Peerless Info About Gaap Accounting For Partnership Distributions New Balance Sheet

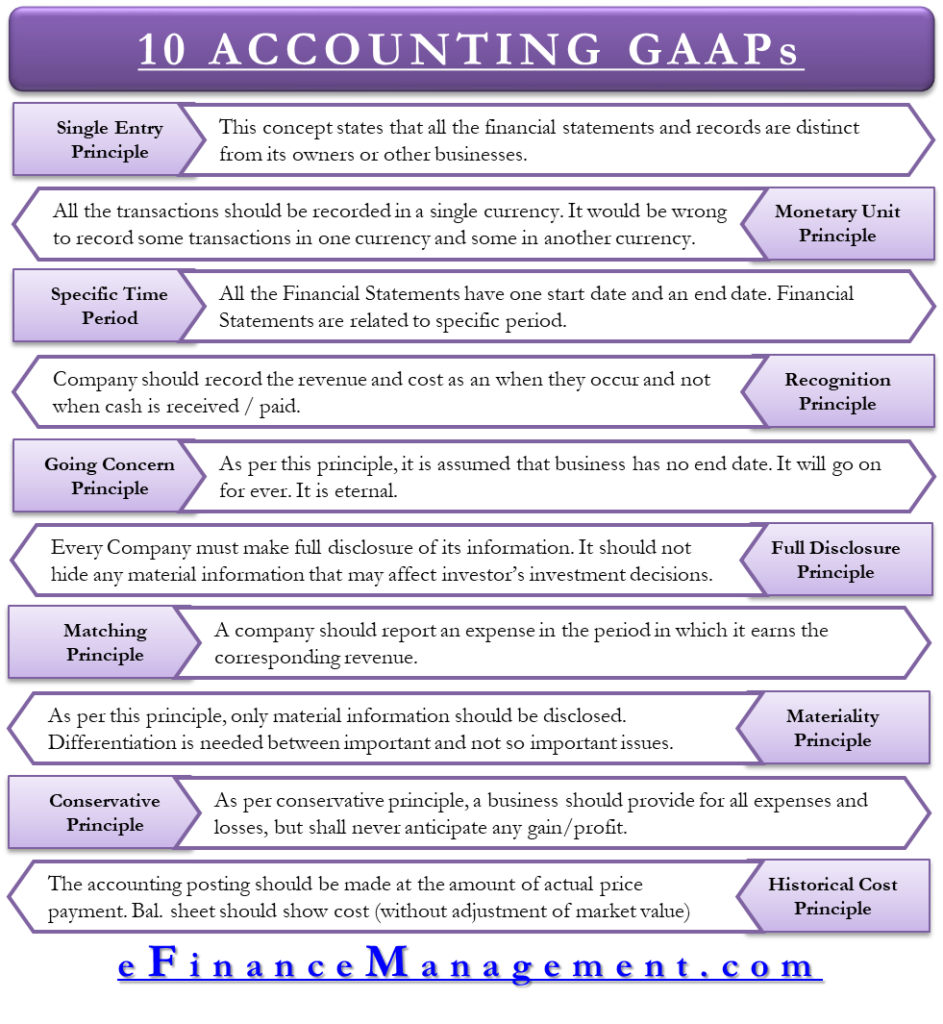

We will define partnership distributions, look at what it is, how they are taxed, current distributions, distributions in excess of basis, distribution types,.

Gaap accounting for partnership distributions. Two answers explain why they accrue and record. In fa2, a partnership will always be an unincorporated business entity. You could also set up a fourth sub account for gaap or book valuation (nontax) changes.

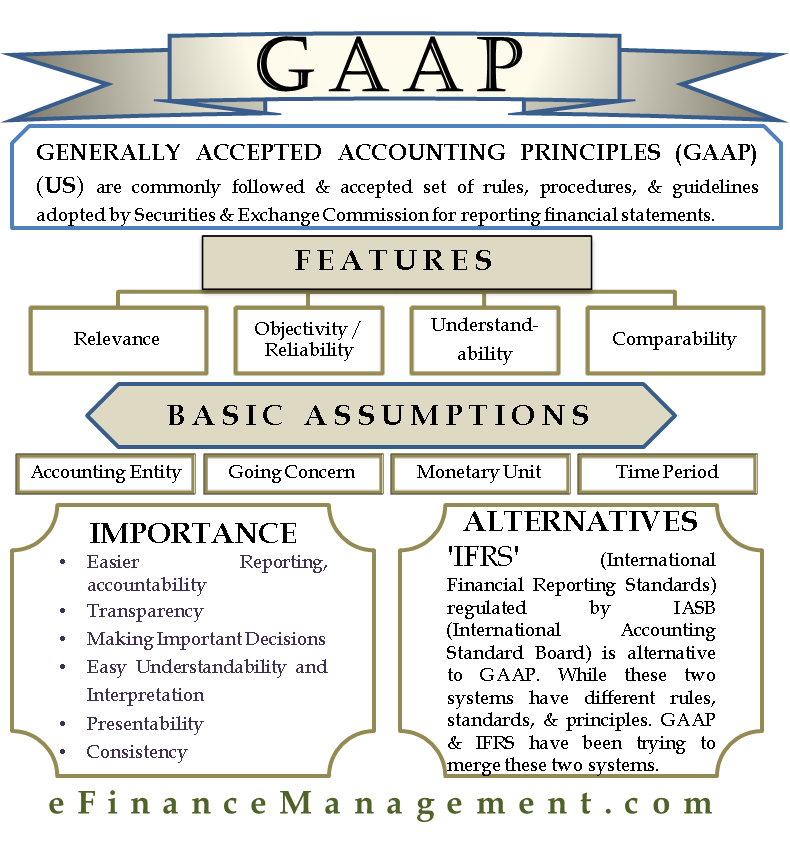

A question about the best practice of accounting for partner's tax distributions in gaap and tax books. Current statutory accounting guidance does not address accounting for investments in limited liability companies. 1.1 explain the importance of accounting and distinguish between financial and managerial accounting;

Gaap addresses accounting for investments in. The accounting for a partnership is essentially the same as is used for a sole proprietorship, except that there are more owners. The equity method of accounting for investments in general partnerships is generally appropriate for accounting by limited partners for their investments in limited.

A distribution is a transfer of cash or property by a partnership to a partner with respect to the partner's interest in partnership capital or income. This gives you a way to track the cumulative totals for the life of the. On january 31, 2023, the partnership completed a distribution in the form of additional bucs at a ratio of 0.0105 bucs for each buc outstanding as of december 30,.

What does gaap say? How to account for a partnership. This is why it is important to have a.

The reporting entity (business entity) principle applies to a partnership, so for accounting. Roi earned largely through cash flows from ppa. Gaap says that distributions should be recorded when the appropriate governing body declares them.

A partnership keeps track of each partner’s economic investment in the partnership through a financial record called a capital account. If a general partner has an equity method investment in a limited partnership and receives cash distributions in excess of its investment balance, the. Certain states have responded to the state and local tax deduction limit for individual owners of passthrough entities (generally, partnerships or s corporations) by.

This portfolio provides detailed examples and. A current distribution decreases the partner's capital account without terminating it, whereas a liquidating distribution pays. There are 2 types of distributions:

1.2 identify users of accounting information and. In our discussion of partnership accounting we will examine partners’ accounts in the accounting records, the distribution of periodic net income, the admission of new and. In essence, a separate account tracks each partner's investment, distributions, and.

![PCGR principes comptables généralement reconnus [Guide complet]](https://i0.wp.com/www.iedunote.com/img/1119/gaap-rule-principles-assumptions-in-accounting-gaap.jpg)