Perfect Info About Profit And Loss Statement For Independent Contractor Define Interim Financial Statements

It might be tied up in accounts receivable or a piece of equipment you purchased.

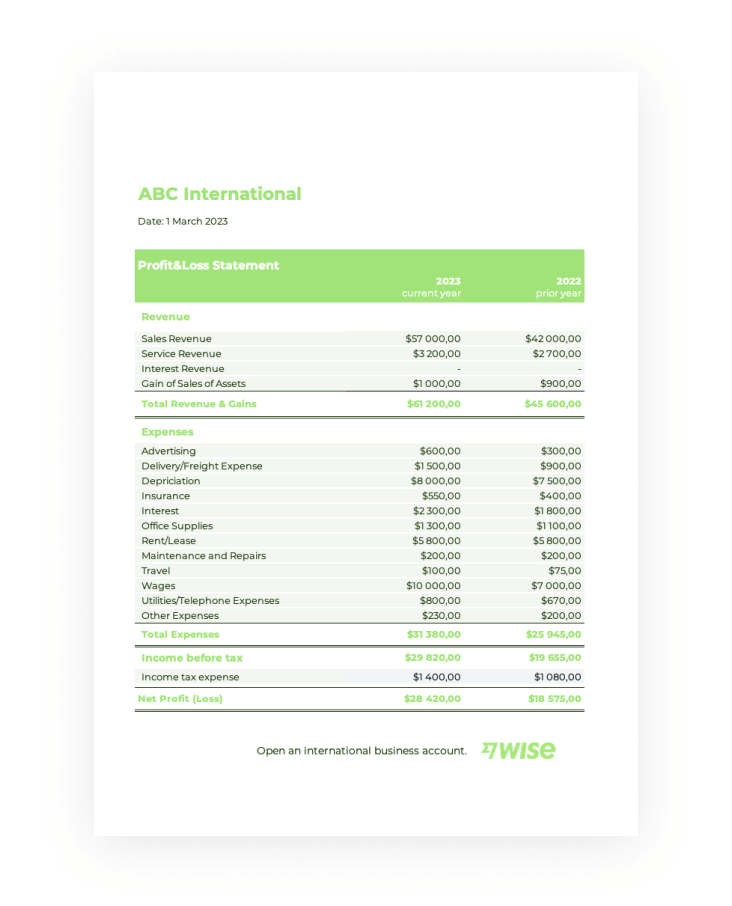

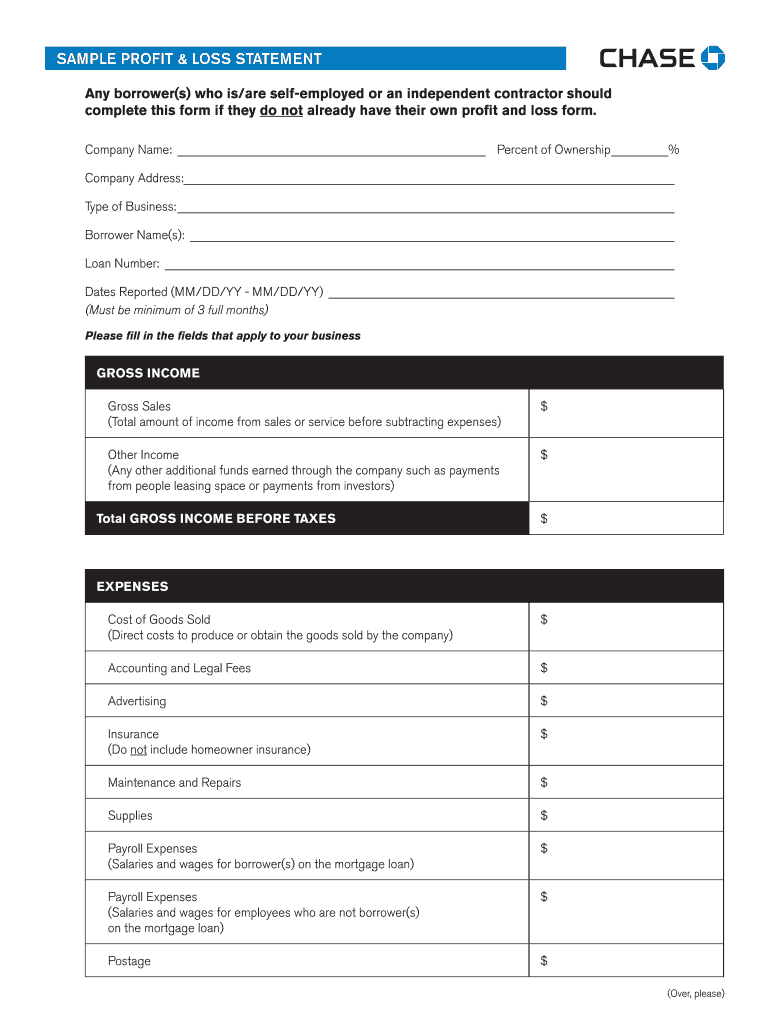

Profit and loss statement for independent contractor. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda). A p&l statement compares company revenue against expenses to determine the net income of the business. Just because your business made $100,000 doesn’t mean that $100,000 is in the bank.

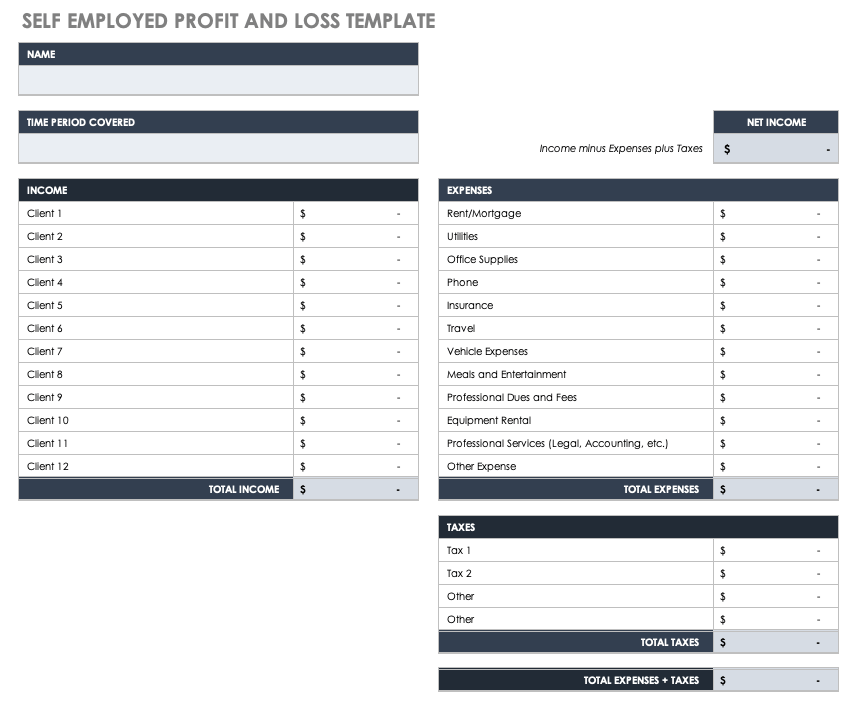

As an independent contractor, as a self employed person, you are a business owner. An income statement shows the total income the company received during the period and the expenses. Profit and loss statements look like checkbooks but aren’t checkbooks.

Also known as a profit and loss statement, the income statement is an essential tool in managing a construction business. This gives a full overview of all relevant details, relating to invoices and all company expenses. Explore a profit and loss account and understand a uk balance sheet for effective financial management.

A profit and loss statement is just one of several financial reports that businesses use to track their progress and performance. Securities and exchange commission ).”. What a business makes is not the money coming in, it’s the money left over.

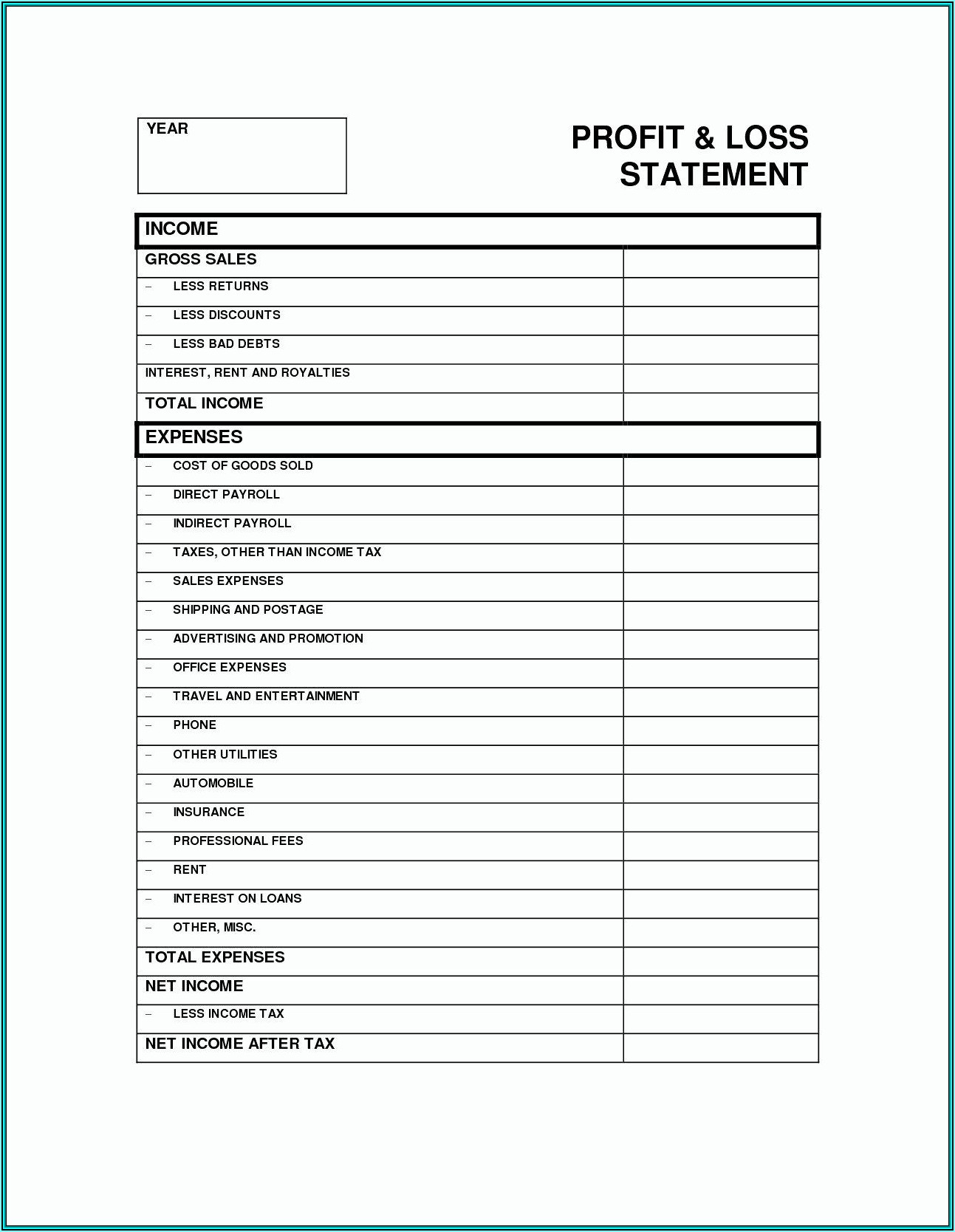

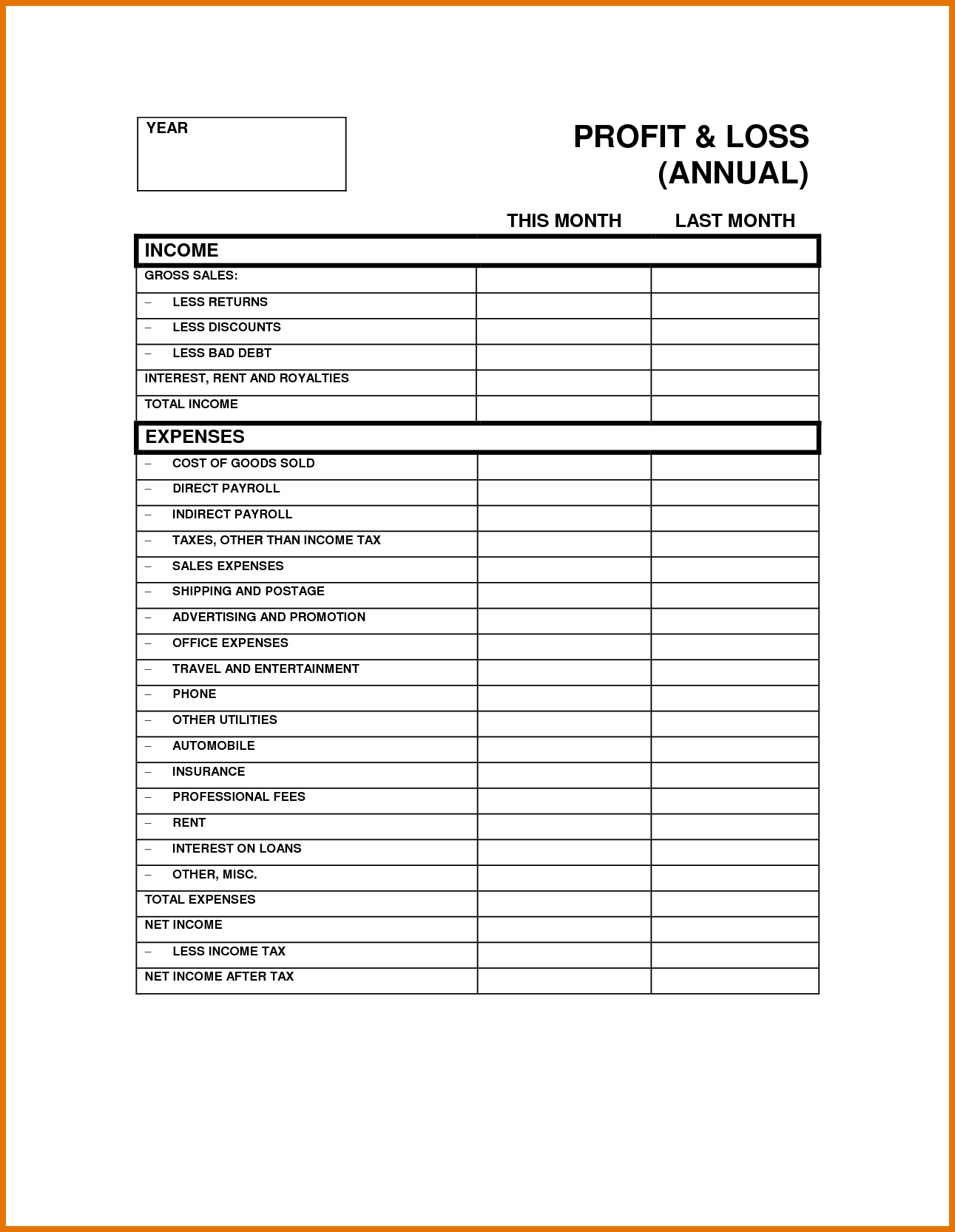

Basic income statements contain the following elements: Economic profit as small business owner, there are a couple of advantages to using an excel template that you should consider: Balance sheets tell you where the money is located.

An income statement summarizes a company’s income, expenses, and profit over a period of time. There are four basic reports that make up the core financial statements of a construction company: However, an independent contractor might create a separate profit and loss statement for a meeting with a bank for a loan to buy new equipment, or something similar.

A qualified accountant can then develop a comprehensive ‘p&l account statement.’. Subtract operating expenses from business income to see your net profit or loss. The p&l accounts are developed from the bookkeeping information usually inputted by you, the contractor/ company director.

The result is either your final profit (if things went well) or loss. At a minimum, an independent contractor will need a profit and loss statement at tax time to be able to calculate their taxable income. Tracks incoming and outgoing cash.

It’s not the revenue, it’s the profit. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. True independent contractors have an opportunity for profit and loss | greenwald doherty, llp true independent contractors have an opportunity for profit and loss december 10, 2015 topics:

The income statement (also called the profit and loss statement) is a “report that shows how much revenue a company earned over a specific time period… [it] also shows the costs and expenses associated with earning that revenue ( u.s. Revenue, expenses, and net income. Dates reported on this form.

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-and-Loss-Statement-Overview.jpg)