Cool Info About Profit And Loss For Nonprofit Disclosure Of Related Party Transactions In Financial Statements

In this article, we’ll explain more about each financial statement, why and when nonprofits need financial statements and share examples of how organizations have used them in their annual reports.

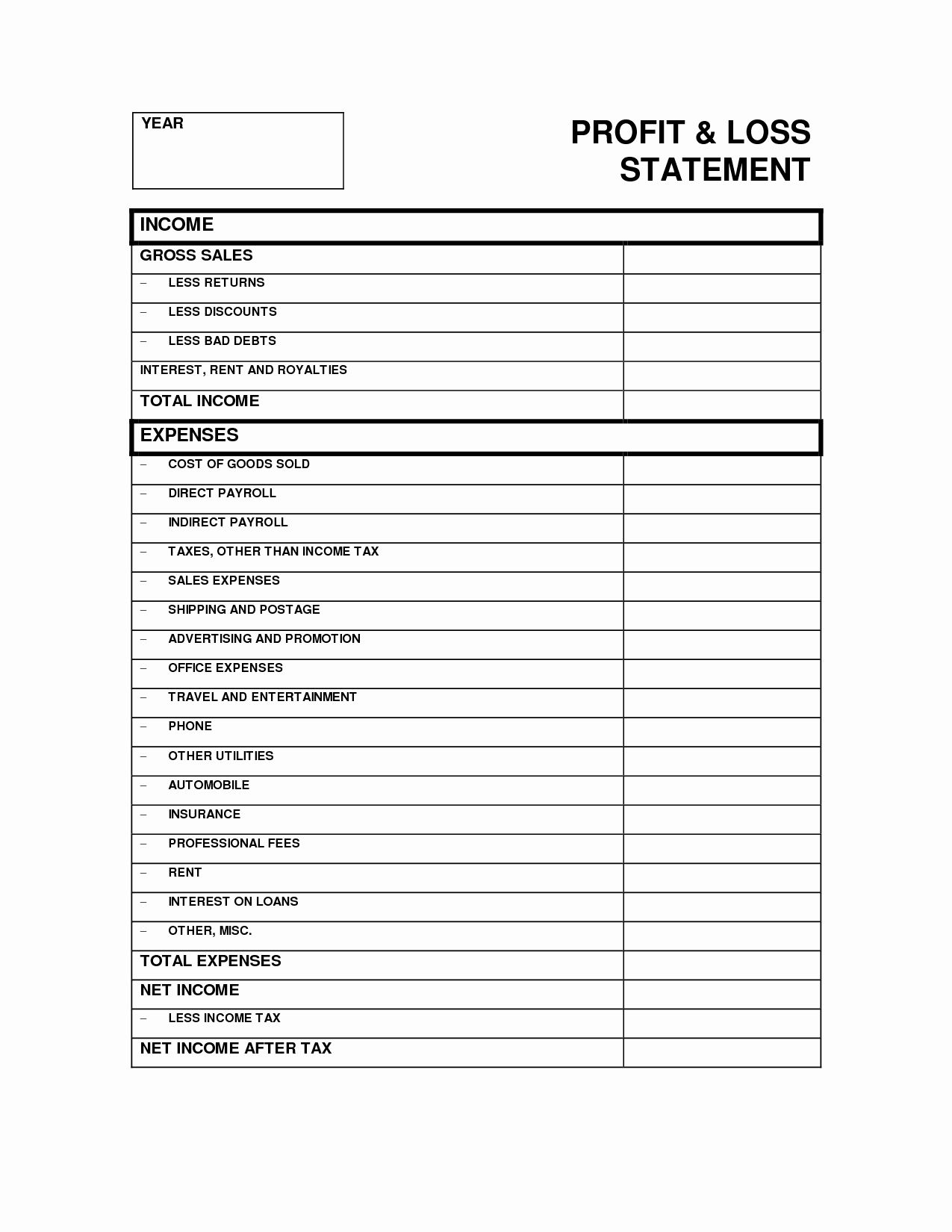

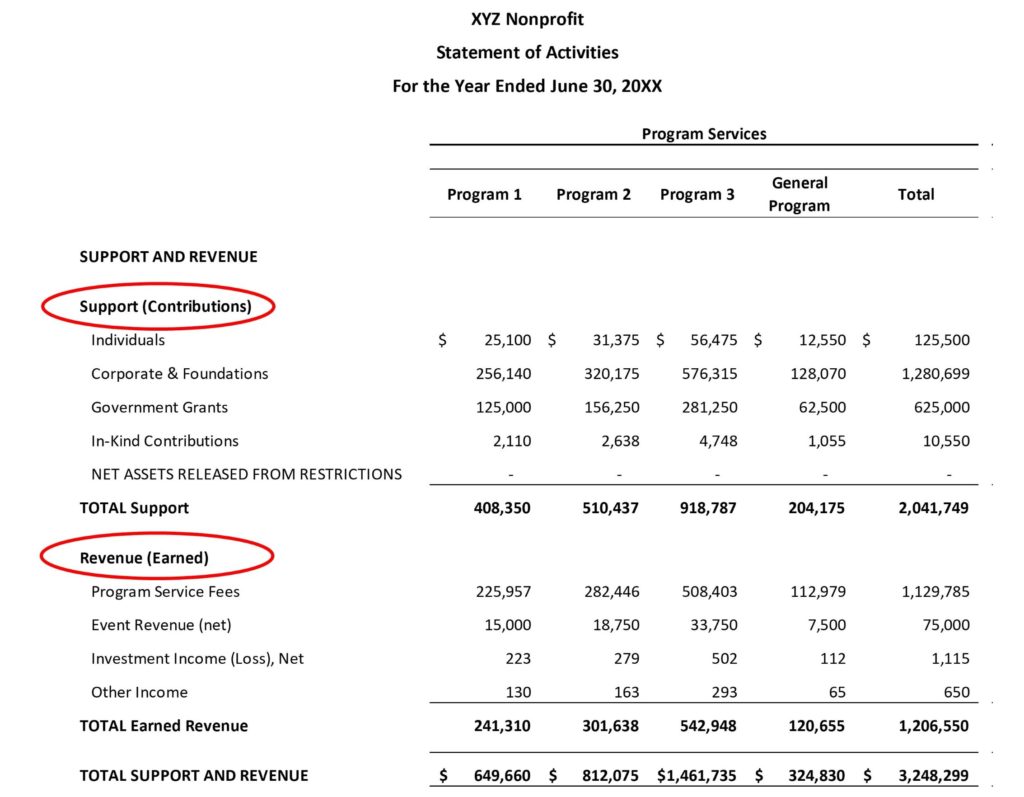

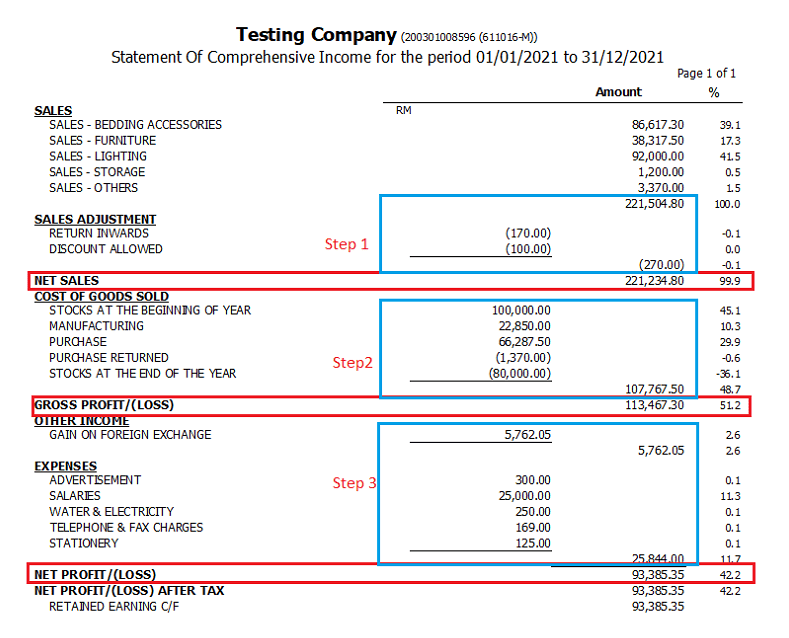

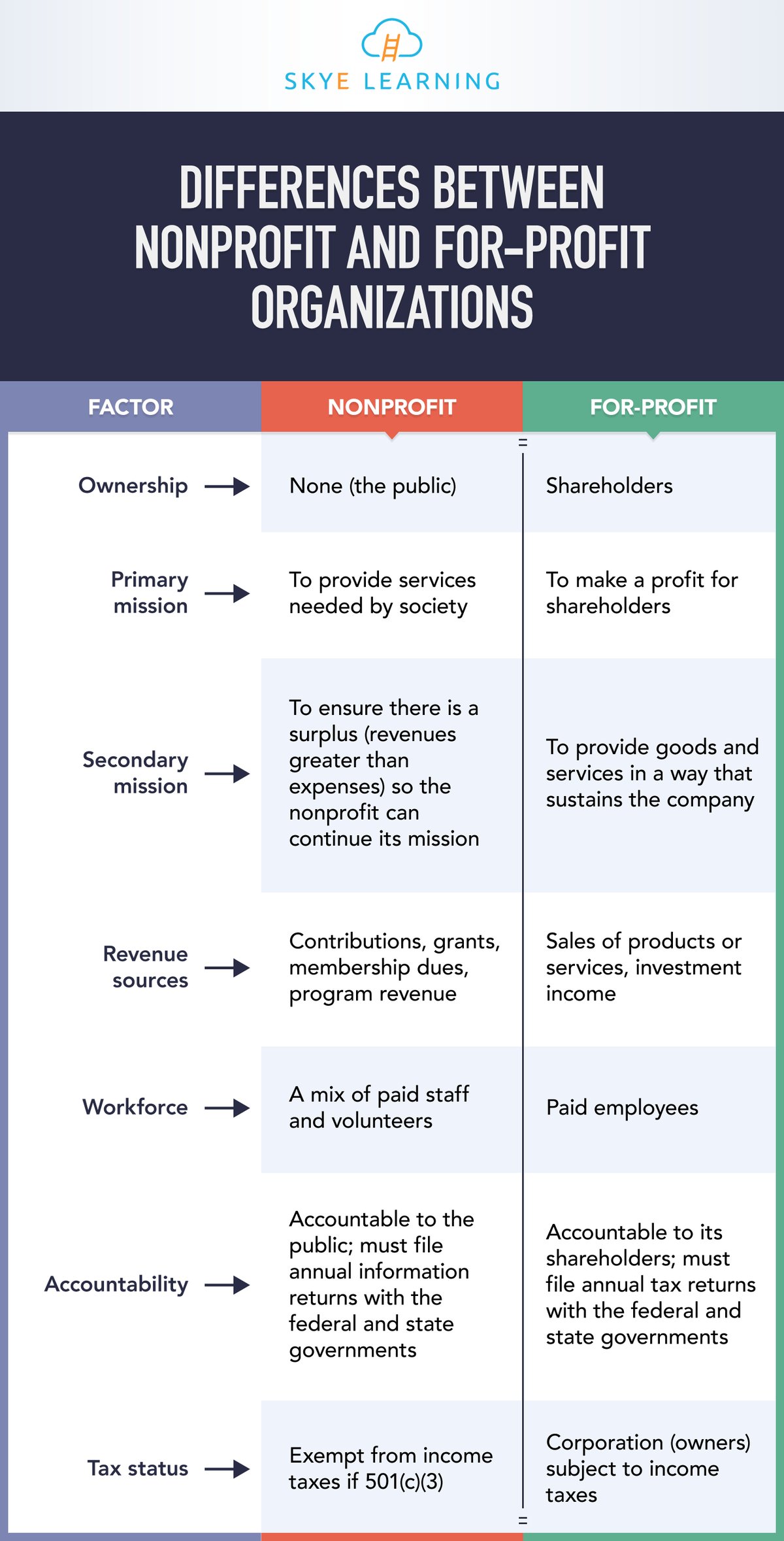

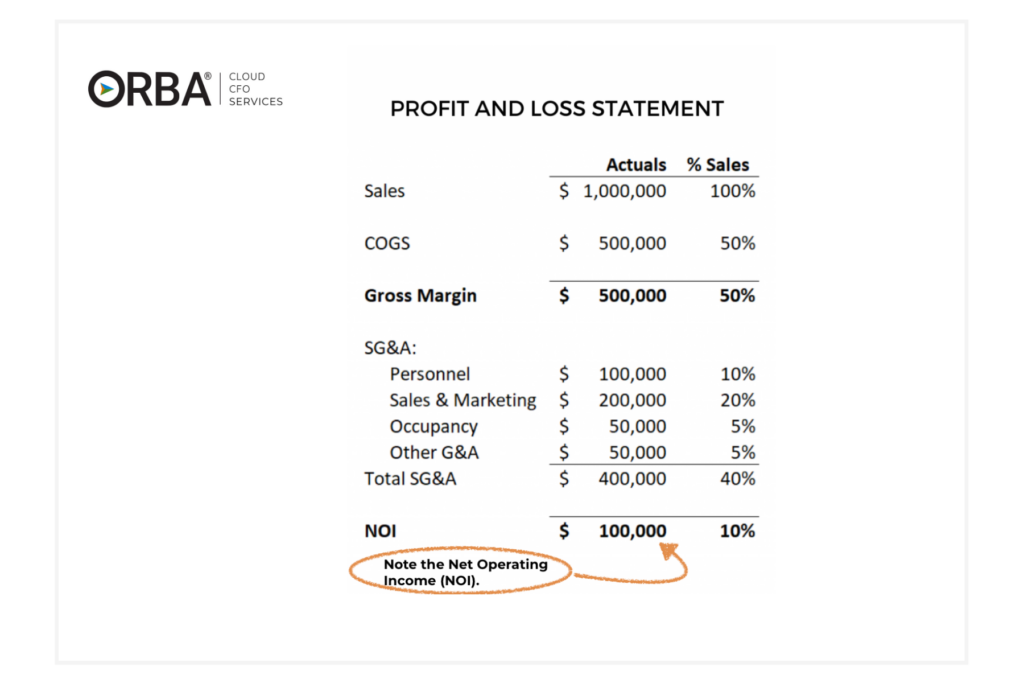

Profit and loss for nonprofit. Your financial statement should include: A statement of activities, also called a profit & loss statement, is a financial report that shows how much a nonprofit organization earned or spent over a period of time, typically one year. The nonprofit statement of activities and the income statement are two different terms that refer to the same report.

The number of accounts depends on the number of programs that the nonprofit has, the types of revenues it earns, and the level of detail required for planning and control of the organization. These reports collectively provide the financial insights your nonprofit needs to thrive. introducing our grief support group:

You may also hear it referred to as a profit and loss statement or income and expense report. In the broadest sense, the answer is no. Nonprofits are usually required to provide states with a copy of.

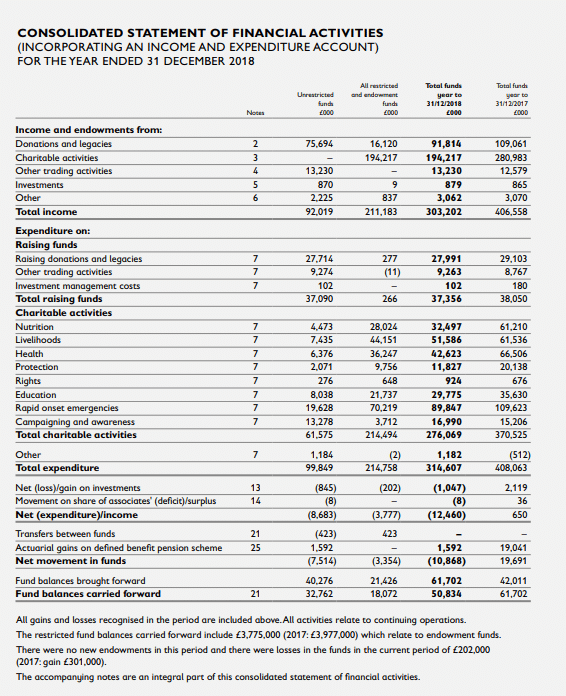

Ideally, a government wants expenditures to be very close to revenue in any given. Failure to comply with proper reporting can result in penalties and loss of nonprofit status. Typically, expenses are broken into two distinct sections—overhead expenses and.

However, nonprofits are not in the business of making a profit (or a loss), thus this is an incorrect assumption. The statement can be used to track the organization’s progress and make sure it is meeting its financial goals. As shown in exhibit 2 , this is accomplished by listing each net asset fund in a separate column.

Regular monthly reporting typically includes a statement of financial position (balance sheet), a statement of activities (profit and loss [p&l] and income statements), and other required reports. Still coping with the loss of his nephew and charged with a desire to create change, richardson put what he was learning in business school into practice. What is a profit and loss statement, and do nonprofits need one?

You could use an excel spreadsheet, like the one we’ve prepared for you here. Additionally, sloppy or inaccurate accounting can lead to problems with the irs, which include possibly losing nonprofit status, hefty fines, and even criminal charges. The statement of activities is the income statement of a nonprofit organization.

Having no profit does not mean that there is no income. A profit and loss statement may also be called a p&l or an income statement. In the first section of the statement of

Reading a statement of activities can be. Net assets are the organization’s generate draw its cost. Consequently, a significant portion of the board’s time

Sanctuary circle at fourth tri in the midst of the u. The statement of activities (soa) is the correct nonprofit term for the report we may commonly have called the income statement, budget report, profit & loss, income and expense report, etc. In 2022, two former veterans of.

![17+ Profit And Loss Template EDITABLE Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/07/pal-6.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-for-Small-Business-TemplateLab.com_-scaled.jpg)