Have A Info About Related Party Footnote Disclosure Example How To Read Financial Statements

Such disclosure would only be.

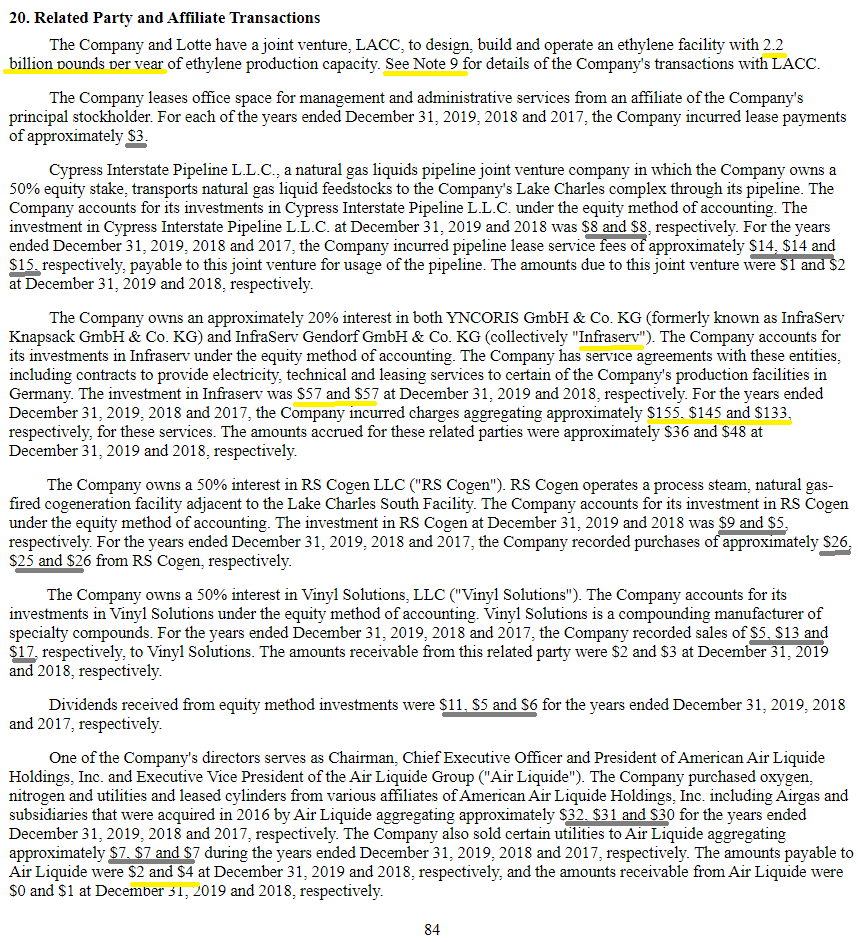

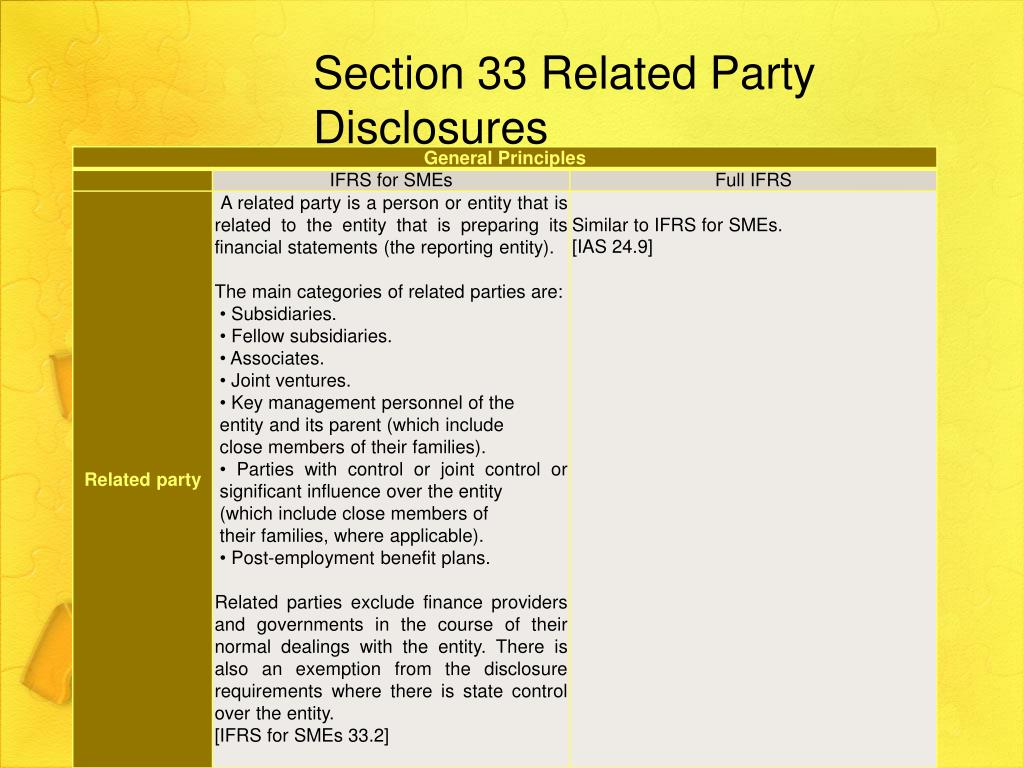

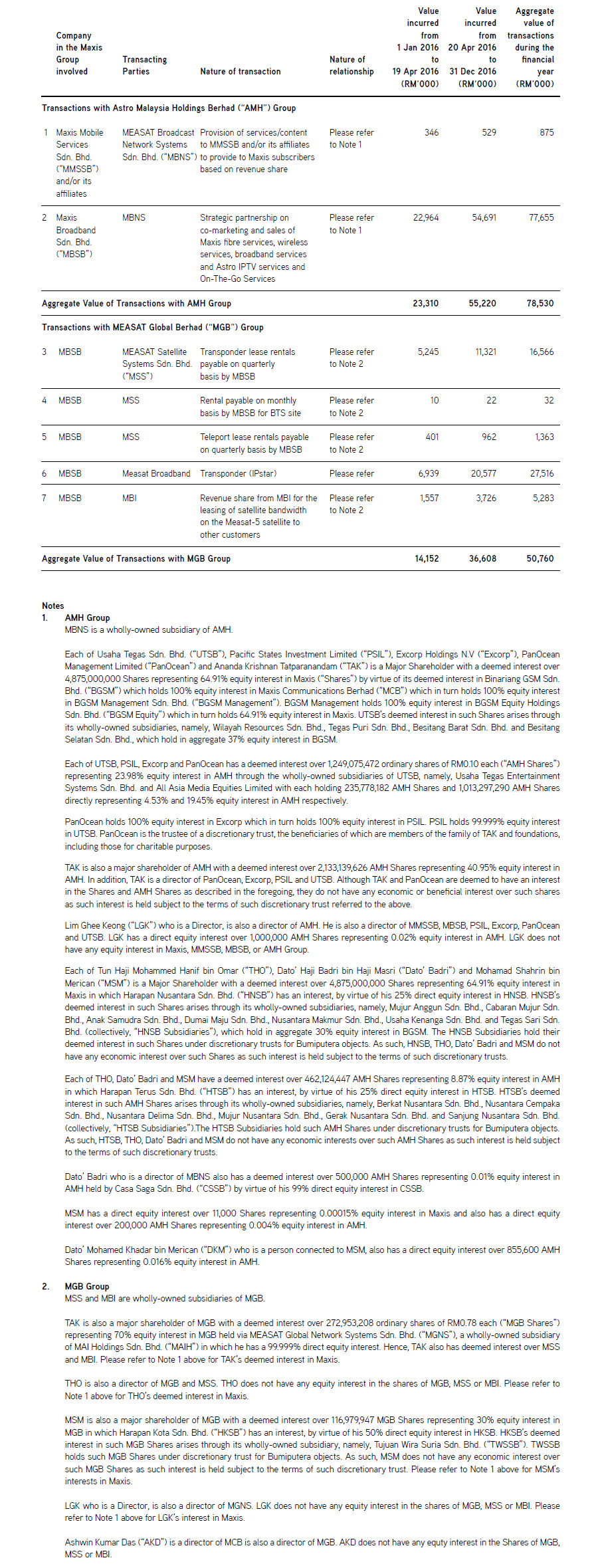

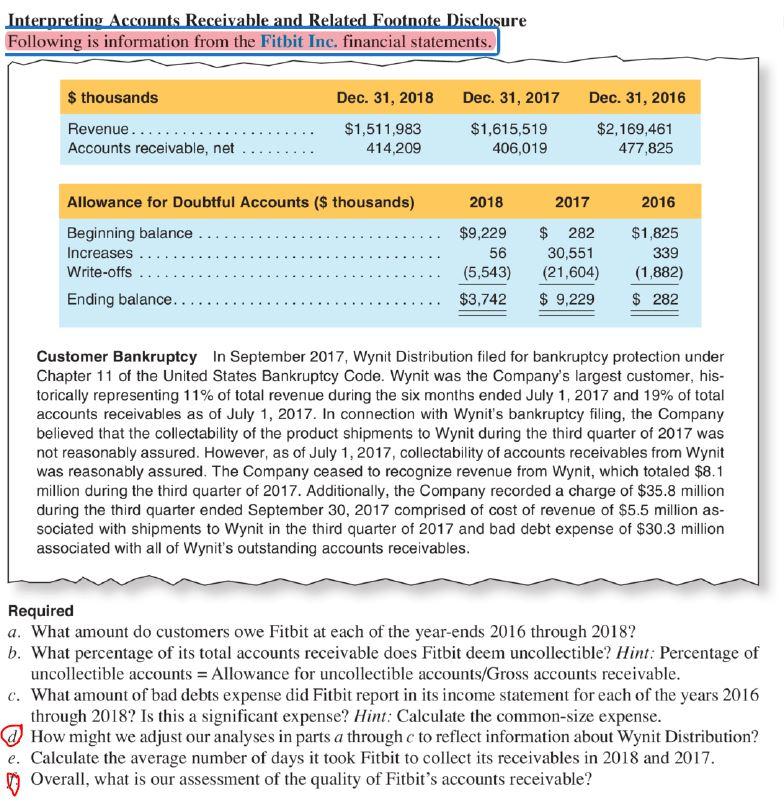

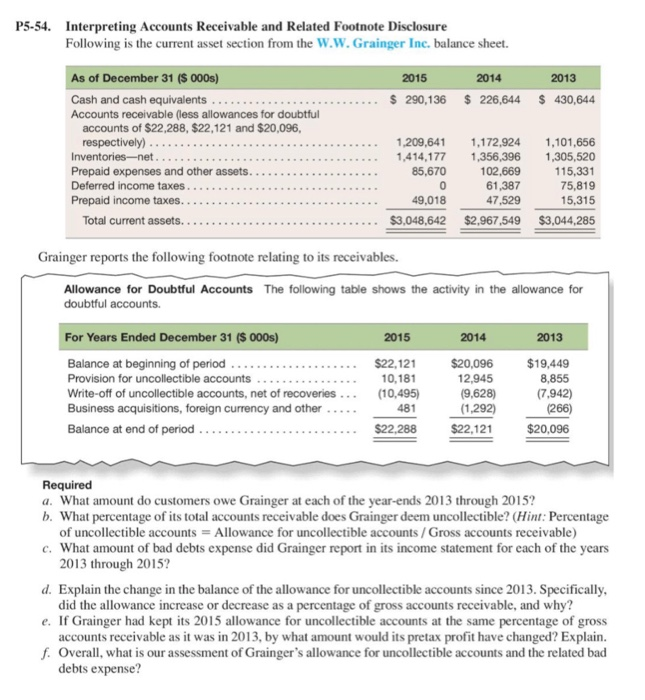

Related party footnote disclosure example. Ias 24 related party disclosures requires disclosures about transactions and outstanding balances with an entity's related parties. Note 45 to the financial statements) to indicate that the paragraph relates to recognition and measurement requirements, as.

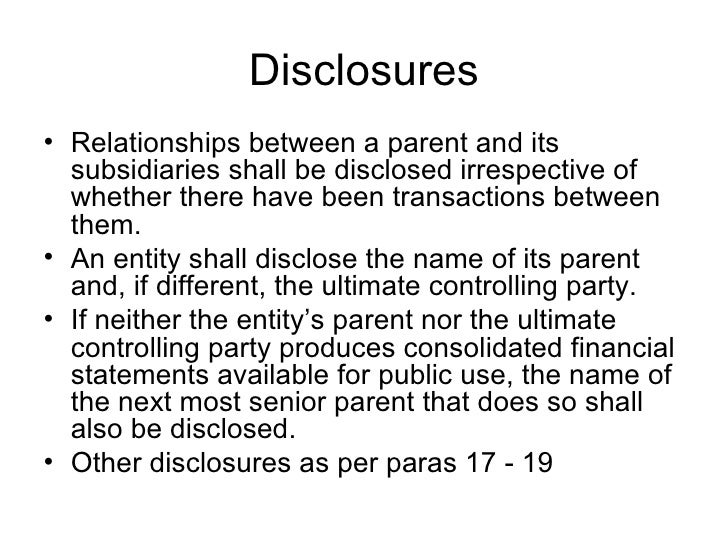

In respect of outstanding balances; The amount of transaction (if any) 4. Entities will need to consider how and in what format the required information should be provided,.

Leases between related parties should be classified in accordance with the lease classification criteria applicable to all other leases on the basis. Related party disclosures are a critical component of a company’s financial statements. Conducted by related parties.

Learn about the major issues. The objective of this standard is to ensure that an entity’s financial statements contain the disclosures necessary to draw attention to the. The following are examples of the related party disclosure required in a set of statutory accounts.

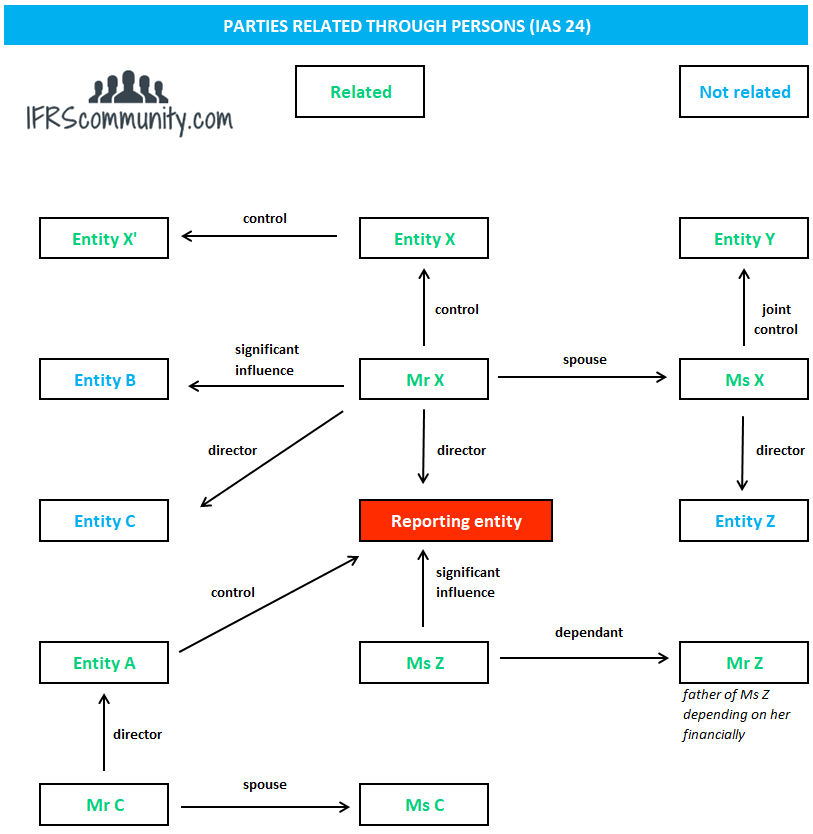

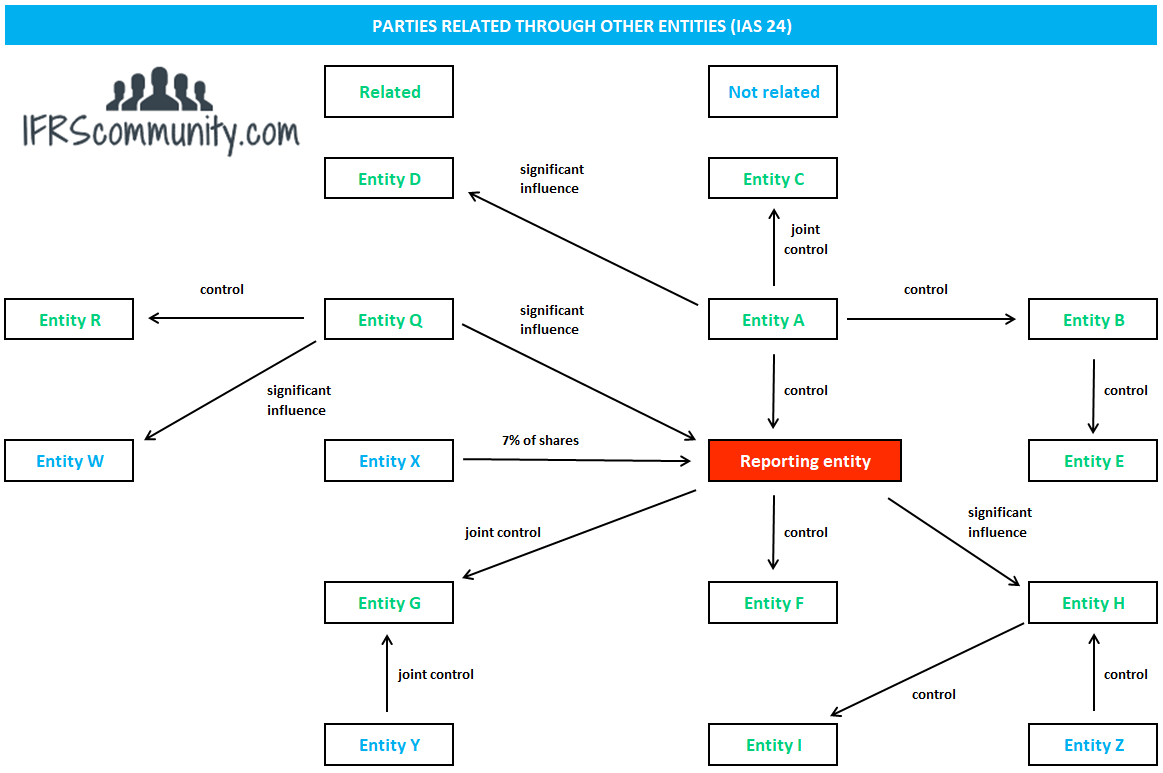

Examples of related parties. Certain accounting pronouncements prescribe accounting treatment when related parties are involved; The nature of related party relationship 3.

Ias 24 related party disclosures requires the following disclosures: See fsp 26 for disclosures of related party transactions. A parent entity and its subsidiaries.

Their terms and conditions 4.3. The disclosure under transactions with directors is as a result of the. For example, a reporting entity may want to disclose that a loan arrangement between the reporting entity and a related party is at arm’s length.

Sales, purchases, and transfers of real and personal property services received or furnished,. Related party lessees and lessors should apply the disclosure requirements for related party transactions in asc 850. The statement requires the following information to be disclosed about related party transactions:

Examples of related parties are affiliates, other subsidiaries under common control, owners of the business, its managers, and their. Examples of related qualitative disclosures are not provided. Examples of related party transactions include those between:

The board revised ias 24 again to address the disclosures in government‑related entities. Subsidiaries of a common parent. Disclosure of significant accounting policies (e.g.