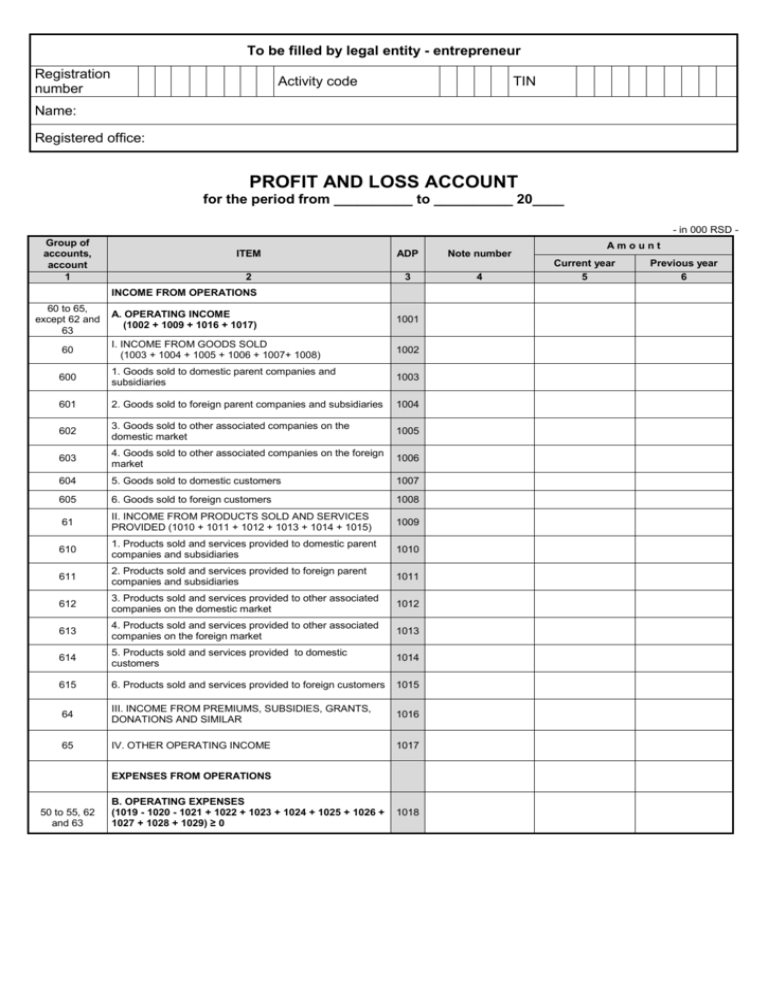

Here’s A Quick Way To Solve A Info About Profit And Loss Account Also Known As How To Find Net Sales From Balance Sheet

Download your free copy of 7 tips to supercharge your business decisions to help you make the right choices so your company thrives.

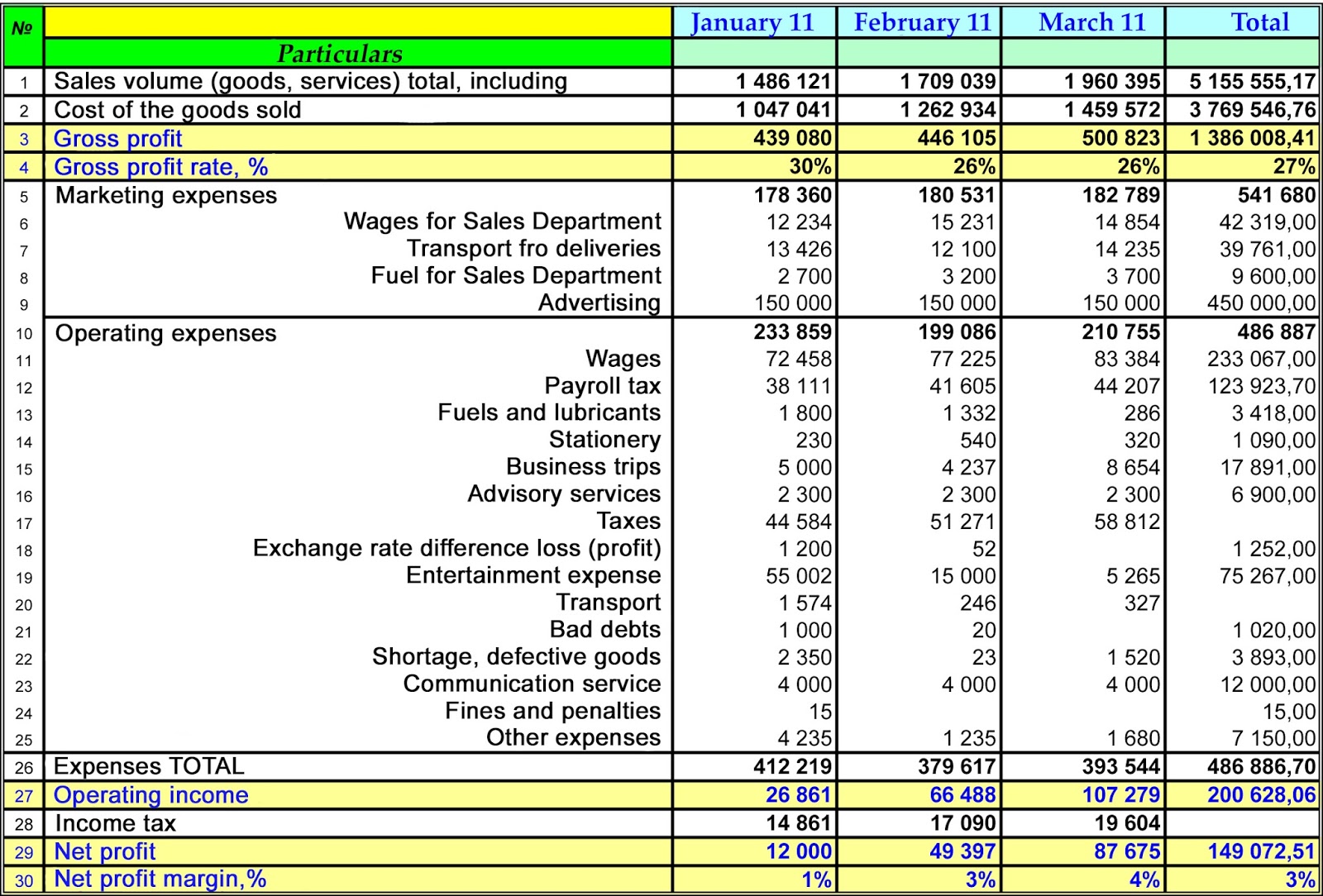

Profit and loss account also known as. The difference is the net profit, also known as net income. Trading account used to find the gross profit/loss of the business for an accounting period: Profit and loss account or income statement is used to find the net profit/loss of the business for an accounting period:

Let’s define the key terms in the order they arise on the profit and loss account. A p&l statement is also known as: It shows both turnover and profitability for the company over that length of.

A profit and loss (p&l) account shows the annual net profit or net loss of a business. Gross profit determines how well a company can earn a profit while. It is prepared to determine the net profit or net loss of a trader.

The difference, known as the bottom line, is net income, also referred to as profit or earnings. A company’s p&l is complemented by its. The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow statement.

It's like having your own personal accountant, except that it's automated, easy to read and can be used to track profits at any given point in time. A profit and loss (p&l) account, also known as an income statement, is a financial statement that summarizes the revenues and expenses of a company over a specified period of time, typically a fiscal quarter or year. United parcel service inc.

The profit & loss statement is a crucial financial statement summarising the costs, revenues and expenses incurred by a business during a specific period, usually a quarter. Only the revenue or expenses related to the current year are debited or credited to profit and loss account. A profit and loss (p&l) account, also known as an income statement, is used for various purposes, including:

Profit and loss accounts explained. Timing trading account is prepared first and then profit and loss account is. A profit and loss account is also known as an income and expenditure statement.

Gross profit refers to a company's profits after subtracting the costs of producing and distributing its products. The p&l account is a component of final accounts. Besides balance sheet and statement of cash flows, income statement is also among important financial statements which measures the financial performance of a company over a certain period.

It has to be prepared on a continuous basis and reviewed with caution to know the true profitability of the business. The profit and loss account starts with gross profit at the credit side and if there is a gross loss, it is shown on the debit side. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period.

A profit and loss account can give owners a sense of their business’s finances, helping them to identify inefficiencies and potential improvements. The profit and loss account is also known as a p&l report, an income statement, a statement of operation, a statement of financial results, or an income and expense statement. It helps obtain the operating income operating income operating income, also known as ebit or recurring profit, is an important yardstick of profit measurement and reflects the operating performance of the business.