Out Of This World Tips About Equity On Balance Sheet Management Discussion

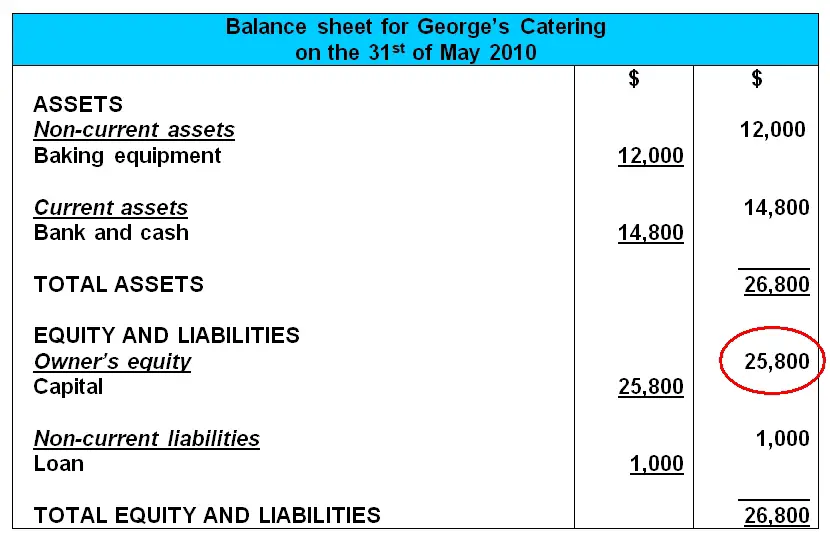

These are assets that can be converted to cash.

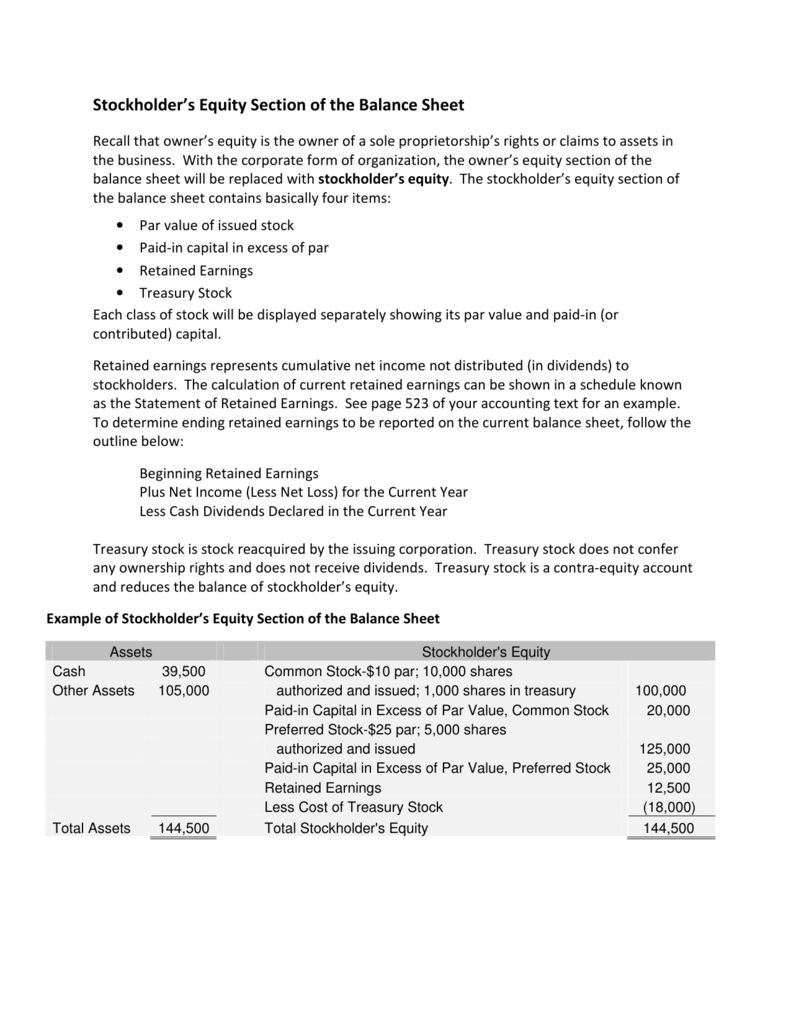

Equity on balance sheet. The ability to read and understand a balance sheet is a crucial skill for anyone involved in business, but it's one that many people lack. Equity represents the shareholders’ stake in the company, identified on a company's balance sheet. It is also a valuable tool for management to know the value of assets a business owns, including equipment, bank balance and what it owes at any given time.

The formula can also be rearranged like so: It can also be referred to as a statement of net worth or a statement of financial position. It is calculated by subtracting total liabilities from total assets.

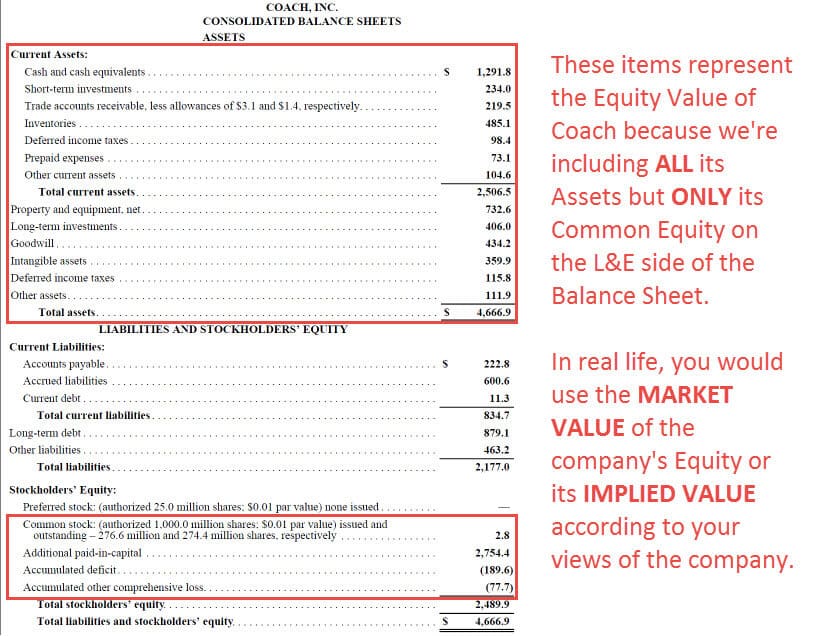

The book value of equity is calculated as the difference between assets and liabilities on the company’s balance sheet, while the market value of equity is based on the current share price (if public) or a value that is determined by investors or valuation professionals. Owner’s equity grows when an owner increases their investment or the company increases its profits. Assets = liabilities + shareholders’ equity.

This study examines whether firms with debt contacts that contain more restrictive balance sheet covenants are more likely to conduct seasoned equity offerings. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. When it comes down to it, the balance sheet is just a more detailed version of the fundamental accounting equation:

The deal comes at a time when banks are beefing up their balance sheets ahead of a potential economic downturn, and as federal regulators have proposed higher capital requirements for lenders. The calculation of equity is a company's total assets minus its total liabilities, and. Assets = liabilities + owners’ equity.

It also represents the residual value of assets minus liabilities. The balance sheet equation. A negative owner’s equity often shows that a company has more liabilities than assets and can signify trouble for a business.

Assets = liabilities + equity. Equity is the owners’ residual interest in the assets of a company, net of its liabilities. Equity is the remainder value when liabilities are subtracted from assets.

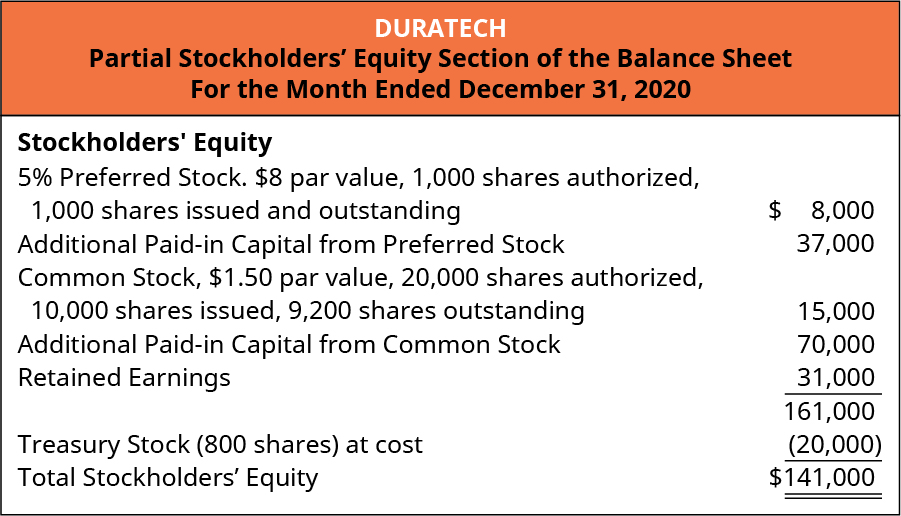

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. When it comes to equity, the accounts displayed depend on the type of entity of your business. To calculate total equity, simply deduct total.

Summary shareholders’ equity is the shareholders’ claim on assets after all debts owed are paid up. The three components of the equation will now be described in further detail in the following sections. Assets = liabilities + owners’ equity or, if you prefer to look at it in equity terms:

So, the simple answer of how to calculate owner's equity on a balance sheet is to subtract a business' liabilities from its assets. The balance sheet (also referred to as the statement of financial position) discloses what an entity owns (assets) and what it owes (liabilities) at a specific point in time. As a reminder, the balance sheet has three major sections:

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)