Amazing Info About Pro Forma Cost How To Make A Projected Cash Flow Statement

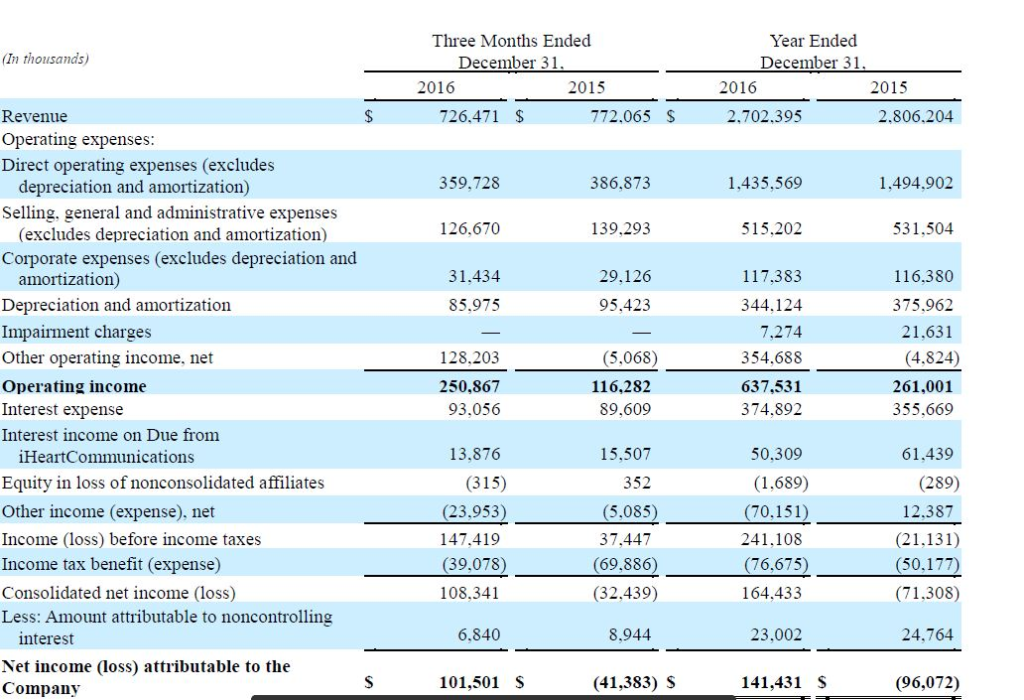

Pro forma cost. Definition of pro forma and cost control: Similarly, the revenue side of financials can often benefit from sustainable. Pro forma income statement can be used to analyze and predict transactions and is a great tool to predict the future growth, sales, and even expenses of the organization.

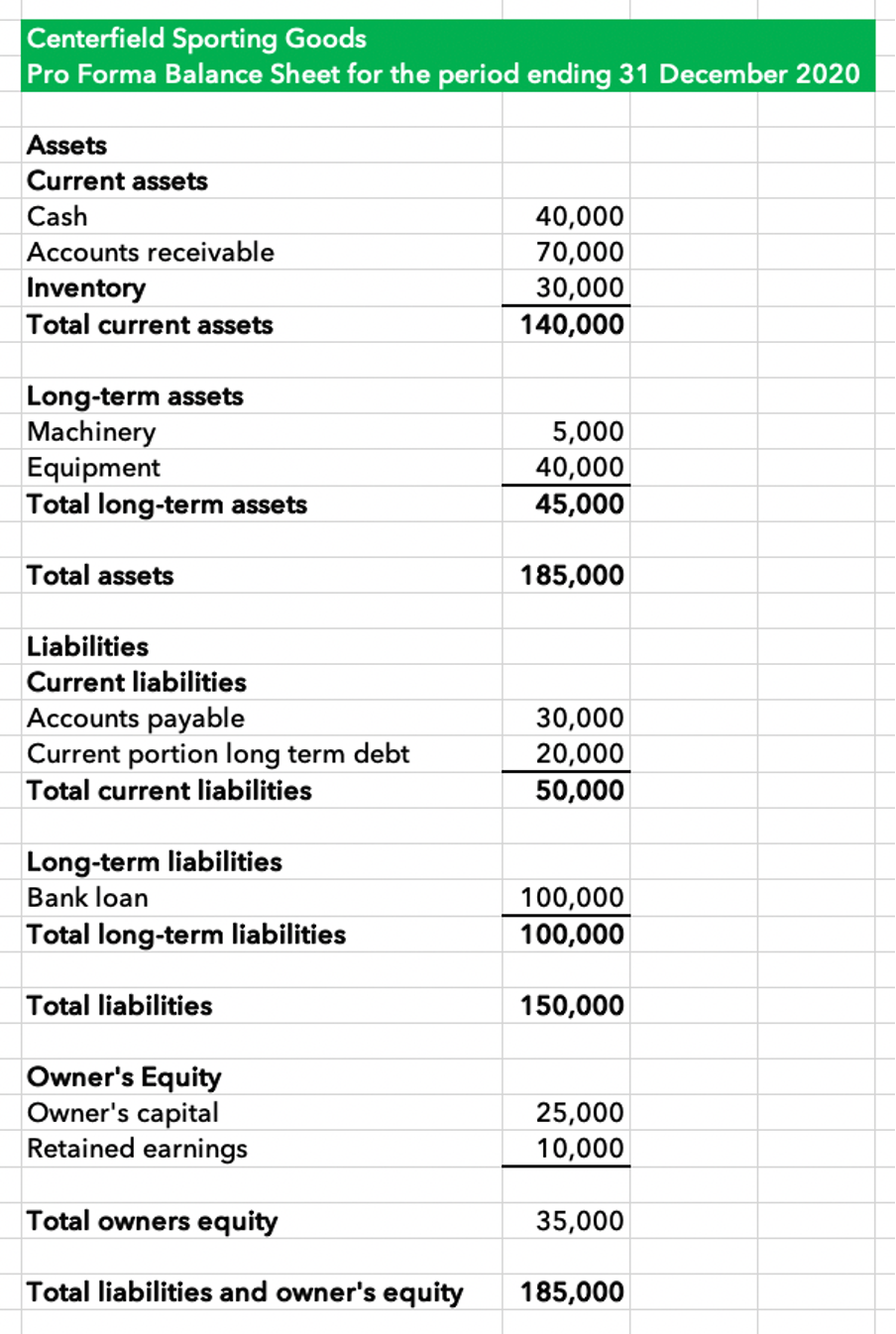

Liabilities include loans and lines of credit. The steps are: Pro forma is latin for “as a matter of” or “for the sake of form.” it is used primarily in reference to the presentation of information in a formal way, assuming or forecasting pieces of information that may be unavailable.

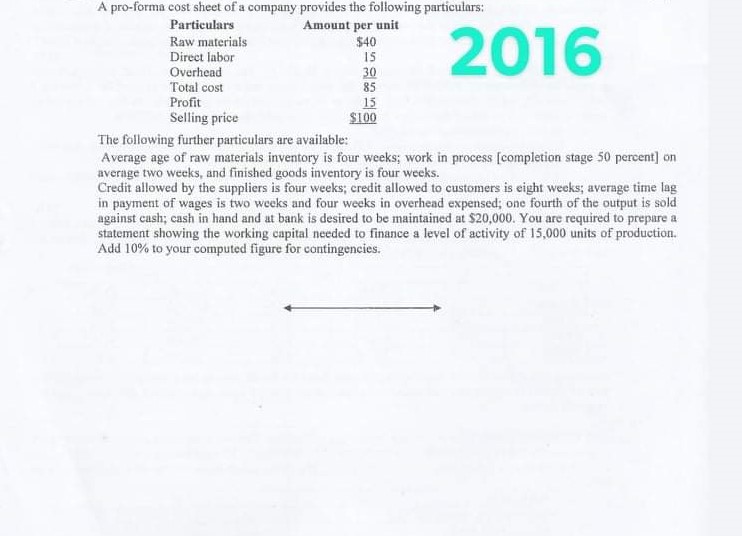

Pro forma financial statements look a lot like regular financial statements. Define pro forma costs. It is a preliminary bill of sale.

Estimate your total liabilities and costs. Download excel template why use pro forma statement templates? Calculate the estimated revenue projections for your business.

Your budget may be based on the financial information of your pro forma statements—after all, it. Pro forma cost savings means, without duplication of any amounts referenced in the definition of “ pro forma basis ,” an amount equal to the amount of cost savings, expense reductions, improvements (including the entry into any material contract or arrangement) and synergies, in each case, reasonably expected to have a continuing impact and proj. The term pro forma is latin for as a matter of form or for the sake of form.

Thus, $1,100,000 minus $550,000 equals your gross profit, or $550,000. Meaning & examples | invoiced what is a pro forma invoice? To figure your pro forma gross profit for next year, subtract the pro forma cost of goods sold from the pro forma sales.

Sustainability and pro forma incorporating sustainability cost. Like other site costs, these costs are estimated in detail by site engineers, based on the unique characteristics of each site. A couple of observations are noteworthy before.

The pro forma income statement is used to create cash flow statements and balance sheets, which are an important part of the business plan. Pro forma disclosures because asc 805 does not provide guidance on how entities should calculate the items that must be disclosed (pro forma revenue and earnings). What is a pro forma income statement?

Consequently, pro forma statements summarize the projected future status of a company, based on. For example, see section 4.4.1.1, nonrecurring items, for details. Pro forma is an estimate of future performance and cost control is a process of monitoring and controlling expenditures.

It is also important to note that registrants determining whether to include asc 805 pro forma. Learn about pro forma invoices, an invoice type that can remove the element of surprise from your sales efforts and avoid stress. What may happen if a business receives a $150,000 loan?