Peerless Info About Direct And Indirect Method Of Cash Flow Withholding Tax Balance Sheet

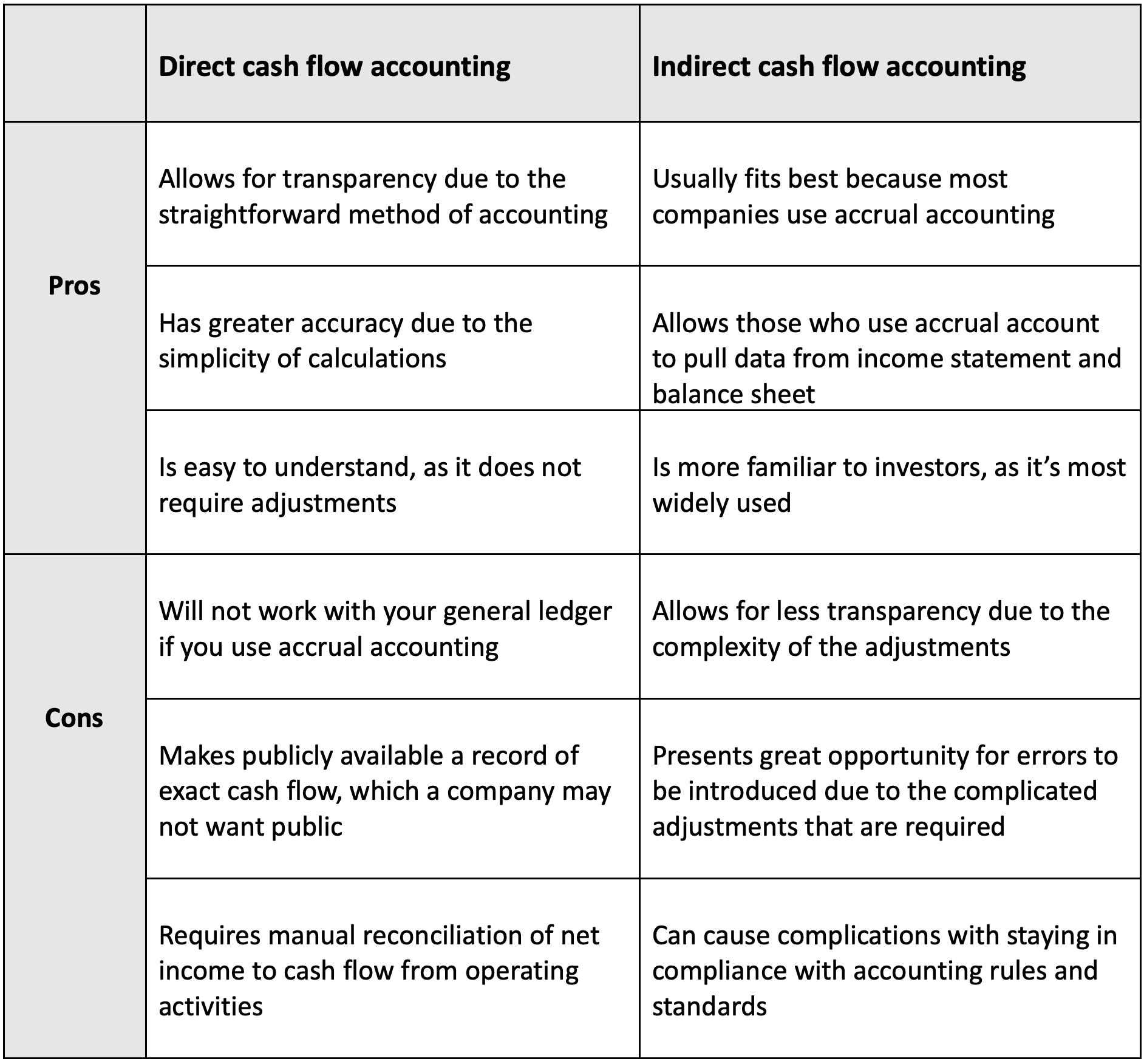

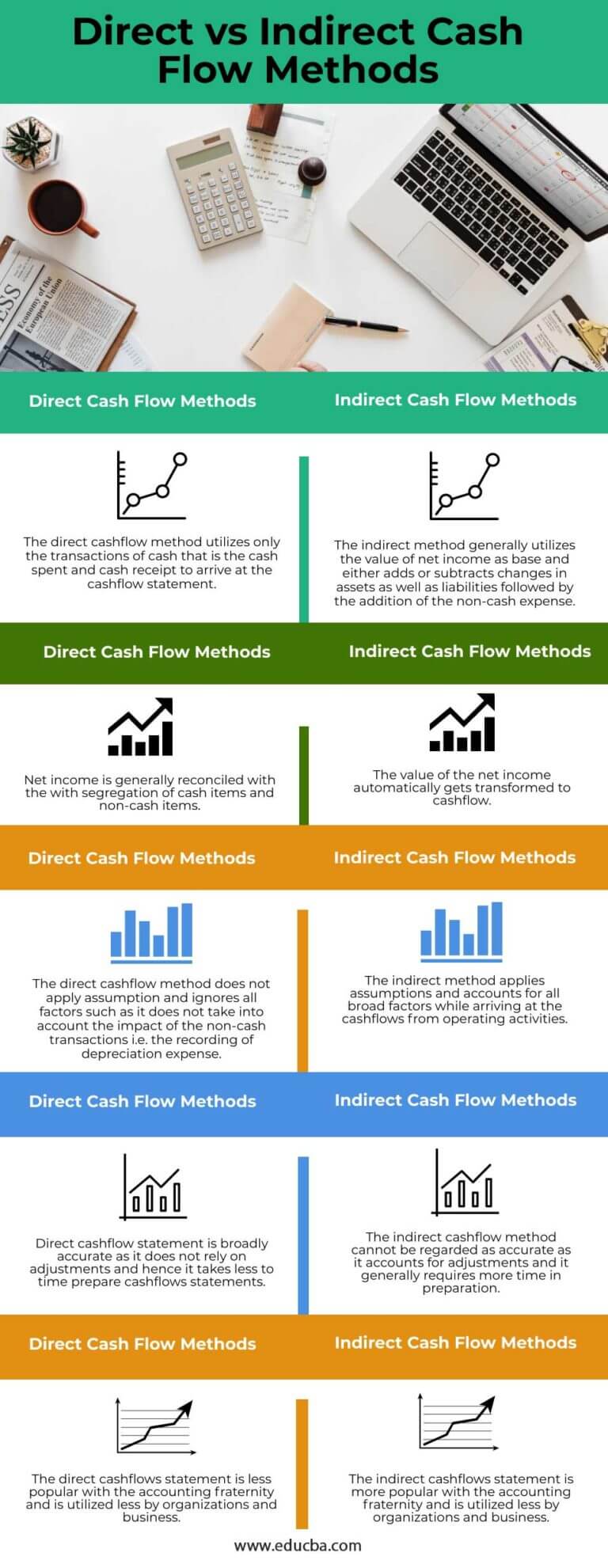

Comparing the direct and indirect cash flow methods.

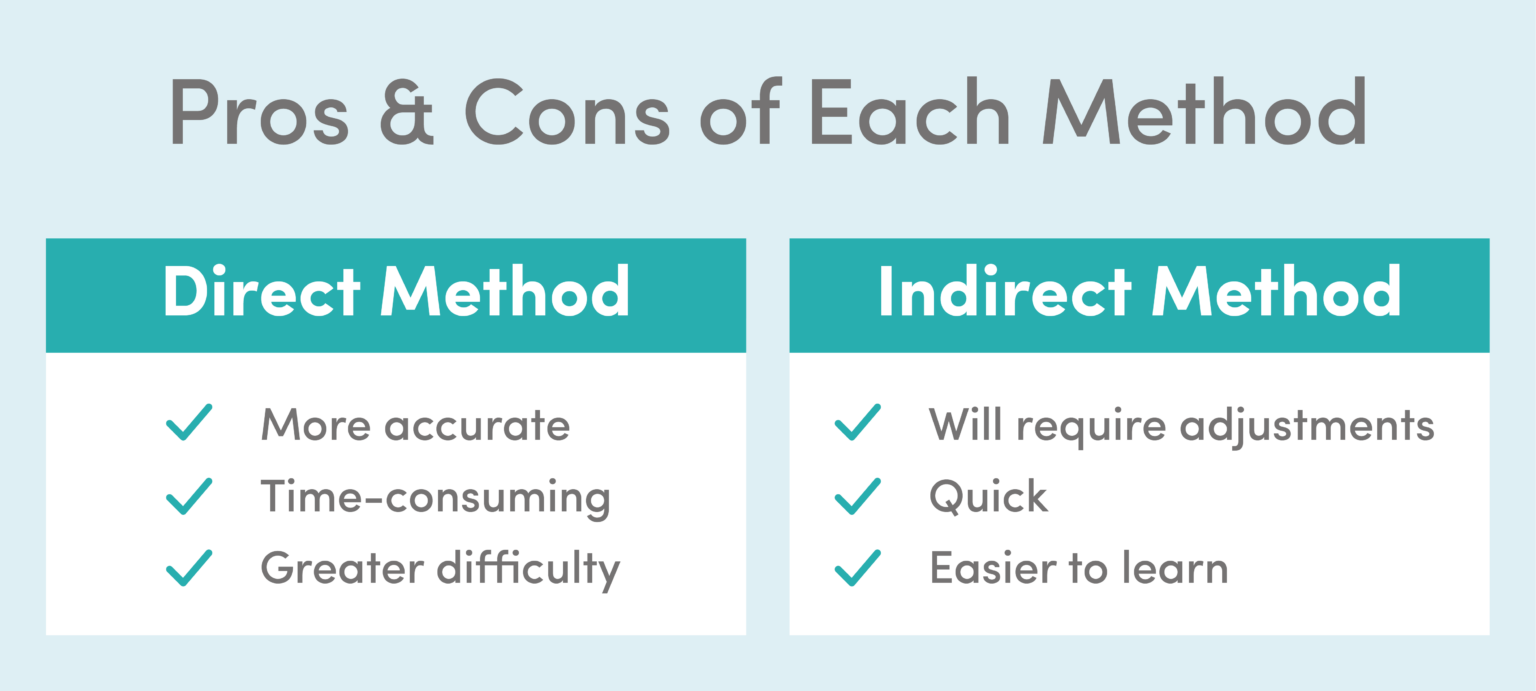

Direct and indirect method of cash flow. In contrast, the direct method only includes cash transactions. The direct method is one of two accounting treatments used to generate a cash flow statement. The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow.

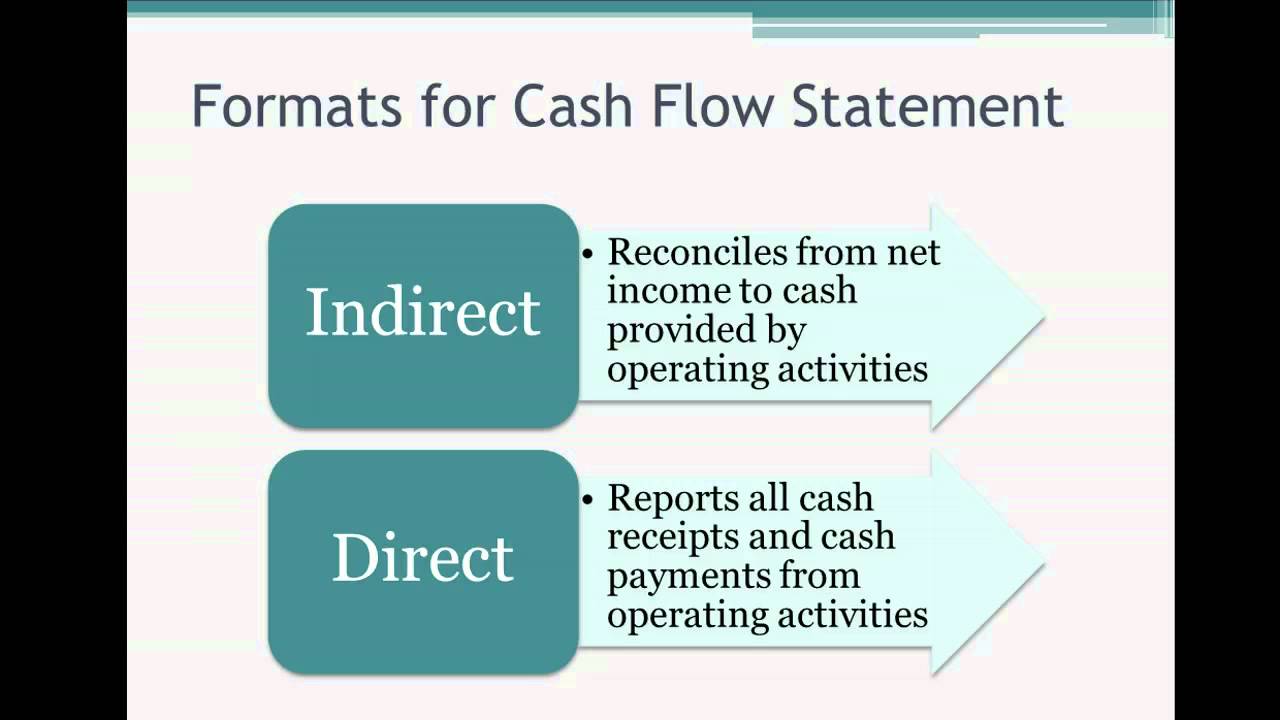

The indirect method always starts with the net income and makes adjustments. With the indirect cash flow method, you begin with your net income and then add back or deduct those items that do not impact cash. The two methods differ in their approaches, which are explained below.

Direct vs indirect method cash flow statement. Unlike the indirect method, it directly reports each major cash inflow and outflow, offering a detailed view of cash flows from. The direct method (cash flow) is an accounting approach used in the preparation of a cash flow statement, which portrays the exact payments and receipts of cash by a company during a certain period.

The direct method, in essence, subtracts the money you spend from the money you receive. Cash collected from customers interest and dividends received cash paid to employees cash paid to suppliers interest paid income taxes paid Information for indirect cash flow is simple to compile as it comes directly from the income statement and balance sheet.

Indirect cash flow method is the type of transactions used to produce a cash flow statement. The second and third steps in the preparation of the cash flow statement entail the determination of the total cash flows from investing activities and financing activities. There are two commonly used methods of calculating cash flow:

The main way you can spot the difference between the direct method and indirect method is as follows: September 07, 2023 what is the cash flow statement indirect method? The indirect method is one of two accounting treatments used to generate a cash flow statement.

The direct method and the indirect method are alternative ways to present information in an organization’s statement of cash flows. The indirect method focuses on net income and may include cash that is not yet in the business. The direct method converts each item on the income statement to a cash basis.

Direct cash flow method. The main difference between the direct method and the indirect method of presenting the statement of cash flows (scf) involves the cash flows from operating activities. For example, if a retailer sells an item on credit, the indirect method will.

The direct method, also known as the income statement method, is one of two methods utilized while crafting the cash flow statement—the other method being the indirect method, which we will examine later. Creating a cash flow statement involves using either the direct or indirect cash flow method and setting up the right processes. Instead, the direct method is more clear in how it’s calculated and can give you a better idea of your current cash standing.

When using the direct method to calculate cash flow from operating, investing and financing activities, your statement may look something like this: In this article we will guide you through the process and help you understand the details and differences between the direct and indirect cash flow method. It is one of the two methods used to create a cash flow statement for a business.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)