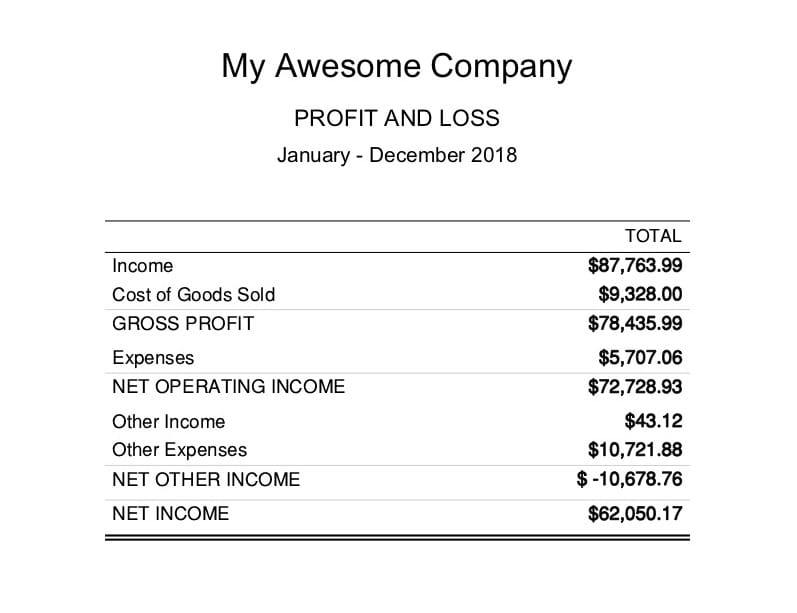

A p&l statement is a financial report that summarizes a company’s revenue, expenses and profits or losses over a fiscal year or quarter.

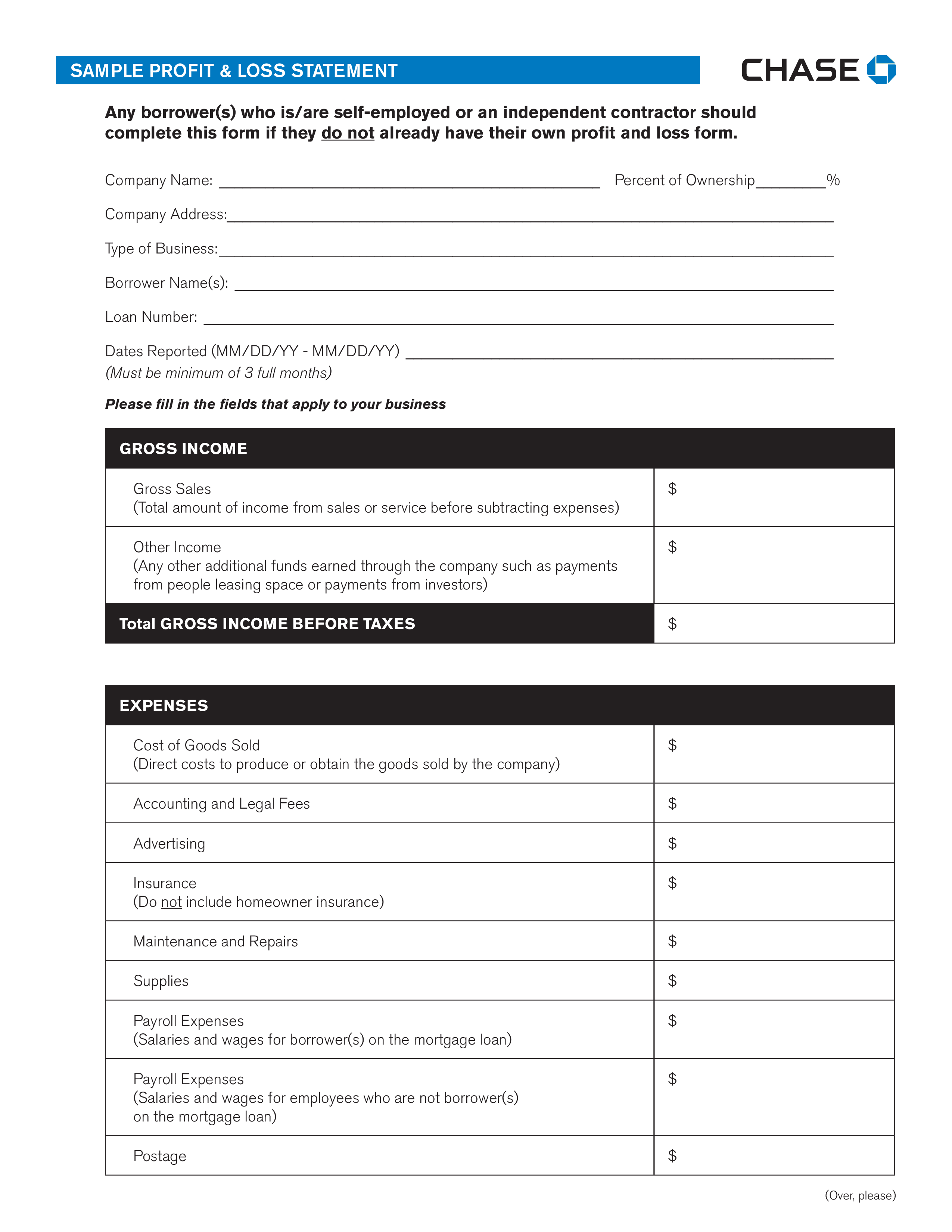

Fake profit and loss statement. The template is also known as an income statement. The result is either your final profit (if. What is a profit and loss statement?

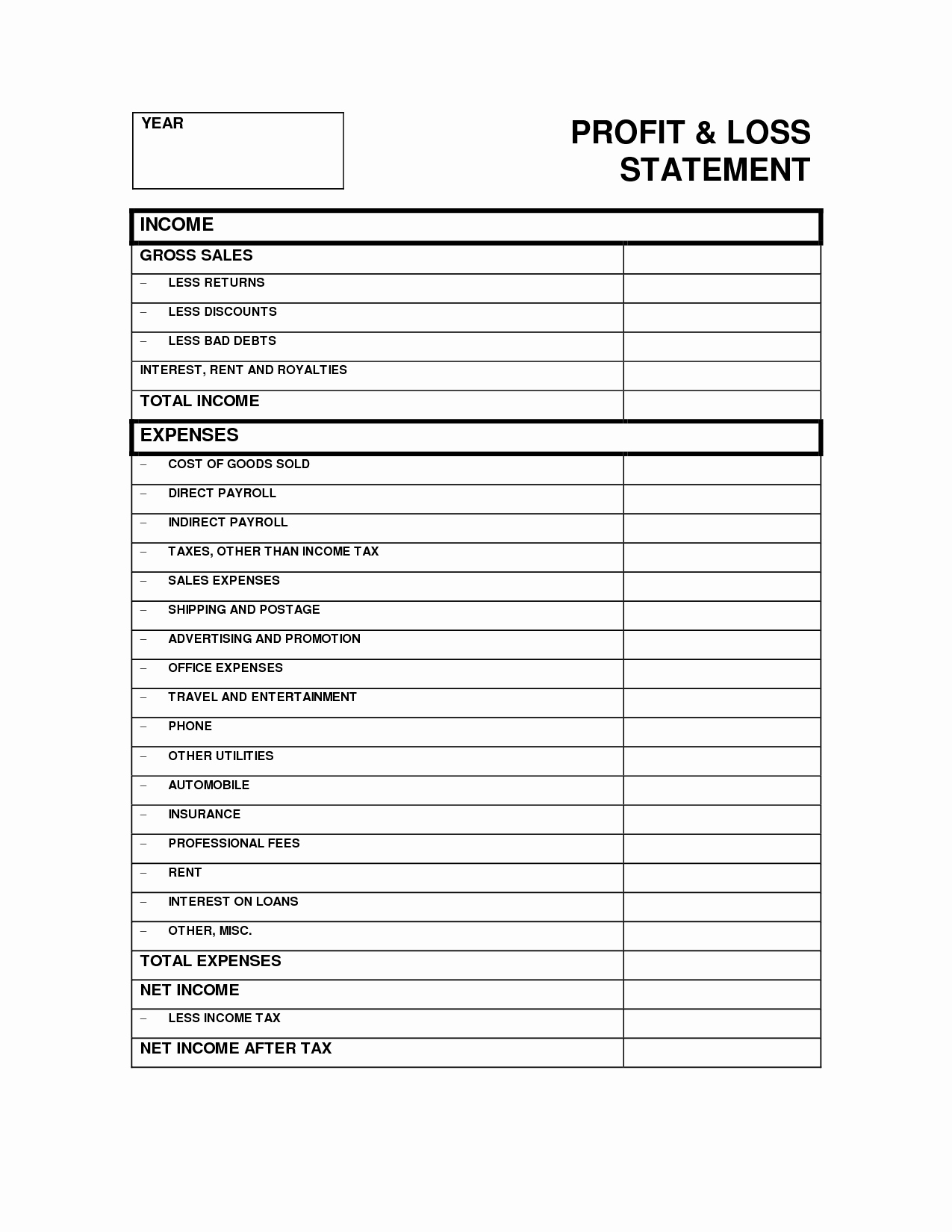

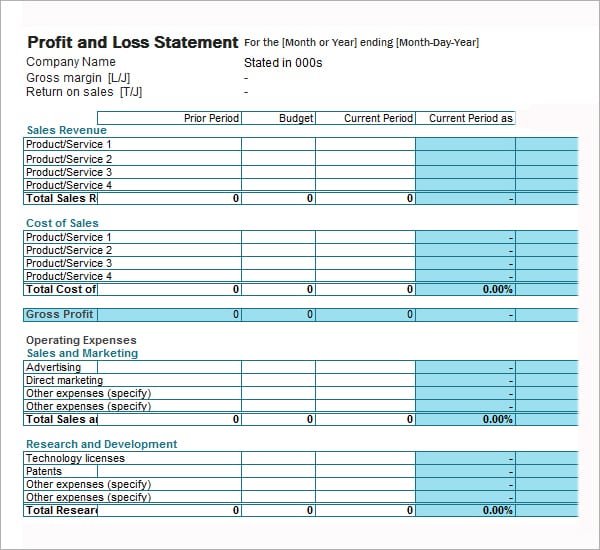

The profit and loss statement template is easy to set up and use. Plus, find tips for using these p&l templates. This blank profit and loss statement allows you to record quarterly financial data over one year.

What is a profit & loss statement? It summarizes revenues, costs, and expenses, allowing stakeholders to evaluate profitability. A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time.

It outlines the company's revenues, expenses, and ultimately, its net income or net loss during that timeframe. Knowing whether or not your business is profitable is important. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

The income statement indicates whether a company has made a profit or loss for a given period. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. You’ll sometimes see profit and loss statements called an income statement, statement of operations, or statement of earnings.

It’s usually assessed quarterly and at the end of a business’s accounting year. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. It is prepared based on accounting principles that include revenue recognition, matching, and accruals, which makes it different from the cash flow statement.

The template layout is simple and intuitive, including sections for tracking business revenue, expenses, and tax information. Realized profits and loss. Simply put, it shows whether the company is making a profit or taking a loss for a given period.

It is a picture of a company's income and expenditure. Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received. A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit.

An income statement, also known as a profit and loss statement, is a crucial financial document that provides a snapshot of a company's financial performance over a specific period, typically a quarter or a year. Let’s take a look at how you can create your own profit and loss statement for your small business. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

Profit and loss (p&l) statement template. Additional free bookkeeping resources frequently asked questions why create p&l statements with freshbooks? The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.