Divine Info About Profit And Loss Adjustment Account Format Deferred Gain On Balance Sheet

It begins with the balance carried down.

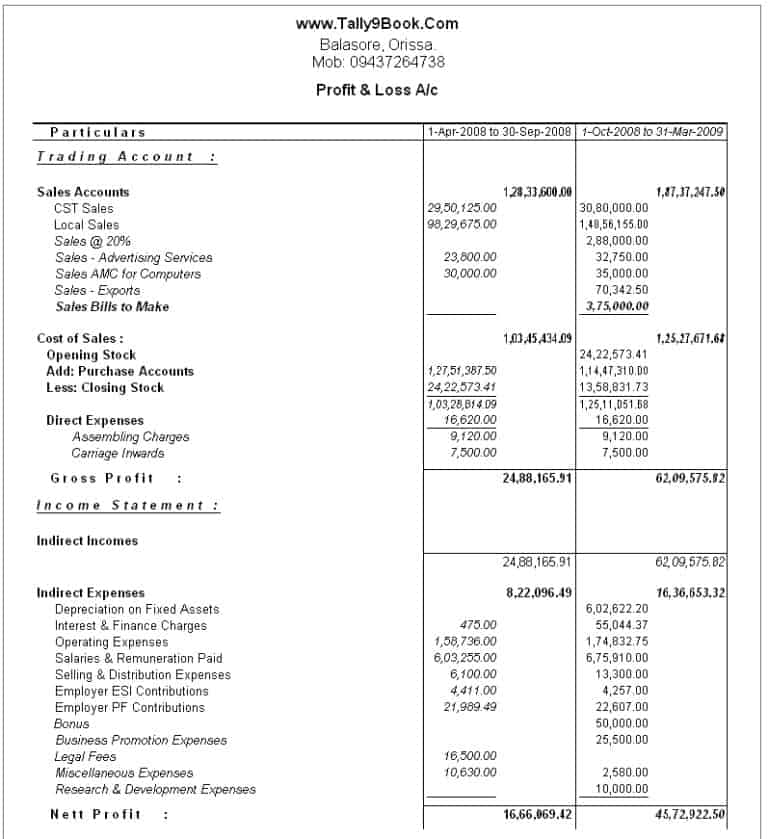

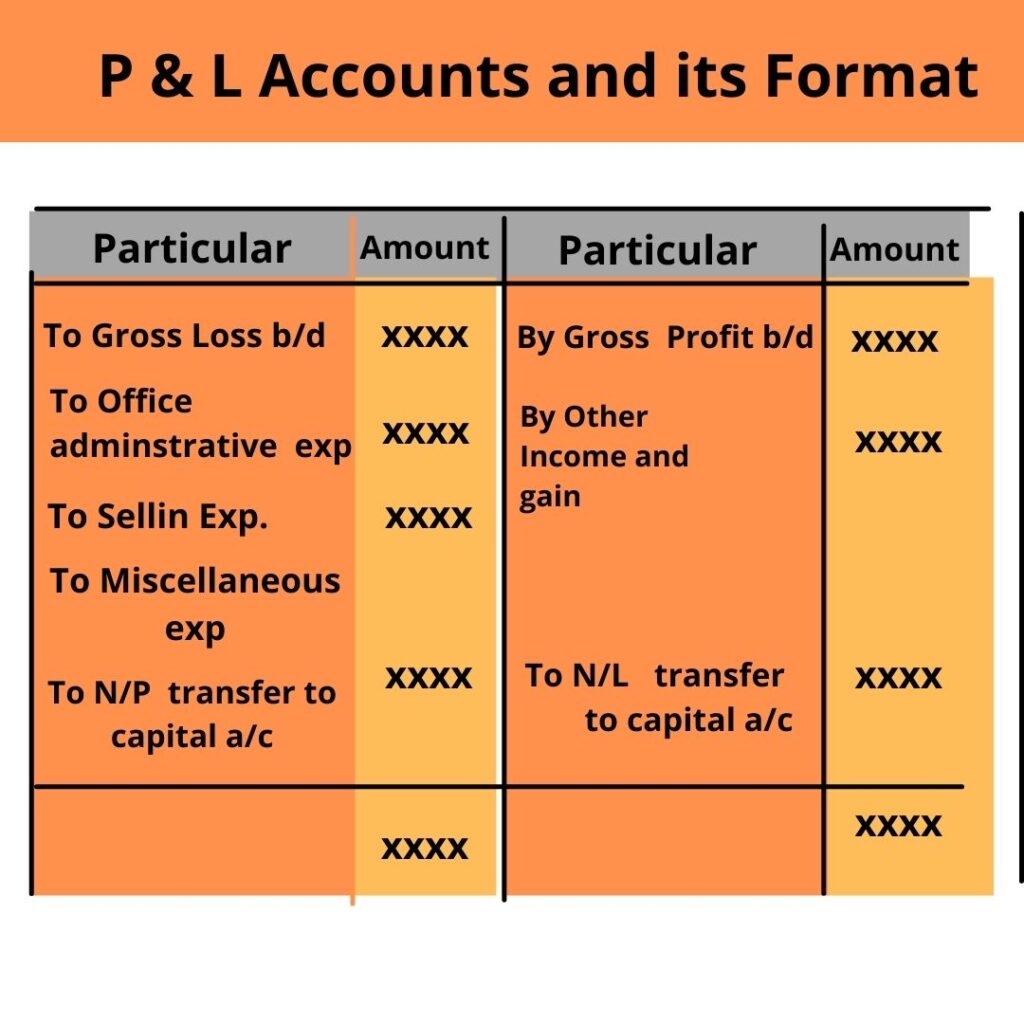

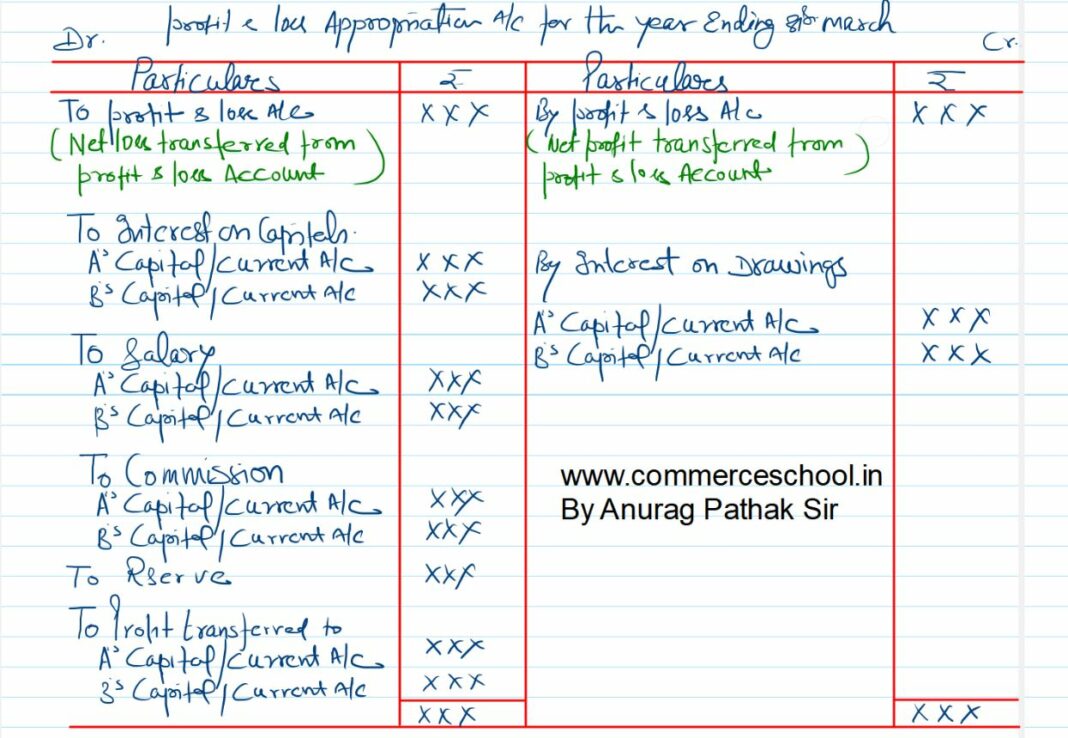

Profit and loss adjustment account format. Net loss transferred from p&l account, 2. Let us take you through different formats of the profit & loss account: The profit and loss abbreviated as the p&l statement is a financial statement that summarizes the revenues, the costs, and the expenses that are being incurred.

Different formats of the profit & loss account. Profit and loss account is commonly known as the account which enlists and shows all the profits and loss of a company have in a special period of time. Benefits of using vyapar profit and loss adjustment account format clear presentation:.

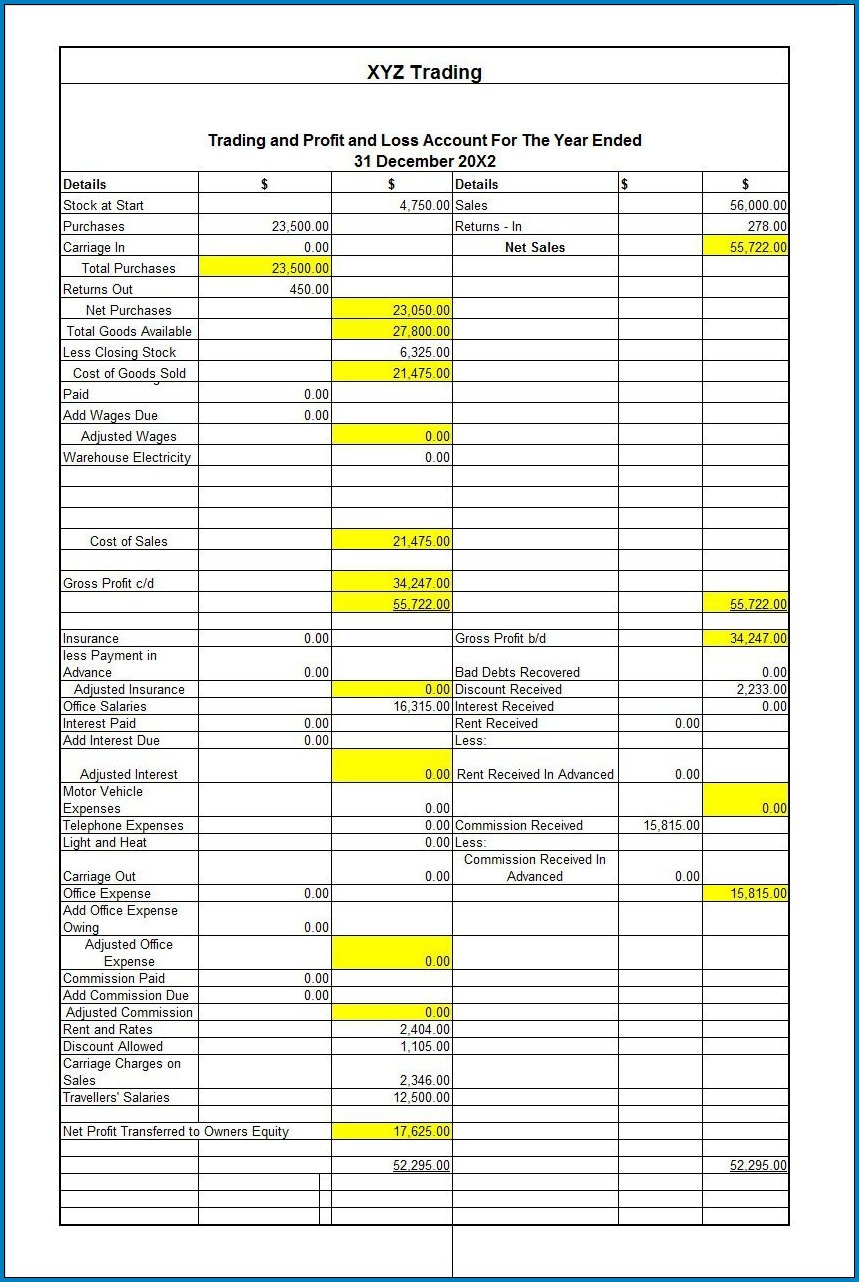

The statement of profit or loss and other comprehensive income. The cost of sales consists of opening inventory plus purchases, minus closing inventory. A profit and loss statement contains three basic elements:

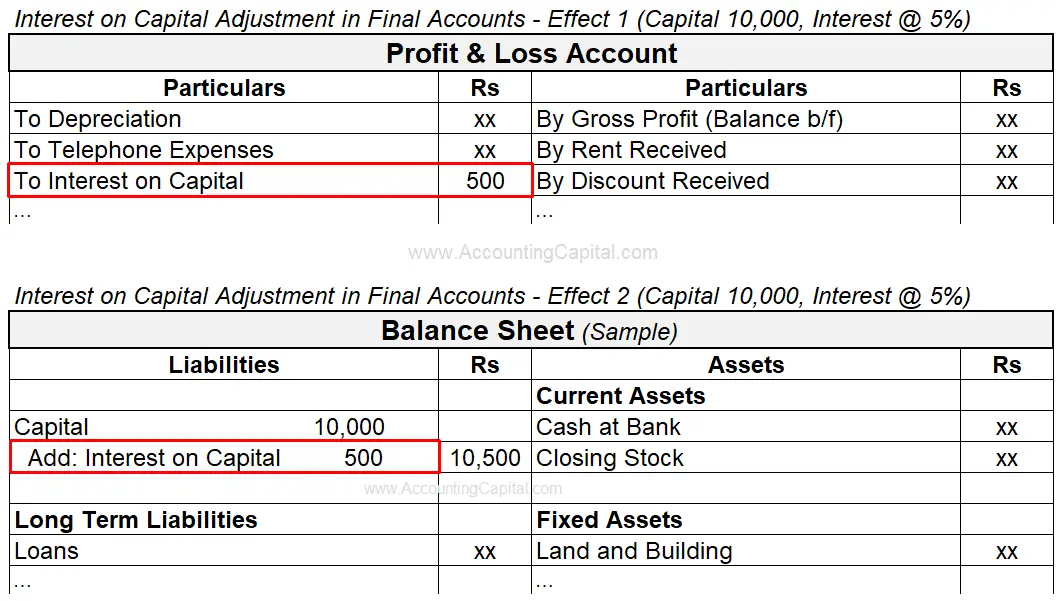

Under this method, we make up an account by name adjusted profit and loss a/c posting the net profit along with all the postings representing losses, gains, appropriations and. The profit and loss account determines the net profit or net loss of the business for the accounting period. Out of the amount of insurance premium which was debited to profit and loss account, rs 5,000.

Trading profit and loss account format. The closing inventory is therefore a. More advanced profit and loss statements also include.

Inventory this is a very common adjustment. Format for sole traders & partnership. The trading account and the profit and loss account can be combined into a single summary known as a trading.

Revaluation account is a nominal account which is prepared at the time of admission,. The preparation of simple final. I n chapter 8, you learnt about the preparation of simple final accounts in the format of trading and profit and loss account and balance sheet.

The profit and loss statement format is also called the income statement and it is used to show the details of revenue earned and expenses incurred during an accounting period. Revenue, expenses, and net income. Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business.

Revaluation account or profit and loss adjustment account are the same. Transfer of profit to reserves, 3. 6) the capital account of all the partners to be adjusted in their new profit sharing ratio and excess amount to be transferred to their loan account.

The statement of financial position must comply with the balance sheet format requirements of the companies act. The profit and loss adjustment account format provides separate sections or categories. In this article, we will see types of profit and loss account and profit and loss account format.