Impressive Tips About Operating Activities Investing Financing Financial Analysis Of Statements

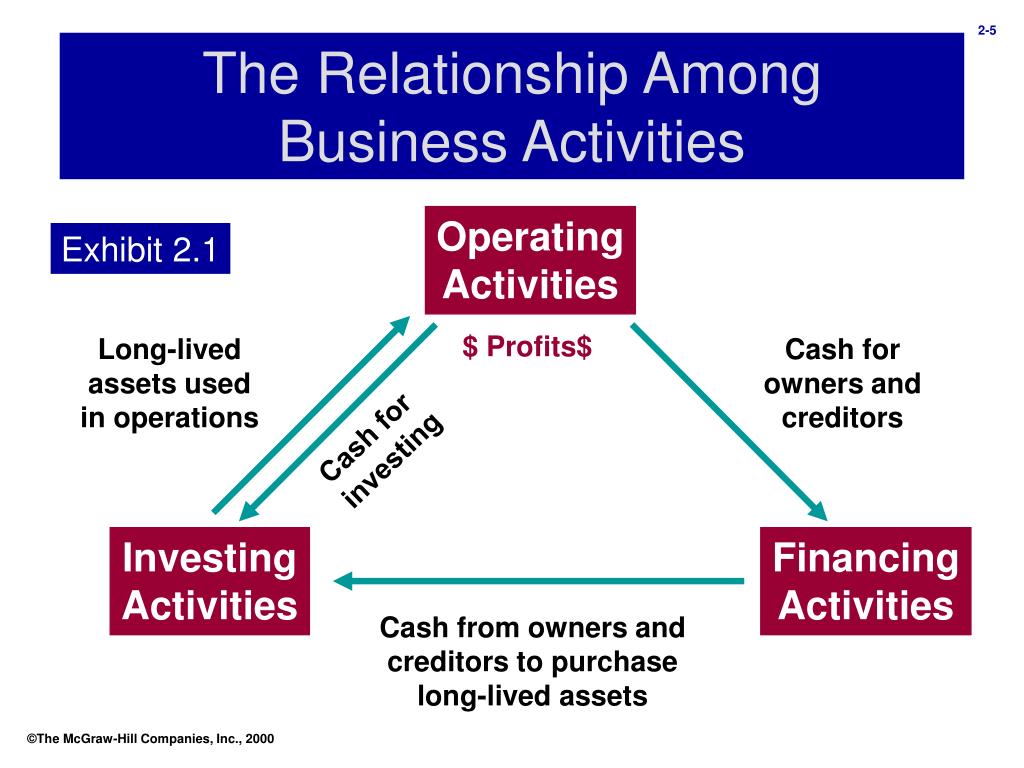

The relationship between operating, investing, and financing activities.

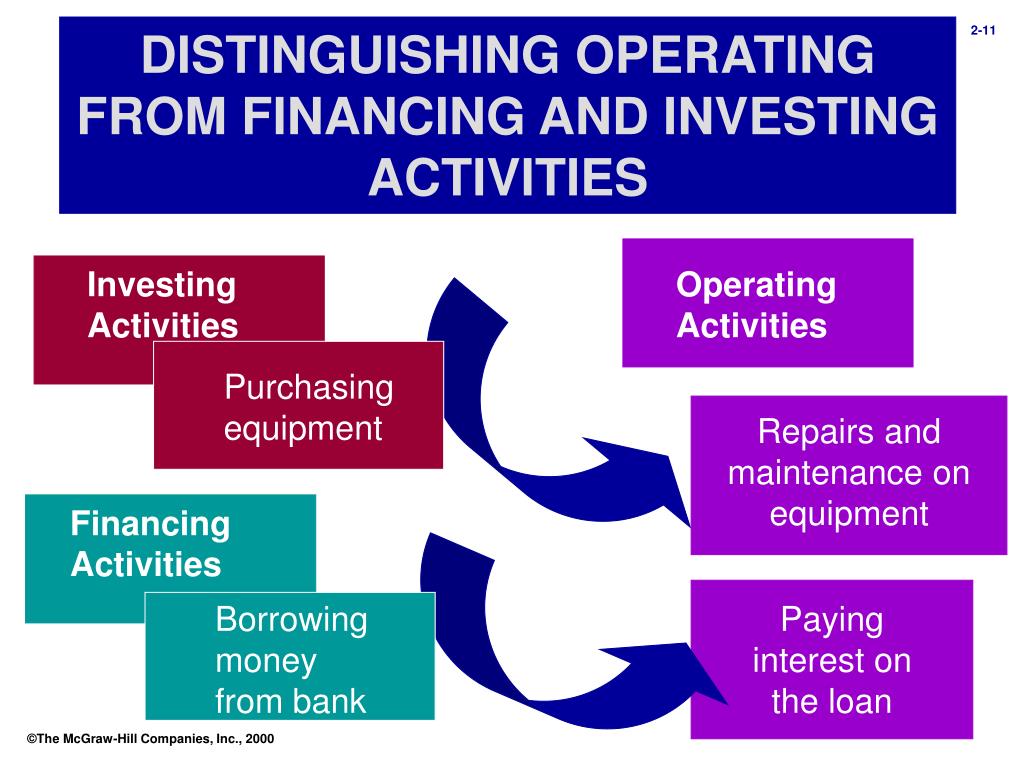

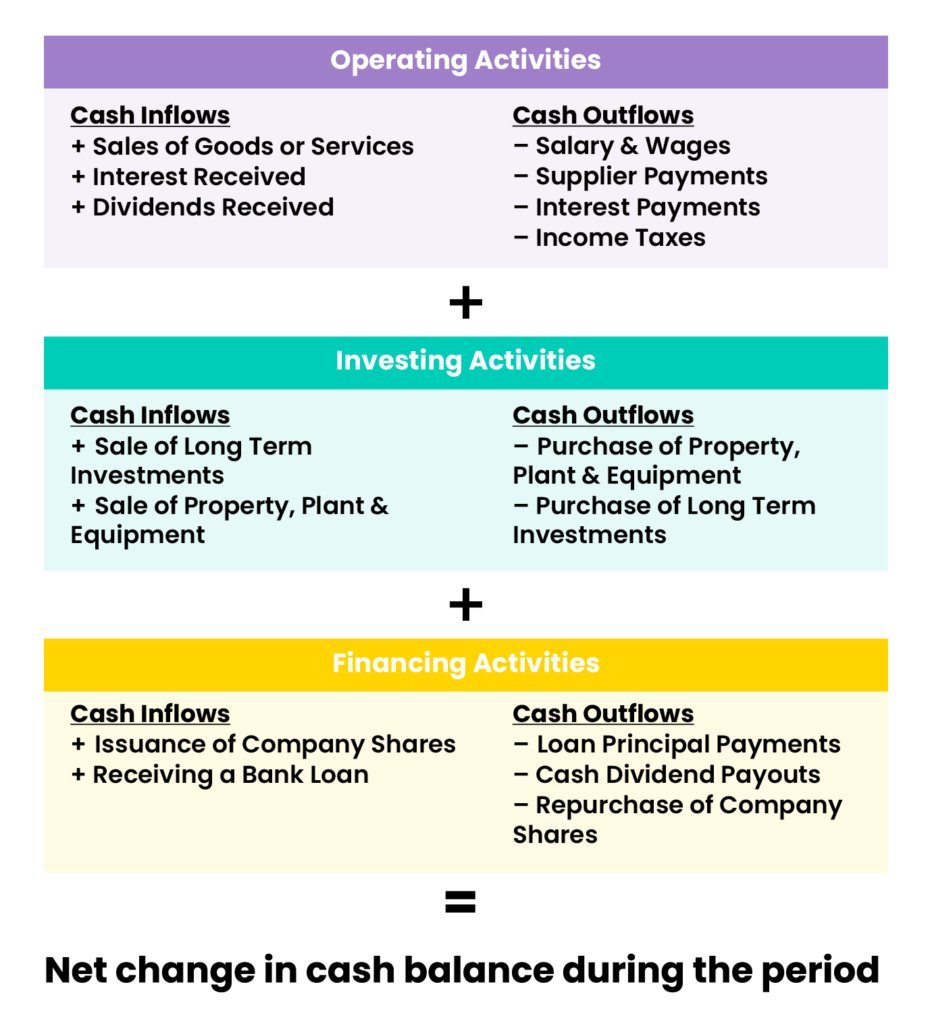

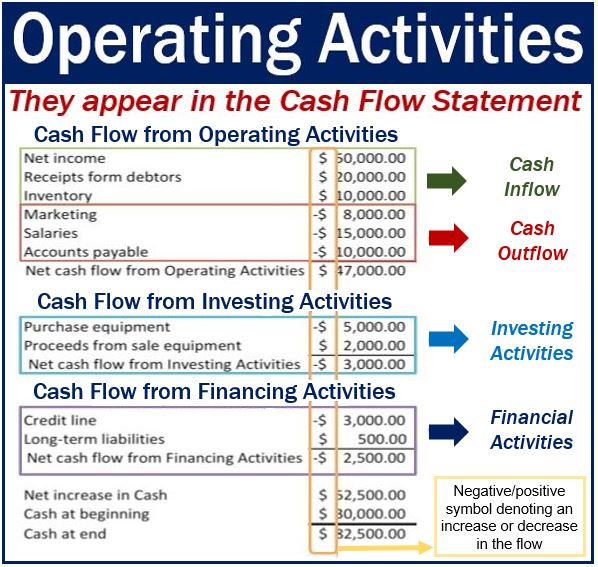

Operating activities investing activities financing activities. Investing activities include cash activities related to noncurrent assets. For example, operating cash flows include cash sources from sales and cash used to purchase inventory and to pay for operating expenses such as salaries and utilities. Operating activities 13 investing activities 16 financing activities 17 reporting cash flows from operating activities 18 reporting cash flows.

Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Question 1 which of the following would be classified as a cash flow from investing activity?

Proceeds from the sale of. 349 (674) cash flows (for) from investing activities: Cash flows from operating activities, cash flows from investing.

Operating activities include cash activities related to net income. Cash flow from financing activities. Companies can choose two different ways of.

Cash flows from operating activities cash flows from operating activities arise from the activities a business uses to produce net income. The statement of cash flows presents sources and uses of cash in three distinct categories: Operating activities, investing activities and financing activities.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Cash flows from operating activities, cash flows from investing activities, and cash. The statement of cash flows presents sources and uses of cash in three distinct categories:

Operating cash flows also include cash flows. The statement of cash flows presents sources and uses of cash in three distinct categories: The three sections of the cash flow statement are:

Some cash flows relating to investing or financing activities are classified as operating activities. Cash flows from operating activities, cash flows from investing activities, and cash. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors.

Cash flow from operating activities is the first section depicted on a cash flow statement, which also includes cash from investing and financing activities. Cash flows from operating activities arise from the activities a business uses to produce net income. Begin with net income from the income.

For example, receipts of investment income (interest and dividends) and. Proceeds from the issuance of bonds. Operating activities are distinguished from investing or financing activities, which are functions of a company not directly related to the provision of goods.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/operatingactivities-4-3-da3b96abecd644be990481917a5c7e9b.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)

:max_bytes(150000):strip_icc()/Term-Definitions_CFF-Final-V2-59b1197815114baf8e44d14286edbf6e.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)